Click here for The Coming Week by TheStreet.com.

Click here for Stocks on the Move for Tuesday by Bloomberg.

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – US markets closed

Tues. – ISM Manufacturing, ISM Prices Paid, Construction Spending

Wed. – Total Vehicle Sales, weekly retail sales reports, Fed’s Beige Book, Factory Orders, Challenger Job Cuts, weekly MBA Mortgage Applications report

Thur. – Weekly EIA energy inventory report, ADP Employment Change, Non-farm Productivity, Unit Labor Costs, Initial Jobless Claims, ISM Non-Manufacturing, ICSC Chain Store Sales

Fri. – Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – US markets closed

Tues. – Donaldson Co.(DCI)

Wed. – Joy Global(JOYG), H&R Block(HRB), Hovnanian Enterprises(HOV), Staples(SPLS), Guess? Inc.(GES)

Thur. – Jackosn Hewitt Tax Services(JTX), Ciena Corp.(CIEN), Cooper Cos.(COO), ADC Telecom(ADCT), Quiksilver Inc.(ZQK), Toll Brothers(TOL)

Fri. – National Semi(NSM), Korn/Ferry(KFI)

Other events that have market-moving potential this week include:

Mon. – US markets closed

Tue. – Lehman Brothers Energy Conference, Citigroup Tech Conference,

Wed. – Kaufman Brothers Investor Conference, Keefe Bruyette Woods Insurance Conference, Citigroup Tech Conference, Lehman Consumer Conference, Thomas Weisel Healthcare Conference, Goldman Sachs Retail Conference, Morgan Keegan Equity Conference

Thur. – Goldman Retail Conference, Keefe Bruyette Woods Insurance Conference, Thomas Weisel Healthcare Conference, Morgan Keegan Equity Conference, Cowen Clean Energy Conference, Kaufman Brothers Investor Conference, Citigroup Tech Conference, Lehman Consumer Conference, Needham HDD Investor Day, CSFB Automotive Conference

Fri. – Kaufman Brothers Investor Conference, Morgan Keegan Equity Conference, Thomas Weisel Healthcare Conference

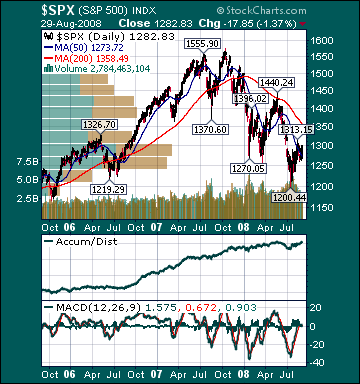

BOTTOM LINE: I expect US stocks to finish the week modestly higher bargain-hunting, less credit market angst, diminishing financial sector pessimism, less economic pessimism, mostly positive earnings reports, lower commodity prices, a stronger US dollar and short-covering. My trading indicators are giving bullish signals and the Portfolio is 100% net long heading into the week. I will be unable to post the Tuesday Watch due to a scheduling conflict. I hope everyone had a safe and happy holiday weekend.