Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Sunday, April 14, 2013

Weekly Outlook

U.S. Week Ahead by Reuters (video).

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on rising global growth fears, Mideast unrest, Asian tensions, bird flu concerns, more Eurozone debt angst, earnings worries, profit-taking, technical selling and more shorting. My intermediate-term trading indicators are giving neutral signals and the Portfolio is 50% net long heading into the week.

Friday, April 12, 2013

Weekly Scoreboard*

Indices

ETFs

Stocks

*5-Day Change

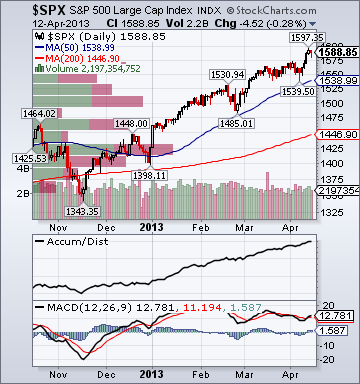

- S&P 500 1,588.85 +2.29%

- DJIA 14,865.0 +2.06%

- NASDAQ 3,294.94 +2.84%

- Russell 2000 942.85 +2.12%

- Value Line Geometric(broad market) 407.99 +2.29%

- Russell 1000 Growth 725.81 +2.51%

- Russell 1000 Value 809.11 +2.13%

- Morgan Stanley Consumer 993.18 +2.98%

- Morgan Stanley Cyclical 1,163.24 +2.72%

- Morgan Stanley Technology 733.41 +2.29%

- Transports 6,143.75 +1.76%

- Utilities 523.32 +1.67%

- Bloomberg European Bank/Financial Services 91.02 +2.98%

- MSCI Emerging Markets 42.22 +1.20%

- Lyxor L/S Equity Long Bias 1,138.01 -.27%

- Lyxor L/S Equity Variable Bias 842.12 -.55%

- NYSE Cumulative A/D Line 181,630 +1.77%

- Bloomberg New Highs-Lows Index 871.0 +977

- Bloomberg Crude Oil % Bulls 38.9 +26.4%

- CFTC Oil Net Speculative Position 223,398 -10.2%

- CFTC Oil Total Open Interest 1,768,185 +2.1%

- Total Put/Call 1.14 +9.62%

- OEX Put/Call 2.82 +90.54%

- ISE Sentiment 56.0 -28.21%

- NYSE Arms 1.38 +40.82%

- Volatility(VIX) 12.06 -13.36%

- S&P 500 Implied Correlation 51.59 -7.02%

- G7 Currency Volatility (VXY) 9.24 +.65%

- Smart Money Flow Index 11,729.18 +3.52%

- Money Mkt Mutual Fund Assets $2.623 Trillion -.3%

- AAII % Bulls 19.3 -45.6%

- AAII % Bears 54.5 +93.4%

- CRB Index 287.21 -.37%

- Crude Oil 91.29 -1.89%

- Reformulated Gasoline 280.18 -2.48%

- Natural Gas 4.22 +2.0%

- Heating Oil 287.18 -1.85%

- Gold 1,501.40 -5.08%

- Bloomberg Base Metals Index 197.83 +.87%

- Copper 335.0 +.06%

- US No. 1 Heavy Melt Scrap Steel 368.0 USD/Ton unch.

- China Iron Ore Spot 141.0 USD/Ton +3.75%

- Lumber 371.40 -.85%

- UBS-Bloomberg Agriculture 1,499.98 +1.5%

- ECRI Weekly Leading Economic Index Growth Rate 6.2% unch.

- Philly Fed ADS Real-Time Business Conditions Index -.3283 +1.38%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 115.13 +.22%

- Citi US Economic Surprise Index 7.8 +3.8 points

- Citi Emerging Mkts Economic Surprise Index -37.7 -8.4 points

- Fed Fund Futures imply 52.0% chance of no change, 48.0% chance of 25 basis point cut on 5/1

- US Dollar Index 82.31 -.32%

- Euro/Yen Carry Return Index 134.41 +1.71%

- Yield Curve 149.0 +1 basis point

- 10-Year US Treasury Yield 1.72% +1 basis point

- Federal Reserve's Balance Sheet $3.210 Trillion +.39%

- U.S. Sovereign Debt Credit Default Swap 32.50 -5.39%

- Illinois Municipal Debt Credit Default Swap 124.0 -8.29%

- Western Europe Sovereign Debt Credit Default Swap Index 97.26 -3.83%

- Emerging Markets Sovereign Debt CDS Index 186.95 -6.83%

- Israel Sovereign Debt Credit Default Swap 116.61 -3.15%

- South Korea Sovereign Debt Credit Default Swap 82.0 -6.45%

- China Blended Corporate Spread Index 402.0 -6 basis points

- 10-Year TIPS Spread 2.44% -3 basis points

- TED Spread 21.75 unch.

- 2-Year Swap Spread 14.50 -.5 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -17.75 -.25 basis point

- N. America Investment Grade Credit Default Swap Index 82.85 -5.95%

- European Financial Sector Credit Default Swap Index 167.55 -4.50%

- Emerging Markets Credit Default Swap Index 222.89 -11.80%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 110.50 -5.5 basis points

- M1 Money Supply $2.511 Trillion +2.16%

- Commercial Paper Outstanding 1,021.70 +1.90%

- 4-Week Moving Average of Jobless Claims 358,000 +3,700

- Continuing Claims Unemployment Rate 2.4% unch.

- Average 30-Year Mortgage Rate 3.43% -11 basis points

- Weekly Mortgage Applications 826.10 +4.48%

- Bloomberg Consumer Comfort -34.0 +.1 point

- Weekly Retail Sales +2.90% -10 basis points

- Nationwide Gas $3.56/gallon -.06/gallon

- Baltic Dry Index 875.0 +1.63%

- China (Export) Containerized Freight Index n/a

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 17.50 unch.

- Rail Freight Carloads 231,648 -.83%

- Mid-Cap Growth +2.67%

- Small-Cap Value +2.06%

- Gaming +6.4%

- Alt Energy +6.2%

- Biotech +5.7%

- Networking +4.9%

- Oil Service +4.7%

- Construction +.3%

- Disk Drives -.3%

- Agriculture -.5%

- Hospitals -.6%

- Gold & Silver -7.7%

- FSLR, LUFK, TSRO, SPWR, NUS, PICO, FSCI, NGVC and FBC

- IGTE, INFI, TTEK, BRLI, MG, HMA, FTNT, FFIV, SHLM and TITN

ETFs

Stocks

*5-Day Change

Stocks Slighly Lower into Final Hour on Rising Global Growth Fears, Eurozone Debt Angst, Profit-Taking, Commodity/Financial Sector Weakness

Today's Market Take:

Broad Market Tone:

Broad Market Tone:

- Advance/Decline Line: Lower

- Sector Performance: Most Sectors Declining

- Volume: Below Average

- Market Leading Stocks: Performing In Line

- VIX 12.33 +.74%

- ISE Sentiment Index 54.0 -50.0%

- Total Put/Call 1.12 +28.74%

- NYSE Arms 1.38 +54.35%

- North American Investment Grade CDS Index 81.90 +.32%

- European Financial Sector CDS Index 167.55 +5.4%

- Western Europe Sovereign Debt CDS Index 97.26 +1.5%

- Emerging Market CDS Index 223.32 -.78%

- 2-Year Swap Spread 14.50 +.5 bp

- TED Spread 22.55 +.75 bp

- 3-Month EUR/USD Cross-Currency Basis Swap -17.75 -.5 bp

- 3-Month T-Bill Yield .06% unch.

- Yield Curve 149.0 -7 basis points

- China Import Iron Ore Spot $141.0/Metric Tonne +.07%

- Citi US Economic Surprise Index 7.80 -1.2 points

- 10-Year TIPS Spread 2.44 -3 bps

- Nikkei Futures: Indicating -45 open in Japan

- DAX Futures: Indicating +42 open in Germany

- Slightly Higher: On gains in my biotech sector longs and emerging markets shorts

- Disclosed Trades: None

- Market Exposure: 50% Net Long

Today's Headlines

Bloomberg:

- Slovenia to Test Debt Appetite as Financing Pressure Mounts. Slovenia’s government failed to raise 100 million euros ($131 million) at a debt sale this week. Now it’s shooting for five times that amount next week. With bond yields approaching levels that prompted bailouts of other euro nations, the government will offer 500 million euros of 18-month Treasury bills on April 17. The International Monetary Fund estimates Slovenia will need to borrow about 3 billion euros this year to repay maturing debt, aid banks and finance the budget. The debt sale will test the willingness of investors abroad to finance Slovenia’s economy as a banking crisis strains the budget, government bonds plunge and soaring default risk threaten to make the country the euro region’s sixth bailout recipient after Cyprus last month. The largest local lenders are state owned and struggling with rising bad debt.

- Demetriades Says Cyprus Central Bank’s Independence Under Attack. The head of Cyprus’s central bank said the government is attacking his institution’s independence at the same time as his family receives death threats from people who lost money in the country’s recent bailout. “The independence of the central bank of Cyprus is being attacked at this time,” Panicos Demetriades, who is also a member of the European Central Bank’s Governing Council, said in an interview in Dublin today. His ability to manage the situation is being made more difficult by “death threats not only to myself, but toward my children and my wife,” he said.

- VW Sales Growth Slows in March on Europe Market Declines. Volkswagen AG (VOW), Europe’s biggest automaker, said global sales growth slowed in March and that headwinds in its home region are intensifying. VW eked out a 0.2 percent rise in deliveries last month to 864,400 vehicles as demand in China and North America more than offset shrinking sales across Europe, the Wolfsburg, Germany- based carmaker said today. In the first two months of the year, VW vehicle deliveries rose 8.3 percent to 1.4 million. “The data for March clearly show that the markets are becoming even more difficult,” Christian Klingler, VW’s sales chief, said in the statement.

- Bank Risk Models to Face Further Basel Probe on Capital Concerns. Banks (BEBANKS) face further scrutiny from global regulators into their risk models amid concerns lenders are underestimating the amount of capital they need to cope with losses. Initial studies of how lenders measure risk on assets they intend to trade as well as those they intend to hold to maturity found “substantial” differences in the amount of capital different banks hold against identical securities, the Basel Committee on Banking Supervision said in a report to finance ministers from the Group of 20 nations and central bank chiefs. Banks’ modeling choices are a “key source of variation,” the group said. “Further analysis is therefore under way, and areas where Basel committee standards might be modified to reduce excessive variation are becoming apparent.” The committee is considering tightening its rules to narrow banks’ freedom to design models and said it’s also weighing the need for tougher scrutiny by supervisors and stronger disclosure requirements.

- China Said to Plan Replacing Chen at Largest Policy Lender. China Development Bank Corp. Chairman Chen Yuan will step down, handing the reins of the world’s largest policy lender to Bank of Communications Co.’s Hu Huaibang, said two people with knowledge of the matter. CDB is the biggest lender to so-called local government financing vehicles that have accumulated at least 10.7 trillion yuan in debt. Half of the bank’s lending this year will go to urbanization, according to a Jan. 29 notice on its website.

- Commodities Fall to Lowest Since July on ‘Soft’ U.S. Data. Commodities tumbled to the lowest since July, led by a plunge in precious metals, as U.S. retail sales fell the most in nine months and consumer sentiment unexpectedly declined. The Standard & Poor’s GSCI Spot Index of 24 raw materials dropped 1.6 percent to 621.49 at 12:08 p.m. New York time. Earlier, the gauge touched 617.55, the lowest since July 13. Gold headed for a bear market, and silver plummeted to the lowest since November 2010. Crude oil slumped to a one-month low.

- Gold Heading for Bear Market Plunges to Lowest Since July 2011. Gold tumbled to the lowest price since July 2011, heading for a bear market, on signs that investors are favoring the dollar and equities as the global economy recovers. Silver dropped more than 5 percent.

- Wells Fargo(WFC) Uses Cost Cuts to Set Profit Record as Revenue Slips. Wells Fargo & Co., the largest U.S. home lender, said lower expenses helped the company post a record profit in the first quarter even as revenue dropped and lending margins narrowed. Net income advanced 22 percent to a record $5.17 billion, or 92 cents a diluted share, from $4.25 billion, or 75 cents, a year earlier, according to a statement today from the San Francisco-based bank. While the results topped estimates from analysts surveyed by Bloomberg, new home loans and mortgage banking income weakened, and the shares slipped 2.3 percent in New York trading.

- J.P. Morgan, Wells Fargo Struggle With Weak Demand for Loans. Banks Report Higher First-Quarter Profits But See Declines in Mortgage Business, Profit on Lending.

- EU Lawmaker Sees Fight Over ECB Scrutiny. The European Central Bank must open itself up to greater democratic scrutiny as it prepares to take on major new powers, a senior European lawmaker said Thursday. "The biggest alarm bell I would say has been the attitude of the European Central Bank, [which] is causing the Parliament a lot of concern," Sharon Bowles, chairwoman of the European Parliament's influential economic and monetary affairs committee, said in an interview.

- Despite sequester, State Department ups support for the UN. Even as the mandated sequester bites into U.S. federal spending -- and newly appointed Secretary of State John Kerry boasts that he is cutting his budget by 6 percent -- the State Department is planning to boost spending on the United Nations in 2014 by more than 4 percent to at least $3.6 billion.

- North Korea reportedly warns Japan it would target Tokyo first.

- 'Zombie' Buyers Threaten 'Consumer is Back' Meme: Economist. (video)

- The Euro Zone Crisis Is Back—On Multiple Fronts. Europe's finance ministers meeting in Dublin on Friday are facing a renewed crisis on multiple fronts,with a backlash against austerity acting as a gloomy backdrop for negotiations over bailout extensions for Portugal and Ireland, while tackling Cyprus's botched bailout and growing worries about Slovenia. Investors, increasingly aware of the euro zone's disarray, will be closely watching the results of that meeting.

- The One-Chart Summary Of All That Is Wrong With The US Financial System: JPM Deposits Over Loans. (graph)

- March Retail Slide, Miss Expectations, Post Biggest Drop Since June. (graph)

- Usage Of 401(k)s As An ATM Soars By 28% In Q4.

- Consumer Confidence Plummets To Nine Month Low, Biggest Miss To Consensus On Record. (graph)

- US Economic Data Plunges Most In 10 Months To 4-Month Lows.

- Visualizing The 'Orderly' Japanese Bond Market. (graphs)

- Medical School Student Debt Is Skyrocketing.

- The West Has 'Hard Evidence' That Assad Used Chemical Weapons In Syria.

- ART CASHIN: People Are Worried About Kim Jong-un's 'Messiah Complex'.

- Teens Are Bored With Facebook(FB).

- Brazil's Mantega says c.bank could raise rates if needed. Brazil's central bank could raise interest rates if needed to control rising inflation, Finance Minister Guido Mantega said on Friday, helping to increase bets that policymakers could tighten monetary policy as early as next week. "We will not hesitate to take measures, even measures that are considered less popular, like for example those related to interest rates," Mantega said during an economic event organized by a magazine in Sao Paulo. Although Mantega has previously said that the central bank is free to raise rates if needed, his latest comments are seen as confirmation that President Dilma Rousseff, as prices continue to rise in Latin America's biggest economy, agrees it is time to increase borrowing costs.

- Copper drops on growth worries, ample supply.

- Cyprus goes from bad to worse by the day; so does Portugal.

- Dutch government to rein in austerity in break from EU policy. The Dutch government is to postpone some austerity measures, in a significant break away from EU policy that risks angering Germany.

- Cyprus faces economic meltdown as EU-IMF refuses extra aid. Cyprus must take on an extra €5.5bn in the cost of its bail-out, a sum equivalent to a third of the island's annual GDP, without any additional help from the European Union and IMF.

Bear Radar

Style Underperformer:

- Small-Cap Value -.81%

- 1) Gold & Silver -4.70% 2) Oil Tankers -2.33% 3) Steel -2.03%

- NGD, CLF, TVL, PCS, SU, SJR, IMGN, INFI, JCP, CSTE, CHUY, KUB, INFY, MPW, CEF, ABX, IEP, IMGN, MTB, PRLB, HRS, TFX, IM, CRS, ASA, AU, SLW, CG, BAP, CF, CTF, AUY, CTSH, IART, EWY, PCS, GGN, DNR, JCP, GLD, IAU, RGLD, GDX, NEM, UCO, HRS and EEFT

- 1) FTK 2) M 3) XLF 4) MYGN 5) HL

- 1) CHRW 2) EEFT 3) CG 4) HLF 5) DECK

Subscribe to:

Comments (Atom)