Market Snapshot

Detailed Market Summary

Market Internals

Economic Commentary

Movers & Shakers

Today in IBD

NYSE OrderTrac

I-Watch Sector Overview

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Option Dragon

Real-time Intraday Chart/Quote

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, July 03, 2006

Sunday, July 02, 2006

Monday Watch

Weekend Headlines

Bloomberg:

- Wal-Mart Stores(WMT) said June same-store sales in the US rose 1.2%, the slowest monthly rate since April 2005.

- Credit Suisse Group and Morgan Stanley say the storm has passed for stock investors. They recommend that investors increase their stockholdings while reducing cash. The firms point to bullish signs such as corporate stock buybacks and even cite bearish indicators that are so pessimistic they’re cause for optimism.

- Japan’s largest companies plan to increase investment at the fastest pace in almost 16 years, strengthening the central bank’s base for raising interest rates from close to zero percent.

- Saddam Hussein’s oldest daughter, named by Iraq’s government on a list of the 41 most wanted Iraqis, is living in Jordan as a guest of King Abdullah II, Jordan’s official news agency Petra said.

- Texas Instruments(TXN) and Broadcom(BRCM) filed a complaint to South Korea’s antitrust regulator, claiming that Qualcomm(QCOM) unfairly hindered competition.

Barron’s:

- Ned Davis, president of Ned Davis Research, said the economy may grow more than 3.5% in the next year on low inflation rates.

Wall Street Journal:

- General Motors’(GM) board will meet on a conference call next week after the US July 4 holiday to discuss Kirk Kerkorian’s proposal about allying with Nissan Motor and Renault SA.

NY Times:

- The US government showed undercover videotapes of some of the seven men alleged to have been plotting to blow up the Sears Tower in Chicago and other buildings in Miami.

Washington Post:

- Chinese President Hu Jintao said in a speech that widespread corruption might diminish the Chinese Communist Party’s popular legitimacy and weaken its grip on power.

- The US government has paid at least $1.3 billion in agriculture subsidies since 2000 to people who don’t farm, citing an analysis of government records.

- US and Canadian police agencies are increasingly working together through cross-border investigations, shared intelligence and joint patrols along the Great Lakes.

San Francisco Chronicle:

- San Francisco may become the first US city to offer universal healthcare by offering its health plan for low-income people to all uninsured residents. Mayor Gavin Newsom wants the system opened to residents of any income, immigration status or medical condition.

CRN:

- Apple Computer’s(AAPL) Next Big Thing: Home Entertainment

AP:

- Osama bin Laden told insurgents in Iraq to keep fighting against the US-led coalition in a new message posted on the Internet.

London Daily Telegraph:

- Prostate cancer patients may benefit from drinking eight ounces of pomegranate juice daily, citing a Univ. of Cal. study.

Xinhua News Agency:

- Beijing has banned businesses from setting up offices in residential buildings to cool property prices.

- Chinese companies in more than 30 industries had losses or “marginal profits” in the first five months of the year because of rising costs of raw materials and fuel, citing the director of the National Bureau of Statistics.

Etemadd:

- Venezuela’s President Hugo Chavez will visit Iran, North Korea and Vietnam in late July, citing the Venezuelan Foreign Ministry.

WirtschaftsWoche:

- Hewlett-Packard(HPQ) plans to make “targeted” acquisitions to complement its businesses, citing CEO Hurd.

Sunday Times:

- The European Union may ban alcohol advertising, including sponsorship for sports events, before 9 pm.

Weekend Recommendations

Barron's:

- Had positive comments on (C) and (NEM).

Night Trading

Asian indices are -.25% to +.25% on average.

S&P 500 indicated +.26%

NASDAQ 100 indicated +.27%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- None of note

Upcoming Splits

- (UIL) 5-for-3

Economic Releases

10:00 am EST

- Construction Spending for May is estimated to rise .2% versus a .1% decline in April.

- ISM Manufacturing for June is estimated to rise to 55.0 versus a reading of 54.4 in May.

- ISM Prices Paid for June is estimated to fall to 75.0 versus a reading of 77.0 in May.

Afternoon:

- Total Vehicle Sales for June are estimated to rise to 16.4M versus 16.1M in May.

- Domestic Vehicle Sales for June rose to 12.6M versus 12.4M in May.

Bloomberg:

- Wal-Mart Stores(WMT) said June same-store sales in the US rose 1.2%, the slowest monthly rate since April 2005.

- Credit Suisse Group and Morgan Stanley say the storm has passed for stock investors. They recommend that investors increase their stockholdings while reducing cash. The firms point to bullish signs such as corporate stock buybacks and even cite bearish indicators that are so pessimistic they’re cause for optimism.

- Japan’s largest companies plan to increase investment at the fastest pace in almost 16 years, strengthening the central bank’s base for raising interest rates from close to zero percent.

- Saddam Hussein’s oldest daughter, named by Iraq’s government on a list of the 41 most wanted Iraqis, is living in Jordan as a guest of King Abdullah II, Jordan’s official news agency Petra said.

- Texas Instruments(TXN) and Broadcom(BRCM) filed a complaint to South Korea’s antitrust regulator, claiming that Qualcomm(QCOM) unfairly hindered competition.

Barron’s:

- Ned Davis, president of Ned Davis Research, said the economy may grow more than 3.5% in the next year on low inflation rates.

Wall Street Journal:

- General Motors’(GM) board will meet on a conference call next week after the US July 4 holiday to discuss Kirk Kerkorian’s proposal about allying with Nissan Motor and Renault SA.

NY Times:

- The US government showed undercover videotapes of some of the seven men alleged to have been plotting to blow up the Sears Tower in Chicago and other buildings in Miami.

Washington Post:

- Chinese President Hu Jintao said in a speech that widespread corruption might diminish the Chinese Communist Party’s popular legitimacy and weaken its grip on power.

- The US government has paid at least $1.3 billion in agriculture subsidies since 2000 to people who don’t farm, citing an analysis of government records.

- US and Canadian police agencies are increasingly working together through cross-border investigations, shared intelligence and joint patrols along the Great Lakes.

San Francisco Chronicle:

- San Francisco may become the first US city to offer universal healthcare by offering its health plan for low-income people to all uninsured residents. Mayor Gavin Newsom wants the system opened to residents of any income, immigration status or medical condition.

CRN:

- Apple Computer’s(AAPL) Next Big Thing: Home Entertainment

AP:

- Osama bin Laden told insurgents in Iraq to keep fighting against the US-led coalition in a new message posted on the Internet.

London Daily Telegraph:

- Prostate cancer patients may benefit from drinking eight ounces of pomegranate juice daily, citing a Univ. of Cal. study.

Xinhua News Agency:

- Beijing has banned businesses from setting up offices in residential buildings to cool property prices.

- Chinese companies in more than 30 industries had losses or “marginal profits” in the first five months of the year because of rising costs of raw materials and fuel, citing the director of the National Bureau of Statistics.

Etemadd:

- Venezuela’s President Hugo Chavez will visit Iran, North Korea and Vietnam in late July, citing the Venezuelan Foreign Ministry.

WirtschaftsWoche:

- Hewlett-Packard(HPQ) plans to make “targeted” acquisitions to complement its businesses, citing CEO Hurd.

Sunday Times:

- The European Union may ban alcohol advertising, including sponsorship for sports events, before 9 pm.

Weekend Recommendations

Barron's:

- Had positive comments on (C) and (NEM).

Night Trading

Asian indices are -.25% to +.25% on average.

S&P 500 indicated +.26%

NASDAQ 100 indicated +.27%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- None of note

Upcoming Splits

- (UIL) 5-for-3

Economic Releases

10:00 am EST

- Construction Spending for May is estimated to rise .2% versus a .1% decline in April.

- ISM Manufacturing for June is estimated to rise to 55.0 versus a reading of 54.4 in May.

- ISM Prices Paid for June is estimated to fall to 75.0 versus a reading of 77.0 in May.

Afternoon:

- Total Vehicle Sales for June are estimated to rise to 16.4M versus 16.1M in May.

- Domestic Vehicle Sales for June rose to 12.6M versus 12.4M in May.

BOTTOM LINE: Asian Indices are mostly higher, boosted by financial shares in the region. I expect US stocks to open modestly higher and to maintain gains into the afternoon. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for The Week Ahead by Reuters

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week. US stock markets close at 1pm EST on July 3 and all day on July 4.

Economic reports for the week include:

Mon. - Construction Spending, ISM Manufacturing, Total Vehicle Sales

Tues. - US Markets Closed

Wed. - Factory Orders

Thur. - Initial Jobless Claims, ISM Non-Manufacturing, Pending Home Sales

Fri. - Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - None of note

Tues. - US Markets Closed

Wed. - None of note

Thur. - Delta & Pine Land(DLP), Highwood Properties(HIW)

Fri. - 99 Cents Only(NDN), Shaw Group(SGR)

Other events that have market-moving potential this week include:

Mon. - None of note

Tue. - US Markets Closed

Wed. - None of note

Thur. - None of note

Fri. - None of note

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week. US stock markets close at 1pm EST on July 3 and all day on July 4.

Economic reports for the week include:

Mon. - Construction Spending, ISM Manufacturing, Total Vehicle Sales

Tues. - US Markets Closed

Wed. - Factory Orders

Thur. - Initial Jobless Claims, ISM Non-Manufacturing, Pending Home Sales

Fri. - Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - None of note

Tues. - US Markets Closed

Wed. - None of note

Thur. - Delta & Pine Land(DLP), Highwood Properties(HIW)

Fri. - 99 Cents Only(NDN), Shaw Group(SGR)

Other events that have market-moving potential this week include:

Mon. - None of note

Tue. - US Markets Closed

Wed. - None of note

Thur. - None of note

Fri. - None of note

BOTTOM LINE: I expect US stocks to finish the week mixed as mostly weaker economic data offsets short-covering, bargain hunting and a decline in long-term rates. My trading indicators are now giving neutral signals and the Portfolio is 100% net long heading into the week.

Market Week in Review

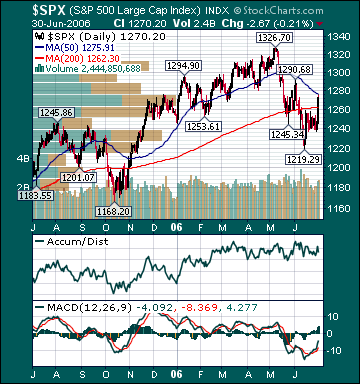

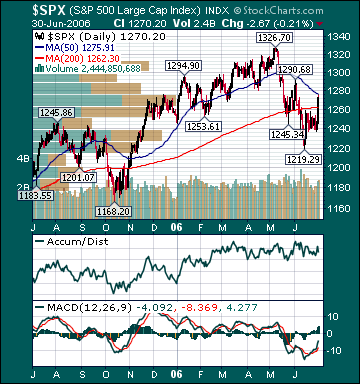

S&P 500 1,270.20 +2.06%*

Click here for the Weekly Wrap by Briefing.com.

*5-day % Change

Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was bullish. The advance/decline line rose, almost every sector rose and volume was about average on the week. Measures of investor anxiety were mostly lower. The AAII % Bulls rose to 38.60%, but is still below average levels. The % Bears fell to 39.77% and is still above average levels. Many other measures of investor sentiment are still near levels associated with meaningful market bottoms.

The average 30-year mortgage rate rose to 6.78% which is 157 basis points above all-time lows set in June 2003. I still believe housing is in the process of slowing to more healthy sustainable levels. I suspect mortgage rates have peaked for the year and will trend lower over the intermediate-term.

The benchmark 10-year T-note yield fell 8 basis points on the week as bond investors began anticipating slower economic growth and moderating inflation. I still believe inflation concerns have peaked for the year as investors continue to anticipate slower economic growth, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies fell more than expectations even as refinery utilization increased. Unleaded Gasoline futures rose and are now 23.3% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. According to TradeSports.com, the percent chance of a US and/or Israeli strike on Iran this year has fallen to 11.5% from 36% late last year. I continue to believe the elevated level of gas prices related to shortage speculation and crude oil production disruption speculation will further dampen fuel demand over the coming months, sending gas prices back to reasonable levels.

Natural gas inventories rose more expectations this week. Supplies are now 31.6% above the 5-year average, an all-time record high for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have plunged 61.5% since December 2005 highs. There is still little evidence of a pick-up in industrial demand for the commodity despite the collapse in price.

US oil inventories are still approaching 9-year highs. Since December 2003, global oil demand is down 1.19%, while global supplies have increased 5.19%. Moreover, worldwide inventories are poised to begin increasing at an accelerated rate over the next year. I continue to believe oil is priced at extremely elevated levels on fear and record speculation by investment funds, not fundamentals. As the fear premium in oil dissipates back to more reasonable levels, global growth slows and supplies continue to rise, crude oil should head meaningfully lower over the intermediate-term. This will likely begin to happen later this quarter.

Gold rose for the week on US dollar weakness and short-covering. The US dollar fell on more dovish Fed policy statements than most expected and mixed economic data.

Commodity stocks outperformed for the week on US dollar weakness and a rebound in emerging market stocks. The forward p/e on the S&P 500 has contracted relentlessly over the last few years and now stands at a very reasonable 14.8. The average US stock, as measured by the Value Line Geometric Index(VGY), is up 2.6% this year. The Russell 2000 Index is still up 8.3% year-to-date, notwithstanding the recent correction. In my opinion, the current pullback is providing longer-term investors very attractive opportunities in many stocks that have been punished indiscriminately. In my entire investment career, I have never seen the best growth companies in the world priced as cheaply as they are now relative to the broad market. However, the most overvalued economically sensitive and emerging market stocks should continue to underperform over the intermediate-term as the manias for those shares subside. I continue to believe a chain reaction of events has begun that will eventually result in a substantial increase in demand for US stocks.

In my opinion, the market is still factoring in way too much bad news at current levels. Problematic inflation, substantially higher long-term rates, a significant US dollar decline, a “hard-landing” in housing, a plunge in consumer spending and ever higher oil prices appear to be mostly factored into stock prices at this point. I view any one of these as unlikely and the occurrence of all as highly unlikely. Upcoming earnings reports will likely provide another positive catalyst for stocks over the near-term.

Over the coming months, an end to the Fed rate hikes, lower commodity prices, decelerating inflation readings, lower long-term rates, increased consumer confidence, rising demand for US stocks and the realization that economic growth is only slowing should provide the catalysts for another substantial push higher in the major averages through year-end as p/e multiples begin to expand. I still believe the S&P 500 will return a total of around 15% for the year. The ECRI Weekly Leading Index fell again this week and is forecasting healthy, but decelerating, US economic activity.

*5-day % Change

Saturday, July 01, 2006

Friday, June 30, 2006

Weekly Scoreboard*

Indices

S&P 500 1,270.20 +2.06%

DJIA 11,150.22 +1.47%

NASDAQ 2,172.09 +2.39%

Russell 2000 724.67 +5.0%

Wilshire 5000 12,808.89 +2.36%

S&P Equity Long/Short Index 1,129.31 +.08%

S&P Barra Growth 586.68 +1.71%

S&P Barra Value 681.93 +2.41%

Morgan Stanley Consumer 611.41 +1.71%

Morgan Stanley Cyclical 829.04 +2.78%

Morgan Stanley Technology 493.80 +1.53%

Transports 4,928.89 +3.27%

Utilities 413.95 +1.91%

S&P 500 Cum A/D Line 6,874.0 +9.0%

Bloomberg Oil % Bulls 53.0 +32.5%

CFTC Oil Large Speculative Longs 171,371 +6.0%

Put/Call .92 -7.07%

NYSE Arms 1.54 +105.33%

Volatility(VIX) 13.08 -17.68%

ISE Sentiment 107.00 -20.15%

AAII % Bulls 38.60 +12.21%

AAII % Bears 39.77 -4.40%

US Dollar 85.16 -1.98%

CRB 346.39 +3.39%

ECRI Weekly Leading Index 136.0 -.51%

Futures Spot Prices

Crude Oil 73.85 +2.99%

Unleaded Gasoline 222.30 +2.56%

Natural Gas 6.08 -1.29%

Heating Oil 203.85 +.67%

Gold 616.20 +4.97%

Base Metals 217.65 +8.36%

Copper 335.55 +4.01%

10-year US Treasury Yield 5.13% -1.72%

Average 30-year Mortgage Rate 6.78% +1.04%

Leading Sectors

Energy +6.27%

Gaming +5.04%

REITs +4.13%

Biotech +3.01%

I-Banks +2.81%

Lagging Sectors

Retail +.49%

Alternative Energy +.48%

Defense +.15%

Computer Hardware -.25%

Semis -.83%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

S&P 500 1,270.20 +2.06%

DJIA 11,150.22 +1.47%

NASDAQ 2,172.09 +2.39%

Russell 2000 724.67 +5.0%

Wilshire 5000 12,808.89 +2.36%

S&P Equity Long/Short Index 1,129.31 +.08%

S&P Barra Growth 586.68 +1.71%

S&P Barra Value 681.93 +2.41%

Morgan Stanley Consumer 611.41 +1.71%

Morgan Stanley Cyclical 829.04 +2.78%

Morgan Stanley Technology 493.80 +1.53%

Transports 4,928.89 +3.27%

Utilities 413.95 +1.91%

S&P 500 Cum A/D Line 6,874.0 +9.0%

Bloomberg Oil % Bulls 53.0 +32.5%

CFTC Oil Large Speculative Longs 171,371 +6.0%

Put/Call .92 -7.07%

NYSE Arms 1.54 +105.33%

Volatility(VIX) 13.08 -17.68%

ISE Sentiment 107.00 -20.15%

AAII % Bulls 38.60 +12.21%

AAII % Bears 39.77 -4.40%

US Dollar 85.16 -1.98%

CRB 346.39 +3.39%

ECRI Weekly Leading Index 136.0 -.51%

Futures Spot Prices

Crude Oil 73.85 +2.99%

Unleaded Gasoline 222.30 +2.56%

Natural Gas 6.08 -1.29%

Heating Oil 203.85 +.67%

Gold 616.20 +4.97%

Base Metals 217.65 +8.36%

Copper 335.55 +4.01%

10-year US Treasury Yield 5.13% -1.72%

Average 30-year Mortgage Rate 6.78% +1.04%

Leading Sectors

Energy +6.27%

Gaming +5.04%

REITs +4.13%

Biotech +3.01%

I-Banks +2.81%

Lagging Sectors

Retail +.49%

Alternative Energy +.48%

Defense +.15%

Computer Hardware -.25%

Semis -.83%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

Subscribe to:

Posts (Atom)