Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, January 12, 2009

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

Exchange Volume vs. Average

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Real-Time Intraday Quote/Chart

Dow Jones Hedge Fund Indexes

Sunday, January 11, 2009

Monday Watch

Weekend Headlines

Bloomberg:

- Crude oil fell for a fifth day in New York, extending last week’s 12 percent drop, on concern demand will decline more rapidly than the Organization of Petroleum Exporting Countries cuts output. Deutsche Bank AG on Jan. 10 lowered its forecast for the average price of crude oil this quarter by $10 to $45 a barrel, citing expectations consumption will fall by 1 million barrels a day this year.

Wall Street Journal:

- Technology Levels Playing Field In Race to Market Electric Car.

MarketWatch.com:

NY Times:

- US Automakers Place Their Bets on Electric Cars.

- McDonald’s(MCD) Makeover Wins Over Hardened Skeptics.

- In India, Crisis Pairs With Fraud.

Forbes.com:

Silicon Alley Insider:

60 Minutes:

Bespoke Investment Group:

CNNMoney.com:

MSNBC:

Economist.com:

Reuters:

Financial Times:

Sueddeutsche Zeitung:

- German Finance Minister Peer Steinbrueck suggested cutting the countries marginal tax rate to 12% from the current level of 15% to combat the recession.

SonntagsZeitung:

- UBS AG may post a $7.2 billion loss for the fourth quarter of 2008. UBS spokeswoman Rebeca Garcia declined to comment on the report.

Folha de S. Paulo:

- Rio Tinto Group(RTP), the world’s third-largest mining company, will cancel a $2.2 billion expansion plan in

Nikkei:

- Hino Motors Ltd. plans to sell a gas-electric truck next year offering twice the fuel efficiency of its current hybrids and 2 ½ times that of the company’s conventional engines.

Hankyoreh:

-

Weekend Recommendations

Barron's:

- Made positive comments on (KALU), (MSFT), (PNC), (STT), (EXC), (ETR), (TMO), (ACAP) and (AEM).

Citigroup:

- Reiterated Buy on (BAC), target $22.

- Reiterated Buy on (NVDA), target $10.50.

- Reiterated Buy on (ATVI), target $15, added to Top Picks Live list.

Night Trading

Asian indices are -1.75% to +.25% on avg.

S&P 500 futures -.53%.

NASDAQ 100 futures -.45%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (AA)/-.08

- (SCHW)/.26

Upcoming Splits

- None of note

Economic Releases

- None of note

Other Potential Market Movers

- The Fed’s Lockhart speaking, Cowen Consumer Conference and JPMorgan Healthcare Conference could also impact trading today.

BOTTOM LINE: Asian indices are mostly lower, weighed down by industrial and commodity shares in the region. I expect

Weekly Outlook

Click here for a weekly preview by MarketWatch.

Click here for stocks in focus for Monday by MarketWatch.

There are a number of economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – Weekly retail sales, IBD/TIPP Economic Optimism, Monthly Budget Statement

Wed. – Weekly MBA mortgage applications, weekly EIA energy inventory data, Import Price Index, Advance Retail Sales, Business Inventories

Thur. – Producer Price Index, EIA natural gas inventory report, Initial Jobless Claims, Empire Manufacturing, Philly Fed.

Fri. – Consumer Price Index, Net Long-term TIC Flows, Industrial Production,

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Alcoa Inc.(AA), Charles Schwab(SCHW)

Tues. – Linear Technology(LLTC)

Wed. – Xilinix Inc.(XLNX), AMR Corp.(AMR)

Thur. – Marshall & Ilsley(MI), Genentech(DNA), Intel Corp.(INTC), Amphenol(APH), TK Shipping(TK), BlackRock(BLK)

Fri. – PPG Industries(PPG), Johnson Controls(JCI), Sony(SNE)

Other events that have market-moving potential this week include:

Mon. – The Fed’s Lockhart speaking, Cowen Consumer Conference, JPMorgan Healthcare Conference

Tue. – The Fed’s Bernanke speaking, Fed’s Lacker speaking, (HRB) Investment Conference, (MOS) Analyst Meeting, (MGAM) Analyst Meeting, JPMorgan Healthcare Conference, CSFB Homebuilding Conference, Deutsche Bank Auto Analysts Conference, Cowen Consumer Conference, BMO Capital Unconventional Gas Conference

Wed. – The Fed’s Yellen speaking, Fed’s Plosser speaking, Fed’s Stern speaking, (WAG) Shareholders Meeting, (MON) Shareholders Meeting, (MNKD) Analyst Meeting, CSFB Homebuilding Conference, Deutsche Bank Auto Analysts Conference, Goldman Sachs Energy Conference, JPMorgan Healthcare Conference

Thur. – The Fed’s Lockhart speaking, Fed’s Evans speaking, (MTW) Analyst Day, (MON) Pipeline Review, (AYI) Annual Meeting, Needham Growth Conference, Goldman Sachs Healthcare Conference, Citi Entertainment/Media/Telecom Conference, JPMorgan Tech Forum

Fri. – Fed’s Lacker speaking, (TWX) Shareholders Meeting

Friday, January 09, 2009

Weekly Scoreboard*

Indices

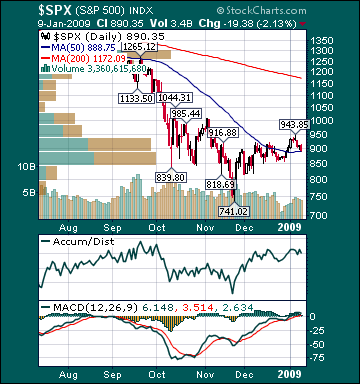

S&P 500 890.35 -4.45%

DJIA 8,599.18 -4.82%

NASDAQ 1,571.59 -3.71%

Russell 2000 481.30 -4.85%

Wilshire 5000 8,949.19 -4.10%

Russell 1000 Growth 372.16 -3.16%

Russell 1000 Value 475.19 -5.06%

Morgan Stanley Consumer 540.06 -4.42%

Morgan Stanley Cyclical 497.83 -.22%

Morgan Stanley Technology 353.74 -.78%

Transports 3,460.71 -5.21%

Utilities 370.79 -2.12%

MSCI Emerging Markets 24.89 -2.73%

Sentiment/Internals

NYSE Cumulative A/D Line 25,220 +17.46%

Bloomberg New Highs-Lows Index -63 +80.25%

Bloomberg Crude Oil % Bulls 41.0 -15.81%

CFTC Oil Large Speculative Longs 235,246 +4.67%

Total Put/Call 1.0 +6.38%

OEX Put/Call 1.54 +28.33%

ISE Sentiment 89.0 -25.21%

NYSE Arms 2.47 +257.97%

Volatility(VIX) 42.82 +9.26%

G7 Currency Volatility (VXY) 19.15 -6.72%

Smart Money Flow Index 7,527.86 +2.49%

AAII % Bulls 48.70 +102.92%

AAII % Bears 35.06 -35.87%

Futures Spot Prices

Crude Oil 40.40 -12.96%

Reformulated Gasoline 110.75 -.14%

Natural Gas 5.55 -7.81%

Heating Oil 148.90 +1.20%

Gold 853.60 -2.56%

Base Metals 113.75 +2.54%

Copper 154.95 +4.36%

Agriculture 316.29 +2.45%

Economy

10-year US Treasury Yield 2.39% +2 basis points

10-year TIPS Spread .58% +46 basis points

TED Spread 1.20 -13 basis points

N. Amer. Investment Grade Credit Default Swap Index 200.25 +.12%

Emerging Markets Credit Default Swap Index 711.19 -1.46%

Citi US Economic Surprise Index -100.50 +14.32%

Fed Fund Futures imply 72.0% chance of no change, 28.0% chance of 25 basis point cut on 1/28

Iraqi 2028 Govt Bonds 42.12 +2.34%

4-Wk MA of Jobless Claims 525,800 -4.9%

Average 30-year Mortgage Rate 5.01% -9 basis points

Weekly Mortgage Applications 1,143,800 -8.18%

Weekly Retail Sales -1.0%

Nationwide Gas $1.78/gallon -.15/gallon

US Heating Demand Next 7 Days 6.0% above normal

ECRI Weekly Leading Economic Index 109.40 +1.30%

US Dollar Index 82.66 +1.0%

Baltic Dry Index 821.0 +6.21%

CRB Index 229.91 -2.21%

Best Performing Style

Mid-cap Growth -2.87%

Worst Performing Style

Small-cap Value -5.42%

Leading Sectors

Computer Hardware +15.19%

Homebuilders +4.53%

Disk Drives +3.78%

Steel +1.82%

Airlines +1.22%

Lagging Sectors

Restaurants -5.53%

Insurance -5.76%

Gold -6.69%

REITs -6.88%

Banks -11.80%

Stocks Finish at Session Lows, Weighed Down by REIT, Energy and Bank shares

Market Summary

Top 20 Biz Stories

Today’s Movers

Market Performance Summary

WSJ Data Center

Sector Performance

ETF Performance

Style Performance

Commodity Movers

Market Wrap CNBC Video(bottom right)

S&P 500 Gallery View

Timely Economic Charts

GuruFocus.com

PM Market Call

After-hours Commentary

After-hours Movers

After-hours Real-Time Stock Bid/Ask

After-hours Stock Quote

After-hours Stock Chart

In Play