Bloomberg:

- Greek Tensions Revived as Creditors Reject Reform List. Greece’s provisional agreement with creditors to avert a default started to crack as European officials said the country’s latest proposals fell far short of what was tabled two weeks ago and Greek ministers floated the prospect of a referendum if their reforms are rejected. The list of measures Greece’s government sent to euro region finance ministers last Friday, including the idea of hiring non-professional tax collectors such as tourists, is “far” from complete and the country probably won’t receive an aid disbursement this month, Eurogroup chairman Jeroen Dijsselbloem said on Sunday.

- Greece Mulls Referendum as No Deal With Lenders in Sight. Greece’s anti-austerity coalition is considering calling a referendum on government policy as euro-area finance ministers are set to withhold further aid payments at a meeting in Brussels tomorrow. European Commission Vice President Valdis Dombrovskis said he doesn’t expect the Eurogroup to make any decisions on Greece on Monday. Reform proposals must first be approved by the Greek parliament and then implemented before the next bailout disbursement is made, Dombrovskis said in an interview with Frankfurter Allgemeine Zeitung.

- China Overtakes North Korea as Japan’s Top Security Concern. Japanese people are more concerned about China’s military strength and assertiveness in Asia than any other security issue, according to a public opinion poll released by the government at the weekend. More than 60 percent of respondents to the survey conducted in January said China concerned them, compared with 46 percent in a similar poll three years earlier. The number worried about North Korea fell to about 53 percent from around 65 percent.

- China Defaults Seen in Private Bonds as Real Yields Surge. A forklift maker, a leather producer and a textiles company have missed payments on privately sold bonds in China this year, as the central bank’s failure to cut borrowing costs in line with slowing inflation wrecks profits. HSBC Holdings Plc is forecasting more defaults after consumer price increases in the world’s second-biggest economy cooled to 0.8 percent in January, the slowest since 2009. Rates on the benchmark one-year lending rate after accounting for living costs rose to a five-year high at 4.59 percent. Prices received by manufacturers dropped 4.3 percent last month, matching January’s decline that was the biggest since 2009, according to a Bloomberg survey before data due tomorrow.

- Tesla(TSLA) Cuts Jobs in China; Sales Are Slow on Car Charging Concerns. Tesla Motors Inc., the electric-car maker led by billionaire Elon Musk, said it’s cutting jobs in China after a local newspaper reported the company will reduce staff by 30 percent. Tesla will eliminate some positions as it makes structural changes to its business in China, Gary Tao, a local spokesman for the carmaker, said Monday by phone. He said he didn’t know how many jobs will be affected. The Chinese newspaper Economic Observer reported earlier Tesla will eliminate 180 of the 600 positions at its China unit because sales haven’t met expectations.

- Russian Court Charges Five in Connection With Nemtsov Murder. A Russian court indicted five men on Sunday in connection with the murder of opposition politician Boris Nemtsov, little more than a week after his death sparked protests and brought condemnation from world leaders. The men, from the country’s predominantly Muslim North Caucasus, were charged in Moscow a day after being arrested, the Interfax news service reported, citing Judge Natalya Mushnikova. One of the accused, Zaur Dadaev, admitted a role in the murder, Interfax said.

- Japan’s Emergence From Recession Weaker Than First Thought. Japan’s emergence from recession was weaker than estimated as companies unexpectedly cut investment and drew down inventories, offsetting a pickup in consumer spending. Gross domestic product expanded an annualized 1.5 percent in the three months through December from the previous quarter, less than a preliminary 2.2 percent, revised government data show. The rebound followed a contraction caused by an increase in the sales tax last April.

- China’s Stocks Fall to Three-Week Low as Brokerages Slump. China’s stocks fell to a three-week low amid concern new share sales will divert funds from existing equities and as securities firms tumbled after regulators said they may allow banks to conduct brokerage businesses. Citic Securities Co. and Haitong Securities Co. retreated more than 3 percent after the China Securities Regulatory Commission said it’s considering allowing banks to apply for brokerage licenses. Jiangxi Copper Co. dropped 2.6 percent to pace declines for commodity shares as a steeper-than-forecast drop in imports signaled weak demand. The Shanghai Composite Index fell for a third day, losing 1 percent to 3,209.22 as of 9:45 a.m.

- Asian Stocks, Bonds Pace U.S. Rout on Payrolls; Oil Slips. Asian stocks and bonds fell, tracking a selloff in the U.S., after American jobs data spurred traders to bring forward bets on higher interest rates and Japanese growth was revised down. The dollar held gains, while oil and copper slipped. The MSCI Asia Pacific Index slid 0.8 percent by 10:52 a.m. in Tokyo, extending last week’s drop as Japan’s Topix index slipped from a seven-year high.

- Iron Ore Majors Raising Supply as Surplus, China Sink Prices. Global iron ore supplies are set to expand further as the world’s biggest producers press on with capacity expansions, raising shipments of the steel-making raw material into a market facing a record surplus and sinking prices. Net supplies will increase about 60 million to 75 million metric tons in 2015, in line with a 75 million ton rise in 2014, as mine expansions in Australia and Brazil more than offset closures in China, according to Sanford C. Bernstein & Co. Morgan Stanley predicts a net rise of 63 million tons this year, with production expected to peak in September to October.

- China’s Scrap Copper Imports Seen Lingering Near 10-Year Low. China’s imports of scrap copper, the feedstock for one-third of the country’s production of the metal, are unlikely to rebound from a 10-year low as U.S. supplies remain tight, according to the world’s largest listed metals and electronics recycler. Industries that provide the bulk of recycled material in the U.S., the biggest exporter of scrap metal to China, have not yet recovered sufficiently to improve supply, Michael Lion, chairman of Sims Metal Management Asia Ltd., said in a March 6 interview in Hong Kong.

- The Clinton Foundation and Haiti Contracts. After the earthquake in 2010, the Clintons’ outsize influence in the small nation increased. The Clinton Foundation lists the Brazilian construction firm OAS and the InterAmerican Development Bank (IDB) as donors that have given it between $1 million and $5 million. Those relationships are worth learning more about. OAS has been in the news because it is caught up in a corruption scandal centered on Brazil’s state-owned oil company, Petrobras. In November Brazilian police arrested three top OAS executives for their alleged roles in a bribery scheme involving inflated contracts

- McConnell vows no debt default as deadline nears. Senate Majority Leader Mitch McConnell said Sunday that the Republican-controlled Congress won’t allow the government to default as the Treasury Department quickly approaches its so-called “debt ceiling.” “I made it clear after November that we won’t shut down the government or default on debt,” the Kentucky Republican told CBS’ “Face the Nation.”

- Tech insiders dumping stocks as their companies buy them back. The next time a technology company executive says the billions being spent on stock repurchases are a sign of confidence in the company’s business, or because they believe it’s a good investment, feel free to hit the B-S button.

Zero Hedge:

- The Nasdaq Has Become The Biggest Circle-Jerk In History. (graph) Goepfert said insider selling by tech execs is now at the heaviest pace seen in at least eight years.

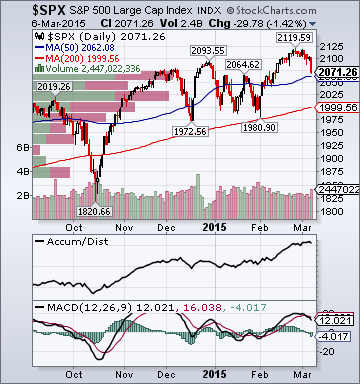

- The Charts That Matter. (graph)

Business Insider:.

Reuters:

Telegraph: - Exclusive - Foreign banks tighten lending rules for China state-backed firms. Some banks are adopting stricter lending criteria for China's state-owned enterprises (SOEs), demanding collateral from some companies they used to deem as safe as government debt, as Beijing tries to reform its bloated firms and the economy slows.

- Exports jump in China, but slide in imports signals economic weakness. China's exports picked up in the first two months of 2015, propelled by February's exceptionally strong performance that was inflated by the timing of Lunar New Year, while a slide in imports pointed to persistent weakness in the economy. China's imports tumbled 20.2 percent in the first two months from a year earlier, signalling stubborn weakness in the world's second-largest economy that may require more policy support, analysts say. Imports inched up 0.4 percent in 2014. "The sharp decline in imports highlights slackening domestic demand, so we expect the government to take more policy measures to stabilise economic growth," Nie said. A 20.5 percent slide in February imports was the sharpest since the global financial crisis.

- Europe holds 'noose around Greek necks' as Athens scrambles to make debt payments. Alexis Tsipras says the European Central Bank is strangling the Greek economy as panic grips the cash-strapped government.

- Asian indices are -1.0% to -.50% on average.

- Asia Ex-Japan Investment Grade CDS Index 104.0 +4.0 basis points.

- Asia Pacific Sovereign CDS Index 64.5 +2.5 basis points.

- S&P 500 futures -.14%.

- NASDAQ 100 futures -.10%.

Earnings of Note

Company/Estimate

- (URBN)/.57

- (UNFI)/.67

- (IDT)/.40

- (KFY)/.46

- (CASY)/.83

- None of note

- (ROL) 3-for-2

- The Fed's Fisher speaking, Fed's Mester speaking, German Trade balance, Labor Market Conditions Index for February, Deutsche Bank Media/Internet/Telecom conference, (MCD) Feb comps, (AAPL) watch media event and the (QCOM) annual meeting could also impact trading today.