The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 1,232.14 +1.20%

- S&P 500 High Beta 33.99 -1.45%

- Goldman 50 Most Shorted 136.57 -.11%

- Wilshire 5000 21,513.17 -.60%

- Russell 1000 Growth 984.92 -.93%

- Russell 1000 Value 1,007.74 -.50%

- S&P 500 Consumer Staples 494.06 -1.27%

- Solactive US Cyclical 138.23 -1.09%

- Morgan Stanley Technology 1,011.49 -2.37%

- Transports 8,945.13 +.42%

- Bloomberg European Bank/Financial Services 114.03 +.26%

- MSCI Emerging Markets 38.58 -3.06%

- HFRX Equity Hedge 1,192.95 -.64%

- HFRX Equity Market Neutral 993.91 +.22%

Sentiment/Internals

- NYSE Cumulative A/D Line 234,464 -.28%

- Bloomberg New Highs-Lows Index -19 -3

- Bloomberg Crude Oil % Bulls 28.13% -35.08%

- CFTC Oil Net Speculative Position 260,659 -.62%

- CFTC Oil Total Open Interest 1,670,894 -1.01%

- Total Put/Call 1.21 -5.47%

- ISE Sentiment 78.0 +90.24%

- Volatility(VIX) 16.0 +5.26%

- S&P 500 Implied Correlation 60.26 -.82%

- G7 Currency Volatility (VXY) 11.02 +14.32%

- Emerging Markets Currency Volatility (EM-VXY) 11.01 +6.27%

- Smart Money Flow Index 17,631.28 -1.50%

- ICI Money Mkt Mutual Fund Assets $2.691 Trillion +.68%

- ICI US Equity Weekly Net New Cash Flow -$1.934 Billion

- AAII % Bulls 31.60 -20.6%

- AAII % Bears 25.41 +8.8%

Futures Spot Prices

- Reformulated Gasoline 176.23 -6.38%

- Heating Oil 171.30 -8.49%

- Bloomberg Base Metals Index 168.54 -.68%

- US No. 1 Heavy Melt Scrap Steel 226.67 USD/Ton unch.

- China Iron Ore Spot 57.66 USD/Ton -3.08%

- UBS-Bloomberg Agriculture 1,113.54 -1.92%

Economy

- ECRI Weekly Leading Economic Index Growth Rate -4.0% +60 basis points

- Philly Fed ADS Real-Time Business Conditions Index -.0693 -3.21%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 122.41 +.16%

- Citi US Economic Surprise Index -60.10 -12.6 points

- Citi Eurozone Economic Surprise Index 44.10 -5.2 points

- Citi Emerging Markets Economic Surprise Index 5.60 +11.5 points

- Fed Fund Futures imply 52.0% chance of no change, 48.0% chance of 25 basis point cut on 3/18

- US Dollar Index 100.33 +2.67%

- Euro/Yen Carry Return Index 133.08 -2.74%

- Yield Curve 146.0 -6.0 basis points

- 10-Year US Treasury Yield 2.11% -13.0 basis points

- Federal Reserve's Balance Sheet $4.451 Trillion +.05%

- U.S. Sovereign Debt Credit Default Swap 16.90 +2.13%

- Illinois Municipal Debt Credit Default Swap 183.0 +2.32%

- Western Europe Sovereign Debt Credit Default Swap Index 21.10 +3.51%

- Asia Pacific Sovereign Debt Credit Default Swap Index 66.64 +3.42%

- Emerging Markets Sovereign Debt CDS Index 359.24 +3.56%

- Israel Sovereign Debt Credit Default Swap 73.14 +.88%

- Iraq Sovereign Debt Credit Default Swap 350.76 +4.22%

- Russia Sovereign Debt Credit Default Swap 485.39 +6.88%

- iBoxx Offshore RMB China Corporates High Yield Index 113.84 -.29%

- 10-Year TIPS Spread 1.70%-13.0 basis points

- TED Spread 25.0 -.75 basis point

- 2-Year Swap Spread 27.75 +2.0 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -19.25 +5.0 basis points

- N. America Investment Grade Credit Default Swap Index 65.78 +6.95%

- America Energy Sector High-Yield Credit Default Swap Index 733.0 +6.20%

- European Financial Sector Credit Default Swap Index 55.84 +2.52%

- Emerging Markets Credit Default Swap Index 419.52 +7.49%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 85.0 unch.

- M1 Money Supply $2.998 Trillion +.30%

- Commercial Paper Outstanding 1,023 +2.40%

- 4-Week Moving Average of Jobless Claims 302,250 -2,500

- Continuing Claims Unemployment Rate 1.8% unch.

- Average 30-Year Mortgage Rate 3.86% +11.0 basis points

- Weekly Mortgage Applications 415.40 -1.26%

- Bloomberg Consumer Comfort 43.3 -.2 point

- Weekly Retail Sales +2.60% -10 basis points

- Nationwide Gas $2.44/gallon -.02/gallon

- Baltic Dry Index 560.0 -.89%

- China (Export) Containerized Freight Index 1,067.94 +.35%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 27.50 unch.

- Rail Freight Carloads 253,762 +5.03%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (28)

- CBMG, RTI, LBIO, PNK, CLDN, BBNK, TWOU, FSTR, CVTI, EXPR, LTM, SUPN, URBN, OME, ISSI, LJPC, CFI, GLPI, MYCC, DMND, XOXO, MYRG, BANC, JRN, LL, MW, EAGL and BIG

Weekly High-Volume Stock Losers (24)

- TTPH, ITCI, PLOW, ESL, UNFI, MMI, RAVN, TPUB, INTC, ERA, ANAT, LMOS, SGMS, ACAD, KKD, TITN, PGEM, BLT, CKP, IDT, VRA, MRD, NNBR and CMTL

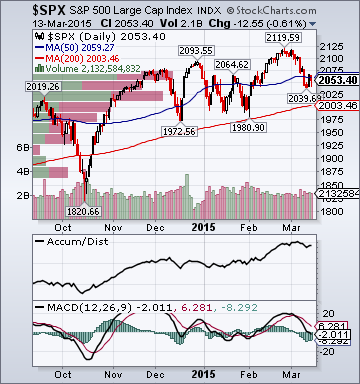

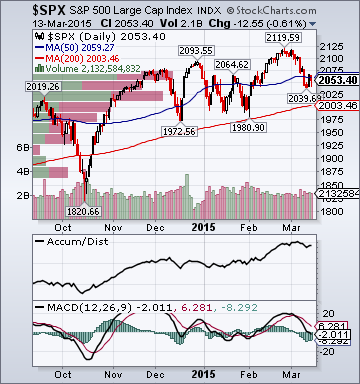

Weekly Charts

ETFs

Stocks

*5-Day Change

Broad Equity Market Tone:

- Advance/Decline Line: Substantially Lower

- Sector Performance: Almost Every Sector Declining

- Market Leading Stocks: Performing In Line

Equity Investor Angst:

- Volatility(VIX) 16.67 +8.11%

- Euro/Yen Carry Return Index 132.66 -1.54%

- Emerging Markets Currency Volatility(VXY) 11.0 +4.27%

- S&P 500 Implied Correlation 61.22 +3.19%

- ISE Sentiment Index 71.0 -7.79%

- Total Put/Call 1.14 +6.54%

Credit Investor Angst:

- North American Investment Grade CDS Index 66.20 +3.47%

- America Energy Sector High-Yield CDS Index 733.0 +.36%

- European Financial Sector CDS Index 55.90 -.75%

- Western Europe Sovereign Debt CDS Index 21.10 +.98%

- Asia Pacific Sovereign Debt CDS Index 66.64 +2.69%

- Emerging Market CDS Index 418.59 +2.64%

- iBoxx Offshore RMB China Corporates High Yield Index 113.84 +.06%

- 2-Year Swap Spread 27.75 +.25 basis point

- TED Spread 25.0 -.25 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -19.25 -1.25 basis points

Economic Gauges:

- 3-Month T-Bill Yield .03% +1.0 basis point

- Yield Curve 147.0 +3.0 basis points

- China Import Iron Ore Spot $57.66/Metric Tonne -.53%

- Citi US Economic Surprise Index -60.10 -4.5 points

- Citi Eurozone Economic Surprise Index 44.1 -1.2 points

- Citi Emerging Markets Economic Surprise Index 5.60 +.7 point

- 10-Year TIPS Spread 1.69 -3.0 basis points

Overseas Futures:

- Nikkei Futures: Indicating -25 open in Japan

- DAX Futures: Indicating +35 open in Germany

Portfolio:

- Lower: On losses in my medical/tech sector longs

- Disclosed Trades: Added to my (IWM)/(QQQ) hedges

- Market Exposure: Moved to 25% Net Long

Style Underperformer:

Sector Underperformers:

- 1) Coal -4.71% 2) Oil Service -3.27% 3) Construction -2.18%

Stocks Falling on Unusual Volume:

- MMI,

WSTC, CTRN, CBPX, FRC, LL, FTD, WX, HIBB, ZUMZ, PUK, HOG, MED, UNF,

SGMS, DEST, HPTX, LORL, E, HABT, EPZM, RTEC, PLCE, CENX, TKR, CFG, SMCI and HABT

Stocks With Unusual Put Option Activity:

- 1) ULTA 2) HOG 3) ORCL 4) HYG 5) WDC

Stocks With Most Negative News Mentions:

- 1) BHI 2) BRCM 3) GM 4) CNX 5) WHR

Charts:

Style Outperformer:

Sector Outperformers:

- 1) Airlines +.10% 2) Gaming -.06% 3) HMOs -.13%

Stocks Rising on Unusual Volume:

- CKEC, LOCO, IMPV, RGEN, HLF, GWPH, ANN, ANAC, EBIX, P, W, TTPH, BMRN, NXPI and TA

Stocks With Unusual Call Option Activity:

- 1) FSL 2) HOG 3) ULTA 4) LOCO 5) EUO

Stocks With Most Positive News Mentions:

- 1) MBLY 2) NXPI 3) VRX 4) CVS 5) KKD

Charts:

Evening Headlines

Bloomberg:

- Putin and Kim Jong Un Go a-Courtin’. Partly to rile the U.S., Russia ships aid to the dictatorship. In his more than three years in power, North Korea’s Kim Jong Un has

purged his government of rivals, forged ahead with the country’s nuclear

weapons program, and, if the FBI is right, humbled Sony after it dared

to mock him in a movie.

- China Financials Flash Warning Seen Before 2008 Mainland Slump. Chinese stock bulls may want to take note of

the selloff in financial shares. If recent history is a guide, the losses in the CSI 300

Financials Index -- which total 8.1 percent since the start of

the year compared with a 1.7 percent gain in the CSI 300 Index -

- are signaling that the world-beating rally in Chinese equities

could be about to come to an abrupt, and painful, end. The last

time the industry lagged behind the broader market by this much

in November 2007 and August 2009, the CSI 300 Index lost an

average 42 percent over the following 12 months.

- IDC Widens Global 2015 PC Shipments Outlook to 4.9% Decline. Worldwide personal-computer shipments will

fall further than forecast this year as the strong U.S. dollar

and the lack of new products threaten sales, researcher IDC

said.

Shipments will drop 4.9 percent in 2015 instead of the

previous forecast for 3.3 percent decline, the Framingham,

Massachusetts-based research firm said in a statement Thursday.

- Asian Futures Extend Gains as Fed Rate-Rise Concerns Ease. Asian stocks rose, paring their worst weekly

drop this year, after an unexpected decline in U.S. retail sales

bolstered the case for low interest rates. The dollar held its

retreat versus some major peers, while U.S. oil traded near a

six-week low and gold rallied.

The MSCI Asia Pacific Index rose a second day, adding 0.2

percent by 10:02 a.m. in Tokyo, to trim its weekly decline to

0.9 percent.

- Oil CEOs Said to Ask Obama Administration to Lift Export Ban. About a dozen U.S. drilling executives,

including ConocoPhillips Chief Executive Officer Ryan Lance,

were in Washington this week trying to persuade White House

officials and lawmakers to lift the 40-year ban on U.S. oil

exports, according to two people familiar with the meetings. Chief executives from the lobbying group Producers for

American Crude Oil Exports, or PACE, met with White House senior

energy policy adviser Brian Deese March 11 to ask the Obama

administration to roll back a prohibition on most U.S. oil

exports imposed after the 1973 Arab oil embargo, according to

two people, who asked not to be identified because the

discussions weren’t public.

- It's Back: Your Guide to the $18 Trillion Debt Ceiling. Bigger than U.S. GDP, the debt limit returns with plenty at stake. The cap on U.S. government borrowing kicks back into action Monday after

Congress temporarily suspended it last year. The reinstatement means

lawmakers in coming months must either lift or re-suspend the ceiling on

the nation's debt, which exceeds the size of the economy and which,

divided among the world's population, would make every person on the

planet $2,500 poorer.

Wall Street Journal:

Fox News:

- Hackers, probing Clinton server, cite security lapses. (video) Stirred by the controversy surrounding Hillary Clinton’s use of a

private email server when she was secretary of state, a determined band

of hackers, IT bloggers, and systems analysts have trained their

specialized talents and state-of-the-art software on clintonemail.com,

the domain under which Clinton established multiple private email

accounts, and uncovered serious lapses in security, according to data

shared with Fox News.

MarketWatch.com:

CNBC:

Zero Hedge:

Business Insider:

Reuters:

- Germany's Schaeuble says can't rule out "Grexident". German

Finance Minister Wolfgang Schaeuble said on Thursday the onus was on

Greece to help itself and he could not rule out an accidental exit of

the country from the euro zone. "As the responsibility, the

possibility to decide what happens only lies with Greece, and because we

don't exactly know what those in charge in Greece are doing, we can't

rule it out,"

Schaeuble told Austrian broadcaster ORF when asked about the

prospect of a "Grexident".

Evening Recommendations

Night Trading

- Asian equity indices are -.25% to +.75% on average.

- Asia Ex-Japan Investment Grade CDS Index 105.0 -2.75 basis points.

- Asia Pacific Sovereign CDS Index 65.0 -2.25 basis points.

- NASDAQ 100 futures +.11%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

8:30 am EST

- PPI Final Demand for February is estimated to rise +.3% versus a -.8% decline in January.

- PPI Ex Food and Energy for February is estimated to rise +.1% versus a -.1% decline in January.

10:00 am EST

- Preliminary Univ. of Mich. Consumer Confidence for March is estimated to rise to 95.5 versus 95.4 in February.

Upcoming Splits

Other Potential Market Movers

- The Japan Industrial Production data could also impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by technology and industrial shares in the region. I expect US stocks to open mixed and to rally into the afternoon, finishing modestly higher. The Portfolio is 75% net long heading into the day.