Style Outperformer:

Sector Outperformers:

- 1) Gaming +1.55% 2) Education +.98% 3) Hospitals +.72%

Stocks Rising on Unusual Volume:

- REN, IRE, PGH, BVSN, GNW, WPRT and BBRY

Stocks With Unusual Call Option Activity:

- 1) GNW 2) ACT 3) HOT 4) EMC 5) NRG

Stocks With Most Positive News Mentions:

- 1) HRB 2) BBY 3) DELL 4) GPC 5) T

Charts:

Weekend Headlines

Bloomberg:

- EU Chiefs Seeking to Stave Off Euro Crisis Turn to Cyprus. European

leaders grappling with

political deadlock in Italy and spiraling unemployment in France will

turn to a financial rescue for Cyprus in an effort to stave off a return

of market turmoil over the debt crisis. European Union leaders will

meet for a March 14-15 summit in Brussels to discuss terms for Cyprus,

including the island nation’s debt sustainability and possibly imposing

losses on depositors. That comes as Italy struggles to form a government

after an inconclusive Feb. 24-25 election and as concern over the

French economy mounts with unemployment at a 13-year high. “We haven’t turned the corner yet,

but we’re on a good path,” German Finance Minister Wolfgang Schaeuble

told Austria’s Der Standard newspaper in a March 8 interview. “It

would be wrong at this point to change course.”

- Merkel’s FDP Partner Says ‘Hands Off ECB’ in Election Vow. German Economy Minister Philipp Roesler said he’ll fight attempts across Europe to weaken the

euro, pledging that his Free Democratic Party will stand up for

central-bank independence before federal elections on Sept. 22. Roesler, whose FDP is Chancellor Angela Merkel’s junior

coalition partner, warned in a speech to a party convention in

Berlin of a “new danger” emerging in Europe as governments

resist austerity and policies to boost competitiveness and

instead discuss artificially devaluing the euro. Such moves risk

spurring inflation, hurting those on middle incomes, savers and

retirees, he said today. “That’s why we’re fighting so hard for a stable

currency,” Roesler said. “That’s why we view attempts to

impose political influence on the independence of the European

Central Bank as lethal. That’s a threat to stable money. That is

why we as Free Democrats say: ‘Hands off our ECB.’”

- Li Says 'Hard to Say' Whether China Rate Boost Will Be Needed.

CPI to be "relatively well' controlled at around 3% this year, Bank of

China President Li Lihui said in an interview in Beijing.

- China’s Economic Data Show Weakest Start Since 2009. China’s retail sales and industrial output had their weakest

combined start to a year since the global recession in 2009, adding to

signs of a moderating rebound in the world’s second-biggest economy. Retail

sales increased 12.3 percent in the first two months of 2013 from a

year earlier and industrial production rose 9.9 percent, the National

Bureau of Statistics said yesterday in Beijing. Both numbers trailed

economists’ estimates. February inflation, distorted by a weeklong

holiday, accelerated to 3.2 percent. “The time is still

way off for an explicit policy change” such as raising interest rates or

banks’ reserve requirements, Liu Li-Gang, chief Greater China economist

at Australia & New Zealand Banking Group Ltd. in Hong Kong, said in

a note. The recovery is being led by “fast investment growth” and

“could falter once monetary policy becomes tight on concerns of rising

risks of inflation” and a property bubble. The gain in retail

sales was below the lowest economist projection of 13.8 percent and was

the smallest for a January- February period since 2004. The increase in

factory output compared with the 10.6 percent median estimate in a

Bloomberg survey and was the weakest for the first two months since

2009.

- China Streamlines Maritime Law Enforcement Amid Island Disputes. China

brought the law-enforcement arms of its maritime agencies under one

body, a move aimed at protecting the country’s interests as it presses

territorial claims in the East and South China Seas. The State Oceanic Administration will oversee the coast guard, fisheries law-enforcement and the smuggling police, which

now fall under separate ministries, a report to the National

People’s Congress, the country’s legislature, said yesterday.

The administration also has a law enforcement arm.

- Rebar Falls to Two-Month Low as China Shows Weaker Start to 2013. Steel reinforcement-bar futures

fell to the lowest in more than two months after China’s

industrial output had the weakest start to a year since 2009. Rebar

for delivery in October on the Shanghai Futures

Exchange fell by as much as 1.6 percent to 3,867 yuan ($622) a metric

ton, the lowest level for a most-active contract since Dec. 27, and was little changed at 3,928 yuan at 10:40 a.m.

local time. The contract declined for a third week last week.

- China’s Stocks Drop for Third Day as Data Spurs Economy Concerns. China’s

stocks fell, heading for their longest losing streak in three months,

as the country’s industrial output had the weakest start to a year since

2009 and

lending and retail sales growth slowed. Ping An Bank Co. led lenders

lower after the nation’s new

loans last month trailed analyst estimates. Liquor maker Sichuan

Swellfun Co. dropped among consumer companies after the country’s retail

sales growth in the first two months was the smallest for that period

since 2004. “The economic recovery is weaker than expected,” said Wang

Zheng, Shanghai-based chief investment officer at Jingxi Investment

Management Co., which manages $120 million. “Investors are worried

that stocks may already have moved ahead of fundamentals.” The Shanghai

Composite Index (SHCOMP) dropped 0.8 percent to

2,299.17 at 9:39 a.m. local time.

- Japan Machinery Orders Fall 13% in Sign of Limits on Investment. Japan’s

machinery orders plunged 13 percent in January, the biggest decline in

eight months, signaling limits on corporate investment as Prime Minister

Shinzo Abe tries to drive an economic revival. The decline from the

previous month, announced by the Cabinet Office today in Tokyo, compared

with the median estimate

in a Bloomberg News survey of 26 economists for a 1.7 percent

fall. Today’s

data are a reminder that business investment will not drive the

recovery, said Izumi Devalier, a Japan economist at HSBC

Holdings Plc in Hong Kong. “Looking ahead, we expect accelerating

consumption, residential and public investment,” Devalier said. “But given

that exports are trending at still-weak levels, it will take

more time before we see the improved business environment

spurred by the weak yen and increased manufacturer optimism

translate into robust corporate investment.”

- Abe's Quadrillion Yen Debt Risk at Pre-Quake Level: Japan Credit. Two years after a record earthquake devastate Japan's northeast,

Prime Minister Shinzo Abe has driven the nation's bond risk to levels

from before the disaster with a plan that will add to the world biggest

debt burden. The cost to insure Japan's government bonds from non-payment for five years decreased to 61 basis points on March 7, the lowest close since November 2010 and down from as much as 155 in October 2011. Abe's nominee for Bank of Japan Governor, Haruhiko Kuroda, plans to boost buying

of longer-term JGBs to stimulate growth, dismissing concerns of his

predecessor that doing so risks creating a debt crisis. Outstanding JGBs

will swell to 1,014.9 trillion yen($10.7 trillion) in fiscal 2022 from

732.2 trillion yen in the 12 months starting April 1, according to

government estimates. Total public debt including borrowings amounted to 997 trillion yen at the end of last year, closing in on the quadrillion level.

- Fukushima Toxic Waste Swells as Japan Marks Mar. 11. Every morning, 3,000 cleanup

workers at the Fukushima disaster site don hooded hazard suits,

air-filtered face masks and multiple glove layers. Most of the

gear is radioactive waste by day’s end. Multiply those cast-offs by the 730 days since a tsunami

wrecked the Dai-Ichi nuclear station two years ago and the trash

could fill six Olympic swimming pools. The tens of thousands of

waste bags stored in shielded containers illustrate the dilemma

of dealing with a nuclear accident: Everything that touches it

becomes toxic.

- North Korea Threatens South’s Defense Minister Nominee. North

Korea threatened to target the South Korean defense minister nominee

after he vowed to respond to attack by the North by toppling the regime.

A retired general and former deputy commander of the U.S.- South Korea

Combined Forces, Kim Byung Kwan will be the “first target in the great

war for national reunification” should he

continue his criticisms, a spokesman for the North Korea-based

Committee for the Peaceful Reunification of Korea said in a

statement carried by the Korean Central News Agency March 9.

- Australian Central Bank Hacked by China Malware, AFR Says. The

Reserve Bank of Australia was repeatedly and successfully hacked in a

series of cyber-attacks with malicious software developed in China,

the Australian Financial Review reported. Australia’s central bank has

responded by hiring a private security firm to carry out penetration

testing, or authorized hacking of its computer networks, to assess its

security, the newspaper said.

- Karzai Accuses U.S. of Taliban Collusion as Hagel Visits.

Defense Secretary Chuck Hagel was

greeted on his first visit to Afghanistan since taking office by suicide

bombs, threats and Afghan President Hamid Karzai’s accusation that the

U.S. is colluding with the Taliban. As Hagel prepared to leave a U.S. military compound in

Kabul on March 9, a Taliban suicide bomber blew himself up

outside the Ministry of Defense, and another suicide bomb

detonated in Khost province. Yesterday, Karzai said that those

attacks, which together killed 19 people, aided U.S. goals.

Wall Street Journal:

- Job Numbers Are Good, but Some Perils Loom. No jobs report is without its disappointments, and this one was no

exception: The drop in the unemployment rate was driven in part by job

seekers who gave up their search, and the employment gains were

concentrated among part-time workers. What is worse, long-term unemployment, which had been showing signs of

improvement, rose in February. The average unemployed American has been

out of work for more than eight months, and more than a quarter have

been looking for at least a year.

- Silver Spring Networks Looks to Tap 'Smart Grid'. Energy-technology company Silver Spring Networks Inc. plans to bring an initial

public offering to market this week, a deal from a once-hot sector that has been

largely dormant this year. The IPO market has produced big trading gains from companies in the

financial, industrial, health-care, consumer and energy sectors. But flotations

in the technology field have been unusually tame. Silver Spring's modest $66.7

million offering will be the sector's second, and largest, this year, according

to Ipreo, a market-intelligence firm.

- A New Obama? The Republican response should be don't trust but verify.

Fox News:

- White House suspends public tours, but first family trips in full swing. Visitors to the nation's capital looking for a White House public

tour are out of luck starting this weekend, courtesy of what the Secret

Service says is its own decision to deal with the sequester cuts. But while the agency said it needed to pull officers off the tours

for more pressing assignments, the budget ax didn't swing early or deep

enough to curtail a host of recent Secret Service-chaperoned trips like

President Obama's much-discussed Florida golf outing with Tiger Woods

and first lady Michelle Obama's high-profile multi-city media

appearances.

CNBC:

Zero Hedge:

- Meet The New US Petroleum Pipelines. (graph) Still confused why crony capitalist #1, the "rustic" Octogenarian of Omaha, and Obama tax advisor #1,

Warren Buffett has been aggressively attempting to corner the railroad

market, while the administration relentlessly refuses to allow assorted

new, and very much competing petroleum pipelines from

America's neighbor to the north to cross through the US (in gratitude

for the former's generous "tax advice" and pedigree by association)?

Hint: it's not concern about the environment. The answer is the chart

below.

Business Insider:

Reuters:

- Egypt protesters torch buildings, target Suez Canal. Egyptian

protesters torched buildings in Cairo and tried unsuccessfully to

disrupt international shipping on the Suez Canal, as a court ruling on a

deadly soccer riot stoked rage in a country beset by worsening

security. The ruling enraged residents of

Port Said, at the northern entrance of the Suez Canal, by confirming

the death sentences imposed on 21 local soccer fans for their role in

the riot last year, when more than 70 people were killed. But

the court also angered rival fans in Cairo by acquitting a further 28

defendants whom they wanted punished, including seven members of the

police force, reviled across society for its brutality under deposed

autocrat Hosni Mubarak.

- Nigerian forces say they have killed 52 Islamists, arrested 70. Nigerian security

forces said on Saturday they had killed 52 Islamist militants over 10

days of fighting in the northeasterly Borno state, at a cost of only two

of their own men, with no civilian deaths. The announcement came a day

after President Goodluck Jonathan paid a visit to the state in which he

rejected the idea of an amnesty for the Islamist sect Boko Haram, which

has killed hundreds in gun and bomb attacks in the past two years. The

Islamists are seen as the main security threat to Africa's top energy

producer, although their sphere of influence is far from the crucial oil

fields in the south.

Telegraph:

- Germany's anti-euro party is a nasty shock for Angela Merkel. Political revolt against the euro construct has spread to Germany. A new party led by economists, jurists, and Christian Democrat rebels will

kick off this week, calling for the break-up of monetary union before it can

do any more damage. "An end to this euro," is the first line on the webpage of

Alternative für Deutschland (AfD). "The introduction of the euro

has proved to be a fatal mistake, that threatens the welfare of us all. The

old parties are used up. They stubbornly refuse to admit their mistakes."

They propose German withdrawl from EMU and return to the D-Mark, or a

breakaway currency with the Dutch, Austrians, Finns, and like-minded

nations.

- Greece should still leave the euro. Greece still remains the biggest risk for the euro and would be better off to

leave the single currency, a close ally of German chancellor Angela Merkel’s

has said.

Le Temps:

- Patek Philippe SA Chairman Thierry Stern expects 2013 to be a more difficult year for global watchmakers, he says in an interview.

El Economista:

- Spain

May Cut 2013 GDP Forecast to 1% Decline. Government may change current

forecast for .5% contraction, which analyst don't consider credible.

Govt may announce shift around March 25-31 Easter holiday, citing people close to the government.

Korean Central News Agency:

- North Korea Military Holds Rallies in 2 Provinces. Armed forces hold rallies in North Phyongan and South Hwanghae provinces today. It is the "final conclusion and will" of North Korea to "settle accounts with the U.S.," said Ri Man Gon, chief secretary of the North Phyongan Provincial Committee of the Workers' Party of Korea, and Pak Yong Ho, chief secretary of the Southern Hwanghae Provincial Committee of the WPK, in a joint statement.

Xinhua:

- S. Korea's Defense Ministry warns DPRK to "vanish from earth". The

government of the Democratic People's Republic of Korea (DPRK)

will"vanish from the earth" if it wages a nuclear attack on South Korea,

the South Korean Defense Ministry here said Friday. "I am telling

you this as a member of the human race: If North Korea (DPRK) attacks

South Korea with nuclear weapons, the Kim Jong Un regime will vanish

from the earth by the will of the humanity,"ministry spokesman Kim

Min-seok told reporters. The remark came shortly after the DPRK saidit would sever a military

hotline with South Korea and nullify non-aggression agreements between

the two countries, a response to newly expanded sanctions approved by

the UN.

China Securities Journal:

- China Economic Recovery May Slow on Property Curbs. China's economic recovery may slow on uncertainties about investment growth, according to a front-page commentary written

by reporter Ni Mingya. Recent recovery driven by property investment

growth from 4Q last year, the commentary said. Government property

market control will limit property investment growth, it said.

Weekend Recommendations

Barron's:

- Bullish commentary on (KSU), (NSC), (UNP), (LYV), (GNW), (DELL), (FFIV), (BBBY) and (CP).

Night Trading

- Asian indices are -.25% to +.25% on average.

- Asia Ex-Japan Investment Grade CDS Index 100.0 -3.0 basis points.

- Asia Pacific Sovereign CDS Index 79.25 -1.25 basis points.

- NASDAQ 100 futures +.04%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

Upcoming Splits

Other Potential Market Movers

- The

Eurozone industrial production data, Italian gdp report, Portugal gdp

report, BoJ minutes, India rate decision, CSFB Services Conference and the (TREX) analyst day could also impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by real estate and consumer shares in the region. I expect US stocks to open modestly higher and to weaken into the afternoon, finishing modestly lower. The Portfolio is 50% net long heading into the week.

U.S. Week Ahead by MarketWatch (video).

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on global growth fears, rising Mideast tensions, Eurozone

debt angst, profit-taking, technical selling and more shorting. My

intermediate-term trading indicators are giving neutral signals and the

Portfolio is 50% net long heading into the week.

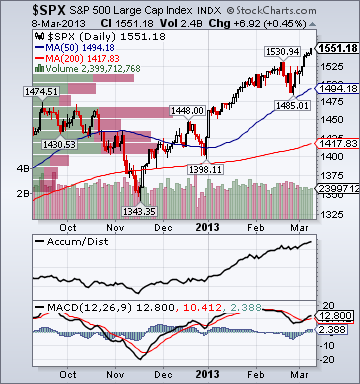

S&P 500 1,551.18 +2.17%*

The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 942.50 +3.04%

- Value Line Geometric(broad market) 403.74 +2.74%

- Russell 1000 Growth 708.56 +2.02%

- Russell 1000 Value 791.31 +2.50%

- Morgan Stanley Consumer 943.05 +1.62%

- Morgan Stanley Cyclical 1,162.79 +3.62%

- Morgan Stanley Technology 739.25 +1.86%

- Transports 6,143.48 +2.65%

- Bloomberg European Bank/Financial Services 97.12 +2.45%

- MSCI Emerging Markets 43.98 +1.27%

- Lyxor L/S Equity Long Bias 1,131.16 +1.39%

- Lyxor L/S Equity Variable Bias 842.86 +1.50%

Sentiment/Internals

- NYSE Cumulative A/D Line 178,577 +2.09%

- Bloomberg New Highs-Lows Index 622 +341

- Bloomberg Crude Oil % Bulls 35.14 +8.36%

- CFTC Oil Net Speculative Position 235,740 -.15%

- CFTC Oil Total Open Interest 1,710,526 +3.41%

- Total Put/Call .90 -23.73%

- OEX Put/Call 1.46 -25.13%

- ISE Sentiment 113.0 +36.14%

- Volatility(VIX) 12.59 -18.03%

- S&P 500 Implied Correlation 55.44 -7.51%

- G7 Currency Volatility (VXY) 9.29 -4.13%

- Smart Money Flow Index 11,352.59 +1.57%

- Money Mkt Mutual Fund Assets $2.646 Trillion -.60%

Futures Spot Prices

- Reformulated Gasoline 320.35 +2.39%

- Heating Oil 297.49 +1.34%

- Bloomberg Base Metals Index 205.82 +.90%

- US No. 1 Heavy Melt Scrap Steel 352.67 USD/Ton unch.

- China Iron Ore Spot 146.30 USD/Ton -2.86%

- UBS-Bloomberg Agriculture 1,537.72 +.48%

Economy

- ECRI Weekly Leading Economic Index Growth Rate 6.2% -60 basis points

- Philly Fed ADS Real-Time Business Conditions Index -.5711+6.76%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 114.0 +.11%

- Citi US Economic Surprise Index 21.10 +13.4 points

- Fed Fund Futures imply 56.0% chance of no change, 44.0% chance of 25 basis point cut on 3/20

- US Dollar Index 82.70 +.51%

- Yield Curve 179.0 +19 basis points

- 10-Year US Treasury Yield 2.04% +20 basis points

- Federal Reserve's Balance Sheet $3.090 Trillion +.59%

- U.S. Sovereign Debt Credit Default Swap 39.01 -1.24%

- Illinois Municipal Debt Credit Default Swap 137.0 -5.03%

- Western Europe Sovereign Debt Credit Default Swap Index 96.39 -6.26%

- Emerging Markets Sovereign Debt CDS Index 169.62 -5.83%

- Israel Sovereign Debt Credit Default Swap 121.83 -1.39%

- Iraq Sovereign Debt Credit Default Swap 427.26 -4.22%

- China Blended Corporate Spread Index 392.0 -5 basis points

- 10-Year TIPS Spread 2.58% +4 basis points

- TED Spread 19.5 +1.25 basis points

- 2-Year Swap Spread 14.5 +.75 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -16.50 +3.75 basis points

- N. America Investment Grade Credit Default Swap Index 81.51 -6.39%

- European Financial Sector Credit Default Swap Index 138.77 -15.19%

- Emerging Markets Credit Default Swap Index 238.99 -2.02%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 130.0 +.5 basis point

- M1 Money Supply $2.461 Trillion +.09%

- Commercial Paper Outstanding 1,020.60 -4.0%

- 4-Week Moving Average of Jobless Claims 348,800 -6,200

- Continuing Claims Unemployment Rate 2.4% unch.

- Average 30-Year Mortgage Rate 3.52% +1 basis point

- Weekly Mortgage Applications 864.10 +14.75%

- Bloomberg Consumer Comfort -32.4 +.4 point

- Weekly Retail Sales +2.6% -10 basis points

- Nationwide Gas $3.71/gallon -.06/gallon

- Baltic Dry Index 834.0 +7.47%

- China (Export) Containerized Freight Index 1,110.77 -2.12%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 17.50 unch.

- Rail Freight Carloads 249,438 +4.69%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (22)

- NAV, HOTT, HCI, MBI, PCRX, CLVS, CIEN, CREE, SBGI, SNTS, CKP, MHO, ARCP, LEN/B, GTY, WDAY, EVER, CCG, AIRM, DISCK, EPAM and LYV

Weekly High-Volume Stock Losers (10)

- ISRG, KAR, NX, BKU, SCSS, MFB, TFM, AVAV, IPXL and APEI

Weekly Charts

ETFs

Stocks

*5-Day Change

Style Underperformer:

Sector Underperformers:

- 1) Steel -.40% 2) Gaming -.26% 3) Semis -.20%

Stocks Falling on Unusual Volume:

- CPE, NTT, BKU, CHTR, PBR, RF, EMKR, VALE, RIO, AI, AMTG, AVG, MED, FL, YY, NXPI, FNSR, DKS, GS and ASML

Stocks With Unusual Put Option Activity:

- 1) KMI 2) MDY 3) AFFY 4) TSN 5) STT

Stocks With Most Negative News Mentions:

- 1) MXWL 2) TIF 3) LVS 4) GD 5) F

Charts: