- Pending Home Sales for October rose .6% versus estimates of a 1.0% decline and an upwardly revised 1.4% gain in September.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, December 10, 2007

Pending Home Sales Rise Again

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Sunday, December 09, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- US stocks posted their steepest two-week advance since September after President Bush announced a plan to freeze some mortgage rates to prevent foreclosures from causing a recession.

- Treasuries posted their first weekly decline since October as the government introduced a plan to freeze some subprime mortgages, reducing the safe-haven appeal of US debt.

- The US dollar rose to a one-month high against the yen after a US government report showed Friday that November job growth exceeded forecasts.

- Central bankers from the six Gulf Arab states, including Saudi Arabia and Bahrain, have no plans to meet to discuss revaluing their dollar-pegged currencies, Bahrain Central Bank Governor Rasheed al-Maraj said.

- Global economic growth will prevent a slowing

- President Bush would veto a Democratic proposal to tie war funding to billions of dollars of additional domestic spending, White House budget director Jim Nussle said.

- Oprah Winfrey called Democratic presidential candidate Barack Obama a politician with an “ear for eloquence and a tone dipped in unvarnished truth,” saying his life experience makes him best suited to lead the nation.

-

- The average price of regular gasoline at the pump in the

- China Petrochemical Corp. signed a $2 billion agreement to develop Iran's Yadavaran oil field, China's state-run media said, underscoring closer ties with the Middle Eastern nation as the U.S. and Europe curb investment.

- China, India Say Mandatory Emissions Cuts Are ‘Inconceivable.’

- Former Arkansas Governor Mike Huckabee has a 22-point lead in the Republican presidential contest in

- CompUSA(CPU), the consumer electronics retailer owned by Mexican billionaire Carlos Slim, said it was acquired by restructuring firm Gordon Brothers Group LLC, which plans to close or sell its 103 stores.

- Hollywood studios and striking writers halted labor negotiations after failing to reach an agreement on pay for using writers’ work on the Internet.

-

- Celgene’s(CELG) Revlimid, a treatment for a deadly cancer of the bone marrow, was safer and helped patients live longer when used in combination with a lower-than-usual dose of an immune-suppressing drug.

- Biogen Idec’s(BIIB) Zevalin, a drug that unloads radiation onto cancer cells, helped 76% of patients with non-Hodgkins lymphoma achieve complete remission after a single shot, a study found.

- Tension in Hillaryland Grows as Plan Goes Awry: Albert R. Huut.

- Pharmion Corp.’s(PHRM) Vidaza helped patients live longer with rare bone marrow disorder that can lead to leukemia, researchers said.

- UK Prime Minister Gordon Brown, visiting British troops in

- Derivatives traded on exchanges surged 27% to a record $681 trillion in the third quarter, the biggest increase in three years, the Bank for International Settlements said.

-

- Stock Market Rallies When US Economy Slows to Less Than 1%. Just because most economists on Wall Street predict the

- Now that analysts on Wall Street are forecasting the worst to come for the securities industry, the biggest money managers are closing their eyes and buying. T. Rowe Price Group and Legg Mason spent about $1 billion combined since June to raise their stakes in Goldman Sachs(GS), Morgan Stanley(MS), Lehman Brothers(LEH) and Bear Stearns(BSC) as earnings fell from the record first half of 2007. Billionaire investor Josehp Lewis paid more than $1 billion to buy Bear Stearns(BSC) shares, while Dallas-based money manager James Barrow tripled his holding in the fifth-biggest

Wall Street Journal:

- A top federal bank regulator said some investors who are criticizing the new rescue plan for troubled homeowners also may be placing bets in which they would benefit from a jump in foreclosures.

NY Times:

- REITs Are Down, but for How Long?

- What Did the Professor Say? Check Your iPod.

CNBC.com:

- 6 Ways to Kill Your Credit Rating.

MarketWatch.com:

- The Federal Reserve will cut rates by a quarter-percentage point when they meet in four days despite no clear signal of weakness from the November jobs report, analysts said Friday.

- China promises less-wasteful growth in 2008. Over the weekend, China again hiked the reserve ratio for commercial banks by 100 basis points to 14.5% beginning Dec. 26 as a high-level planning meeting promised both lower growth and inflation next year.

- Chief economist for RBS Greenwich Capital wins MarketWatch award for fourth time, sees Fed cutting interest rates Tuesday, then holding firm in January.

- These stocks’ blood is running in the streets. True contrarians like George Putnam relish buying opportunity.

- Sound Shore finding relative bargains in tech, health care and media.

- Has China’s IPO boom run its course? Risk worries emerge; share offerings in Hong Kong delayed.

IBD:

- Apple Macintosh Computers Likely To Gain Market Share.

Forbes.com:

- Holiday Gift List.

Business Week:

- More Clicks at the Bricks. How retail stores are scrambling to catch up with shoppers empowered by the Web.

- S&P unearthed nine issues under $10 that are good bests for bargain hunters. They’re undervalued and they have momentum.

CNNMoney.com:

- 28 Best Money Web Sites.

AP:

-

Dow Jones:

- Citigroup’s(C) board will meet next week to choose a new CEO, with Vikram Pandit among frontrunners for the job.

Financial Times:

- James Murdoch may succeed Pete Chernin as Chief Operating Officer of News Corp.(NWS/A) when Cherin’s contract expires in 2009.

- China is to treble the amount of money that foreigners can invest in the mainland capital market, making the long-awaited announcement on the eve of this week’s high-level economic summit between Chinese and US policymakers.

Daily Telegraph:

- Blackstone Group LP is planning a bid for Rio Tinto Group(RTP) that may include China’s sovereign wealth fund.

Il Sole-24 Ore:

- Otmar Issing, the European Central Bank’s former chief economist, said China must allow its currency to gain in value soon to head off serious economic consequences. The negative effect of waiting to allow the yuan to appreciate will be evident “in terms of inflation and the distortion of resources,” Issing said.

Star:

- Chicago Mercantile Exchange(CME) may buy a 10% stake in Bursa Malaysia Bhd.

Gulf News:

- Gulf Cooperation Council states are unlikely to meet their self-imposed 2010 deadline to create a regional monetary union and single currency, citing Qatar’s prime minister.

Weekend Recommendations

Barron's:

- Made positive comments on (ALL) and (JPM).

- Made negative comments on (KCI).

Citigroup:

- Reiterated Buy on (T), target $47.

- Upgraded (RATE) to Buy, target $55.

- Raised Samsung Electronics to Buy from Hold.

Night Trading

Asian indices are -.50% to +.25% on avg.

S&P 500 futures -.03%.

NASDAQ 100 futures +.07%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (MTN)/-.79

- (FCEL)/-.27

- (HRB)/-.35

- (PLL)/.32

- (QSFT)/.19

- (VRNT)/.18

- (IDT)/-.40

- (JW/A)/.42

Upcoming Splits

- (XTO) 5-for-4

- (DNR) 2-for-1

Economic Data

10:00 am EST

- Pending Home Sales for October are estimated to fall 1.0% versus a .2% increase in September.

Other Potential Market Movers

- The BB&T Consumer Conference, (NVO) analyst meeting, (ITW) investor meeting, (PPG) investor day, (WTSLA) analyst meeting, (HIG) investor call and (AVT) analyst meeting could also impact trading today.

Weekly Outlook

Click here for the Wall St. Week Ahead by Reuters.

Click here for Stocks in Focus for Monday by MarketWatch.com.

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Pending Home Sales

Tues. – Weekly retail sales reports, IBD/TIPP Economic Optimism, Wholesale Inventories, FOMC Rate Decision

Wed. – Weekly MBA Mortgage Applications report, weekly EIA energy inventory report, Trade Deficit, Import Price Index, Monthly Budget Deficit

Thur. – Initial Jobless Claims, Producer Price Index, Advance Retail Sales, Business Inventories

Fri. – Consumer Price Index, Industrial Production, Capacity Utilization

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Vail Resorts(MTN), H&R Block(HRB), FuelCell Energy(FCEL), Pall Corp.(PLL), John Wiley & Sons(JW/A), Quest Software(QSFT)

Tues. – Sharper Image(SHRP), Multimedia Games(MGAM), Cooper Cos(COO), Krogere(KR)

Wed. – Martek Biosciences(MATK), ADC Telecom(ADCT), CKE Restaurants(CKE)

Thur. – CostcoWholesale(COST), Quiksilver(ZQK), JOS A Bank(JOSB), Lehman Brothers(LEH)

Fri. – Tektronix(TEK), CSK Auto(CAO), Winnebago(WGO), Ciena Corp.(CIEN)

Other events that have market-moving potential this week include:

Mon. – BB&T Consumer Conference, (NVO) analyst meeting, (ITW) investor meeting, (PPG) investor day, (WTSLA) analyst meeting, (HIG) investor call, (AVT) analyst meeting

Tue. – CIBC Virtualization Conference, Goldman Sachs Financial Services Conference, Wedbush Morgan California Dreamin’ Conference, (ARM) analyst meeting, (HPQ) analyst meeting, (T) investor day, (VVC) analyst breakfast, (INWK) analyst meeting, (VTIV) analyst meeting, (GNW) strategic update, (MRK) business briefing, (GMR) analyst meeting, (WLP) investor conference, (A) analyst meeting, (VRGY) analyst meeting, (ALTR) analyst meeting, (GE) outlook meeting

Wed. – CIBC Virtualization Conference, Wedbush Morgan California Dreamin’ Conference, (BDC) investor day, (SUN) analyst meeting, (YUM) investors conference, (LII) analyst meeting, (MALL) analyst meeting, (DHR) analyst meeting, (VVC) analyst luncheon

Thur. – Thomas Weisel Telecom Tomorrow Conference, Merrill Lynch Growth Industrial Conference, RBC Healthcare Conference, (PBG) investor day, (AMD) analyst day, (SMG) analyst day, (ZGEN) analyst meeting, (JAV) analyst meeting, (UTX) analyst meeting

Fri. – Roth Capital Software Event, (ACAD) analyst meeting, (IDT) analyst meeting

Saturday, December 08, 2007

Friday, December 07, 2007

Weekly Scoreboard*

Indices

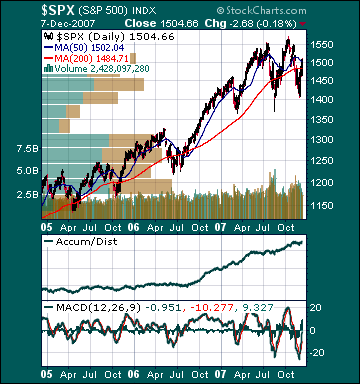

S&P 500 1,504.66 +1.59%

DJIA 13,625.58 +1.90%

NASDAQ 2,706.16 +1.70%

Russell 2000 785.52 +2.31%

Wilshire 5000 15,130.98 +1.76%

Russell 1000 Growth 625.82 +1.79%

Russell 1000 Value 818.68 +1.60%

Morgan Stanley Consumer 759.96 +.75%

Morgan Stanley Cyclical 1,020.34 +2.82%

Morgan Stanley Technology 632.85 +2.66%

Transports 4,876.35 +4.61%

Utilities 550.66 +3.46%

MSCI Emerging Markets 159.61 +3.87%

Sentiment/Internals

NYSE Cumulative A/D Line 64,580 +3.08%

Bloomberg New Highs-Lows Index -199 +32.1%

Bloomberg Crude Oil % Bulls 19.57 -41.3%

CFTC Oil Large Speculative Longs 215,237 -6.8%

Total Put/Call .96 -10.3%

NYSE Arms .92 +10.84%

Volatility(VIX) 20.85 -8.83%

ISE Sentiment 111.0 +15.63%

AAII % Bulls 40.65 +42.3%

AAII % Bears 39.84 -29.0%

Futures Spot Prices

Crude Oil 88.28 -.48%

Reformulated Gasoline 226.90 -1.72%

Natural Gas 7.15 -2.01%

Heating Oil 250.47 -.41%

Gold 800.20 +1.41%

Base Metals 218.16 -3.01%

Copper 312.60 -1.84%

Economy

10-year US Treasury Yield 4.11% +17 basis points

4-Wk MA of Jobless Claims 340,300 +1.4%

Average 30-year Mortgage Rate 5.96% -14 basis points

Weekly Mortgage Applications 791.80 +22.51%

Weekly Retail Sales +2.4%

Nationwide Gas $3.03/gallon -.05/gallon

US Heating Demand Next 7 Days 10% below normal

ECRI Weekly Leading Economic Index 138.70 +1.31%

US Dollar Index 76.29 +.19%

CRB Index 342.92 +.91%

Best Performing Style

Mid-cap Growth +2.56%

Worst Performing Style

Large-cap Value +1.60%

Leading Sectors

Homebuilders +10.05%

Disk Drives +7.18%

Engineering & Construction +7.05%

Steel +6.27%

Alternative Energy +6.23%

Lagging Sectors

Tobacco +.66%

Drugs +.42%

Hospitals -.01%

Airlines -.39%

Banks -.71%