Click here for a weekly preview by MarketWatch.com.

There are a few economic reports of note and a number of significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Empire Manufacturing

Tues. – Net Long-term TIC Flows, Industrial Production, Capacity Utilization, NAHB Housing Market Index, weekly retail sales

Wed. – Weekly EIA energy inventory data, weekly MBA Mortgage Applications report, Consumer Price Index, Housing Starts, Building Permits, Fed’s Beige Book

Thur. – Initial Jobless Claims, Leading Indicators, Philly Fed

Fri. – None of note

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Nuveen Investments(JNC), Mattel Inc.(MAT), Citigroup(C), Eaton Corp.(ETN), Genentech(DNA), WR Grainger(GWW)

Tues. – Domino’s Pizza(DPZ), Forest Labs(FRX), Polaris Industries(PII), Regions Financial(RF), State Street(STT), US Bancorp(USB), Jeffries Group(JEF), Wells Fargo(WFC), Champion Enterprises(CHB), CSX Corp.(CSX), Intel Corp.(INTC), International Business Machines(IBM), Liner Tech(LLTC), Seagate Technology(STX), Adtran(ADTN), Delta Airlines(DAL), Illumina(ILMN), Johnson & Johnson(JNJ), Keycorp(KEY), Yahoo!(YHOO)

Wed. – Abbott Labs(ABT), BlackRock(BLK), CIT Group(CIT), Comerica(CMA), Coca-Cola(KO), Gannett Co(GCI), United Technologies(UTX), Altria Group(MO), JPMorgan Chase(JPM), Illinois Tool Works(ITW), AMR Corp.(AMR), Stryker Corp.(SYK), Teradyne Inc.(TER), Allstate(ALL), E*Trade(ETFC), Washington Mutual(WM), Cbot Holdings(BOT), eBay Inc.(EBAY), Gerber Scientific(GRB)

Thur. – Eli Lilly(LLY), Southwest Airlines(LUV), United Health(UNH), Bank of NY(BK), St. Jude Medical(STJ), Capital One(COF), Gilead Sciences(GILD), Cerner Corp.(CERN), SanDisk(SNDK), Advanced Micro(AMD), Bank of America(BAC), Baxter Intl.(BAX), Continental Air(CAL), Google Inc.(GOOG), HCA Inc.(HCA), Hershey(HSY), Intuitive Surgical(ISRG), Mohawk Industries(MHK), Mellon Financial(MEL), Nucor Corp.(NUE), PNC Financial(PNC), PPG Industries(PPG), Pfizer Inc.(PFE), Wyeth(WYE), Xilinx(XLNX)

Fri. – Boston Scientific(BSX), Harley-Davidson(HOG), Honeywell Intl.(HON), Schlumberger(SLB), Wachovia Corp.(WB), Caterpillar(CAT), 3M(MMM), McDonald’s(MCD)

Other events that have market-moving potential this week include:

Mon. – Fed’s Bernanke speaking, (ISV) analyst meeting

Tue. – Wachovia Consumer Growth Conference, (VQ) analyst meeting, (TESO) analyst meeting

Wed. – Fed’s Hoenig speaking, Bear Stearns Retail Outing, Wachovia Consumer Growth Conference

Thur. – Bear Stearns Retail Outing, Wachovia Consumer Growth Conference, (NGG) investor seminar

Fri. – Fed’s Bernanke speaking, Fed’s Poole speaking

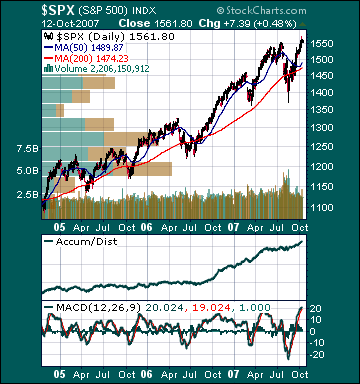

BOTTOM LINE: I expect US stocks to finish the week mixed as diminishing economic fears, better-than-expected earnings reports, investment manager performance anxiety, a stronger US dollar and short-covering offsets more hawkish Fed commentary and profit-taking. My trading indicators are still giving bullish signals and the Portfolio is 100% net long heading into the week.