U.S. Week Ahead by MarketWatch (video).

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on rising global growth fears, less US economic optimism, rising Eurozone debt angst, technical selling and more shorting. My intermediate-term trading indicators are giving mostly bearish signals and the Portfolio is 50% net long heading into the week.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Sunday, June 03, 2012

Friday, June 01, 2012

Weekly Scoreboard*

Indices

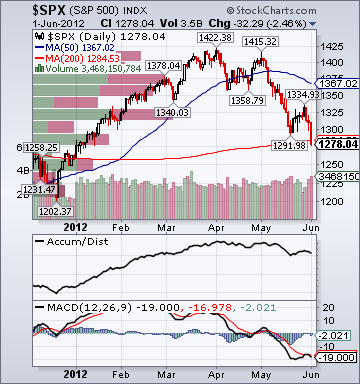

- S&P 500 1,278.04 -3.23%

- DJIA 12,118.50 -3.28%

- NASDAQ 2,747.48 -3.24%

- Russell 2000 737.42 -3.80%

- Value Line Geometric(broad market) 324.37 -3.85%

- Russell 1000 Growth 602.28 -3.64%

- Russell 1000 Value 625.53 -3.01%

- Morgan Stanley Consumer 753.64 -3.0%

- Morgan Stanley Cyclical 869.45 -4.88%

- Morgan Stanley Technology 604.59 -4.57%

- Transports 4,911.87 -3.85%

- Utilities 464.31 -.56%

- Bloomberg European Bank/Financial Services 65.61 -4.0%

- MSCI Emerging Markets 37.27 -.60%

- Lyxor L/S Equity Long Bias 997.39 +.67%

- Lyxor L/S Equity Variable Bias 806.72 +.08%

- Lyxor L/S Equity Short Bias 539.22 unch.

- NYSE Cumulative A/D Line 137,223 -.41%

- Bloomberg New Highs-Lows Index -385 -144

- Bloomberg Crude Oil % Bulls 27.0 unch.

- CFTC Oil Net Speculative Position 178,885 -2.82%

- CFTC Oil Total Open Interest 1,440,107 -.17%

- Total Put/Call 1.37 +25.69%

- OEX Put/Call .77 -8.33%

- ISE Sentiment 94.0 -7.84%

- NYSE Arms 2.12 +69.60%

- Volatility(VIX) 26.66 +23.77%

- S&P 500 Implied Correlation 73.32 +9.58%

- G7 Currency Volatility (VXY) 11.81 +5.82%

- Smart Money Flow Index 10,920.14 -.51%

- Money Mkt Mutual Fund Assets $2.572 Trillion +.30%

- AAII % Bulls 28.0 -8.04%

- AAII % Bears 42.0 +8.66%

- CRB Index 268.31 -4.83%

- Crude Oil 83.23 -8.32%

- Reformulated Gasoline 265.68 -5.92%

- Natural Gas 2.33 -14.13%

- Heating Oil 262.79 -7.17%

- Gold 1,622.10 +3.99%

- Bloomberg Base Metals Index 195.48 -3.62%

- Copper 331.35 -3.59%

- US No. 1 Heavy Melt Scrap Steel 399.0 USD/Ton +1.0%

- China Iron Ore Spot 135.0 USD/Ton +3.44%

- Lumber 280.10 -2.37%

- UBS-Bloomberg Agriculture 1,382.68 -3.62%

- ECRI Weekly Leading Economic Index Growth Rate -.60% -100 basis points

- Philly Fed ADS Real-Time Business Conditions Index -.1676 +2.56%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 111.04 +.14%

- Citi US Economic Surprise Index -53.60 -29.1 points

- Fed Fund Futures imply 64.0% chance of no change, 36.0% chance of 25 basis point cut on 6/20

- US Dollar Index 82.89 +.60%

- Yield Curve 120.0 -25 basis points

- 10-Year US Treasury Yield 1.45% -29 basis points

- Federal Reserve's Balance Sheet $2.825 Trillion -.61%

- U.S. Sovereign Debt Credit Default Swap 48.64 +2.40%

- Illinois Municipal Debt Credit Default Swap 248.0 +3.77%

- Western Europe Sovereign Debt Credit Default Swap Index 329.0 +4.23%

- Emerging Markets Sovereign Debt CDS Index 357.08 +10.51%

- Saudi Sovereign Debt Credit Default Swap 136.36 +3.19%

- Iraq Sovereign Debt Credit Default Swap 432.59 -2.66%

- China Blended Corporate Spread Index 591.0 -43 basis points

- 10-Year TIPS Spread 2.05% -9 basis points

- TED Spread 40.25 +1.75 basis points

- 2-Year Swap Spread 37.25 +2.0 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -55.75 -8.0 basis points

- N. America Investment Grade Credit Default Swap Index 125.91 +7.35%

- Euro Financial Sector Credit Default Swap Index 302.28 +2.15%

- Emerging Markets Credit Default Swap Index 322.02 +.55%

- CMBS Super Senior AAA 10-Year Treasury Spread 186.0 unch.

- M1 Money Supply $2.241 Trillion -.71%

- Commercial Paper Outstanding 1,028.6 +2.0%

- 4-Week Moving Average of Jobless Claims 374,500 +4,500

- Continuing Claims Unemployment Rate 2.6% unch.

- Average 30-Year Mortgage Rate 3.75% -4 basis points

- Weekly Mortgage Applications 794.70 -1.27%

- Bloomberg Consumer Comfort -39.3 +2.7 points

- Weekly Retail Sales +3.0% unch.

- Nationwide Gas $3.61/gallon -.04/gallon

- U.S. Cooling Demand Next 7 Days 17.0% below normal

- Baltic Dry Index 923.0 -12.76%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 35.0 -6.67%

- Rail Freight Carloads 244,726 +1.27%

- Large-Cap Value -3.01%

- Mid-Cap Growth -4.32%

- Gold & Silver +3.60%

- Airlines +.58%

- Utilities -.56%

- Education -1.65%

- Drugs -1.96%

- Banks -5.11%

- Oil Service -5.43%

- Disk Drives -6.39%

- Oil Tankers -8.56%

- Homebuilders -10.0%

- IBI, TFM, OVTI, GET, VSH, GLPW, NLNK, KMI and BAH

- JOSB, MENT, P, TSCO, BRS, PRX, SMS, PAY and TEA

ETFs

Stocks

*5-Day Change

Stocks Falling into Final Hour on Rising Global Growth Fears, Faltering US Data, Rising Eurozone Debt Angst, Technical Selling

Broad Market Tone:

- Advance/Decline Line: Substantially Lower

- Sector Performance: Almost Every Sector Declining

- Volume: Slightly Above Average

- Market Leading Stocks: Underperforming

- VIX 26.70 +10.97%

- ISE Sentiment Index 94.0 -20.34%

- Total Put/Call 1.36 +27.10%

- NYSE Arms 1.89 +64.72%

- North American Investment Grade CDS Index 126.75 +2.80%

- European Financial Sector CDS Index 302.30 +1.74%

- Western Europe Sovereign Debt CDS Index 329.0 +.82%

- Emerging Market CDS Index 343.22 +3.24%

- 2-Year Swap Spread 37.25 +1.5 basis points

- TED Spread 40.25 -.25 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -55.75 -5.5 basis points

- 3-Month T-Bill Yield .07% unch.

- Yield Curve 120.0 -11 basis points

- China Import Iron Ore Spot $134.0/Metric Tonne +.15%

- Citi US Economic Surprise Index -53.60 -17.7 points

- 10-Year TIPS Spread 2.05 -4 basis points

- Nikkei Futures: Indicating a -200 open in Japan

- DAX Futures: Indicating -21 open in Germany

- Lower: On losses in my Retail, Biotech, Medical and Tech sector longs

- Disclosed Trades: Added to my (IQM)/(QQQ) hedges, added to my (EEM) short, then covered some of them

- Market Exposure: Moved to 50% Net Long

Today's Headlines

Bloomberg:

- Berlusconi Says ECB Must Print Euros or Italy May Say 'Ciao'. Former Premier Silvio Berlusconi said Italy should say “ciao, euro” if the European Central Bank doesn’t start printing money to tackle the debt crisis and Germany should quit the single currency if it won’t back a bolder role for ECB. “The economic crisis can’t be solved” in Italy, Berlusconi said in comments posted on his party’s website today. He called on Prime Minister Mario Monti to “change his political line” and lobby European leaders to back a money- printing campaign by the Frankfurt-based ECB. If the central bank doesn’t become a “lender of last resort,” Italy should say “ciao, euro,” the former premier said. The media tycoon-turned-politician became the latest European leaders to step up pressure on German Chancellor Angela Merkel and the ECB to permit a more aggressive response to the region’s debt crisis. Monti yesterday called on Merkel to drop her opposition to allowing the euro region’s rescue mechanism to lend directly to banks.

- Deutsche Bank(DB) Borrowed $11.1 Billion From ECB for Spain, Italy. Deutsche Bank AG borrowed 9 billion euros from the European Centra Bank through its Spanish and Italian units after saying it took only "a small amount" in a second round of emergency funding. Deutsche Bank SA Espanola, the lender's Spanish unit, took 5.5 billion euros and Deutsche Bank SpA, the Italian arm, borrowed 3.5 billion euros in the ECB's second longer-term refinancing operation in February, according to annual reports filed by the 2 divisions.

- Euro-Area Unemployment Reaches Record 11%, Led by Spain. Euro-area unemployment reached the highest on record as a deepening economic slump and budget cuts prompted companies from Spain to Italy to reduce their workforces. The jobless rate in the 17-nation euro zone was at 11 percent in April and March, the European Union's statistics office in Luxembourg said today. That's the highest since the data series started in 1995. The March figure was revised higher to 11 percent from 10.9 percent estimated earlier. Europe's companies are under pressure to lower costs to protect earnings as the worsening fiscal crisis erodes exports and consumer spending. Euro-area economic confidence dropped more than economists forecast last month and manufacturing output contracted. Deutsche Lufthansa AG said on May 30 that it may cut as many as 1,000 jobs at LSG Sky Chefs, the world's largest inflight caterer, in a bid to lower costs through 2014. "The labor-market recession in the euro zone continues to spread and deepen," said Martin van Vliet, an economist at ING Bank in Amsterdam.

- Euro Bank Downgrades Threaten Swap Deals. European bank downgrades have increased the risk that termination clauses or renegotiation payments on billions of dollars of swaps may be triggered by counterparties. Technically called additional termination events, the downgrade clauses have become a common addition to the standard International Swaps and Derivatives Association master agreement as a way to manage counterparty risk on over-the-counter derivatives traded bilaterally.

- Euro Area Has Significant Risk of Breakup: Rehn. The 17-nation euro area is in real danger of disintegrating unless policy makers revamp the bloc’s fiscal and economic ties, Economic and Monetary Commissioner Olli Rehn said. “The way things are going and under the current structures, the euro area has a significant risk of breaking up,” Rehn said in a speech at a European Commission event in Helsinki. “We’re either headed for a deterioration of the euro area or a gradual strengthening of the European Union.” A divergence in the sovereign yields of euro countries shows bets against the integrity of the 17-member currency bloc are growing. German two-year yields fell below zero for the first time this week while the yield on similar-maturity Spanish notes rose 11.8 basis points to 5.11 percent today.

- BMW Says Germany's Auto Market Won't Grow Following Jump in 2011. The BMW brand's deliveries in its home market in the five months through May were at about 2011's level.

- Global Growth Heads for Lull as Europe Output Shrinks. The world economy is heading for its third straight mid-year lull after manufacturing output shrank in Europe and slowed in China, leaving the U.S. under pressure to drive global growth. A gauge of manufacturing in the 17-nation euro zone fell to a three-year low of 45.1 in May, indicating a 10th month of contraction, while unemployment reached 11 percent, the highest on record. China’s Purchasing Managers’ Index dropped to 50.4 from 53.3, the weakest production growth since December. Signs of a renewed international slowdown are mounting as Europe’s two-year debt crisis threatens to engulf Spain and spread abroad by undermining demand and investor confidence. With China’s economy also decelerating, economists are looking to the U.S. for growth. Data today is forecast to show hiring picked up in May. “Things are turning down again and the underlying state of every economy is pretty ropey,” said Rob Carnell, chief international economist at ING Bank NV in London. “The world may avoid recession, but large chunks of it will remain in it.”

- U.S. Employers Add 69,000 Jobs, Fewer Than Forecast. The American jobs engine sputtered in May as employers added the fewest workers in a year and the unemployment rate rose, dealing a blow to President Barack Obama’s re-election prospects and raising the odds the Federal Reserve will step in to boost growth. Payrolls climbed by 69,000 last month, less than the most- pessimistic forecast in a Bloomberg News survey, after a revised 77,000 gain in April that was smaller than initially estimated, Labor Department figures showed today in Washington. The median projection called for a 150,000 May advance. The jobless rate rose to 8.2 percent from 8.1 percent. “The picture is getting more worrisome,” Bruce Kasman, chief economist for JPMorgan Chase & Co. in New York, said on a conference call with clients. “The U.S. economy is going to be somewhat softer over the next couple of quarters.”

- Manufacturing in U.S. Expanded at a Slower Pace in May. Manufacturing in the U.S. grew at a slower pace in May as factories tempered production and pared inventories in response to weakness in the global economy. The Institute for Supply Management’s factory index fell to 53.5 after reaching a 10-month high of 54.8 in April, the Tempe, Arizona-based group reported today. Readings greater than 50 signal growth. The median projection of economists surveyed by Bloomberg News called for a decrease to 53.8 in May.

- Treasuries Surge as Dow Gives Back All of 2012 Gain. Treasuries rose, driving 10-year yields below 1.50 percent for the first time, while the Dow Jones Industrial Average erased its 2012 gain after U.S. employers created the fewest jobs in a year and Chinese manufacturing slowed. Commodities slumped. Yields on 10-year Treasuries dropped nine basis points to 1.47 percent at 11:49 a.m. New York time and reached 1.4387 percent earlier. The Standard & Poor’s 500 Index (SPX) sank 2 percent, its biggest drop of the year, after completing its worst monthly slide since September. The Stoxx Europe 600 Index slumped 1.9 percent. The S&P GSCI gauge of 24 commodities slipped to the lowest level since October as crude oil plunged 3.7 percent to $83.36 a barrel. The yield on Germany’s two-year note dropped as low as minus 0.012 percent. Gold futures rallied 3.2 percent to $1,614.40 an ounce.

- S&P 1500 Homebuilding Index down as much as 6.7%, most intraday since Aug. 2011. All 11 index members down 2.6% or more. May's jobs report "step backward for housing in every way," with contruction employment falling, job growth especially slow in hard-hit housing markets, job picture slipping for 25-34 year-olds: Jed Kolko, Trulia chief economist.

- GM Joins Toyota Missing U.S. Sales Estimates as Jobs Falter. General Motors Co., Toyota Motor Corp., Chrysler Group LLC and Nissan Motor Co. reported U.S. sales gains in May that trailed estimates as incentive offers failed to draw enough buyers amid slumping job growth.

- JPMorgan's(JPM) Iksil Said to Take Big Risks Long Before Loss. (video) Iksil’s value-at-risk, a measure of how much a trader might lose in one day, was typically $30 million to $40 million even before this year’s buildup, said the person, who wasn’t authorized to discuss the trades. Sometimes the figure, known as VaR, could surpass $60 million, the person said. That’s about as high as the level for the firm’s entire investment bank, which employs 26,000 people.

- Mittal(MT) Price Squeeze in $960 Billion Steelmaking Industry. Lakshmi Mittal, whose $46 billion takeover in 2006 created ArcelorMittal as the world’s largest steelmaker, is getting pushed around. The U.K.’s richest person can’t stop his iron-ore suppliers from raising prices and can’t pass on higher costs to customers share like Volkswagen AG (VOW), after the Luxembourg-based company’s market fell to its lowest since 2009. The company’s stock slid to a record today, and yields on debt issued this year are close to their highest relative to benchmark bonds. Even after years of consolidation, today’s five biggest steelmakers including ArcelorMittal and South Korea’s Posco (005490) control no more than 19 percent of the $960 billion global market, too little to defend their prices.

- Commodity Index Extends Slide to Lowest Since October. Commodities extended their decline, touching the lowest level in almost eight months, after U.S. employers created fewer jobs than economists estimated and Chinese manufacturing slowed. The Standard & Poor’s GSCI Spot Index fell 2.1 percent to 583.53 at 10:27 a.m. in New York, after touching 578.35, the lowest level since Oct. 4. The index has dropped 6 percent this week, heading for a fifth straight decline and the biggest since September.

- Commodity Revenues at Banks Decline as Volatility Drops. Revenues generated by the 10 largest banks’ commodity units slumped 33 percent in the first quarter as volatility declined, clients reduced trading and gas supplies climbed, according to Coalition, a London research company. Revenues fell to a combined $2 billion from $3 billion a year earlier, Coalition said in a report. Overall revenues at the banks, including from equities, origination and advisory, declined to $51 billion from $53 billion, Coalition said. The drop in commodity revenues reflects the challenge banks face driving income from energy and metals.

- Weaker Brazil Economy Raises Doubts About Credit-Led Growth. Brazil’s economy grew less than analysts expected in the first quarter, reinforcing signs that its consumer-led growth model, a magnet for investment over the past decade, is running out of steam. Gross domestic product expanded 0.2 percent in the first quarter and 0.8 percent from the same period a year ago, the national statistics agency said in a report today. Growth in the first three months of the year was lower than expected by all but one of 50 analysts surveyed by Bloomberg, whose median forecast was for a 0.5 percent expansion.

Fox News:

Washington Post:

- Italy, Spain Default Insurance Costs Hit Record. The cost of insuring Spanish and Italian government debt against default via instruments known as credit default swaps, or CDS, hit new records on Friday, according to data provider Markit. The spread on five-year Spanish CDS widened to 610 basis points from 596 basis points on Thursday. That means it would now cost $610,000 annually to insure $10 million of Spanish debt against default for five years, up $14,000 from the previous day. The spread on Italian CDS widened by 22 basis points to 579. Core euro-zone countries also saw a rise, with the French CDS spread widening by 8 basis points to 225 and Germany widening by 4 basis points to 106, Markit said.

- Small Biz Lending Shrinks as Owners Grow Cautious.

- More Fed Easing Might Not Help Much Now: Pros.

- Jobs Report Signals More Trouble for Housing.

- Romney Just Thrashed Obama on the Jobs Report on CNBC.

- Watch: Jon Stewart Unloads on Michael Bloomberg's Soda Ban.

- Chart of the Day: The Scariest Jobs Chart Ever.

- Sophisticated Ignorance Part 2: Pressuring Germany To Do The Wrong Thing Is A Short Seller's Dream. Today's lead story on Bloomberg and the primary theme throughout the financial MSM is Merkel’s Isolation Deepens As Draghi Criticizes Strategy. This is general pressure to force Merkel to succumb to extreme short term thinking that will most assuredely bring the EU to its knees and potentially end the hegemony of what use to be the European empire - that is unless... You know.... This time is different!

- Santelli And Kaminsky On Broken Rules, Unpredictability, and Deleveraging.

- 2012 Just Woke Up in 2011 All Over Again.

Washington Post:

- Bill Clinton sticks another fork in Obama’s Bain strategy, says Romney had ‘sterling’ business career. The shelf life of President Obama’s Bain Capital strategy appears to be rapidly shrinking. Less than two weeks after Newark Mayor Cory Booker caused the Obama campaign plenty of heartburn by calling on it to “stop attacking private equity,” the biggest name in Democratic politics (outside of Obama) has lodged his own torpedo. Bill Clinton, in an appearance on CNN last night, said that Mitt Romney has a “sterling business career” and that the campaign shouldn’t be about what kind of work Romney did.

- Housing Market Still Suffers Mortgage Hangover. I recently wrote that quarterly data from the Federal Deposit Insurance Corp. reveal more signs of stress in the banking system. One of stressful line items in the FDIC's Quarterly Banking Profile for the first quarter of 2012 was "Other Real Estate Owned." In that article I stated that OREO peaked at $53.2 billion in the third quarter of 2010 and was still seriously elevated at $44.8 billion at the end of the first quarter of this year. On Thursday we learned from RealtyTrac that 26% of all existing-home sales in the first quarter were distressed properties, including bank-owned homes from OREO. This was up from 22% in the fourth quarter of 2011.

Real Clear Markets:

Reuters:

- Exclusive: China Arrests Security Official on Suspicion of Spying for U.S. A Chinese state security official has been arrested on suspicion of spying for the United States, sources said, a case both countries have kept quiet for several months as they strive to prevent a fresh crisis in relations. The official, an aide to a vice minister in China's security ministry, was arrested and detained early this year on allegations that he had passed information to the United States for several years on China's overseas espionage activities, said three sources, who all have direct knowledge of the matter. The aide had been recruited by the U.S. Central Intelligence Agency and provided "political, economic and strategic intelligence", one source said, though it was unclear what level of information he had access to, or whether overseas Chinese spies were compromised by the intelligence he handed over. The case could represent China's worst known breach of state intelligence in two decades and its revelation follows two other major public embarrassments for Chinese security, both involving U.S. diplomatic missions at a tense time for bilateral ties.

- Greek companies seek Balkan refuge from debt storm. Iosif Komninakidis smokes nervously behind his desk in the sleepy Bulgarian town of Rakovski and contemplates plunging sales of his Greek company's trendy jeans. Business in Komninakidis's main market Greece was already in freefall when an election left Bulgaria's neighbour rudderless and further threatened its solvency and euro membership. "Sales to Greece went down 30-35 percent. After the vote, they completely stopped. People just stand and wait," said the energetic 57-year-old manager of Staff Jeans & Co's sewing factory. But his business can't wait.

- EXCLUSIVE - Egypt Islamist says he is choice for revolutionaries. The Islamist aiming to be Egypt's president vowed to keep Hosni Mubarak in jail forever and forecast his liberal rivals would back him in an election runoff against a former general he sees as heir to the deposed leader. In his first international media interview since he won the first round ballot, the Muslim Brotherhood's Mohamed Mursi professed confidence the liberal rivals would swallow their fears of religious rule and vote him to victory.

- Copper Sinks to 2012 Low on Economic Slowdown Fears.

Financial Times:

- Defiant Spain to Test the Bond Market. A defiant Spain has said it will tap the sovereign bond markets for funds next week, although the high cost of its borrowing has reinforced analysts’ predictions that the country can no longer avoid an international bailout like those of Greece, Ireland and Portugal. If Spain does become the fourth eurozone country forced into a bailout, it would send tremors through the global economy and could spell disaster for the five-month-old government of Mariano Rajoy, prime minister.

Telegraph:

Bear Radar

Style Underperformer:

- Small-Cap Growth -3.35%

- 1) Homebuilders -7.5% 2) Banks -4.71% 3) Gaming -4.41%

- OVTI, IMOS, DWRE, HBAN, DB, SIVB, WFC, SAVE, LCC, BHLB, VRA, USMO, LBTYK, VPRT, BPOP, NVLS, WPPGY, FCFS, LRCX, SYNC, MOLXA, AWAY, ORIG, RDEN, CIEN, MELI, VTR, GET, TUP, BWS, PH, RATE, RDEN, BEN, KMI, FCN, ROK, PXD, EOG, BKD, BWA, MOV, UCO, OAS, YUM, LEN and URI

- 1) KEY 2) YUM 3) IBB 4) KBH 5) OVTI

- 1) HPQ 2) AIG 3) BEN 4) CF 5) GRPN

Subscribe to:

Posts (Atom)