Bloomberg:

- Israel extended its attacks on targets in Lebanon after Hezbollah forces fired rockets into Haifa, Israel’s third-biggest city in the north as the conflict entered its sixth day.

- The G-8 condemned “extremists” who triggered violence in the Middle East, calling on Hamas and Hezbollah to cease missile attacks on Israel and for Israel to limit its retaliation.

- Russia’s bid to join the World Trade Organization stalled over its barriers to US meat exports, officials from both countries said, hours after a statement from President Bush that a deal was “almost reached.”

- The UN Security Council voted 15-0 to adopt a resolution demanding that North Korea suspend its missile program and barring the communist nation from acquiring or selling missile technology.

- South Korean and Taiwanese stocks may be among Asia’s worst performers in the next six months as higher US interest rates and fuel prices threaten exports that powered their economies since 2002.

- Boeing Co.(BA) expects record oil prices to push US airlines to order new, more fuel efficient planes next year.

- When European Union officials created a market for trading pollution credits, they boasted it was a “cost-conscious way” to save the planet from global warming. Five years later, the 25-nation EU is failing to meet the Kyoto Protocol’s carbon-dioxide emission standards. Rather than help protect the environment, the trading system has led to increases in electricity prices of more than 50% and record profits for utility companies.

- Phelps Dodge(PD) boosted its friendly offer for Canadian nickel producers Inco Ltd.(N) and Falconbridge Ltd. to $36.3 billion in cash and stock, attempting to thwart hostile suitors in the biggest mining takeover ever.

Wall Street Journal:

- Wal-Mart Stores(WMT), France’s Carrefour SA and other overseas retailers may face higher costs expanding in China, where new rules are planned to regulate big shopping outlets.

- Chinese Premier Wen Jiabao called for stronger economic-control measures because of concern that the country’s rapidly growing economy could overheat.

Forbes:

- Hedge funds are leading a $25 billion bet on this year’s hurricane season.

NY Times:

- US oil imports may be completely eliminated by 2030 with an aggressive approach to energy efficiency and commercialization of already-demonstrated technologies for making fuels, citing a study by the Southern States Energy Board.

Washington Post:

- The Environmental Protection Agency ordered US dry cleaning shops in residential buildings to stop using a toxic solvent in their machines by 2020.

- A bipartisan group of US senators is gathering support for legislation that would create military tribunals based on military law and rules of courts martial to try suspected terrorists.

Star-Ledger of Newark:

- New Jersey and New York residents, faced with rising housing prices and higher taxes, are moving across the Delaware River to Pennsylvania.

Business Week:

- Toyota Motor(TM) may make an overture to General Motors(GM) to keep it from forging an alliance with Nissan Motor and Renault SA.

AP:

- Arab foreign ministers holding an emergency summit in Cairo on the conflict between Israel and Lebanon can’t agree on the legitimacy of Hezbollah’s attacks on Israel, citing unidentified delegates. Saudi Arabian Foreign Minister Pricnce Saud Al-Faisal said Hezbollah’s actions were “unexpected, inappropriate and irresponsible.” That’s a view shared by Egypt, Jordan, Kuwait, Iraq, the Palestinian Authority, the United Arab Emirates and Bahrain, the AP said.

Financial Times:

- One in five western Europeans trust Russian President Putin and fewer consider his nation a democracy.

Xinhua News Agency:

- Unsold residential and commercial floorspace in China was 18% higher at the end of May than a year earlier, and price increases are slowing.

- China’s government is struggling to boost consumer spending, making it difficult to reduce dependence on exports for economic growth, Qiu Xiaohua, director of the country’s National Bureau of Statistics said.

WirtschaftsWoche:

- DaimlerChrylser AG’s Mercedes Benz unit plans to sell its first hybrid car at the beginning of 2008.

Weekend Recommendations

Barron's:

- Had positive comments on (AAPL), (MGM), (HET), (LVS), (STN), (BYD), (IGT), (YHOO) and (RSG).

- Had negative comments on (PNRA).

Night Trading

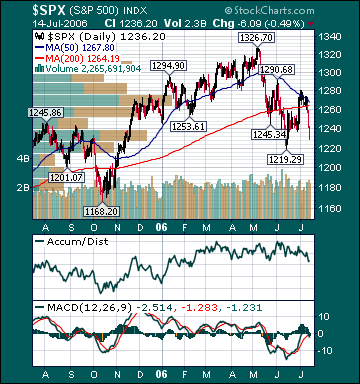

Asian indices are -1.25% to -.75% on average.

S&P 500 indicated +.02%

NASDAQ 100 indicated -.03%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (SCHW)/.20

- (C)/1.06

- (CBH)/.41

- (CMVT)/.19

- (ETN)/1.63

- (HDI)/.91

- (MI)/.78

- (MAT)/.04

Upcoming Splits

- (XRAY) 2-for-1

- (INFY) 2-for-1

Economic Releases

8:30 am EST

- Empire Manufacturing for July is estimated to fall to 20.0 versus a reading of 29.0 in June.

9:15 am EST:

- Industrial Production for June is estimated to rise .5% versus a .1% decline in May.

- Capacity Utilization for June is estimated to rise to 82.0% versus 81.7% in May.

BOTTOM LINE: Asian Indices are lower, weighed down by exporting shares in the region. I expect US stocks to open modestly lower and to rally into the afternoon, finishing modestly higher. The Portfolio is 75% net long heading into the week.