Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, September 08, 2008

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

Exchange Volume vs. Average

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Real-Time Intraday Quote/Chart

Dow Jones Hedge Fund Indexes

Sunday, September 07, 2008

Monday Watch

Weekend Headlines

Bloomberg:

- Asian stocks surged from the lowest level in almost three years after the U.S. government took control of Fannie Mae and Freddie Mac, boosting confidence financial companies will weather the subprime mortgage crisis. Futures on the U.S. Standard & Poor's 500 Index jumped more than 2 percent.

- OPEC's Gulf-Arab members, which pump half of the group's oil, are likely to urge their colleagues to leave output unchanged when they meet this week as prices above $100 a barrel squeeze the global economy. Saudi Arabia, the world's biggest producer and de facto leader of the 13-member Organization of Petroleum Exporting Countries, the United Arab Emirates, Qatar and Kuwait may reject calls from Venezuela and Iran to trim supplies at its Sept. 9 meeting in Vienna, according to 29 of the 32 energy analysts surveyed by Bloomberg. Falling oil prices and the simultaneous strengthening of the dollar may benefit Middle Eastern countries by sucking up excessive liquidity in the region, said Robert Mckinnon, Head of Research at Dubai's Al Mal Capital PSC. ``The stronger dollar is attracting liquidity out of the region, slowing down the economy, which is what people want to combat inflation,'' Mckinnon said. ``At $80-$90 a barrel, the region's economies are still fundamentally sound -- as long as oil remains above about $50 a barrel, most government budgets are in surplus.'' Inflation has accelerated to records across the Persian Gulf as oil-fueled economic growth creates shortages of housing and services, while the weaker U.S. dollar and higher global food prices make imports more expensive. Inflation in Saudi Arabia, the biggest economy in the Middle East, accelerated to a record 11.1 percent in July.

- The US stock market is “pretty close to a bottom” and may mount a “powerful” rally, hedge-fund manager Barton Biggs said. ``There's a possibility out there that with oil down as much as it is, we're going to get a push in consumer spending.''

- President George W. Bush urged Congress to enact measures to boost global trade, block a tax increase and authorize more offshore oil drilling before U.S. lawmakers resume their re-election campaigns next month. Bush's final list of election-year priorities includes approving the Colombia and Korean free-trade agreements, extending relief from the alternative minimum tax, ``and addressing one of the American people's biggest concerns -- the high price of gasoline.'' ``This is their final chance to take action before the November elections,'' the president said in his weekly radio address today. ``If members of Congress do not support the American people at the gas pump, then they should not expect the American people to support them at the ballot box.''

- France may have to cut its growth forecasts after the economy shrank in the second quarter and because of ``current economic circumstances,'' Finance Minister Christine Lagarde said.

- Wheat plunged to a three-month low on speculation that record global production will outpace demand, boosting grain inventories. Growers worldwide will collect 670.8 million metric tons in the year ending May 31, up 9.9 percent from the prior year, the U.S. Department of Agriculture said last month. Global stockpiles will increase 18 percent to 136.2 million tons, the USDA said. Wheat prices have tumbled 44 percent from a record $13.495 a bushel on Feb. 27. ``The world is awash in wheat,'' said Gavin Maguire, a director of research for EHedger LLC in Chicago. ``Prices will fall to keep supplies moving.''

- Ike, an ``extremely dangerous'' hurricane, pounded the Bahamas today and charted a course toward Cuba and the Gulf of Mexico, bringing the region its second major storm in as many weeks.

- General Electric Co.(GE) said the U.S. Securities and Exchange Commission plans to recommend a civil complaint against the company in a three-year-old probe that includes the way it recognizes revenue and presents cash flow. ``This thing could turn into something big if they find a pattern,'' said Edward Ketz, an accounting professor at Pennsylvania State University, in an interview.

- Asian currencies had a weekly decline, led by South Korea's won and Indonesia's rupiah, on signs investors are dumping emerging-market assets as a deepening U.S. slowdown threatens to damp global growth. ``Risk aversion is making investors pare holdings of commodities and stocks and cutting down exposures to emerging markets,'' said Enrico Tanuwidjaja, an economist at Oversea- Chinese Banking Corp. in Singapore.

- European stocks posted their steepest weekly decline in five years on concerns that slowing growth will curb earnings at commodity producers while banks will face higher costs as the European Central Bank tightened lending rules.

- Republican vice presidential nominee Sarah Palin isn't giving interviews to the news media and won't until ``the campaign is ready,'' campaign manager Rick Davis said today. ``Sarah Palin will have the opportunity to speak to the American people,''

- Why replace a perfectly good Web browser like Firefox, Internet Explorer, or Safari with Google Inc.'s(GOOG) new Chrome? Because you want something simpler, a little faster, and less prone to crashing. Google, the search engine giant based in Mountain View, California, released the beta, or test, version of Chrome last week, a Web browser that competes directly with market leader Internet Explorer 7, or IE7, from Microsoft Corp.

- The cost to protect Australian corporate bonds from default fell by the most in more than five months, credit-default swaps show. The Markit iTraxx Australia credit-default swap index declined 17 basis points to 148 at 8:40 a.m. in Sydney, Citigroup Inc. prices show.

- Bill Gross, who manages the world’s largest bond fund as co-chief investment officer of PIMCO, comments on the takeover of Fannie Mae and Freddie Mac by the

- Treasuries fell the most in almost two months as the government takeover of Fannie Mae and Freddie Mac gave investors confidence to buy higher-yielding assets.

Wall Street Journal:

- US Outlines Fan-Fred Takeover.

- Hedge Funds Get Rattled As Investors Seek Exits. Requests by Funds-of-Funds To Pull Out Cash Weaken Performance and Managers’ Grip on the Helm. With anxiety about hedge-fund woes gripping the market, funds have their own fear: their investors.

- Nomura Holdings Inc., Japan's biggest brokerage, is mulling possible uses for the capital it has raised since April, including potentially investing some of it in beleaguered Wall Street firm Lehman Brothers Holdings Inc.(LEH), according to a person familiar with the situation.

- Kerry Killinger, who helped build Washington Mutual Inc.(WM) into the nation's largest thrift and then presided over its rapid decline, is being ousted as chief executive, making him the latest casualty of the mortgage crisis.

Barron’s:

- Johnson & Johnson(JNJ) topped the annual list of the world’s most respected companies, beating last year’s No. 1 Berkshire Hathaway Inc.(BRK/A).

MarketWatch.com:

- Sen. John McCain's acceptance speech at the Republican National Convention Thursday night drew a total of more than 38.9 million viewers on eight television networks, surpassing the 38.3 million that tuned in for Sen. Barack Obama's address a week earlier, according to data from Nielsen Media Research.

- U.S. banking regulators said Sunday they will work with banks whose holdings of Fannie Mae(FNM) and Freddie Mac(FRE) securities could be adversely affected by the federal government's takeover of the two firms over the weekend.

- One of the key indications of the market's inflation expectations is the spread between yields on 10-year Treasury notes and Treasury Inflation Protected Securities, known as TIPS. "With commodity prices falling, people are putting two and two together, said William O'Donnell, U.S. bond strategist at UBS Securities. "The weaker global growth and weaker commodity prices in lockstep is a toxic combination for inflation. People are not rushing for inflation protection." The gap between regular 10-year Treasurys and TIPS yields has fallen to 1.93%, a level not seen since 2003. The drop in commodity prices, chiefly oil, is being interpreted as easing pressure on virtually all other kinds of prices.

CNBC.com:

- The U.S. Treasury expects to purchase $5 billion of Fannie Mae(FNM) and Freddie Mac(FRE) mortgage-backed securities within the next month as part of its takeover of the mortgage finance giants.

- Continued OPEC production at current levels would lead to over-supply of its crude in the first half of 2009, causing a fall in prices, Iran's OPEC governor was quoted as saying on Sunday.

- Officials at Lehman Brothers(LEH) are hoping to finalize plans to raise capital and sell off bad debts sometime this week, though the exact nature of the effort is still in flux, people close to the company tell CNBC.

- Bursting speculative bubbles will provide an opportunity to bring down inflation, the European Central Bank's new governing council member Ewald Nowotny was quoted as saying. "The speculation bubble in energy markets is bursting, and we should use this opportunity for a stronger receding in inflation," the daily Kurier quoted Nowotny as saying in an interview published on Saturday.

IBD:

- Merit Medical Systems(MMSI): Stream Of New Products Drives Growth For Medical Device Maker.

Business Week:

- The Best Places to Launch a Career. To lure and keep young talent when cash is tight, companies of all stripes are appealing to Gen Yers’ ambitions for speedy advancement – and their desire to do good while doing well.

- Haier Struggles to Overcome the China Slowdown. The white-goods maker has been hit hard by the rising cost of labor, raw materials, and oil, as well as the appreciation of the yuan.

- The Republican National Convention has given John McCain and his party a significant boost, a USA TODAY/Gallup Poll taken over the weekend shows, as running mate Sarah Palin helps close an "enthusiasm gap" that has dogged the GOP all year. McCain leads Democrat Barack Obama by 50%-46% among registered voters, the Republican's biggest advantage since January and a turnaround from the USA TODAY poll taken just before the convention opened in St. Paul. Then, he lagged by 7 percentage points. In the new poll, taken Friday through Sunday, McCain leads Obama by 54%-44% among those seen as most likely to vote.

- 4 tips to save home energy and your money.

Reuters:

- A Chinese state oil firm must start work developing Iraq's Ahdab oil field within the next two months or risk losing the $3 billion service contract, Iraq's oil minister said.

- How Boeing strike affects the company, suppliers and the US economy. Boeing Co's (BA) 27,000-strong machinists union is on strike, halting commercial airplane production, after last-ditch talks failed to agree to a new labor contract by a deadline of midnight Seattle time on Saturday. The strike could impact the US economy in the following ways:

2) Figures for U.S. companies' inventories would rise.

Financial Times:

- The latest cheap manufacturing site for European companies is not in Asia or eastern Europe but the United States, say top executives from some of the continent's biggest companies. "It may sound like a joke but it can be cheaper than you imagine to manufacture there," the chairman of one of Germany's largest automobile groups told the Financial Times. The reason is less the level of the dollar, which remains relatively high in spite of the euro's recent plunge, but rather the huge level of incentives some US states are offering companies to set up factories in their region. A senior executive at Fiat, the Italian industrial conglomerate, said: "With the amount of money US states are willing to throw at you, you would be stupid to turn them down at the moment. It is one of the low-cost locations to be in at the moment." Incentives are not new but their increasing size, plus the relative weakness of the dollar and increasing wages in China and eastern Europe, makes the US more attractive.

- Paulson & Co, last year's most successful hedge fund, has told investment bankers it is ready to consider backing rescue recapitalizations of troubled financial institutions - signaling a switch from betting against the sector to buying into it.

Weekend Recommendations

Barron's:

- Made positive comments on (DFS), (CTSH) and (SCHN).

CSFB:

- Reiterated Outperform on (CEPH), raised estimates, boosted target to $84.

Night Trading

Asian indices are +.50% to +3.75% on avg.

S&P 500 futures +2.63%.

NASDAQ 100 futures +2.15%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (ARTC)/.40

Upcoming Splits

- None of note

Economic Releases

3:000 pm EST

- Consumer Credit for July is estimated to fall to $8.46 billion versus $14.3 billion in June.

Other Potential Market Movers

- The Fed’s Fisher speaking, Lehman Brothers Financial Services Conference, Citigroup Biotech Conference, Sidoti Healthcare Conference and Wachovia Transport Conference could also impact trading today.

Weekly Outlook

Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – Consumer Credit

Tues. – Pending Home Sales, IBD/TIPP Economic Optimism, weekly retail sales reports, Wholesale Inventories

Wed. – Weekly MBA mortgage applications report, weekly EIA energy inventory data

Thur. – Trade Balance, Import Price Index, Initial Jobless Claims, Monthly Budget Statement

Fri. – Producer Price Index, Advance Retail Sales,

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – None of note

Tues. – PEP Boys(PBY), John Wiley(JW/A), Korn/Ferry(KFI), VeriFone(PAY)

Wed. – None of note

Thur. –

Fri. – None of note

Other events that have market-moving potential this week include:

Mon. – Fed’s Fisher speaking, Lehman Brothers Financial Services Conference, Citigroup Biotech Conference, Sidoti Healthcare Conference, Wachovia Transport Conference

Tue. – (OC) Investor Day, (CRA) analyst meeting, (NFX) analyst meeting, (MMM) investor day, (BBND) analyst meeting, (SRX) analyst meeting, (TXN) Mid-quarter Update, Wachovia Transport Conference, Deutsche Bank Tech Conference, Morgan Stanley Global Healthcare Conference, Lehman Financial Services Conference

Wed. – (ZLC) investor day, (PNR) investor day, (COV) analyst meeting, Lehman Financial Services Conference, Morgan Stanley Industrials Conference, Keybanc Basic Materials Conference, BB&T Conference, BMO Capital Back to School Conference, Cowen Clean Energy Conference, Deutsche Bank Tech Conference, Jeffries Tech Conference, Robert W. Baird Small-cap Healthcare Conference

Thur. – BMO Capital Real Estate Conference, Jeffries Tech Conference, Deutsche Bank Tech Conference, Keybanc Basic Materials Conference, Morgan Stanley Industrials Conference

Fri. – (AGP) investor day, Kaufman Brothers Investor Conference, Morgan Keegan Equity Conference, Thomas Weisel Healthcare Conference

Friday, September 05, 2008

Weekly Scoreboard*

Indices

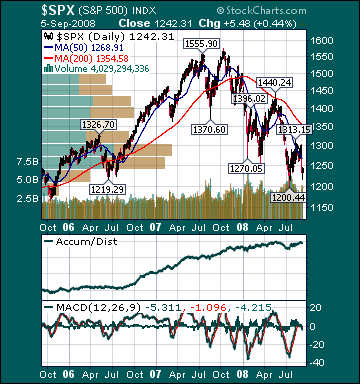

S&P 500 1,242.31 -4.48%

DJIA 11,220.96 -4.22%

NASDAQ 2,255.88 -6.46%

Russell 2000 718.85 -3.87%

Wilshire 5000 12,636.10 -4.49%

Russell 1000 Growth 521.36 -6.20%

Russell 1000 Value 671.13 -2.91%

Morgan Stanley Consumer 685.46 -1.66%

Morgan Stanley Cyclical 842.37 -4.56%

Morgan Stanley Technology 527.14 -8.15%

Transports 4,888.81 -4.89%

Utilities 448.53 -7.73%

MSCI Emerging Markets 36.86 -8.22%

Sentiment/Internals

NYSE Cumulative A/D Line 42,609 -1.55%

Bloomberg New Highs-Lows Index -834 -203.27%

Bloomberg Crude Oil % Bulls 43.0 +13.2%

CFTC Oil Large Speculative Longs 193,540 -5.8%

Total Put/Call .99 +19.28%

OEX Put/Call .88 -25.42%

ISE Sentiment 101.0 -37.65%

NYSE Arms .69 -17.86%

Volatility(VIX) 23.06 +18.68%

G7 Currency Volatility (VXY) 11.59 +12.2%

Smart Money Flow Index 8,070.48 -5.34%

AAII % Bulls 37.04 +20.73%

AAII % Bears 43.21 -4.93 %

Futures Spot Prices

Crude Oil 106.23 -7.87%

Reformulated Gasoline 268.61 -6.11%

Natural Gas 7.45 -7.14%

Heating Oil 298.28 -7.15%

Gold 802.80 -3.95%

Base Metals 208.21 -5.02%

Copper 309.85 -7.94%

Agriculture 383.46 -7.24%

Economy

10-year US Treasury Yield 3.70% -11 basis points

10-year TIPS Spread 1.99% -15 basis points

TED Spread 1.04 -6 basis points

N. Amer. Investment Grade Credit Default Swap Index 145.99 +4.07%

Emerging Markets Credit Default Swap Index 282.26 +7.77%

Citi US Economic Surprise Index +66.20 +5.92%

Fed Fund Futures 2.0% chance of 25 hike, 98.0% chance of no move on 9/16

Iraqi 2028 Govt Bonds 73.0 -1.22%

4-Wk MA of Jobless Claims 438,000 -.7%

Average 30-year Mortgage Rate 6.35% -5 basis points

Weekly Mortgage Applications 453,100 +7.47%

Weekly Retail Sales +1.7%

Nationwide Gas $3.67/gallon unch.

US Cooling Demand Next 7 Days 6.0% above normal

ECRI Weekly Leading Economic Index 126.30 +.72%

US Dollar Index 78.87 +2.31%

Baltic Dry Index 5,874 -15.22%

CRB Index 367.70 -6.52%

Best Performing Style

Small-cap Value -2.28%

Worst Performing Style

Mid-cap Growth -6.2%

Leading Sectors

Airlines +4.29%

Banks +4.22%

Retail +2.55%

Tobacco +1.78%

Insurance +.55%

Lagging Sectors

Oil Services -10.8%

Gold -13.64%

Construction -13.74%

Steel -14.11%

Coal -17.8%

Stocks Finish at Session Highs, Boosted by Financial, Homebuilding and Airline Shares

Market Summary

Top 20 Biz Stories

Today’s Movers

Market Performance Summary

WSJ Data Center

Sector Performance

ETF Performance

Style Performance

Commodity Movers

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Commentary

After-hours Movers

After-hours Real-Time Stock Bid/Ask

After-hours Stock Quote

After-hours Stock Chart

In Play