Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, October 09, 2006

Sunday, October 08, 2006

Monday Watch

Weekend Headlines

Bloomberg:

- Former US Fed chairman Alan Greenspan said the “worst may well be over” for the US housing slowdown.

- US stocks rallied last week, pushing the Dow Jones Industrial Average to an all-time high, as oil fell the most since March.

- The US gasoline pump price fell another 14 cents in the past two weeks to $2.28 a gallon, Trilby Lundberg said, citing her survey of about 7,000 filling stations nationwide.

- Gold’s appeal is fading as slumping commodity prices reduce the appeal of the precious metal as a hedge against inflation.

- Crude oil is up .71 in NY after six members of OPEC agreed to cut production by 1 million barrels a day to help stem the slide in prices.

- Natural gas futures, the worst-performing commodity this year, may fall in New York as inventories rise further, straining storage capacity and forcing producers to shut down wells, according to a Bloomberg survey of analysts.

- Russian journalist Anna Politkovskaya, one of the most vocal critics of Russian President Putin, was gunned down in Moscow yesterday, the third execution-style killing in the past three weeks.

- Japan and China warned North Korea not to conduct a nuclear weapons test and agreed to improve their own relations as Prime Minister Abe made the first visit by a Japanese leader to Beijing in five years.

- The consumer spending spree that Prime Minster Abe and central banker Toshihiko Fukui are counting on to drive Japan’s economic growth may fizzle.

- Deutsche Telekom AG, Europe’s biggest phone company, plans to spend $2.7 billion over three years to build a high-speed mobile network in the US.

- The US dollar surged to the highest against the yen since March this week after a US government report showed a drop in unemployment to 5-year lows.

- President Bush proposed strengthening the No Child Left Behind law, saying he wasn’t to further improve the quality of US teachers and giv4e parents more options to flee failing schools.

- Wall Street and corporate America have found a potent champion in Washington to back their demands for reduced corporate regulation: Treasury Secretary, and former Goldman Sachs(GS) CEO, Henry Paulson.

- Merrill Lynch(MER) leads as hedge fund drive a resurgence in Wall Street research.

Wall Street Journal:

- Harrah’s Entertainment’s(HET) private equity bidders plan to borrow against the company’s real estate to fund their $15 billion takeover.

- Chicago Mercantile Exchange(CME), the top US futures market, and Deutsche Boerse AG have considered discussing a combination.

Time:

- Many in the US government are now convinced that Cuban leader Fidel Castro has terminal cancer and won’t return to power.

NY Times:

- If US cars had the same fuel efficiency as those in Europe, global oil demand would decline by 4 million barrels a day, equal to Iran’s production, the CEO of Eni SpA said.

- Ismail Haniya, the Palestinian prime minister from Hamas, vowed not to recognize Israel in a speech before thousands of supporters in a soccer stadium in Gaza City.

- Archer-Daniels-Midland(ADM) CEO Woertz said the company will work over the next decade to develop ways to make ethanol from agricultural waste, grasses and other materials besides corn.

Rocky Mountain News:

- UAL Corp. and JetBlue Airways(JBLU) both may be studying mergers with rival carriers as part of an industry wide consolidation, citing airline analysts.

LA Times:

- The Tribune Co.(TRB) has hardened its resistance to selling off individual assets, making a potential sale of the LA Times to local investors less likely.

Financial Times:

- Over 100 US technology companies are considering listing on London Stocks Exchange Plc’s Alternative Investment Market.

- Recent move by some hedge funds to outsource some so-called “middle office” functions to cut costs will help make the industry more transparent, citing the SEC.

- Starbucks(SBUX) will sell packaged coffee in UK supermarkets from next year as part of a distribution agreement with Kraft Foods(KFT).

Observer:

- Chicago Board of Trade CEO Dan will talk with London Metal Exchange chief Martin Abbott about a link-up at a meeting this week.

Automobilqoche:

- German carmakers DaimlerChrysler AG(DCX), BMW AG, Audi AG and Volkswagen AG plan to form an alliance to help market their new diesel engines in the US.

Khaleej Times:

- Oman’s budget for next year will be based on an average oil price of $40 a barrel.

Sunday Times:

- Al-Qaeda planned to kill the Australian and English cricket teams during the 2005 Ashes series using sarin nerve gas. Mohammad Sidique Khan and Shehzad Tanweer, who bombed the London Underground, were allegedly ordered to get jobs as stewards at the Edgbaston, Birmingham cricket ground and spray the lethal gas in the changing rooms.

Weekend Recommendations

Barron's:

- Made positive comments on (CSCO), (BID) and (WU).

Night Trading

Asian indices are -.25% to +.25% on average.

S&P 500 indicated -.15%

NASDAQ 100 indicated -.24%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (CAKE)/.28

- (EMMS)/.11

Upcoming Splits

- (ACH) 4-for-1

Economic Releases

- None note

Bloomberg:

- Former US Fed chairman Alan Greenspan said the “worst may well be over” for the US housing slowdown.

- US stocks rallied last week, pushing the Dow Jones Industrial Average to an all-time high, as oil fell the most since March.

- The US gasoline pump price fell another 14 cents in the past two weeks to $2.28 a gallon, Trilby Lundberg said, citing her survey of about 7,000 filling stations nationwide.

- Gold’s appeal is fading as slumping commodity prices reduce the appeal of the precious metal as a hedge against inflation.

- Crude oil is up .71 in NY after six members of OPEC agreed to cut production by 1 million barrels a day to help stem the slide in prices.

- Natural gas futures, the worst-performing commodity this year, may fall in New York as inventories rise further, straining storage capacity and forcing producers to shut down wells, according to a Bloomberg survey of analysts.

- Russian journalist Anna Politkovskaya, one of the most vocal critics of Russian President Putin, was gunned down in Moscow yesterday, the third execution-style killing in the past three weeks.

- Japan and China warned North Korea not to conduct a nuclear weapons test and agreed to improve their own relations as Prime Minister Abe made the first visit by a Japanese leader to Beijing in five years.

- The consumer spending spree that Prime Minster Abe and central banker Toshihiko Fukui are counting on to drive Japan’s economic growth may fizzle.

- Deutsche Telekom AG, Europe’s biggest phone company, plans to spend $2.7 billion over three years to build a high-speed mobile network in the US.

- The US dollar surged to the highest against the yen since March this week after a US government report showed a drop in unemployment to 5-year lows.

- President Bush proposed strengthening the No Child Left Behind law, saying he wasn’t to further improve the quality of US teachers and giv4e parents more options to flee failing schools.

- Wall Street and corporate America have found a potent champion in Washington to back their demands for reduced corporate regulation: Treasury Secretary, and former Goldman Sachs(GS) CEO, Henry Paulson.

- Merrill Lynch(MER) leads as hedge fund drive a resurgence in Wall Street research.

Wall Street Journal:

- Harrah’s Entertainment’s(HET) private equity bidders plan to borrow against the company’s real estate to fund their $15 billion takeover.

- Chicago Mercantile Exchange(CME), the top US futures market, and Deutsche Boerse AG have considered discussing a combination.

Time:

- Many in the US government are now convinced that Cuban leader Fidel Castro has terminal cancer and won’t return to power.

NY Times:

- If US cars had the same fuel efficiency as those in Europe, global oil demand would decline by 4 million barrels a day, equal to Iran’s production, the CEO of Eni SpA said.

- Ismail Haniya, the Palestinian prime minister from Hamas, vowed not to recognize Israel in a speech before thousands of supporters in a soccer stadium in Gaza City.

- Archer-Daniels-Midland(ADM) CEO Woertz said the company will work over the next decade to develop ways to make ethanol from agricultural waste, grasses and other materials besides corn.

Rocky Mountain News:

- UAL Corp. and JetBlue Airways(JBLU) both may be studying mergers with rival carriers as part of an industry wide consolidation, citing airline analysts.

LA Times:

- The Tribune Co.(TRB) has hardened its resistance to selling off individual assets, making a potential sale of the LA Times to local investors less likely.

Financial Times:

- Over 100 US technology companies are considering listing on London Stocks Exchange Plc’s Alternative Investment Market.

- Recent move by some hedge funds to outsource some so-called “middle office” functions to cut costs will help make the industry more transparent, citing the SEC.

- Starbucks(SBUX) will sell packaged coffee in UK supermarkets from next year as part of a distribution agreement with Kraft Foods(KFT).

Observer:

- Chicago Board of Trade CEO Dan will talk with London Metal Exchange chief Martin Abbott about a link-up at a meeting this week.

Automobilqoche:

- German carmakers DaimlerChrysler AG(DCX), BMW AG, Audi AG and Volkswagen AG plan to form an alliance to help market their new diesel engines in the US.

Khaleej Times:

- Oman’s budget for next year will be based on an average oil price of $40 a barrel.

Sunday Times:

- Al-Qaeda planned to kill the Australian and English cricket teams during the 2005 Ashes series using sarin nerve gas. Mohammad Sidique Khan and Shehzad Tanweer, who bombed the London Underground, were allegedly ordered to get jobs as stewards at the Edgbaston, Birmingham cricket ground and spray the lethal gas in the changing rooms.

Weekend Recommendations

Barron's:

- Made positive comments on (CSCO), (BID) and (WU).

Night Trading

Asian indices are -.25% to +.25% on average.

S&P 500 indicated -.15%

NASDAQ 100 indicated -.24%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (CAKE)/.28

- (EMMS)/.11

Upcoming Splits

- (ACH) 4-for-1

Economic Releases

- None note

BOTTOM LINE: Asian Indices are mostly lower on reports of a North Korea nuclear test. I expect US stocks to open modestly lower and to rally into the afternoon, finishing modestly higher. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for The Week Ahead by Reuters

There are some economic reports of note and several significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - None of note

Tues. - Wholesale Inventories

Wed. - Sept. 20 FOMC Minutes

Thur. - Trade Balance, Initial Jobless Claims, Fed’s Beige Book

Fri. - Import Price Index, Advance Retail Sales, Univ. of Mich. Consumer Confidence, Business Inventories

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Cheesecake Factory(CAKE)

Tues. - Alcoa(AA), Chattem(CHTT), Genentech(DNA)

Wed. - Gannett Co.(GCI), Lam Research(LRCX), M&T Bank(MTB), Monsanto(MON), Progressive Corp.(PGR), Ruby Tuesday(RI)

Thur. - Apollo Group(APOL), Fastenal Group(FAST), Genzyme Corp.(GENZ), Harley-Davidson(HDI), MGIC Investment(MTG), Polaris Industries(PII), Winnebago Industries(WGO)

Fri. - General Electric(GE), JB Hunt Transportation(JBHT), Regions Financial(RF)

Other events that have market-moving potential this week include:

Mon. - None of note

Tue. - (SPLS) Analyst and Investor Conference, (CVS) Sept. Sales release, (CIEND) Analyst Day

Wed. - Fed’s Bies speaking, Fed’s Lacker speaking

Thur. - (WEN) Analyst Meeting, Fed’s Beige Book, Fed’s Moskow speaking

Fri. - None of note

There are some economic reports of note and several significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - None of note

Tues. - Wholesale Inventories

Wed. - Sept. 20 FOMC Minutes

Thur. - Trade Balance, Initial Jobless Claims, Fed’s Beige Book

Fri. - Import Price Index, Advance Retail Sales, Univ. of Mich. Consumer Confidence, Business Inventories

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Cheesecake Factory(CAKE)

Tues. - Alcoa(AA), Chattem(CHTT), Genentech(DNA)

Wed. - Gannett Co.(GCI), Lam Research(LRCX), M&T Bank(MTB), Monsanto(MON), Progressive Corp.(PGR), Ruby Tuesday(RI)

Thur. - Apollo Group(APOL), Fastenal Group(FAST), Genzyme Corp.(GENZ), Harley-Davidson(HDI), MGIC Investment(MTG), Polaris Industries(PII), Winnebago Industries(WGO)

Fri. - General Electric(GE), JB Hunt Transportation(JBHT), Regions Financial(RF)

Other events that have market-moving potential this week include:

Mon. - None of note

Tue. - (SPLS) Analyst and Investor Conference, (CVS) Sept. Sales release, (CIEND) Analyst Day

Wed. - Fed’s Bies speaking, Fed’s Lacker speaking

Thur. - (WEN) Analyst Meeting, Fed’s Beige Book, Fed’s Moskow speaking

Fri. - None of note

BOTTOM LINE: I expect US stocks to finish the week modestly higher on lower energy prices, short-covering, investment manager performance anxiety, bargain hunting, mostly positive economic reports and less pessimism. My trading indicators are still giving bullish signals and the Portfolio is 100% net long heading into the week.

Saturday, October 07, 2006

Market Week in Review

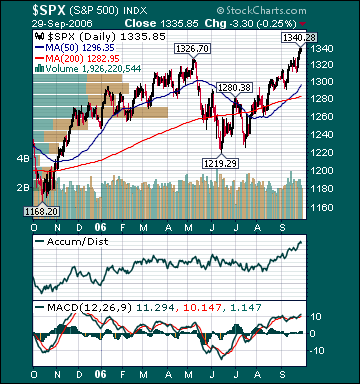

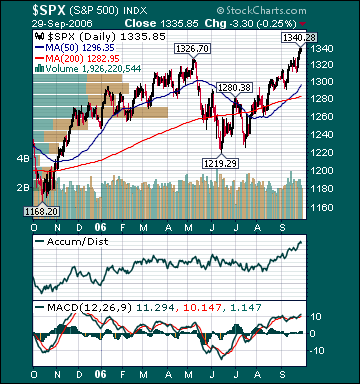

S&P 500 1,349.58 +1.03%*

Click here for the Weekly Wrap by Briefing.com.

*5-day % Change

Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was bullish as the Dow Jones Industrial Average made a new all-time high. The advance/decline line rose, most sectors gained and volume was above average on the week. Measures of investor anxiety were mostly higher. The AAII % Bulls plunged to 37.78% this week from 51.32% the prior week. This reading is now below average levels. The AAII % Bears soared to 46.67% this week from 32.89% the prior week. This reading is now approaching elevated levels. The 10-week moving average of the % Bears is currently 36.61%. The 10-week moving-average of the % Bears was 43.0% at the major bear market lows during 2002.

Soaring bearish sentiment and plunging bullish sentiment is absolutely mind-boggling considering the recent rally and the fact that the DJIA just took out its January 14, 2000 record high. There is overwhelming evidence that investor sentiment regarding U.S. stocks has never been this poor in history with the DJIA registering all-time highs. As well, there are many other indicators registering high levels of investor skepticism regarding recent stock market gains. This bodes very well for another substantial move higher in the major averages as the bears remain stunningly complacent, thus providing a high wall of worry for stocks to climb.

I believe this week's sharp deterioration in investor sentiment is a direct result of the strong belief by the herd that the U.S. is in a long-term trading range or secular bear environment. In my opinion, the bears' abuse of George Soros' Theory of Reflexivity(the theory basically states that the future outcome of an events can be altered by changing current perceptions regarding such an event) during the last few years has left most investors substantially underexposed to U.S. equities, specifically growth stocks, and many active traders leaning heavily the wrong way. Short interest on the NYSE and Nasdaq is at all-time highs. The ISE Sentiment Index has bounced around depressed levels for months. Domestic stock mutual funds are still seeing outflows.

The average 30-year mortgage rate fell another basis point to 6.3%, which is 50 basis points below July highs. I still believe housing is in the process of slowing, but will stabilize at relatively high levels over the coming months. Former Fed Chairman Alan Greenspan said this week he believes the “worst may well be over” for the housing slowdown. Mortgage applications surged 11.9% this week, the most since June 2005. The Case-Shiller housing futures are still projecting a 5% decline in the average home price over the next 9 months. Considering the average house has appreciated over 50% during the last few years, this would be considered a “soft landing.” The overall negative effects of housing on the US economy are currently being exaggerated by the bears, in my opinion. Housing has been slowing substantially for 14 months and has been mostly offset by many other very positive aspects of the economy. Americans’ median net worth is still very close to or at record high levels, unemployment is low, interest rates are low, stocks are rising and most measures of income growth are almost twice the inflation rate, just to name a few.

The benchmark 10-year T-note yield rose 6 basis points on the week on profit taking and diminishing economic growth concerns. Overall, September retail sales rose more than estimates and excluding Wal-Mart(WMT), gained a vigorous 6.0%. In my opinion, investors’ continuing fears over an economic “hard landing” are misplaced. Consumer spending is very important to the health of the US economy. Spending is poised to remain strong on plunging energy prices, low long-term interest rates, a rising stock market, healthy job market, decelerating inflation and more optimism. The CRB Commodities Index, the main source of inflation fears, has now declined 7.3% over the last 12 months and is down 17.8% from May highs, approaching bear market territory. The average commodity hedge fund is down 13.8% for the year. I believe inflation fears have peaked for this cycle as global economic growth moderates to around average levels, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies rose slightly less than expectations as refinery utilization fell substantially. U.S. gasoline supplies are still at the highest level since 1991 for this time of the year. Unleaded Gasoline futures fell again for the week and are 48.3% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. Gasoline demand is estimated to rise .8% this year versus a 20-year average of 1.7% demand growth. Moreover, distillate stocks are 18% above the five-year average for this time of the year as we head into the winter heating season. According to TradeSports.com, the percent chance of a US and/or Israeli strike on Iran this year has fallen to 6.6% from 36% late last year. The still elevated level of gas prices related to crude oil production disruption speculation by investment funds is further dampening fuel demand, which will send gas prices still lower.

US oil inventories have only been higher during one other period over the last 7 years. Since December 2003, global oil demand is only up .7%, while global supplies have increased 4.8%, according to the Energy Intelligence Group. Moreover, worldwide inventories are poised to begin increasing at an accelerated rate over the next year. I continue to believe oil is priced at extremely elevated levels on fear and record speculation by investment funds, not fundamentals. The Amaranth Advisors hedge fund blow-up is a prime example of the extent to which many investment funds have been speculating on ever higher energy prices through futures contracts, thus driving the price of the underlying commodity to absurd levels. Amaranth, a multi-strategy hedge fund, lost about $6.5 billion of its $9.5 billion under management in less than two months speculating mostly on higher natural gas prices. I suspect a number of other funds will experience similar fates over the coming months, which will further pressure energy prices as these funds unwind their leveraged positions to meet investor redemptions.

Oil has clearly broken its uptrend, notwithstanding that this is the seasonally strong period for the commodity. A major top in oil is likely already in place. However, further OPEC production cuts could lead to a temporary bounce higher in price over the next couple of weeks, accelerating demand destruction, resulting in a complete technical breakdown in crude. Demand destruction is already pervasive globally. Moreover, many Americans already feel as though they are helping fund terrorism or hurting the environment every time they fill up their gas tanks. I do not believe we will ever again see the demand for gas-guzzling vehicles that we saw in recent years, even if gas prices continue to plunge. An OPEC production cut with oil at still very high levels and weakening global growth would only further deepen resentment towards the cartel and result in even greater long-term demand destruction. Finally, as the fear premium in oil dissipates back to more reasonable levels, global growth slows and supplies continue to rise, crude oil should continue heading meaningfully lower over the intermediate-term, notwithstanding OPEC production cuts.

Natural gas inventories rose less than expectations this week, resulting in a short-covering rally in the commodity. Supplies are still 12.1% above the 5-year average, a record high level for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have collapsed 59.3% since December 2005 highs. It is very likely US natural gas storage will become full sometime this month, creating the distinct possibility of a “no-bid” situation for the physical commodity. Colorado State recently reduced its forecast from two to zero major hurricanes for this season versus seven last year. The peak of hurricane season was September 10. Natural gas prices are still in their seasonally strong period despite recent losses.

Gold fell on the week on US dollar strength and diminishing inflation worries. The US dollar rose on more economic optimism. I continue to believe there is very little chance of another Fed rate hike anytime soon. An eventual cut is more likely at this point as inflation continues to decelerate.

Restaurant stocks outperformed for the week on rising optimism over consumer spending on the decline in energy prices, low unemployment and rising stock prices. Energy stocks continued their recent substantial underperformance as the mania for these shares continues to unwind. S&P 500 profit growth for the second quarter came in a strong 16.3% versus a long-term historical average of 7%, according to Thomson Financial. This is the 16th straight quarter of double-digit profit growth, the best streak since recording keeping began in 1936. Moreover, another double-digit gain is likely in the third quarter. Earnings pre-announcements are running below average levels so far. Despite a 81.3% total return for the S&P 500 since the October 2002 bottom, its forward p/e has contracted relentlessly and now stands at a very reasonable 15.5. The 20-year average p/e for the S&P 500 is 24.4. The S&P 500 is now up 9.7% and the Russell 2000 Index is up 10.9% year-to-date. The DJIA made a new all-time high this week, breaking above its January 14, 2000 record close. I expect the Dow to break convincingly above 12,000 before year-end.

Current stock prices are still providing longer-term investors very attractive opportunities, in my opinion. In my entire investment career, I have never seen the best “growth” companies in the world priced as cheaply as they are now relative to the broad market. By contrast, “value” stocks are quite expensive in many cases. A recent CSFB report confirmed this view. The report concluded that on a price-to-cash flow basis growth stocks are now cheaper than value stocks for the first time since at least 1977. Almost the entire decline in the S&P 500’s p/e, since the bubble burst in 2000, is attributable to growth stock multiple contraction. I still expect the most overvalued economically sensitive and emerging market stocks to continue underperforming over the intermediate-term as the manias for those shares subside and global growth slows to more average rates. I continue to believe a chain reaction of events has begun that will result in a substantial increase in demand for US stocks.

In my opinion, the market is still factoring in way too much bad news at current levels, notwithstanding recent gains. One of the characteristics of the current “negativity bubble” is that most potential positives are undermined, downplayed or completely ignored, while almost every potential negative is exaggerated and promptly priced in to stock prices. Furthermore, this “irrational pessimism” by investors has resulted in a dramatic decrease in the supply of stock as companies bought back shares, IPOs were pulled and secondary stock offerings canceled. Commodity and emerging market funds, which have received huge capital infusions this year, will likely see significant outflows at year-end. I continue to believe there is massive bull firepower available at a time when the supply of stock is contracting.

Over the coming months, an end to the Fed rate hikes, lower commodity prices, seasonal strength, the November election, decelerating inflation readings, lower long-term rates, increased consumer/investor confidence, short-covering, investment manager performance anxiety, rising demand for US stocks and the realization that economic growth is only slowing to around average levels should provide the catalysts for another substantial push higher in the major averages through year-end as p/e multiples expand further. I still expect the S&P 500 to return a total of at least 15% for the year. The ECRI Weekly Leading Index rose this week and is forecasting healthy US economic activity.

*5-day % Change

Friday, October 06, 2006

Weekly Scoreboard*

Indices

S&P 500 1,349.58 +1.03%

DJIA 11,850.21 +1.47%

NASDAQ 2,299.99 +1.84%

Russell 2000 739.81 +1.96%

Wilshire 5000 13,467.92 +1.09%

S&P Barra Growth 626.66 +1.08%

S&P Barra Value 720.79 +.97%

Morgan Stanley Consumer 652.88 -.09%

Morgan Stanley Cyclical 837.57 +2.19%

Morgan Stanley Technology 537.67 +1.21%

Transports 4,569.83 +2.61%

Utilities 429.14 +.17%

MSCI Emerging Markets 98.90 +2.20%

S&P 500 Cum A/D Line 8,064.0 +4.0%

Bloomberg Crude Oil % Bulls 44.0 +8.7%

CFTC Oil Large Speculative Longs 159,235 -4.0%

Put/Call .96 +15.66%

NYSE Arms 1.06 +23.26%

Volatility(VIX) 11.56 -3.51%

ISE Sentiment 110.0 +37.50%

AAII % Bulls 37.78 -26.38%

AAII % Bears 46.67 +41.90%

US Dollar 86.51 +.56%

CRB 300.20 -1.76%

ECRI Weekly Leading Index 136.40 +.96%

Futures Spot Prices

Crude Oil 59.76 -5.08%

Unleaded Gasoline 150.42 -3.83%

Natural Gas 6.42 +14.24%

Heating Oil 169.40 -3.33%

Gold 577.90 -4.14%

Base Metals 230.79 -1.10%

Copper 339.10 -1.14%

10-year US Treasury Yield 4.69% +1.3%

Average 30-year Mortgage Rate 6.30% -.16%

Leading Sectors

Restaurants +5.32%

Gaming +4.72%

Biotech +3.16%

Internet +3.13%

I-Banks +3.10%

Lagging Sectors

Hospitals -1.29%

Energy -1.57%

Oil Service -3.26%

Gold & Silver -3.29%

Oil Tankers -3.50%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

S&P 500 1,349.58 +1.03%

DJIA 11,850.21 +1.47%

NASDAQ 2,299.99 +1.84%

Russell 2000 739.81 +1.96%

Wilshire 5000 13,467.92 +1.09%

S&P Barra Growth 626.66 +1.08%

S&P Barra Value 720.79 +.97%

Morgan Stanley Consumer 652.88 -.09%

Morgan Stanley Cyclical 837.57 +2.19%

Morgan Stanley Technology 537.67 +1.21%

Transports 4,569.83 +2.61%

Utilities 429.14 +.17%

MSCI Emerging Markets 98.90 +2.20%

S&P 500 Cum A/D Line 8,064.0 +4.0%

Bloomberg Crude Oil % Bulls 44.0 +8.7%

CFTC Oil Large Speculative Longs 159,235 -4.0%

Put/Call .96 +15.66%

NYSE Arms 1.06 +23.26%

Volatility(VIX) 11.56 -3.51%

ISE Sentiment 110.0 +37.50%

AAII % Bulls 37.78 -26.38%

AAII % Bears 46.67 +41.90%

US Dollar 86.51 +.56%

CRB 300.20 -1.76%

ECRI Weekly Leading Index 136.40 +.96%

Futures Spot Prices

Crude Oil 59.76 -5.08%

Unleaded Gasoline 150.42 -3.83%

Natural Gas 6.42 +14.24%

Heating Oil 169.40 -3.33%

Gold 577.90 -4.14%

Base Metals 230.79 -1.10%

Copper 339.10 -1.14%

10-year US Treasury Yield 4.69% +1.3%

Average 30-year Mortgage Rate 6.30% -.16%

Leading Sectors

Restaurants +5.32%

Gaming +4.72%

Biotech +3.16%

Internet +3.13%

I-Banks +3.10%

Lagging Sectors

Hospitals -1.29%

Energy -1.57%

Oil Service -3.26%

Gold & Silver -3.29%

Oil Tankers -3.50%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

Subscribe to:

Posts (Atom)