Weekend Headlines

Bloomberg:

- General Motors(GM), Ford Motor(F) and DaimlerChrysler AG’s Chrysler may create an independent health-insurance fund to trim their combined $114 billion in future retiree health-care obligations.

- Boeing(BA) won an order valued at about $3 billion from OAO Aeroflot for 22 of the 787 Dreamliners in a possible sign of better relations between the US and Russia.

- The US dollar strengthened to a more than two-month high against the euro as rising Treasury yields and economic growth triggered speculation international investors will boost investment in US assets.

- The United Auto Workers, which has yet to organize a US plant built by an Asian carmaker, is planning its second event this year aimed at convincing Toyota Motor(TM) employees in Kentucky that they need union representation.

- Israeli billionaires Nochi Dankner and Yitzhak Tshuva agreed to develop a Las Vegas hotel and casino complex for between $6 billion and $8 billion.

- China’s inflation probably accelerated in May as pork prices soared, increasing the likelihood that interest rates will be raised.

- Indonesia’s rupiah led declines in Asian currencies on speculation losses in global equity markets encouraged investors to sell riskier assets. Concern world interest rates will rise and slow consumer spending and investment spurred the sell-off in emerging-market assets.

- OPEC said oil prices are “reasonable” on an inflation-adjusted basis and world crude markets are “adequately supplied.” OPEC countries are building spare production capacity, currently between 2.5 million and 3 million barrels a day, as a means of moderating prices over the long term, he said.

- US gasoline prices at the pump fell 7 cents during the past three weeks to an average of $3.11 a gallon, Trilby Lundberg said. Gas prices fell as inventories of the motor fuel have jumped 4.3% since April when a 12-week decline in supplies related to a rash of nationwide refinery “problems” ended. Supplies are now 5.3% below the five-year average in the week ended June 1. Three weeks ago they stood a t7.5% below the average.

- Global demand for liquefied natural gas is growing at 8% a year, increasing demand for plants and raising construction costs, said Hassan Marican, chief executive of Malaysian state oil company Petroliam Nasional Bhd.

- French President Nicolas Sarkozy is set to tighten his grip on policy making after his Union for a Popular Movement won the first round of legislative elections in France. “These elections could be a tsunami for the UMP and a triumph for Sarkozy,” said Gerard Grunberg, head of research at the Institute for Political Studies in Paris.

- Iran expects oil production from the Darkhovin oil field, operated by Eni Spa, to rise by almost 300% by the end of 2007. The field’s output will surge to 160,000 barrels per day.

- Gold may fall for a second week on speculation that higher global interest rates will reduce demand for the precious metal as an alternative investment, according to a Bloomberg survey of 36 traders, investors and analysts.

- China is committed to sustainable development of its economy, a continuance of measures to open up the economy, and protection of intellectual property rights, President Hu Jintao said. In his speech, Hu outlined that China has set targets of reducing “energy intensity” by 20% within three years.

- Japan’s economy expanded 3.3% in the first quarter, more than the government first thought after better-than-expected spending by companies.

- Denso Corp., the world’s largest listed auto-parts maker, plans to hire 13% more engineers within 3 years as its biggest customer, Toyota Motor(TM), increases production of hybrid and other alternative-fuel vehicles.

- A new regulation relieving capital restraints may enable the biggest US securities firms to make the rest of 2007 exceptional for shareholders.

- China’s benchmark CSI 300 Index would need to fall as much as 54% to come in line with the price-to-earnings ratio of Hong Kong’s Hang Seng China Enterprises Index, which tracks shares of 41 mainland companies listed in the city. The CSI 300 would have to drop 65% to match the average multiple for Chinese shares traded in Singapore, according to calculations by Bloomberg.

Wall Street Journal:

- The US housing slump may last through at least the end of this year amid a glut of homes for sale and higher interest rates, according to some economists.

- Residents of the Eskimo village of Shungnak, Alaska, are being forced to abandon petroleum products amid a doubling of oil prices over the past few years, and some have reverted to heating their homes with wood and cutting back on gasoline.

- A Hearst Corp. unit and groups suing over the published prices of wholesale drugs won preliminary approval of a settlement that could roll back prices on prescription drugs.

Denver Post:

- More than 18,000 new uranium mining claims for Colorado and Utah have been filed in the past 12 months, a reflection of the growing need to fuel new nuclear power plants worldwide.

NY Times:

- Wyeth(WYE), Elan Corp., Eli Lilly(LLY) and other drugmakers are working to develop new Alzheimer’s disease treatments, with several hundred ideas being examined.

Washington Post:

- The North Korean government spent more than $3 million in UN aid money for the poor on property in France, the UK and Canada, citing a confidential US State Dept. report.

- Labor unions in the US are hiring staff members with investment experience in order to help workers understand how to negotiate worker-friendly agreements with new private equity owners of companies.

- Senior Democratic legislators reached an agreement with the National Rifle Association on a system to toughen national background checks for gun buyers, in what might become the first gun-control legislation since 1994.

NY Post:

- Christmas 2007 Toy Preview.

Barron’s:

- Rebecca Rothstein, a financial adviser at Citigroup Inc.(C) subsidiary Smith Barney, rose to the top spot on Barron’s list of the top 100 women money managers, after ranking second last year.

Chicago Tribune:

- Democratic presidential candidate Barack Obama may have raised as much as $2 million yesterday in less than 10 hours at fundraisers in Chicago.

Information Week:

- Apple WWDC: iPhone Manual Leaked on Eve of Conference.

AP:

- The US is expanding a probe of a terrorist plot against NY’s JFK Intl. Airport and is seeking more suspects beyond the four already in custody.

Business Week:

- BusinessWeek uncovers that CNBC’s own design flaw may be behind the investigation into its million-dollar stockpicking contest.

Google Maps Mania:

- 6 ways to Find Cool Google Maps Street Views.

Financial Times:

- LG Group is seeking the suspension of a US ban on imports of third-generation mobile phones containing chips made by Qualcomm Inc.(QCOM).

- After selling film and television downloads and changing the way people consume music with the iPod, Apple’s latest venture will see it enter a business normally associated with Blockbuster and other DVD rental chains.

- Apple Inc.(AAPL) is in advanced discussions with major Hollywood movie studios about starting an online film rental service. Apple may be aiming for an autumn release of its rental service.

Guardian:

- President Bush insisted Kosovo must be independent and received a hero’s welcome in Albania.

Sunday Times:

- Tesco Plc, the UK’s biggest retailer, plans to open 50 stores in the US by February 2008, the equivalent of about three a week, citing Tim Mason, head of the company’s US operations.

Automotive News Europe:

- Ford Motor(F) hired Goldman Sachs(GS) and Morgan Stanley(MS) to find buyers for its Jaguar, Land Rover and Volvo brands.

Gazeta Wyborcza:

- Poland plans to keep its troops in Iraq next year, delaying a withdrawal, citing military officials.

Neue Zuercher Zeitung:

- Dell Inc.(DELL) plans to almost double its “cash flow” by expanding into emerging markets and by servicing computer systems, CEO Dell said.

Economic Daily News:

- AU Optronics(AUO) forecast sales of liquid-crystal displays for televisions and personal-computer monitors will rise about 60% this year on increased demand, citing Executive Vice President Hui Hsiung.

South China Morning Post:

- The NYSE eased listing requirements to attract more mainland Chinese companies.

21st Century Business Herald:

- China’s next round of adjustments to its export-tax regime may include cancellation of breaks for clothes and shoes, citing an official in the Ministry of Commerce financial affairs office. A plan for further cuts in export-tax rebates may be issued at the beginning of July. China has been reducing or scrapping export tax benefits for metals and other energy intensive, polluting commodities to curb a record trade surplus and encourage production of higher-value goods.

Ham Mihan:

- Iran has set up a committee to supervise the publication of President Mahmoud Ahmadinejad’s ideology, citing the presidential office.

Al-Hayat:

- Baghdad-based National Cars Company signed a contract with Renault SA to import cars and trucks in the country. The agreement with France’s second-biggest carmaker offers customers finance plans and options to pay in installments.

Weekend Recommendations

Barron's:

- Made positive comments on (WYN), (CSCO), (LTD) and (TWB).

Citigroup:

- Reiterated Buy on Google(GOOG), target $600. Compared to other Large Cap Internet stocks, (GOOG) trades at a significant (40-60%) discount on a price-to-earnings-to-growth (PEG) basis. We believe this discount is excessive and offers investors a positive risk-reward outlook on (GOOG) shares, even here at record highs. As a search engine, Google’s query share continues to expand to a record high 67% in April. As a navigation bar, Google’s influence continues to expand. 16% of Amazon’s traffic comes from Google. As a provider of non-search applications, Google’s momentum continues to build. GMaps is bigger AND growing faster than competitors. 1) Material market share gains despite Vista and IE7 may create opportunities when renewal time comes for aggressive distribution deals. 2) GMail and Google Maps are being better and likely materially monetized. Sponsored link and pay-per-call Maps links. Our proprietary study of Google, Yahoo!, & MSN search results highlights much greater integration of video, image, maps and news at Google. Google search is clearly more robust. The so-what here is that existing advertisers will over time have fore formats to buy from Google and brand advertisers will become more attracted to Google. Every percentage point of net advertising market share = $.67 incremental EPS. The seven other Large Cap Internet stocks carry an average PEG of 2.2x. Were GOOG to trade at these PEGs, it current stock price would be between 42% and 57% higher.

- Reiterated Buy on (ABK), target $107.

Night Trading

Asian indices are +.25% to +.75% on average.

S&P 500 indicated -.22%.

NASDAQ 100 indicated -.26%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (CMVT)/.21

- (JOSB)/.42

- (TTWO)/-.52

Upcoming Splits

- (CROX) 2-for-1

- (WMS) 3-for-2

- (ADVNA) 3-for-2

- (BNHN) 3-for-2

- (BWLD) 2-for-1

- (MIDD) 2-for-1

- (PEBK) 3-for-2

Economic Releases

- None of note

Other Potential Market Movers

- The could also impact trading on today.

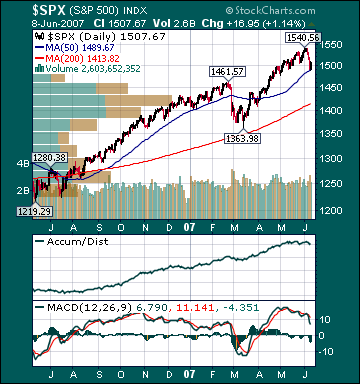

BOTTOM LINE: Asian indices are mostly higher, boosted by technology and financial shares in the region. I expect US stocks to open mixed and to rally into the afternoon finishing modestly higher. The Portfolio is 100% net long heading into the week.