Market Snapshot

Detailed Market Summary

Market Internals

Economic Commentary

Movers & Shakers

Today in IBD

NYSE OrderTrac

I-Watch Sector Overview

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Option Dragon

Real-time Intraday Chart/Quote

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, April 17, 2006

Sunday, April 16, 2006

Monday Watch

Weekend Headlines

Bloomberg:

- President Bush urged Congress to extend tax cuts enacted in his first term and asked lawmakers to address rising energy and health-care costs.

- China plans to let investors buy stocks using margin and sell shares short, seeking to channel more of the nation’s $4 trillion of bank deposits into the stock market and boost trading.

- The global takeover boom shows no sign of peaking. If anything, buyout firms are setting their sights on bigger targets, and corporations are stepping up the pace of purchases while financing remains cheap.

- Flextronics Intl.(FLEX) said it agreed to sell its software unit to a Kohlberg Kravis Roberts affiliate for about $900 million.

- BAA Plc, the target of a hostile takeover from Spain’s Grupo Ferrovial SA, said it rejected a bid led by Goldman Sachs Group(GS) that valued the world’s largest airports operator at $16.5 billion.

- China’s economic growth rose an estimated 10.2% in the first quarter, President Hu Jintao said, as manufacturing investment and exports surged.

Wall Street Journal:

- The Chicago Mercantile Exchange(CME) and the Chicago Board of Trade(BOT) are closing a loophole that had undermined the anonymity of electronic trading.

NY Times:

- LensCrafters will spend an estimated $312 million to upgrade its stores, aiming to distance itself from low-priced competitors.

- Toyota Motor(TM) is considering building its eighth North American assembly plant and is looking at four southern US states for the site.

- Three top Israeli generals warned in separate interviews this week that the army is ready to invade the Gaza Strip to put an end to Palestinian rocket attacks if ordered.

- The US baby boom generation has heeded the advice to stay physically active and is also experiencing more injuries requiring surgery.

- News Corp. (NWS) is introducing a poker show even as the Travel Channel’s “World Poker Tour” has lost 36% of its viewers since its debut and online-poker revenue increases may slow.

Washington Post:

- The administration of President Bush will award as much as $3 billion in contracts in coming weeks to develop new radiation monitors to detect nuclear weapons crossing the country’s borders.

LA Times:

- Sales of wristwatches to young US consumers are falling as trendier accessories including cellular phones and portable music players also indicate the time, citing marketing studies.

Crain’s Chicago Business:

- Sears Holdings(SHLD) is testing its Sears Auto Centers at Kmart stores in a move that could double the size of its car-repair business.

Financial Times:

- Nasdaq Stock Market’s(NDAQ) ability to pay for a takeover bid for London Stock Exchange Plc has been called into question, citing credit rating companies and the newspaper’s own analysis.

- Oracle Corp.(ORCL) is contemplating introducing its own version of the Linux operating system and it considered purchasing Linux distributor Novell Inc.(NOVL), citing CEO Ellison.

- The Nobel Foundation, which funds the Nobel Prizes, invested in Corbin Capital Partners, Rock Creek Potomac fund and the Carnegie Worldwide Long/Short fund in its first hedge fund investments.

AP:

- Television broadcasters are challenging a FCC ruling that found three shows “indecent” because of obscene language.

Sunday Times:

- The NYSE is expected to build a stake in the London Stock Exchange after the Nasdaq Stock Market(NDAQ) bought a holding this month.

Xinhua News Agency:

- Wal-Mart Stores(WMT) will build the company’s sixty-eighth store in China in the southern province of Hainan, citing the retailer’s Chinese partner.

Weekend Recommendations

Barron's:

- Had positive comments on (SEPR), (HPQ), (UNH) and (PDCO).

- Had negative comments on (HRB).

Night Trading

Asian indices are -.50% to unch. on average.

S&P 500 indicated +.17%.

NASDAQ 100 indicated -.03%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (BRO)/.36

- (CBI)/.01

- (C)/1.02

- (ETN)/1.32

- (GPC)/.66

- (JBHT)/.31

- (KRI)/.59

- (MI)/.77

- (RF)/.62

- (STI)/1.43

- (WB)/1.12

Upcoming Splits

- (AVD) 4-for-3

- (NBR) 2-for-1

Economic Releases

8:30 am EST

- Empire Manufacturing for April is estimated to fall to 24.3 versus a reading of 31.2 in March.

9:00 am EST

- Net Foreign Security Purchases for February are estimated to fall to $60.0 billion versus $66.0 billion in January.

1:00 pm EST

- The NAHB Housing Market Index for April is estimated to come in at 55 versus a reading of 55 in March.

Bloomberg:

- President Bush urged Congress to extend tax cuts enacted in his first term and asked lawmakers to address rising energy and health-care costs.

- China plans to let investors buy stocks using margin and sell shares short, seeking to channel more of the nation’s $4 trillion of bank deposits into the stock market and boost trading.

- The global takeover boom shows no sign of peaking. If anything, buyout firms are setting their sights on bigger targets, and corporations are stepping up the pace of purchases while financing remains cheap.

- Flextronics Intl.(FLEX) said it agreed to sell its software unit to a Kohlberg Kravis Roberts affiliate for about $900 million.

- BAA Plc, the target of a hostile takeover from Spain’s Grupo Ferrovial SA, said it rejected a bid led by Goldman Sachs Group(GS) that valued the world’s largest airports operator at $16.5 billion.

- China’s economic growth rose an estimated 10.2% in the first quarter, President Hu Jintao said, as manufacturing investment and exports surged.

Wall Street Journal:

- The Chicago Mercantile Exchange(CME) and the Chicago Board of Trade(BOT) are closing a loophole that had undermined the anonymity of electronic trading.

NY Times:

- LensCrafters will spend an estimated $312 million to upgrade its stores, aiming to distance itself from low-priced competitors.

- Toyota Motor(TM) is considering building its eighth North American assembly plant and is looking at four southern US states for the site.

- Three top Israeli generals warned in separate interviews this week that the army is ready to invade the Gaza Strip to put an end to Palestinian rocket attacks if ordered.

- The US baby boom generation has heeded the advice to stay physically active and is also experiencing more injuries requiring surgery.

- News Corp. (NWS) is introducing a poker show even as the Travel Channel’s “World Poker Tour” has lost 36% of its viewers since its debut and online-poker revenue increases may slow.

Washington Post:

- The administration of President Bush will award as much as $3 billion in contracts in coming weeks to develop new radiation monitors to detect nuclear weapons crossing the country’s borders.

LA Times:

- Sales of wristwatches to young US consumers are falling as trendier accessories including cellular phones and portable music players also indicate the time, citing marketing studies.

Crain’s Chicago Business:

- Sears Holdings(SHLD) is testing its Sears Auto Centers at Kmart stores in a move that could double the size of its car-repair business.

Financial Times:

- Nasdaq Stock Market’s(NDAQ) ability to pay for a takeover bid for London Stock Exchange Plc has been called into question, citing credit rating companies and the newspaper’s own analysis.

- Oracle Corp.(ORCL) is contemplating introducing its own version of the Linux operating system and it considered purchasing Linux distributor Novell Inc.(NOVL), citing CEO Ellison.

- The Nobel Foundation, which funds the Nobel Prizes, invested in Corbin Capital Partners, Rock Creek Potomac fund and the Carnegie Worldwide Long/Short fund in its first hedge fund investments.

AP:

- Television broadcasters are challenging a FCC ruling that found three shows “indecent” because of obscene language.

Sunday Times:

- The NYSE is expected to build a stake in the London Stock Exchange after the Nasdaq Stock Market(NDAQ) bought a holding this month.

Xinhua News Agency:

- Wal-Mart Stores(WMT) will build the company’s sixty-eighth store in China in the southern province of Hainan, citing the retailer’s Chinese partner.

Weekend Recommendations

Barron's:

- Had positive comments on (SEPR), (HPQ), (UNH) and (PDCO).

- Had negative comments on (HRB).

Night Trading

Asian indices are -.50% to unch. on average.

S&P 500 indicated +.17%.

NASDAQ 100 indicated -.03%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (BRO)/.36

- (CBI)/.01

- (C)/1.02

- (ETN)/1.32

- (GPC)/.66

- (JBHT)/.31

- (KRI)/.59

- (MI)/.77

- (RF)/.62

- (STI)/1.43

- (WB)/1.12

Upcoming Splits

- (AVD) 4-for-3

- (NBR) 2-for-1

Economic Releases

8:30 am EST

- Empire Manufacturing for April is estimated to fall to 24.3 versus a reading of 31.2 in March.

9:00 am EST

- Net Foreign Security Purchases for February are estimated to fall to $60.0 billion versus $66.0 billion in January.

1:00 pm EST

- The NAHB Housing Market Index for April is estimated to come in at 55 versus a reading of 55 in March.

BOTTOM LINE: Asian Indices are mostly lower, weighed down by exporting shares in the region. I expect US stocks to open mixed and to weaken into the afternoon, finishing modestly lower. The Portfolio is 50% net long heading into the week.

Weekly Outlook

Click here for The Week Ahead by Reuters

There are some economic reports of note and a number of significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - Empire Manufacturing, Net Foreign Security Purchases, NAHB Housing Market Index

Tues. - Producer Price Index, Housing Starts, Building Permits, March 28 FOMC Minutes

Wed. - Consumer Price Index

Thur. - Initial Jobless Claims, Leading Indicators, Philly Fed

Fri. - None of note

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Brown & Brown(BRO), Citigroup(C), Eaton Corp.(ETN), Genuine Parts(GPC), JB Hunt(JBHT), Knight Ridder(KRI), Marshall & Ilsle(MI), SunTrust Banks(STI), Wachovia Corp.(WB)

Tues. - Adtran(ADTN), Allstate(ALL), Amgen Corp.(AMGN), AmSouth Bancorp(ASO), Boston Scientific(BSX), CR Bard(BCR), DR Horton(DHI), Everest Re(RE), Fifth Third(FITB), Freeport-McMoRan(FCX), Gilead Sciences(GILD), IBM(IBM), Johnson & Johnson(JNJ), Keycorp(KEY), Linear Tech(LLTC), Mattel(MAT), Merrill Lynch(MER), Motorola(MOT), Peabody Energy(BTU), Seagate Technology(STX), State Street(STT), Texas Instruments(TXN), UnitedHealth(UNH), Washington Mutual(WM), Wells Fargo(WFC), Yahoo!(YHOO)

Wed. - Abbott Labs(ABT), AMR Corp.(AMR), Apple Computer(AAPL), Comerica(CMA), CDW Corp.(CDWC), CIT Group(CIT), Coca-Cola(KO), Comerica(CMA), CSX Corp.(CSX), E*Trade(ET), eBay(EBAY), General Dynamics(GD), Intel Corp.(INTC), JPMorgan(JPM), Juniper Networks(JNPR), Kinder Morgan(KMI), Novellus Systems(NVLS), Pfizer Inc.(PFE), Qualcomm(QCOM), St Jude Medical(STJ), United Technologies(UTX)

Thur. - Altria Group(MO), Bank of America(BAC), Baxter Intl.(BAX), BellSouth(BLS), Broadcom Corp.(BRCM), Cerner Corp.(CERN), Eli Lilly(LLY), EMC Corp.(EMC), First Data(FDC), General Motors(GM), Google(GOOG), Hershey Co.(HSY), Linens ‘n Things(LIN), Merck(MRK), Newmont Mining(NEM), Outback Steakhouse(OSI), Ryland Group(RYL), Southwest Air(LUV), Sprint Nextel(S), United Parcel(UPS)

Fri. - 3M Co.(MMM), Ford Motor(F), Fortune Brands(FO), Genzyme(GENZ), Guidant Corp.(GDT), Halliburton(HAL), Ingersoll-Rand(IR), Maytag(MYG), McDonald’s(MCD), Royal Caribbean(RCL), Schlumberger(SLB), Wyeth(WYE)

Other events that have market-moving potential this week include:

Mon. - World Health Care Congress

Tue. - World Health Care Congress

Wed. - World Health Care Congress, Morgan Stanley Retail Conference

Thur. - Morgan Stanley Retail Conference

Fri. - Morgan Stanley Retail Conference

There are some economic reports of note and a number of significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - Empire Manufacturing, Net Foreign Security Purchases, NAHB Housing Market Index

Tues. - Producer Price Index, Housing Starts, Building Permits, March 28 FOMC Minutes

Wed. - Consumer Price Index

Thur. - Initial Jobless Claims, Leading Indicators, Philly Fed

Fri. - None of note

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Brown & Brown(BRO), Citigroup(C), Eaton Corp.(ETN), Genuine Parts(GPC), JB Hunt(JBHT), Knight Ridder(KRI), Marshall & Ilsle(MI), SunTrust Banks(STI), Wachovia Corp.(WB)

Tues. - Adtran(ADTN), Allstate(ALL), Amgen Corp.(AMGN), AmSouth Bancorp(ASO), Boston Scientific(BSX), CR Bard(BCR), DR Horton(DHI), Everest Re(RE), Fifth Third(FITB), Freeport-McMoRan(FCX), Gilead Sciences(GILD), IBM(IBM), Johnson & Johnson(JNJ), Keycorp(KEY), Linear Tech(LLTC), Mattel(MAT), Merrill Lynch(MER), Motorola(MOT), Peabody Energy(BTU), Seagate Technology(STX), State Street(STT), Texas Instruments(TXN), UnitedHealth(UNH), Washington Mutual(WM), Wells Fargo(WFC), Yahoo!(YHOO)

Wed. - Abbott Labs(ABT), AMR Corp.(AMR), Apple Computer(AAPL), Comerica(CMA), CDW Corp.(CDWC), CIT Group(CIT), Coca-Cola(KO), Comerica(CMA), CSX Corp.(CSX), E*Trade(ET), eBay(EBAY), General Dynamics(GD), Intel Corp.(INTC), JPMorgan(JPM), Juniper Networks(JNPR), Kinder Morgan(KMI), Novellus Systems(NVLS), Pfizer Inc.(PFE), Qualcomm(QCOM), St Jude Medical(STJ), United Technologies(UTX)

Thur. - Altria Group(MO), Bank of America(BAC), Baxter Intl.(BAX), BellSouth(BLS), Broadcom Corp.(BRCM), Cerner Corp.(CERN), Eli Lilly(LLY), EMC Corp.(EMC), First Data(FDC), General Motors(GM), Google(GOOG), Hershey Co.(HSY), Linens ‘n Things(LIN), Merck(MRK), Newmont Mining(NEM), Outback Steakhouse(OSI), Ryland Group(RYL), Southwest Air(LUV), Sprint Nextel(S), United Parcel(UPS)

Fri. - 3M Co.(MMM), Ford Motor(F), Fortune Brands(FO), Genzyme(GENZ), Guidant Corp.(GDT), Halliburton(HAL), Ingersoll-Rand(IR), Maytag(MYG), McDonald’s(MCD), Royal Caribbean(RCL), Schlumberger(SLB), Wyeth(WYE)

Other events that have market-moving potential this week include:

Mon. - World Health Care Congress

Tue. - World Health Care Congress

Wed. - World Health Care Congress, Morgan Stanley Retail Conference

Thur. - Morgan Stanley Retail Conference

Fri. - Morgan Stanley Retail Conference

BOTTOM LINE: I expect US stocks to finish the week mixed as better-than-expected earnings reports offset conservative forward earnings guidance, higher long-term rates and mixed economic data. My trading indicators are giving mostly bullish signals and the Portfolio is 50% net long heading into the week.

Market Week in Review

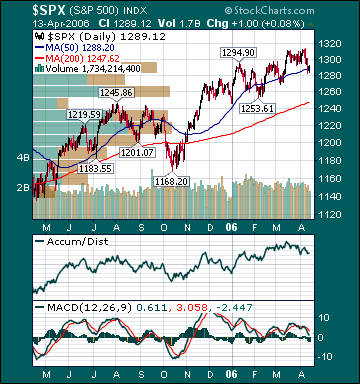

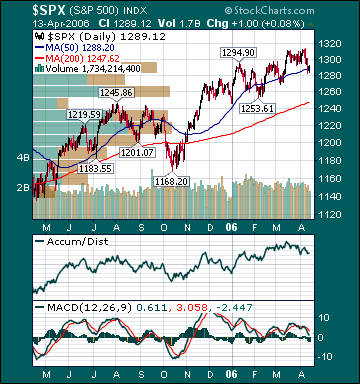

S&P 500 1,289.12 -1.52%*

*5-day % Change

BOTTOM LINE: Overall, last week's market performance was mildly bearish. The advance/decline line fell, almost every sector fell and volume was about average on the week. Measures of investor anxiety were mostly higher. The AAII % Bulls fell to 45.36% and is still only around average levels, which is a positive considering this year’s gains. The average 30-year mortgage rate rose to 6.49% which is 128 basis points above all-time lows set in June 2003.

I continue to believe housing is slowing to more healthy sustainable levels. This will also likely result in the slowing of consumer spending back to around average levels. The benchmark 10-year T-note yield rose 7 basis points on the week even as the Import Price Index fell. I expect inflation concerns to begin declining again later this quarter as economic growth slows to average levels, unit labor costs remain subdued and commodity prices weaken from current levels.

Unleaded Gasoline futures rose again this week, but are still 27.6% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, 22.7% of Gulf of Mexico oil production remains shut-in and fears over Iranian/Nigerian production disruptions persist. Natural gas inventories rose less than expected this week. However, supplies are now 63.4% above the 5-year average, near an all-time record high for this time of year, even as 13.6% of daily Gulf of Mexico production remains shut-in. Natural gas prices have plunged 54.5% since December 2005 highs.

OPEC said recently that global oil demand will average 84.5 million barrels/day for the remainder of the year. The most recent data from Energy Intelligence shows global oil supplies at 85.6 millions barrels/day. Since Dec. 2003, global oil supplies have risen 13.1% while demand has risen 5.0%. U.S. oil inventories are now close to 8-year highs. I continue to believe oil is priced above $60/bbl. on fear and record speculation, not fundamentals. Demand for oil can and will fall, even with healthy economic growth, as we saw in the U.S. last year. As the fear premium in oil dissipates back to more reasonable levels and supplies continue to rise, crude should head meaningfully lower over the intermediate-term.

Gold rose modestly for the week as higher energy prices and mostly positive economic data more than offset the unexpected decline in the Import Price Index. The US dollar rose as speculation increased that the Fed will continuing hiking rates as a result of rising commodity prices and a strong US economy.

Interest rate sensitive stocks such as Homebuilders, REITs and Utilities underperformed for the week as long-term interest rates rose. The average US stock, as measured by the Value Line Geometric Index(VGY), is still up a strong 7.2% so far this year. Moreover, the Russell 2000 Index is up 11.9% year-to-date. I still believe US economic growth peaked for the year during the first quarter and will decelerate back to around average levels through year-end.

I expect stocks to continue trading mixed-to-lower over the next few weeks. Subsequently, a reversal lower in long-term rates and/or energy prices should provide the catalyst for another push higher by the major averages. The ECRI Weekly Leading Index fell slightly this week and is still forecasting healthy, but decelerating, US economic activity.

*5-day % Change

Friday, April 14, 2006

Thursday, April 13, 2006

Weekly Scoreboard*

Indices

S&P 500 1,289.12 -1.52%

DJIA 11,137.65 -.70%

NASDAQ 2,326.11 -1.48%

Russell 2000 751.11 -1.97%

Wilshire 5000 13,031.95 -1.58%

S&P Equity Long/Short Index 1,167.29 unch.

S&P Barra Growth 604.91 -1.56%

S&P Barra Value 681.31 -1.48%

Morgan Stanley Consumer 598.66 -1.67%

Morgan Stanley Cyclical 828.46 -.55%

Morgan Stanley Technology 550.23 -1.87%

Transports 4,645.76 -1.76%

Utilities 382.49 -2.70%

S&P 500 Cum A/D Line 7,844.0 -9.0%

Bloomberg Crude Oil % Bulls 45.0 -6.25%

Put/Call .84 +9.09%

NYSE Arms .70 -7.79%

Volatility(VIX) 12.38 +7.77%

ISE Sentiment 102.00 -40.70%

AAII % Bulls 45.36 -4.85%

AAII % Bears 27.84 +19.69%

US Dollar 89.56 +.66%

CRB 342.32 +.87%

ECRI Weekly Leading Index 137.30 -.51%

Futures Spot Prices

Crude Oil 69.52 +2.09%

Unleaded Gasoline 210.80 +5.71%

Natural Gas 7.15 +2.96%

Heating Oil 199.10 +4.93%

Gold 601.90 +.42%

Base Metals 197.30 +5.10%

Copper 281.35 +6.18%

10-year US Treasury Yield 5.05% +1.40%

Average 30-year Mortgage Rate 6.49% +.93%

Leading Sectors

Gaming unch.

Restaurants -.05%

Software -.27%

Banks -.73%

Wireless -.93%

Lagging Sectors

Networking -3.30%

Airlines -3.38%

Homebuilders -3.93%

REITs -4.28%

Oil Tankers -6.44%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

S&P 500 1,289.12 -1.52%

DJIA 11,137.65 -.70%

NASDAQ 2,326.11 -1.48%

Russell 2000 751.11 -1.97%

Wilshire 5000 13,031.95 -1.58%

S&P Equity Long/Short Index 1,167.29 unch.

S&P Barra Growth 604.91 -1.56%

S&P Barra Value 681.31 -1.48%

Morgan Stanley Consumer 598.66 -1.67%

Morgan Stanley Cyclical 828.46 -.55%

Morgan Stanley Technology 550.23 -1.87%

Transports 4,645.76 -1.76%

Utilities 382.49 -2.70%

S&P 500 Cum A/D Line 7,844.0 -9.0%

Bloomberg Crude Oil % Bulls 45.0 -6.25%

Put/Call .84 +9.09%

NYSE Arms .70 -7.79%

Volatility(VIX) 12.38 +7.77%

ISE Sentiment 102.00 -40.70%

AAII % Bulls 45.36 -4.85%

AAII % Bears 27.84 +19.69%

US Dollar 89.56 +.66%

CRB 342.32 +.87%

ECRI Weekly Leading Index 137.30 -.51%

Futures Spot Prices

Crude Oil 69.52 +2.09%

Unleaded Gasoline 210.80 +5.71%

Natural Gas 7.15 +2.96%

Heating Oil 199.10 +4.93%

Gold 601.90 +.42%

Base Metals 197.30 +5.10%

Copper 281.35 +6.18%

10-year US Treasury Yield 5.05% +1.40%

Average 30-year Mortgage Rate 6.49% +.93%

Leading Sectors

Gaming unch.

Restaurants -.05%

Software -.27%

Banks -.73%

Wireless -.93%

Lagging Sectors

Networking -3.30%

Airlines -3.38%

Homebuilders -3.93%

REITs -4.28%

Oil Tankers -6.44%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

Subscribe to:

Comments (Atom)