BOTTOM LINE: Inventories at US wholesalers rose more than expected in May, led by gains in business equipment and machinery and a jump in petroleum stockpiles, Bloomberg said. Sales rose 1.6% versus a 1.5% gain in April. The inventory-to-sales ratio dropped to a record low of 1.15 months. Sales of durable goods rose 2.6% versus a .2% increase in April. Inventories of metals rose 2.9% versus a 4.5% jump in April. I expect inventory rebuilding to add to economic growth over the intermediate-term as corporations gain confidence in the durability of the current expansion.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, July 10, 2006

Wholesale Inventories Rise as Sales Increase

- Wholesale Inventories for May rose .8% versus estimates of a .5% increase and an upwardly revised 1.3% gain in April.

Sunday, July 09, 2006

Monday Watch

Weekend Headlines

Bloomberg:

- President Bush said Congress needs to make temporary tax cuts permanent and increase funding for basic research in math, science, computers and energy to keep the US economy thriving.

- Iranian President Mahmoud Ahmadinejad called for Islamic nations to “mobilize” to “remove” Israel, which he termed the “main problem” of the Islamic world.

- Corporate tax receipts this year will likely cross the $300 billion threshold for the first time ever, boosting President Bush’s effort to trim the US budget deficit. The Congressional Budget Office, in a monthly review released yesterday, estimated that corporate tax receipts would exceed $330 billion in fiscal 2006, up 18% from 2005.

- Treasury investors, encouraged by slowing jobs growth, are more bullish than they have been since the aftermath of the Sept. 11 terrorist attacks.

- A UN resolution that would impose sanctions on North Korea is the only way to respond to its missile launches, Japanese Foreign Minister Taro Aso said.

- Roger Federer snapped his losing streak against Rafael Nadal and became the first man since Pete Sampras to win four straight Wimbledon titles.

- “Pirates of the Caribbean: Dead Man’s Chest,” the sequel to the 2003 Walt Disney(DIS) hit, took in a record $132 million in estimated ticket sales, the most ever for a three-day debut.

- Italy beat France 5-3 in a penalty shootout to win soccer’s World Cup for a European record fourth time after Zinedine Zidane scored and got a red card in the French captain’s last game in Berlin.

- China is in the best position to pressure North Korea into giving up its nuclear weapons, US lawmakers and Undersecretary of State Nicholas Burns said on network television news show today.

- Scientists discovered a genetic change that doubles the risk of breast cancer, a finding that may lead to better screening and treatment of the disease.

Wall Street Journal:

- China may force foreign companies to allow labor unions under a proposed legal change that would affect firms including Wal-Mart Stores(WMT).

NY Times:

- US tax receipts have been greater than expected this year and will lead to a decline in the US budget deficit. The US is expected to announce July 11 that tax receipts from corporations and wealthy will be about $250 billion more than last year, and the deficit is anticipated to be about $100 billion less than the White House forecast six months ago.

- US regulators may approve as early as next week a new once-daily HIV drug that combines Bristol-Myers Squibb’s(BMY) Sustiva and Gilead Sciences’(GILD) Truvada.

- Texas Instruments(TXN) focused on its integrated-circuits business and invented new uses for its processors to recapture the market share it lost when it strayed into other product lines.

Washington Post:

- President Bush will allow greater cooperation with Russia in the peaceful use of nuclear power.

Detroit Free Press:

- Oakland County, Michigan, may sell $500 million in bonds to pay for retirees’ health-care costs over the next 30 years.

Financial Times:

- Kraft Foods(KFT) has paid about $1.1 billion to acquire part of United Biscuits Group.

- French and German union leaders will oppose a possible three-way alliance between General Motors(GM), Nissan Motor and Renault SA, as it could accelerate the move of jobs out of Western Europe.

- The performance of hedge funds steadied in early July after the industry’s most difficult two-month period in at least five years, citing unidentified investors.

Sunday Times:

- Hilton Hotels(HLT) plans to expand the number of properties it has worldwide by more than a third.

Xinhua News Agency:

- Yum! Brands’(YUM) KFC chain plans to open 100 drive-through outlets in China within three years.

Yomiuri:

- Japan may deploy three of four Patriot interceptor missile systems earlier than planned after North Korea test-fired missiles this week.

Folha de S.Paulo:

- Wal-Mart Stores(WMT) forecast sales from its Brazilian operations will rise to $18.3 billion in 10 years.

Nihon Keizai:

- Japan is making steady progress toward ending deflation, the government will say in its report on the economy and fiscal policy.

Middle East Economic Survey:

- White Nile Operating Co. expects to boost production at its Thar Jath field in Sudan to 60,000 barrels a day.

AFP:

- Make Oil AG plans to build a refinery in the Kurdish area of northern Iraq to process crude from a newly discovered oil field in the region.

China Securities Journal:

- China’s money supply grew at the slowest pace in six months after the central bank stepped up efforts to drain money from the banking system.

Weekend Recommendations

Barron's:

- Had positive comments on (GD) and (LGF).

Night Trading

Asian indices are -.75% to +.% on average.

S&P 500 indicated +.04%

NASDAQ 100 indicated +.10%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (AA)/.86

- (CHTT)/.58

- (EMMS)/-.05

- (HELE)/.26

- (IRBT)/-.20

- (SCHN)/.95

- (SGR)/.37

- (SMSC)/.24

Upcoming Splits

- None of note

Economic Releases

10:00 am EST

- Wholesale Inventories for May are estimated to rise .5% versus a .9% increase in April.

3:00 pm EST:

- Consumer Credit for May is estimated to fall to $3.2B versus $10.6B in April.

Bloomberg:

- President Bush said Congress needs to make temporary tax cuts permanent and increase funding for basic research in math, science, computers and energy to keep the US economy thriving.

- Iranian President Mahmoud Ahmadinejad called for Islamic nations to “mobilize” to “remove” Israel, which he termed the “main problem” of the Islamic world.

- Corporate tax receipts this year will likely cross the $300 billion threshold for the first time ever, boosting President Bush’s effort to trim the US budget deficit. The Congressional Budget Office, in a monthly review released yesterday, estimated that corporate tax receipts would exceed $330 billion in fiscal 2006, up 18% from 2005.

- Treasury investors, encouraged by slowing jobs growth, are more bullish than they have been since the aftermath of the Sept. 11 terrorist attacks.

- A UN resolution that would impose sanctions on North Korea is the only way to respond to its missile launches, Japanese Foreign Minister Taro Aso said.

- Roger Federer snapped his losing streak against Rafael Nadal and became the first man since Pete Sampras to win four straight Wimbledon titles.

- “Pirates of the Caribbean: Dead Man’s Chest,” the sequel to the 2003 Walt Disney(DIS) hit, took in a record $132 million in estimated ticket sales, the most ever for a three-day debut.

- Italy beat France 5-3 in a penalty shootout to win soccer’s World Cup for a European record fourth time after Zinedine Zidane scored and got a red card in the French captain’s last game in Berlin.

- China is in the best position to pressure North Korea into giving up its nuclear weapons, US lawmakers and Undersecretary of State Nicholas Burns said on network television news show today.

- Scientists discovered a genetic change that doubles the risk of breast cancer, a finding that may lead to better screening and treatment of the disease.

Wall Street Journal:

- China may force foreign companies to allow labor unions under a proposed legal change that would affect firms including Wal-Mart Stores(WMT).

NY Times:

- US tax receipts have been greater than expected this year and will lead to a decline in the US budget deficit. The US is expected to announce July 11 that tax receipts from corporations and wealthy will be about $250 billion more than last year, and the deficit is anticipated to be about $100 billion less than the White House forecast six months ago.

- US regulators may approve as early as next week a new once-daily HIV drug that combines Bristol-Myers Squibb’s(BMY) Sustiva and Gilead Sciences’(GILD) Truvada.

- Texas Instruments(TXN) focused on its integrated-circuits business and invented new uses for its processors to recapture the market share it lost when it strayed into other product lines.

Washington Post:

- President Bush will allow greater cooperation with Russia in the peaceful use of nuclear power.

Detroit Free Press:

- Oakland County, Michigan, may sell $500 million in bonds to pay for retirees’ health-care costs over the next 30 years.

Financial Times:

- Kraft Foods(KFT) has paid about $1.1 billion to acquire part of United Biscuits Group.

- French and German union leaders will oppose a possible three-way alliance between General Motors(GM), Nissan Motor and Renault SA, as it could accelerate the move of jobs out of Western Europe.

- The performance of hedge funds steadied in early July after the industry’s most difficult two-month period in at least five years, citing unidentified investors.

Sunday Times:

- Hilton Hotels(HLT) plans to expand the number of properties it has worldwide by more than a third.

Xinhua News Agency:

- Yum! Brands’(YUM) KFC chain plans to open 100 drive-through outlets in China within three years.

Yomiuri:

- Japan may deploy three of four Patriot interceptor missile systems earlier than planned after North Korea test-fired missiles this week.

Folha de S.Paulo:

- Wal-Mart Stores(WMT) forecast sales from its Brazilian operations will rise to $18.3 billion in 10 years.

Nihon Keizai:

- Japan is making steady progress toward ending deflation, the government will say in its report on the economy and fiscal policy.

Middle East Economic Survey:

- White Nile Operating Co. expects to boost production at its Thar Jath field in Sudan to 60,000 barrels a day.

AFP:

- Make Oil AG plans to build a refinery in the Kurdish area of northern Iraq to process crude from a newly discovered oil field in the region.

China Securities Journal:

- China’s money supply grew at the slowest pace in six months after the central bank stepped up efforts to drain money from the banking system.

Weekend Recommendations

Barron's:

- Had positive comments on (GD) and (LGF).

Night Trading

Asian indices are -.75% to +.% on average.

S&P 500 indicated +.04%

NASDAQ 100 indicated +.10%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (AA)/.86

- (CHTT)/.58

- (EMMS)/-.05

- (HELE)/.26

- (IRBT)/-.20

- (SCHN)/.95

- (SGR)/.37

- (SMSC)/.24

Upcoming Splits

- None of note

Economic Releases

10:00 am EST

- Wholesale Inventories for May are estimated to rise .5% versus a .9% increase in April.

3:00 pm EST:

- Consumer Credit for May is estimated to fall to $3.2B versus $10.6B in April.

BOTTOM LINE: Asian Indices are lower, weighed down by automaker and technology shares in the region. I expect US stocks to open mixed and to trade modestly lower into the afternoon. The Portfolio is 50% net long heading into the week.

Weekly Outlook

Click here for The Week Ahead by Reuters

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - Wholesale Inventories, Consumer Credit

Tues. - None of note

Wed. - Trade Balance

Thur. - Initial Jobless Claims, Continuing Claims, Monthly Budget Statement

Fri. - Import Price Index, Advance Retail Sales, Univ. of Mich. Consumer Confidence, Business Inventories

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Alcoa Inc.(AA), Shaw Group(SGR)

Tues. - Flowserve(FLS), Genentech(DNA), Ruby Tuesday(RI)

Wed. - Chaparral Steel(CHAP), Commerce Bancshares(CBSH), Fastenal(FAST), Gannett Co.(GCI), Genzyme Corp.(GENZ), Resources Connection(RECN)

Thur. - Cintas Corp.(CTAS), Marriott Intl.(MAR), Polaris Industries(PII), Progressive Corp.(PGR), Texas Industries(TXI), Tribune Co.(TRB)

Fri. - EW Scripts(SSP), General Electric(GE), Rambus Inc.(RMBS), Regions Financial(RF)

Other events that have market-moving potential this week include:

Mon. - SEMICON West

Tue. - SEMICON West, CIBC Consumer Growth Conference

Wed. - CIBC Consumer Growth Conference, SEMICON West

Thur. - SEMICON West

Fri. - SEMICON West

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - Wholesale Inventories, Consumer Credit

Tues. - None of note

Wed. - Trade Balance

Thur. - Initial Jobless Claims, Continuing Claims, Monthly Budget Statement

Fri. - Import Price Index, Advance Retail Sales, Univ. of Mich. Consumer Confidence, Business Inventories

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Alcoa Inc.(AA), Shaw Group(SGR)

Tues. - Flowserve(FLS), Genentech(DNA), Ruby Tuesday(RI)

Wed. - Chaparral Steel(CHAP), Commerce Bancshares(CBSH), Fastenal(FAST), Gannett Co.(GCI), Genzyme Corp.(GENZ), Resources Connection(RECN)

Thur. - Cintas Corp.(CTAS), Marriott Intl.(MAR), Polaris Industries(PII), Progressive Corp.(PGR), Texas Industries(TXI), Tribune Co.(TRB)

Fri. - EW Scripts(SSP), General Electric(GE), Rambus Inc.(RMBS), Regions Financial(RF)

Other events that have market-moving potential this week include:

Mon. - SEMICON West

Tue. - SEMICON West, CIBC Consumer Growth Conference

Wed. - CIBC Consumer Growth Conference, SEMICON West

Thur. - SEMICON West

Fri. - SEMICON West

BOTTOM LINE: I expect US stocks to finish the week mixed as continuing worries over slowing economic growth offset short-covering, lower energy prices and bargain hunting. My trading indicators are still giving neutral signals and the Portfolio is 50% net long heading into the week.

Saturday, July 08, 2006

Market Week in Review

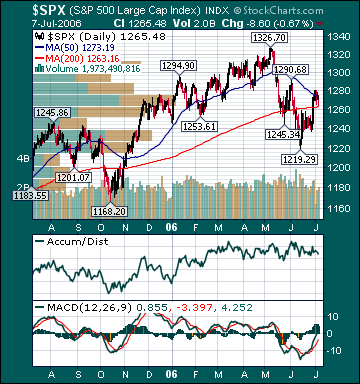

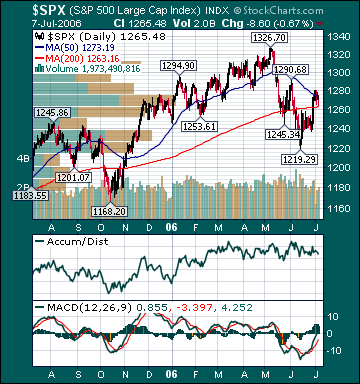

S&P 500 1,265.48 -.58%*

Click here for the Weekly Wrap by Briefing.com.

*5-day % Change

Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was mildly bearish. The advance/decline line fell, most sectors declined and volume was below average on the week. Measures of investor anxiety were mostly higher. The AAII % Bulls fell to 37.70% and is still below average levels. The % Bears rose to 42.62% and is still above average levels. Many other measures of investor sentiment are still near levels associated with meaningful market bottoms.

The average 30-year mortgage rate rose to 6.79% which is 158 basis points above all-time lows set in June 2003. I still believe housing is in the process of slowing to more healthy sustainable levels. Mortgage rates have likely peaked for the year and will trend lower over the intermediate-term.

The benchmark 10-year T-note yield was unchanged on the week as economic data were mixed. I still believe inflation concerns have peaked for the year as investors continue to anticipate slower economic growth, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies rose more than expectations even as refinery utilization fell. Unleaded Gasoline futures were unchanged and are still 23.3% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. According to TradeSports.com, the percent chance of a US and/or Israeli strike on Iran this year has fallen to 10.6% from 36% late last year. I continue to believe the elevated level of gas prices related to shortage speculation and crude oil production disruption speculation will further dampen fuel demand over the coming months, sending gas prices back to reasonable levels.

Natural gas inventories rose more than expectations this week. Supplies are now 29.2% above the 5-year average, an all-time record high for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have plunged 65.1% since December 2005 highs. There is still little evidence of a pick-up in industrial demand for the commodity despite the collapse in price.

US oil inventories are still approaching 9-year highs. Since December 2003, global oil demand is down 1.19%, while global supplies have increased 5.19%. Currently, global supplies of oil are exceeding demand by 2.1 million barrels per day. Moreover, worldwide inventories are poised to begin increasing at an accelerated rate over the next year. I continue to believe oil is priced at extremely elevated levels on fear and record speculation by investment funds, not fundamentals. As the fear premium in oil dissipates back to more reasonable levels, global growth slows and supplies continue to rise, crude oil should head meaningfully lower over the intermediate-term. This will likely begin to happen later this quarter.

Gold rose for the week on US dollar weakness, short-covering and geopolitical concerns. The US dollar fell as economic data came in mixed and speculation increased for a Fed “pause.”

Technology stocks underperformed for the week on disappointing earnings forecasts and fears over a decline in consumer spending. In my opinion, fears over an increase in inventories in some areas of tech are overdone. Despite a 70% total return for the S&P 500 since the October 2002 bottom, its forward p/e has contracted relentlessly and now stands at a very reasonable 14.7. The average US stock, as measured by the Value Line Geometric Index(VGY), is up .95% this year. The Russell 2000 Index is still up 6.0% year-to-date, notwithstanding the recent correction. In my opinion, the current pullback is still providing longer-term investors very attractive opportunities in many stocks that have been punished indiscriminately. In my entire investment career, I have never seen the best growth companies in the world priced as cheaply as they are now relative to the broad market. However, the most overvalued economically sensitive and emerging market stocks should continue to underperform over the intermediate-term as the manias for those shares subside. I continue to believe a chain reaction of events has begun that will eventually result in a substantial increase in demand for US stocks.

In my opinion, the market is still factoring in way too much bad news at current levels. Problematic inflation, substantially higher long-term rates, a significant US dollar decline, a “hard-landing” in housing, a plunge in consumer spending and ever higher oil prices appear to be mostly factored into stock prices at this point. I view any one of these as unlikely and the occurrence of all as highly unlikely.

Over the coming months, an end to the Fed rate hikes, lower commodity prices, decelerating inflation readings, lower long-term rates, increased consumer confidence, rising demand for US stocks and the realization that economic growth is only slowing should provide the catalysts for another substantial push higher in the major averages through year-end as p/e multiples begin to expand. I still believe the S&P 500 will return a total of around 15% for the year. The ECRI Weekly Leading Index rose this week and is forecasting healthy, but decelerating, US economic activity.

*5-day % Change

Friday, July 07, 2006

Weekly Scoreboard*

Indices

S&P 500 1,265.48 -.58%

DJIA 11,090.67 -.89%

NASDAQ 2,130.06 -2.04%

Russell 2000 709.30 -.70%

Wilshire 5000 12,729.05 -.62%

S&P Equity Long/Short Index 1,129.31 +.08%

S&P Barra Growth 583.91 -.79%

S&P Barra Value 680.07 -.37%

Morgan Stanley Consumer 610.0 unch.

Morgan Stanley Cyclical 812.77 -1.46%

Morgan Stanley Technology 481.95 -2.89%

Transports 4,843.20 -.96%

Utilities 416.65 +.92%

S&P 500 Cum A/D Line 6,566.0 -4.0%

Bloomberg Oil % Bulls 68.0 +28.45%

CFTC Oil Large Speculative Longs 176,166 +3.0%

Put/Call .89 +34.85%

NYSE Arms 1.52 +245.45%

Volatility(VIX) 13.97 +7.21%

ISE Sentiment 124.00 +18.10%

AAII % Bulls 37.70 -2.33%

AAII % Bears 42.62 +7.17%

US Dollar 85.01 -1.06%

CRB 348.05 +1.68%

ECRI Weekly Leading Index 136.80 +.66%

Futures Spot Prices

Crude Oil 73.86 -.09%

Unleaded Gasoline 222.62 -.02%

Natural Gas 5.51 -9.57%

Heating Oil 201.20 -1.34%

Gold 630.80 +2.62%

Base Metals 227.41 +4.48%

Copper 352.60 +4.94%

10-year US Treasury Yield 5.13% unch.

Average 30-year Mortgage Rate 6.79% +.15%

Leading Sectors

Gold & Silver +3.18%

Airlines +3.02%

Drugs +2.08%

REITs +1.94%

Tobacco +1.83%

Lagging Sectors

Oil Service -2.20%

Homebuilders -2.70%

Networking -2.99%

Computer Hardware -3.52%

Semis -4.91%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

S&P 500 1,265.48 -.58%

DJIA 11,090.67 -.89%

NASDAQ 2,130.06 -2.04%

Russell 2000 709.30 -.70%

Wilshire 5000 12,729.05 -.62%

S&P Equity Long/Short Index 1,129.31 +.08%

S&P Barra Growth 583.91 -.79%

S&P Barra Value 680.07 -.37%

Morgan Stanley Consumer 610.0 unch.

Morgan Stanley Cyclical 812.77 -1.46%

Morgan Stanley Technology 481.95 -2.89%

Transports 4,843.20 -.96%

Utilities 416.65 +.92%

S&P 500 Cum A/D Line 6,566.0 -4.0%

Bloomberg Oil % Bulls 68.0 +28.45%

CFTC Oil Large Speculative Longs 176,166 +3.0%

Put/Call .89 +34.85%

NYSE Arms 1.52 +245.45%

Volatility(VIX) 13.97 +7.21%

ISE Sentiment 124.00 +18.10%

AAII % Bulls 37.70 -2.33%

AAII % Bears 42.62 +7.17%

US Dollar 85.01 -1.06%

CRB 348.05 +1.68%

ECRI Weekly Leading Index 136.80 +.66%

Futures Spot Prices

Crude Oil 73.86 -.09%

Unleaded Gasoline 222.62 -.02%

Natural Gas 5.51 -9.57%

Heating Oil 201.20 -1.34%

Gold 630.80 +2.62%

Base Metals 227.41 +4.48%

Copper 352.60 +4.94%

10-year US Treasury Yield 5.13% unch.

Average 30-year Mortgage Rate 6.79% +.15%

Leading Sectors

Gold & Silver +3.18%

Airlines +3.02%

Drugs +2.08%

REITs +1.94%

Tobacco +1.83%

Lagging Sectors

Oil Service -2.20%

Homebuilders -2.70%

Networking -2.99%

Computer Hardware -3.52%

Semis -4.91%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

Subscribe to:

Comments (Atom)