Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, May 14, 2007

Sunday, May 13, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- US stocks climbed for a sixth week, the longest stretch of gains since 2004, after easing inflation and takeovers spurred buying.

- Oil demand growth in China, the world’s second-largest energy consumer, may be less than forecast, the IEA said after revising its data for February. The IEA also revised downward overall global demand by .07 percent to 85.7 million barrels a day.

- President Bush appealed for bipartisanship as he urged Congress to act soon to overhaul the nation’s immigration laws.

- Mylan Labs(MYL) said it signed an agreement to buy Merck KGaA’s generic-drug unit for $6.7 billion by paying cash.

- Dow Chemical(DOW) agreed to partner with Saudi Aramco, the largest state-owned oil company, to build a chemicals complex in

- Carlyle Group LP, the buyout firm run by David Rubenstein, plans to raise $1 billion with its first public offering of an investment fund.

- Charles Schwab(SCHW), found and CEO of the biggest discount brokerage, said his small rivals E*Trade Financial(ET) and TD Ameritrade(AMTD) would benefit by merging into a single company.

- Fed Chairman Bernanke’s inflation concerns have prompted speculators to make a record bet against $88.8 billion of two-year Treasuries. That’s the amount of futures contracts on notes traders have sold short at the Chicago Board of Trade, the most since the Commodity Futures and Trading Commission(CFTC) began keeping track of the data in 1993.

- China’s money supply growth exceeded the government target for a third month and lending accelerated, adding pressure on the central bank to raise interest rates.

- European economic growth probably slowed in the first quarter after rising interest rates and a sales-tax increase in Germany discouraged consumer spending, a survey of economist shows.

- Overseas investment will flood emerging markets with $469 billion this year, according to the Institute of International Finance in Washington. That will bring the total since 2005 to almost $1.3 trillion, twice as much as in the prior three years. While fueling growth, all that cash is bringing side effects that threaten to turn booms into busts.

Wall Street Journal:

- Proposed changes for company financial statements by accounting-rule makers may do away with the net income figure, or the profit after all expenses and taxes paid.

- Cerberus Capital Management LP, a private-equity firm, appears to be the winning bidder for the Chrysler Group and an announcement may come tomorrow.

- IAC/InterActiveCorp(IAC) plans to introduce a new service May 14 on Sprint Nextel Corp.(S) mobile phones to combine products like its Citysearch with global positioning system technology. The Ask Mobile GPS service, which will cost about $9 a month, will offer features such as the ability to look up a user’s location on a map and send that to friends.

Barron’s:

- Goldman Sachs Group(GS) won the No. 1 spot in Barron’s 500 annual corporate performance survey based on the investment bank’s culture of “hard work, business acumen and teamwork” that has allowed it to survive market crises and management transitions.

NY Times:

- Former President Bill Clinton has assumed the role of chief political strategist to his wife and Democratic presidential candidate Senator Hillary Rodham Clinton.

- The Supreme Council for the Islamic Revolution in

San Francisco Chronicle:

- House prices in

MIT Review:

- The Secret of Apple Design. The inside story of why Apple’s(AAPL) industrial-design machine has been so successful.

- Qwest Communications(Q) will seek to accelerate negotiations with local municipalities in

LA Times:

- Regal Entertainment Group(RGC) and National Amusements Inc., the two biggest

MarketWatch.com:

- Has Richard Russell finally thrown in the towel on his long-standing bearishness? “To me, a fellow steeped in Dow Theory for over half a century, this was like a clap of thunder...My take on the situation is that the stock market told us that an unprecedented world boom lies ahead,” Russell said.

- Is the best yet to come…from China? Commentary: Huge influx of capital could power US stock boom. The China Banking Regulatory Commission, in an attempt to cool its overheated stock market, has ruled that Chinese banks can now invest as much as 50% of their funds in overseas stock markets. Dennis Slothower, editor of the On the Money newsletter says that this means that “up to $2.3 trillion in

Zacks.com:

- As things stand now, it’s about an even money bet that the median S&P firm will post double-digit year-over-year earnings growth for the first quarter. That would make it the 19th straight quarter, extending the longest streak in US history.

AP:

- Zimbabwe won approval to head the UN Commission on Sustainable Development amid protests from the US, European nations and human rights organizations. President Robert Mugabe, 83, who has ruled

- China catches stock market fever. After watching Chinese stock prices gallop upward for months, Ding Xiurui wanted a piece of the action. The 45-year-old office worker stood in line at a bustling brokerage Friday to open her first trading account. She brought her sister, who opened an account too. They joined millions of other novice investors who are jumping into a market that has soared to dizzying heights, with prices up nearly 50 percent this year.

- Minnesota Governor Pawlenty will sign a bill that makes his state the 20th in the

- Mullah Dadullah, the Taliban’s top military commander, was killed yesterday in fighting with Afghan and NATO troops.

Financial Times:

- Some of the world’s biggest fund managers are set to expand aggressively into the booming Chinese wealth management market following a rule change that could trigger a massive flow of mainland investments into foreign equity products.

- The Middle East provides clues on the outcome of the meteoric recent rise of the Chinese stock market, warns Tim Harris, JPMorgan Private Bank’s chief investment strategist in Europe, Middle East and Africa.

- US online sale rise 29% to $146.5 billion. Americans bought more clothing and shoes online last year than computers and software in a sign of the growing mainstream acceptance of Internet retailing.

- The extended Bancroft family is split over its support for News Corp.’s(NWS/A) $5 billion offer for Dow Jones(DJ), citing a family member. Some family members are in favor of meeting News Corp. Chairman Rupert Murdoch to discuss the offer.

- SEC steps up action on insider trading. International stock exchanges and electronic trading are changing the way US regulators detect and punish insider trading, forcing them to speed up their investigations and take court action more quickly.

Sunday Telegraph:

- Clear Channel Communications(CCU) will put its international billboard business up for sale for an estimated $3.2 billion.

- BHP Billiton Ltd., Rio Tinto Ltd., Brazil’s Cia. Vale do Rio Doce and OAO Russian Aluminum mining companies are considering bids for aluminum producer Alcan Inc.(AL) to prevent Alcoa(AA) from acquiring the company.

Sunday Times:

- Reuters Group Plc’s proposed sale to Thomsan Corp. will be approved this week by the Reuters Founders Share Co., clearing one of the final hurdles in Thomson’s $17.4 billion bid for the financial data provider.

Finanz & Wirtschaft:

- Alcon’s(ACL) profit may double and sales at the eye-care company controlled by Nestle SA should grow up to 10% this year.

Xinhua News Agency:

- Shanghai residents transferred more than $9.1 billion from savings accounts into stock-trading accounts in the first four months of the year, citing the central bank.

-

Weekend Recommendations

Barron's:

- Made positive comments on (STZ), (NLY), (NUE), (AKS), (RS), (STLD) and (CVC).

Citigroup:

- Israeli shares were raised to Overweight from Underweight, citing a growing economy and falling interest rates.

- Reiterated Buy on (MAR), target $62.

- Reiterated Buy on (SNDK), target $52. We remain confident NAND fundamentals can move into under-supply by late-3Q. Upcoming milestones impacting sector psychology include: 1) Motorola’s(MOT) new product launch 2) Bi-monthly contract pricing updates 3) Monthly US retail card/drive/MP3 sell-through date and 4) Apple’s(AAPL) late-June iPhone launch.

Night Trading

Asian indices are +.25% to +1.0% on average.

S&P 500 indicated +.07%.

NASDAQ 100 indicated +.16%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (A)/.43

- (GBE)/-.07

- (NAT)/.81

- (PETS)/.14

- (SINA)/.18

- (ELOS)/.36

Upcoming Splits

- (NXY) 2-for-1

Economic Releases

- None of note

Other Potential Market Movers

- The Fed’s Fisher speaking, Fed’s Lockhart speaking, UBS Global Financial Services Conference and UBS Alternative Energy Conference could also impact trading Monday.

Weekly Outlook

Click here for The Week Ahead by Reuters

Click here for Stocks in Focus for Monday by MarketWatch

There are some economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – Consumer Price Index, Empire Manufacturing, Net Long-term TIC Flows, NAHB Housing Market Index, weekly retail sales

Wed. – Weekly MBA Mortgage Applications, Housing Starts, Building Permits, Industrial Production, Capacity Utilization

Thur. – Initial Jobless Claims, Leading Indicators, Philly Fed

Fri. –

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Agilent(A), Grubb & Ellis(GBE), PetMed Express(PETS), Sina Corp.(SINA), Syneron Medical(ELOS)

Tues. – Applied Materials(AMAT), Compuware(CPWR), Fossil Inc.(FOSL), Freddie Mac(FRE), Home Depot(HD), Shaw Group(SGR), Telephone & Data(TDS), TJX Cos(TJX), Transaction Systems(TSAI), Wal-Mart Stores(WMT)

Wed. – Cato Corp.(CTR), Ctrip.com(CTRP), Deere & Co.(DE), Dick’s Sporting Goods(DKS), Federated Department Stores(FDO), Hewlett-Packard(HPQ), Jack in the Box(JBX), Mentor Corp.(MNT), O’Charleys(CHUX), PetSmart(PETM), Salesforce.com(CRM), Swift Transportation(SWFT)

Thur. – Advance Auto Parts(AAP), Focus Media Holding(FMCN), Gymboree Corp.(GYMB), Intuit Inc.(INTU), JC Penney(JCP), Kohl’s Corp.(KSS), Longs Drug Stores(LDG), Netease.com(NTES), Nordstrom(JWN), Pacific Sunwear(PSUN), Sonic Solutions(SNIC)

Fri. – Activision(ATVI), Alkermes(ALKS), American Eagle Outfitters(AEO), Cleveland-Cliffs(CLF), International Rectifier(IRF), Steinmart(SMRT)

Other events that have market-moving potential this week include:

Mon. - UBS Global Financial Services Conference, UBS Alternative Energy Conference, the Fed’s Fisher speaking, the Fed’s Lockhart speaking

Tue. – UBS Alternative Energy Conference, CSFB Semi&Supply-Chain Summit, Merrill Lynch Global E&C/Infrastructure Conference, Oppenheimer Moving Beyond Voice Conference, UBS Global Financial Services Conference, Deutsche Bank Tech Conference, Morgan Stanley Communications Conference, the Fed’s Lockhart speaking, the Fed’s Bernanke speaking, the Fed’s Minehan speaking, the Fed’s Mishkin speaking, the Fed’s Geithner speaking, the Fed’s Hoenig speaking

Wed. - UBS Global Financial Services Conference, Oppenheimer Semiconductor Tech Conference, Deutsche Bank Tech Conference, Bank of America Smid Cap Conference, Morgan Stanley Communications Conference, Goldman Sachs Basic Materials Conference, CSFB Semi&Supply-Chain Summit, the Fed’s Plosser speaking, the Fed’s Kohn speaking, the Fed’s Fisher speaking

Thur. - CSFB Insurance Forum, Bank of America Smid Cap Conference, Goldman Sachs Basic Materials Conference, Deutsche Bank Tech Conference, former Fed Chairman Greenspan speaking, the Fed’s Moskow speaking, the Fed’s Bernanke speaking

Fri. – None of note

BOTTOM LINE: I expect US stocks to finish the week modestly higher on buyout speculation, constructive Fed comments, better-than-expected earnings reports, lower energy prices, investment manager performance anxiety and short-covering. My trading indicators are still giving bullish signals and the Portfolio is 100% net long heading into the week.Saturday, May 12, 2007

Friday, May 11, 2007

Weekly Scoreboard*

Indices

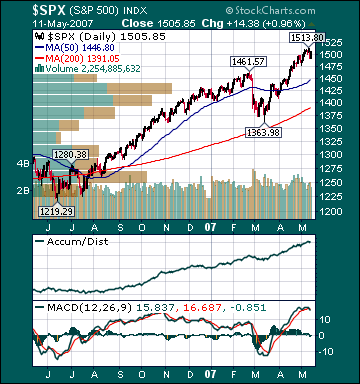

S&P 500 1,505.85 +.01%

DJIA 13,326.22 +.46%

NASDAQ 2,562.22 -.39%

Russell 2000 829.54 -.40%

Wilshire 5000 15,164.43 +.03%

Russell 1000 Growth 593.50 -.16%

Russell 1000 Value 867.33 +.22%

Morgan Stanley Consumer 738.92 -.43%

Morgan Stanley Cyclical 1,052.38 +1.13%

Morgan Stanley Technology 609.70 +.25%

Transports 5,165.92 -.10%

Utilities 526.54 +.06%

MSCI Emerging Markets 124.85 +.02%

Sentiment/Internals

NYSE Cumulative A/D Line 75,890 -.92%

Bloomberg New Highs-Lows Index +175 -67.3%

Bloomberg Crude Oil % Bulls 38.0 +7.7%

CFTC Oil Large Speculative Longs 188,498 -3.4%

Total Put/Call .94 +16.05%

NYSE Arms .62 -36.08%

Volatility(VIX) 12.95 +.31%

ISE Sentiment 122.0 -13.5%

AAII % Bulls 42.86 +50.0%

AAII % Bears 42.86 -21.0%

Futures Spot Prices

Crude Oil 62.46 +1.2%

Reformulated Gasoline 235.50 +6.43%

Natural Gas 7.91 +.11%

Heating Oil 188.50 +3.0%

Gold 672.10 -2.54%

Base Metals 277.35 -1.5%

Copper 360.70 -4.15%

Economy

10-year US Treasury Yield 4.67% +3 basis points

4-Wk MA of Jobless Claims 317,300 -3.5%

Average 30-year Mortgage Rate 6.15% -1 basis point

Weekly Mortgage Applications 680.70 +3.6%

Weekly Retail Sales +.10%

Nationwide Gas $3.04/gallon +.03/gallon

US Heating Demand Next 7 Days 13.0% below normal

ECRI Weekly Leading Economic Index 142.70 +.21%

US Dollar Index 82.11 +.46%

CRB Index 311.13 -.03%

Leading Sectors

Steel +4.0%

Defense +1.84%

Disk Drives +1.55%

Computer Hardware +1.46%

Wireless +1.31%

Lagging Sectors

I-Banks -1.20%

Internet -1.40%

Gold -1.59%

Alternative Energy -1.63%

Drugs -1.86%