Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, July 09, 2007

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Sunday, July 08, 2007

Monday Watch

Weekend Headlines

Bloomberg:

-

- KBR Inc.(KBR) won a $2.85 billion contract to build

- Roger Federer beat Rafael Nadal to become the first player since Bjorn Borg in 1980 to win five straight

- China’s yuan is rising at the fastest pace since the nation’s central bank abandoned its link to the dollar in 2005, and US lawmakers still aren’t satisfied.

- Boeing Co.(BA) today unveils its 787 Dreamliner at an event hosted by former television news anchor Tom Brokaw before 15,000 people and broadcast live by satellite in nine languages.

- There are an estimated 25 billion barrels of oil in the Kurdish-controlled region of Iraq and 10 billion more around the city Kirkuk.

- Japan’s machinery orders, a key indicator of corporate spending plans, rose for a second month in May, supporting the central bank’s case that interest rates need to increase.

- The yen fell to a record low against the euro and a 16-year low against the Australian dollar as signs of stronger global growth gave investors more confidence to buy higher-yielding assets with money borrowed in

- French President Nicolas Sarkozy has a message for European finance ministers and central bankers criticizing his plans to revive France’s economy: Back off.

Wall Street Journal:

- Washington state drivers now pay 36 cents in taxes for each gallon of gasoline after an increase of about 6% in the tax, the most of any in the nation, citing a survey.

- John Riccitiello, who became CEO of Electronic Arts(ERTS) in April, said video-game makers need to draw an audience beyond hard-core players.

- Intercontinental Exchange(ICE) won’t raise its bid to acquire the Chicago Board of Trade(BOT).

- Clearinghouse Faulted On Short-Selling Abuse; Finding the Naked Truth.

- As negotiations with News Corp.(NWS/A) continue, Dow Jones(DJ) is making one last push to find other possible buyers for itself, according to people familiar with the matter.

NY Times:

- Representative John Dingell, chairman of the US House Energy and Commerce Committee, said he plans to introduce a bill proposing a “carbon tax” to spur change in the use of fossil fuels.

- Sears(SHLD) Responds to Its Critics With a Call for Patience.

- Snack-food makers including PepsiCo’s(PEP) Frito-Lay and Campbell Soup’s(CPB) Pepperidge Farm are rolling out smaller, more profitable packages of chips, cookies and crackers as their popularity balloons.

- Residents on the

iLounge:

- All Things iPhone: Add-Ons and Third-Party Software.

- US Senate Majority Leader Harry Reid has assured Democrats who oppose the

- The Federal Reserve will “probably” cut interest rates by the end of the year as the housing slump weighs on the economy, according to Bill Gross, manager of the world’s biggest bond fund.

MarketWatch.com:

- Gilead Sciences(GILD) is one of those rare companies that appears to be in a position to do some good for the world, while at the same time keep investors happy with high earnings and a strong stock performance.

- Betting on ‘bio-refineries’ to harvest new fuels. Worried that corn can’t fill up gas tanks? Make way for cellulosic ethanol.

- The vacancy rate for suburban office space around

Crain’s

- Madison Dearborn Partners LLC CEO John Canning wants to raise $10.5 billion to create the private-equity firm’s largest fund.

Financial Times:

- AT&T(T), the largest US phone company, will offer its first municipal wireless Internet service in Riverside, California.

- Institutional Investor’s list of the top 20 rising hedge fund stars.

- The New York Mercantile Exchange(NMX) on Monday will call for it main rival in energy derivatives trading, the Intercontinental Exchange(ICE), to be brought under the full jurisdiction of federal regulators amid growing concern over light regulation in the rapidly growing over-the-counter markets.

- A Chinese city where residents recently held mass protests against a planned chemicals plant is preparing to tighten controls on the internet and force users to use their real names when posting messages on local websites.

- Hedge funds and private equity have one big thing in common. Both charge whopping fees – typically 2% of assets under management and 20% of investment profits. Otherwise, the differences are huge.

- The UK government will not soften its stance on Iran’s nuclear ambitions and may take steps to toughen sanctions on the country, according to British Foreign Secretary David Miliband.

- News Corp.(NWS/A) has set up a video-gaming league that will debut tomorrow on DIRECTV satellite television in the US, citing Eric Shanks, executive vp of DIRECTV Entertainment.

Financial Mail of Sunday:

- Virgin Media Inc.(VMED), a

Sunday Telegraph:

- The UK will face a threat from terrorists for as long as 15 years, Admiral Sir Alan West, the minister for security, said in an interview.

Sunday Times:

- Ford Motor(F) set July 19 as a deadline for indicative bids for its Jaguar and Land Rover units in the UK.

Focus:

- Volkswagen AG is considering building a

National Business Daily:

- Research In Motion(RIMM) received orders for 5,000 Blackberry e-mail phones from foreign companies based in

People’s Daily:

-

Weekend Recommendations

Barron's:

- Made positive comments on (GILD) and (ITW).

- Made negative comments on (SONO).

Citigroup:

- Reiterated Buy on (MU), (SNDK) and (CELG).

Night Trading

Asian indices are +.50% to +1.0% on average.

S&P 500 indicated +.05%.

NASDAQ 100 indicated unch.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (AGIL)/.03

- (AA)/.80

- (SCHN)/1.07

- (WDFC)/.46

Upcoming Splits

- (FTK) 2-for-1

- (TPL) 5-for-1

Economic Releases

3:00 pm EST

- Consumer Credit for May is estimated to rise to $7.0 billion from $2.6 billion in April.

Other Potential Market Movers

- The (TTWO) conference call could also impact trading on Monday.

Weekly Outlook

Click here for The Week Ahead by Reuters.

Click here for Stocks in Focus for Monday by MarketWatch.com.

There are some economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Consumer Credit

Tues. – Wholesale Inventories, weekly retail sales reports

Wed. – Weekly EIA energy inventory data, weekly MBA Mortgage Applications report

Thur. – Trade Balance, Initial Jobless Claims, ICSC Chain Store Sales, Monthly Budget Statement

Fri. – Import Price Index, Advance Retail Sales,

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Alcoa Inc.(AA), Schnitzer Steel(SCHN), WD-40(WDFC)

Tues. – Acuity Brands(AYI), Audiovox Corp.(VOXX), Biomet(BMET), Chattem(CHTT), Emmis Communications(EMMS), Greenbrier(GBX), Helen of Troy(HELE), Pepsi Bottling(PBG)

Wed. – AAR Corp.(AIR), Chaparral Steel(CHAP), Genentech(DNA), Resources Connection(RECN), Ruby Tuesday(RT), Wolverine World Wide(WWW), Yum! Brands(YUM)

Thur. – Fastenal(FAST), Fleetwood Enterprices(FLE), M&T Bank(MTB), Marriott(MAR), Progressive Corp.(PGR), Texas Industries(TXI)

Fri. – General Electric(GE)

Other events that have market-moving potential this week include:

Mon. – (TTWO) Conference Call

Tue. – CE Unterberg Towbin Emerging Growth Conference, CIBC Consumer Growth Conference, Roth Capital Semi Conference, Kaufman Defense Technology Conference

Wed. – The Fed’s Plosser speaking, (LIZ) analyst meeting, (MSFT) financial analyst briefing, CE Unterberg Towbin Emerging Growth Conference, CIBC Consumer Growth Conference

Thur. – The Fed’s Yellen speaking, (MU) analyst conference, Pacific Growth Cardiology Conference, CE Unterberg Towbin Emerging Growth Conference, CIBC Consumer Growth Conference, BMO Capital Media/Comm/Tech Conference

Fri. – None of note

BOTTOM LINE: I expect US stocks to finish the week modestly higher on lower long-term rates, subsiding terrorism fears, diminished sub-prime concerns, lower energy prices, bargain hunting, better-than-expected earnings reports and short-covering. My trading indicators are now giving mostly bullish signals and the Portfolio is 100% net long heading into the week.Friday, July 06, 2007

Weekly Scoreboard*

Indices

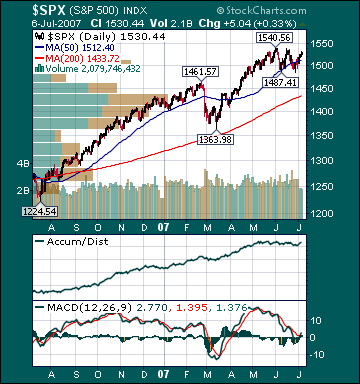

S&P 500 1,530.44 +1.64%

DJIA 13,611.68 +1.41%

NASDAQ 2,666.51 +2.23%

Russell 2000 852.31 +1.58%

Wilshire 5000 15,456.07 +1.77%

Russell 1000 Growth 609.19 +2.14%

Russell 1000 Value 871.56 +1.45%

Morgan Stanley Consumer 735.70 +.73%

Morgan Stanley Cyclical 1,100.52 +2.50%

Morgan Stanley Technology 637.22 +1.87%

Transports 5,231.29 +1.91%

Utilities 505.16 +1.80%

MSCI Emerging Markets 137.60 +4.89%

Sentiment/Internals

NYSE Cumulative A/D Line 77,548 +4.35%

Bloomberg New Highs-Lows Index +561 +289.6%

Bloomberg Crude Oil % Bulls 44.0 -9.3%

CFTC Oil Large Speculative Longs 197,493 -1.63%

Total Put/Call .86 unch.

NYSE Arms .62 -50.79%

Volatility(VIX) 14.72 -5.28%

ISE Sentiment 140.0 -17.6%

AAII % Bulls 43.8 +12.3%

AAII % Bears 32.88 -8.1%

Futures Spot Prices

Crude Oil 72.81 +4.57%

Reformulated Gasoline 230.96 +4.39%

Natural Gas 6.44 -3.17%

Heating Oil 209.51 +3.26%

Gold 654.80 +.55%

Base Metals 257.77 +2.66%

Copper 359.45 +4.84%

Economy

10-year US Treasury Yield 5.18% +15 basis points

4-Wk MA of Jobless Claims 318,500 +.5%

Average 30-year Mortgage Rate 6.63% -4 basis points

Weekly Mortgage Applications 619.40 +.13%

Weekly Retail Sales +1.6%

Nationwide Gas $2.95/gallon -.02/gallon

US Cooling Demand Next 7 Days 15.0% above normal

ECRI Weekly Leading Economic Index 143.0 +.14%

US Dollar Index 81.46 -1.05%

CRB Index 320.86 +2.59%

Leading Sectors

Alternative Energy +4.77%

Airlines +4.15%

Wireless +4.15%

Oil Service +4.03%

REITs +3.32%

Lagging Sectors

Insurance +.44%

Drugs +.43%

Banks +.40%

Foods +.06%

Biotech -.09%