Style Outperformer:

Mid-Cap Growth (+.91%)

Sector Outperformers:

Semis (+2.70%), Oil Service (+2.0%) and HMOs (+1.79%)

Stocks Rising on Unusual Volume:

GMXR, PHG, FST, LRCX, AIXG, ATHR, HES, NVS, RMD, ONXX, CHNG, ACOR, CHBT, DNDN, LLTC, ALOG, CTXS, EBIX, RINO, NVTL, CIEN, MORN, ORLY, WCRX, CPSI, STNR, MIDD, TBH, MTA, ESE, BDK, MBT, SNY, GLP and HVT

Stocks With Unusual Call Option Activity:

1) GRA 2) LLTC 3) BDK 4) AMTD 5) CTXS

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, October 12, 2009

Bull Radar

Trading Links

BNO Breaking Global News of Note

Yahoo Most Popular Biz Stories

Briefing.com Stock Market Update

Stocks On The Move

Upgrades/Downgrades

StockCharts Market Performance Summary

Sector Performance

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

Chart Toppers

CNBC Real-Time Intraday Quote/Chart

HFR Global Hedge Fund Indices

Sunday, October 11, 2009

Monday Watch

Weekend Headlines

Bloomberg:

- Investors outside the

- Wondering what the next bubble might be? How about a merger boom? All the signs are that the global capital markets are gearing up for the next big thing: a wave of mergers and takeover bids.

- Senator John McCain, the top Republican on the Armed Services Committee, said it will take at least 40,000 additional U.S. troops to win in Afghanistan and cautioned the Obama administration against a “half-measure.” “The great danger now is not an American pullout,” McCain, who was his party’s 2008 presidential nominee, said on CNN’s “State of the

- CVS Caremark Corp.(CVS) and Walgreen Co.(WAG), the two largest U.S. drugstore chains, are experiencing spot shortages of seasonal-flu vaccines because of increased demand. CVS MinuteClinics in

- California Governor Arnold Schwarzenegger will know within a month whether a $1.1 billion drop in revenue collections is part of a growing budget shortfall or an isolated event, his budget spokesman said. Revenue in the three months ended Sept. 30 was 5.3 percent less than assumed in the $85 billion annual budget, state controller John Chiang reported yesterday. Income tax receipts led the gap, as unemployment reached 12.2 percent in August. “The culprit here appears to be estimated quarterly personal income tax statements,” H.D. Palmer, the governor’s budget spokesman, said yesterday.

- President Barack Obama risks triggering violence unless he follows through on his promises to promote Middle East peace, according to Prince Turki al-Faisal, a former Saudi ambassador to the U.S. Obama’s Nobel Peace Prize awarded two days ago is a call on the U.S. president to step up efforts to facilitate a peace agreement between the Israelis and the Arabs by pressing Israel to make compromises, Turki, 64, said in an interview yesterday in Riyadh. “I hope that by the end of his term, he will have come to deserve it.”

- The average price of regular gasoline at

Wall Street Journal:

- Now may be the short-lived sweet spot for investing in initial public offerings. IPOs last week had their biggest haul of the year, with more than $10 billion raised, accounting for more than half of 2009's $18 billion total. This past week's multibillion-dollar deals for Banco Santander Brasil SA, the world's largest public offering this year, and Verisk Analytics Inc. will be followed this year by IPOs for Hyatt Corp., Dollar General Corp. and Dole Food Co. Because companies that go public in hard economic times tend to be a relatively strong bunch, the 2009 field has a good chance of doing well over the long-term. "This year, you get the best and the brightest," says Bill Buhr, IPO strategist at research firm Morningstar Inc.

- USA Today, long the country's largest newspaper by weekday circulation, said Friday it had experienced a circulation decline, which is likely to knock it down to No. 2 when the next audited circulation figures are released on Oct. 26. The Wall Street Journal, owned by News Corp., has recently been the nation's second-largest newspaper by circulation. Last year it reported circulation of just over two million weekday copies, based on the average for the six-month period ended September 2008. After USA Today's memo, the Journal said it is now the largest U.S. newspaper by weekday circulation.

- Some hedge-fund managers are getting their heads above high water. For many managers, trying to recapture so-called high-water marks, or the hurdle that money-losing funds must clear to resume collecting performance fees, was a major concern after a tough 2008.

- Chinese leaders are concerned that their nation's enormous economic expansion is becoming an excuse for foreign suppliers to inflate commodity costs. So, they hope to use their three futures exchanges to fight back.Government officials say the country is positioning its futures markets to be major players in setting world prices for metal, energy and farm commodities. By letting the world know how much its companies and investors think goods are worth,

MarketWatch.com:

-

- Congress could be receptive to President Barack Obama's pledge to end a 16-year-old policy banning gay people from serving openly in the military, a top Democratic lawmaker said. The Pentagon also signaled openness to a change. Speaking at a human-rights dinner in

- Alarmed by the rising jobless rate, Democrats are scrambling to "do something" to create jobs. You may have thought that was supposed to be the point of February's $780 billion stimulus plan, and indeed it was. White House economists Christina Romer and Jared Bernstein estimated at the time that the spending blowout would keep the jobless rate below 8%.

CNBC.com:

- If you’re planning to put your home on the market, it’s not your manners that need polishing. Try your silver, among other improvements. Now, more than ever, getting a signed contract in hand is all about price and quality. Here's a few tips to selling your house in a tough market.

- There may not be as much slack in the U.S. economy as many forecasters believe, which means medium-term inflation risks could be higher, a Federal Reserve official said on Sunday. In excerpts of remarks prepared for delivery at an economics conference, St. Louis Federal Reserve President James Bullard said it was hard to accurately measure the gap between what the economy is producing and its full potential.

NY Times:

- Mullah Omar leads an insurgency that has gained steady ground in much of

The Business Insider:

- The Sign That Tells You Everything You Need To Know About Healthcare Regulation:

- An analyst at credit rating firm Standard & Poor's says

NY Post:

- The US Attorney's office appears to have the smoking gun that may be the first of a long line of prosecutions resulting from the financial crash of last year. Sources tell The Post the most damning evidence against Bear Stearns' hedge fund managers Ralph Cioffi and Matthew Tannin appears in an e-mail message from Tannin to Cioffi, which states: "The entire subprime market is toast, there is simply no way for us to make money -- ever." By contrast, the two hedgers held an investor conference call soon after and told investors "We're comfortable with exactly where we are."

CNNMoney.com:

NJ.com:

- Gov. Jon Corzine has never been burdened by self-doubt, second thoughts or a lack of confidence. It's what fueled his rise, associates say, to the pinnacle of Wall Street and then to the top spot in

LA Times:

- The founder of Vizio envisions a wide-screen, flat-panel TV in every home.

San Francisco Chronicle:

- Michael Hasenstab, manager of the Templeton Global Bond Fund, shares his insights. We are looking for the dollar to depreciate, but not necessarily against the major currencies.

Politico:

- It's been conventional wisdom forever that health care reform’s brass tacks will be decided in conference committee, where Senate and House negotiators reconcile each chamber's version into one bill. But what if reform could skip conference on the way to the president’s desk? It wasn't a question I’d considered until a former House and Senate leadership aide sent an email sketching out another route to passage. Instead of introducing a Senate bill, Majority Leader Reid could insert the merged health care reform language into a revenue raising House bill already languishing in conference committee. The Senate would pass it and send it to the House whereupon passage, it would go straight to the president’s desk – completely bypassing conference. Do not pass go, do not collect $200. By cutting out conference, this single-bullet scenario eliminates weeks of expected wrangling and would make it possible to pass a bill by the Thanksgiving target so many Democrats are aiming for. The single-bullet scenario raises other questions, namely would the House pass a bill ordered up by the Senate. Maybe, if it has a public option. Long left for dead in the Senate, the public option made a comeback this week with consensus building around a national public option that states could opt out of. And Obama aides are reportedly meeting with senior Democratic staff to discuss how to include a public plan in the bill Reid will bring to the floor. The other factor making the single-bullet scenario a viable alternative, there is currently a House bill in conference that could be used as the vehicle for Reid’s health reform bill.

- Look for this on the Hill as early as Monday: A report commissioned by America's Health Insurance Plans alleging that the Senate Finance Committee legislation would cause health care costs to go up faster than under the current system. The report, which was conducted by PricewaterhouseCoopers, has caused some buzz among Hill GOP aides. It was described to Pulse by a person familiar with the findings. The report will drop ahead of a crucial vote on the bill Tuesday in the Finance Committee, and could figure into the discussion there.

Rasmussen Reports:

Gigaom:

- The New eBay(EBAY): Bland, But Thriving.

ocregister:

- The chief economist for the California Association of Realtors, has forecast that California home prices will rise for the first time in three years in 2010, but that home sales will decrease slightly. The annual CAR forecast projects that the median house price will increase 3.3% to an annual average of $280,000. But CAR projects that sales will decline 2.3% next year.

USAToday:

- About $270 million in federal stimulus money awarded by the Federal Aviation Administration has gone to more than 90 airport projects that received low-priority ratings by the FAA, according to data by Subsidyscope, an initiative of The Pew Charitable Trusts. The funds make up about a quarter of the $1.1 billion the FAA has granted to airports for shovel-ready projects from March through September this year.

Reuters:

- Billionaire George Soros said on Saturday that he would invest $1 billion in clean energy technology as part of an effort to combat climate change. The Hungarian-born

- The U.S. economy likely grew at its strongest rate in two years during the third quarter, rebounding from a steep downturn that began in December 2007, according to survey of top economists released on Saturday. Private economists polled October 5-6 for the Blue Chip Economic Indicators October survey said gross domestic product grew at an annualized rate of 3.2 percent in the quarter, up 0.2 percentage point from what they estimated a month earlier.

- Private equity firm Blackstone Group LP is planning to list up to eight companies it owns and sell at least five others, the Financial Times said on Monday. The FT said the move by Blackstone, the world's largest buyout firm, marked a reversal of its pessimistic view of the global economy and financial markets. The newspaper quoted Blackstone founder Steve Schwarzman as telling investors in a letter sent on Friday that the firm saw the world changing once again: "At least for private equity, the worst is behind the industry," it quoted him as saying.

- China's Baoshan Iron and Steel Co Ltd (Baosteel) has cut prices for its major steel products by 9-13 percent for November sales versus the October tag, industry consultancy Umetal said on Saturday.

Financial Times:

- Oil groups will meet Nigerian officials this week for crunch talks on an overhaul of sub-Saharan Africa’s biggest energy industry, in the wake of a Chinese company’s bid for stakes in prime fields. Royal Dutch Shell, Chevron, ExxonMobil and others hope to persuade the government to ease tough new terms in draft legislation. They are also locked in negotiations over leases to oil fields they have held for 40 years, with the government asking for billions of dollars to renew them.

- Pressure from institutional investors is starting to build on Bank of America’s(BAC) board to name an outsider to replace Ken Lewis, who retires as chief executive at the end of the year. Three institutional investors have urged BofA to look beyond internal candidates, according to people familiar with the matter. Two insiders – retail banking chief Brian Moynihan and chief risk officer Greg Curl – have been tipped as the lead candidates among BofA executives. However, individual board members also have expressed interest in two former BofA chief financial officers, Jim Hance and Al de Molina, people familiar with the matter said.

- More poor economic data have put

- The storm that swept through the hedge fund universe with the collapse of Lehman Brothers in September 2008 may have mostly blown over, but not without an aftermath. Faced with mounting redemptions and drooping portfolios, some hedge funds suspended valuations while others froze redemptions or staggered withdrawals over time. A few funds implemented simpler measures like prolonging notice periods. Portfolios were also revamped via “side pockets”, special purpose vehicles and the like. Much of the industry’s discussion so far has centered around whether these “restructuring” methods were a legitimate tool or a ploy to hold assets and collect fees. Karim Leguel, investment chief of Swiss advisory firm Rasini & Co in

Telegraph:

-

Globe and Mail:

- Idled drilling rigs in

Weekend Recommendations

Barron's:

- Made positive comments on (GS), (EBAY), (NYX), (F), (MHP), (AN), (GPI) and (AES).

- Made negative comments on (X) and (ENR).

Night Trading

Asian indices are -.25% to +.50% on avg.

Asia Ex-Japan Inv Grade CDS Index 106.0 +2.50 basis points.

S&P 500 futures -.03%.

NASDAQ 100 futures -.06%.

Morning Preview

BNO Breaking Global News of Note

Yahoo Most Popular Biz Stories

MarketWatch Pre-market Commentary

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Stock Quote/Chart

WSJ Intl Markets Performance

Commodity Futures

IBD New America

Economic Preview/Calendar

Earnings Calendar

Who’s Speaking?

Upgrades/Downgrades

Politico Headlines

Rasmussen Reports Polling

Earnings of Note

Company/Estimate

- (FAST)/.33

Upcoming Splits

- None of note

Economic Releases

- None of note

Other Potential Market Movers

- The White House’s Summers speaking, Treasury’s Krueger speaking and the (NVE) investor meeting could also impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by technology and financial stocks in the region. I expect

Weekly Outlook

Click here for Wall St. Week Ahead by Reuters.

Click here for Stocks to Watch Monday by MarketWatch.

Click here for TradeTheNews.com Weekly Calendar.

BOTTOM LINE: I expect US stocks to finish the week modestly higher on less financial sector pessimism, diminishing economic fear, short-covering, mostly positive earnings reports and investment manager performance anxiety. My trading indicators are giving mostly bullish signals and the Portfolio is 100% net long heading into the week.

Saturday, October 10, 2009

Friday, October 09, 2009

Weekly Scoreboard*

Indices

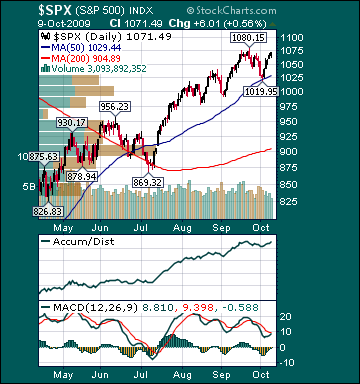

S&P 500 1,071.49 +4.51%

DJIA 9,864.94 +3.98%

NASDAQ 2,139.28 +4.45%

Russell 2000 614.92 +5.98%

Wilshire 5000 10,963.48 +4.72%

Russell 1000 Growth 471.81 +4.17%

Russell 1000 Value 554.32 +5.15%

Morgan Stanley Consumer 650.23 +2.65%

Morgan Stanley Cyclical 754.07 +7.49%

Morgan Stanley Technology 541.83 +5.05%

Transports 3,875.72 +4.95%

Utilities 377.17 +2.70%

MSCI Emerging Markets 39.83 +4.79%

Lyxor L/S Equity Long Bias Index 939.56 -.22%

Lyxor L/S Equity Variable Bias Index 845.88 +.06%

Lyxor L/S Equity Short Bias Index 1,063.92 +.76%

Sentiment/Internals

NYSE Cumulative A/D Line +61,488 +7.53%

Bloomberg New Highs-Lows Index +924 +404.92%

Bloomberg Crude Oil % Bulls 34.0 +78.95%

CFTC Oil Net Speculative Position +50,006 +18.66%

CFTC Oil Total Open Interest 1,248,517 +5.94%

Total Put/Call .78 -29.09%

OEX Put/Call 1.27 +22.12%

ISE Sentiment 160.0 +26.98%

NYSE Arms .98 -6.67%

Volatility(VIX) 23.12 -19.39%

G7 Currency Volatility (VXY) 12.33 -3.60%

Smart Money Flow Index 9,385.31 +1.72%

Money Mkt Mutual Fund Assets $3.446 Trillion +.50%

AAII % Bulls 35.0 -20.45%

AAII % Bears 41.0 +17.14%

Futures Spot Prices

CRB Index 262.55 +3.83%

Crude Oil 71.77 +2.99%

Reformulated Gasoline 176.80 +1.97%

Natural Gas 4.77 +1.27%

Heating Oil 185.28 +3.42%

Gold 1,048.60 +4.50%

Bloomberg Base Metals 184.10 +6.78%

Copper 283.80 +5.68%

US No. 1 Heavy Melt Scrap Steel 258.33 USD/Ton unch.

China Hot Rolled Domestic Steel Sheet 3,402 Yuan/Ton -1.56%

S&P GSCI Agriculture 307.55 +3.56%

Economy

ECRI Weekly Leading Economic Index 128.30 +.94%

Citi US Economic Surprise Index +33.20 +10.67%

Fed Fund Futures imply 63.0% chance of no change, 37.0% chance of 25 basis point cut on 11/04

US Dollar Index 76.35 -.85%

Yield Curve 240.0 +5 basis points

10-year US Treasury Yield 3.38% +16 basis points

Federal Reserve’s Balance Sheet $2.120 Trillion -.14%

U.S. Sovereign Debt Credit Default Swap 20.0 -1 basis point

10-year TIPS Spread 1.85% +14 basis points

TED Spread 22.0 +2 basis points

N. Amer. Investment Grade Credit Default Swap Index 102.37 -6.76%

Euro Financial Sector Credit Default Swap Index 70.65 -8.02%

Emerging Markets Credit Default Swap Index 251.13 -8.64%

CMBS Super Senior AAA 10-year Treasury Spread 503.0 -2.33%

M1 Money Supply $1.654 Trillion +.84%

Business Loans 683.30 -.71%

4-Wk MA of Jobless Claims 539,800 -1.6%

Continuing Claims Unemployment Rate 4.50% -10 basis points

Average 30-year Mortgage Rate 4.87% -7 basis points

Weekly Mortgage Applications 756,300 +16.43%

ABC Consumer Confidence -45 +1 point

Weekly Retail Sales -2.20% +10 basis points

Nationwide Gas $2.47/gallon unch.

US Cooling Demand Next 7 Days 3.0% above normal

Baltic Dry Index 2,647 +15.89%

Oil Tanker Rate(Arabian Gulf to US Gulf Coast) 25.0 unch.

Rail Freight Carloads 206,293 +.32%

Iraqi 2028 Govt Bonds 76.50 +1.52%

Best Performing Style

Small-Cap Value +6.27%

Worst Performing Style

Large-Cap Growth +4.17%

Leading Sectors

Hospitals +14.54%

Gold +12.78%

Oil Service +9.51%

Homebuilders +8.62%

Gaming +8.51%

Lagging Sectors

Medical Equipment +2.07%

Restaurants +1.67%

Biotech +1.50%

Wireless +1.33%

Telecom -2.31%