Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was very bullish as the Dow Jones Industrial Average made another new all-time high and is approaching 12,000. The advance/decline line rose, most sectors gained and volume was slightly above average on the week. Measures of investor anxiety were mostly lower. The AAII percentage of Bulls rose to 48.98% this week from 37.78% the prior week. This reading is now modestly above average levels. The AAII percentage of Bears fell to 37.76% this week from 46.67% the prior week. This reading is now above average levels. The 10-week moving average of the percentage of Bears is currently 36.97%. The 10-week moving-average of the percentage of Bears was 43.0% at the major bear market lows during 2002.

I continue to believe steadfastly high bearish sentiment is mind-boggling considering the recent rally and the fact that the DJIA is making new record highs. Bears remain stunningly complacent, in my opinion. As well, there are many other indicators registering high levels of investor skepticism regarding recent stock market gains. There is overwhelming evidence that investor sentiment regarding U.S. stocks has never been this poor in history with the DJIA registering all-time highs. There is still a very high wall of worry for stocks to climb substantially higher from current levels.

In my opinion, this is a direct result of the strong belief by the herd that the U.S. is in a long-term trading range or secular bear environment. I strongly disagree with this assessment. As I said last week, the bears' abuse of George Soros' Theory of Reflexivity(the theory basically states that the future outcome of an event can be altered by changing current perceptions regarding such an event) during the last few years has left most investors substantially underexposed to U.S. equities, specifically growth stocks, and many traders heavily leaning the wrong way. Short interest on the NYSE and Nasdaq is at all-time highs. The ISE Sentiment Index has bounced around depressed levels for months. Domestic stock mutual funds are still seeing outflows.

The average 30-year mortgage rate rose 7 basis points to 6.7%, which is 43 basis points below July highs. I still believe housing is in the process of slowing, but will stabilize at relatively high levels over the coming months. Former Fed Chairman Alan Greenspan said recently he believes the “worst may well be over” for the housing slowdown. Mortgage applications have turned higher recently with the decline in mortgage rates. The Case-Shiller housing futures are still projecting a 5% decline in the average home price over the next 7 months. Considering the average house has appreciated over 50% during the last few years, this would be considered a “soft landing.” The overall negative effects of housing on the US economy are currently being exaggerated by the bears, in my opinion. Housing has been slowing substantially for 14 months and has been mostly offset by many other very positive aspects of the economy. Americans’ median net worth is still very close to or at record high levels, energy prices have plunged, consumer spending remains very healthy, unemployment is low, interest rates are low, stocks are rising and most measures of income growth are almost twice the inflation rate, just to name a few.

The benchmark 10-year T-note yield rose 10 basis points on the week on profit taking and rising economic optimism. In my opinion, investors’ continuing fears over an economic “hard landing” are misplaced. Consumer spending is very important to the health of the US economy. Weekly retail sales rose an above-average 3.4% for the week. Spending is poised to remain strong on plunging energy prices, low long-term interest rates, a rising stock market, healthy job market, decelerating inflation and more optimism. The CRB Commodities Index, the main source of inflation fears, has now declined 7.8% over the last 12 months and is down 17.0% from May highs, approaching bear market territory. The average commodity hedge fund is down 13.8% for the year. I believe inflation fears have peaked for this cycle as global economic growth moderates to around average levels, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies rose more than expectations even as refinery utilization fell. U.S. gasoline supplies are still at the highest level since 1991 for this time of the year. Unleaded Gasoline futures fell again for the week and are 49.40% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. Gasoline demand is estimated to rise .8% this year versus a 20-year average of 1.7% demand growth. Moreover, distillate stocks are 18% above the five-year average for this time of the year as we head into the winter heating season. The still elevated level of gas prices related to crude oil production disruption speculation by investment funds will further dampen global fuel demand, which will send gas prices still lower over the intermediate-term.

US oil inventories are back at 7-year highs. Since December 2003, global oil demand is only up .7%, while global supplies have increased 4.8%, according to the Energy Intelligence Group. Moreover, worldwide inventories are poised to begin increasing at an accelerated rate over the next year. I continue to believe oil is priced at extremely elevated levels on fear and record speculation by investment funds, not fundamentals. The Amaranth Advisors hedge fund blow-up is a prime example of the extent to which many investment funds have been speculating on ever higher energy prices through futures contracts, thus driving the price of the underlying commodity to absurd levels. Amaranth, a multi-strategy hedge fund, lost about $6.5 billion of its $9.5 billion under management in less than two months speculating mostly on higher natural gas prices. I suspect a number of other funds will experience similar fates over the coming months, which will further pressure energy prices as these funds unwind their leveraged positions to meet investor redemptions.

Oil has clearly broken its uptrend and is now entering its seasonally weak period. A major top in oil is likely already in place. Recent OPEC production cuts will likely result in a complete technical breakdown in crude over the coming weeks. Demand destruction is already pervasive globally. Moreover, many Americans feel as though they are helping fund terrorism or hurting the environment every time they fill up their gas tanks. I do not believe we will ever again see the demand for gas-guzzling vehicles that we saw in recent years, even if gas prices continue to plunge. An OPEC production cut with oil at still very high levels and weakening global growth only further deepens resentment towards the cartel and will result in even greater long-term demand destruction. Finally, as the fear premium in oil dissipates back to more reasonable levels, global growth slows and supplies continue to rise, crude oil should continue heading meaningfully lower over the intermediate-term, notwithstanding OPEC production cuts.

Natural gas inventories rose slightly less than expectations this week, however prices for the commodity plunged again. Supplies are 11.8% above the 5-year average, a record high level for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have collapsed 63.9% since December 2005 highs. It is quite possible US natural gas storage will become full sometime over the next few weeks, creating the distinct possibility of a “no-bid” situation for the physical commodity. Colorado State recently reduced its forecast from two to zero major hurricanes for this season versus seven last year. The peak of hurricane season was September 10. Natural gas prices are still in their seasonally strong period despite recent losses.

Gold rose on the week on short-covering and North Korea’s nuclear test. The US dollar gained on more economic optimism, a flight to safety and somewhat more hawkish Fed commentary. I continue to believe there is very little chance of another Fed rate hike anytime soon. An eventual cut is more likely next year as inflation continues to decelerate.

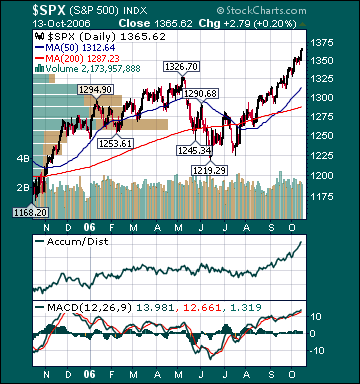

Steel stocks outperformed for the week on takeover speculation and economic optimism. Healthcare stocks underperformed as investors sought more economically sensitive shares. S&P 500 profit growth for the second quarter came in a strong 16.3% versus a long-term historical average of 7%, according to Thomson Financial. This is the 16th straight quarter of double-digit profit growth, the best streak since recording keeping began in 1936. Moreover, another double-digit gain is likely in the third quarter. Earnings pre-announcements are running below average levels heading into the brunt of earnings season next week. Despite an 83.4% total return(which is equivalent to a 16.3% average annual return) for the S&P 500 since the October 2002 bottom, its forward p/e has contracted relentlessly and now stands at a very reasonable 15.7. The 20-year average p/e for the S&P 500 is 24.4. The S&P 500 is now up 11.02% and the Russell 2000 Index is up 14.34% year-to-date. The DJIA made another new all-time high this week and is 210 points above its January 14, 2000 record close. I expect the Dow to break convincingly above 12,000 over the coming weeks.

Current stock prices are still providing longer-term investors very attractive opportunities, in my opinion. In my entire investment career, I have never seen the best “growth” companies in the world priced as cheaply as they are now relative to the broad market. By contrast, “value” stocks are quite expensive in many cases. A recent CSFB report confirmed this view. The report concluded that on a price-to-cash flow basis growth stocks are now cheaper than value stocks for the first time since at least 1977. Almost the entire decline in the S&P 500’s p/e, since the bubble burst in 2000, is attributable to growth stock multiple contraction. I still expect the most overvalued economically sensitive and emerging market stocks to continue underperforming over the intermediate-term as the manias for those shares subside and global growth slows to more average rates. I continue to believe a chain reaction of events has begun that will result in a substantial increase in demand for US stocks.

In my opinion, the market is still factoring in way too much bad news at current levels, notwithstanding recent gains. One of the characteristics of the current “negativity bubble” is that most potential positives are undermined, downplayed or completely ignored, while almost every potential negative is exaggerated and promptly priced in to stock prices. Furthermore, this “irrational pessimism” by investors has resulted in a dramatic decrease in the supply of stock as companies bought back shares, IPOs were pulled and secondary stock offerings canceled. Commodity and emerging market funds, which have received huge capital infusions this year, will likely see significant outflows at year-end. I continue to believe there is massive bull firepower available on the sidelines for US equities at a time when the supply of stock has contracted.

Over the coming months, an end to the Fed rate hikes, lower commodity prices, seasonal strength, the November election, decelerating inflation readings, a strong holiday shopping season, lower long-term rates, increased consumer/investor confidence, short-covering, investment manager performance anxiety, rising demand for US stocks and the realization that economic growth is only slowing to around average levels should provide the catalysts for another substantial push higher in the major averages through year-end as p/e multiples expand further. I still expect the S&P 500 to return a total of at least 15% for the year. The ECRI Weekly Leading Index fell this week and is forecasting healthy US economic activity.

*5-day % Change

No comments:

Post a Comment