Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, January 28, 2008

Links of Interest

Sunday, January 27, 2008

Monday Watch

Weekend Headlines

Bloomberg:

- President Bush said the bipartisan economic stimulus package worked out by lawmakers and his administration will provide direct tax relief to working Americans and urged Congress to pass it as quickly as possible.

- Deutsche Ttelekom AG’s T-Mobile unit has sold more than 70,000 iPhones in

- After the best annual start for Treasuries since 1998, investors are betting the highest-rated mortgage and corporate bonds will outperform as the Federal Reserve cuts interest rates.

- Democratic Senator Ed Kennedy will announce his endorsement of Illinois Senator Barack Obama’s presidential campaign tomorrow.

Wall Street Journal:

- State Street(STT), Franklin Resources(BEN) and Janus Capital(JNS) are among the money managers vying for potentially billions of dollars in fees to manage sovereign wealth investments.

- Obama Scores South Carolina Win, Defeating Clinton by Wide Margin.

- Tony Blair cautioned US presidential candidates not to lock themselves into damaging protectionist or isolationist policies they could have a tough time walking away from once in office.

Forbes.com:

- America’s 25 Fastest-Growing Tech Companies.

NY Times:

- Investor sentiment suggests that the bulk of the stock market’s decline is now behind us.

- French Bank Offers Details of Big Loss.

- The Coming Wave of Gadgets That Listen and Obey.

- Amazon’s(AMZN) new device could turn out to be the iPod of the written word.

CNBC.com:

- Paulson Pushes Senate for Stimulus Deal. President Bush’s chief negotiator on an economic aid deal said Sunday the Senate should quickly get behind a plan or risk drawing the resentment of a frustrated public.

- Warren Buffett Continues to Snap Up Burlington Northern(BNI) Shares.

- Nikkei Battered Since 2007 Peak, Dow More Resilient.

- S&P 500 Earnings Scorecard: 73% Have Met Or Exceeded Expectations To Date.

TheStreet.com:

- Top NYSE Short-Squeeze Plays.

- Juniper(JNPR) Sends Strong Signals for Cisco(CSCO).

Google Trends:

- There has been a parabolic spike in Google searches that include the word ‘recession.’ The largest volume of Google searches that include the word are coming from Washington, DC and New York, New York. (graph)

MSNBC.com:

- Price of gas falls 9 cents in last two weeks. National average for gallon of regular was $2.98 Friday.

Business Week:

- Super Sunday generates major bucks for all involved, from its host network to snackmakers, HDTV sellers, and especially the game’s host city.

- Second-year MBA students looking for full-time jobs appear to be doing as well as, if not better than, their counterparts last year, with many schools reporting increased recruiting, more job offers, and higher salaries for this year’s grads.

- Ford Escape plug-in prototype shows potential.

- Midsize commercial shipyards across the country can’t find enough skilled, experienced workers.

CNNMoney.com:

- 25 top-paying companies.

- 100 Best Companies to Work For By State.

- From Microsoft’s(MSFT) lofty perch, no sign of a slowdown.

TimesOnline:

- As many as 10 European-based hedge funds halted redemptions after losses prompted investors to seek to withdraw their cash, citing a London prime broker.

- The BMW Hydrogen 7.

Oberver:

- Vale Is ‘Days Away’ From Agreed $80 Billion Bid for Xstrata Bid.

Sunday Telegraph:

- Companies affiliated with the Qatar Investment Authority are considering the purchase of a $3 billion stake in Credit Suisse Group.

- Hedge funds: The new global super powers.

Sunday Times:

- Alan Greenspan said there’s no evidence the

Guardian:

- JPMorgan(JPM) CEO sees end in sight to housing downturn.

Le Figaro:

- European Aeronautic, Defense & Space Co., the parent of planemaker Airbus SAS, must make one acquisition in the

- Groupe Bollore, the investment company controlled by French billionaire Vincent Bollore, will invest $293 million to build a plan that will produce batteries for an electric car designed by Pininfarina SpA.

La Nacion:

- Pan American Energy LLC, an Argentine oil and gas company partly owned by BP Plc, has made a new oil discovery in the south of the country. The new reserve is the largest discovered in

Al-Alam al-Yom:

-

Iranian News Agency:

-

Weekend Recommendations

Barron's:

- Made positive comments on (HP).

- Made negative comments on (SYX).

Citigroup:

- Maintained Buy on (CAT), target $86.

Night Trading

Asian indices are -3.25% to -1.0% on avg.

S&P 500 futures -.68%.

NASDAQ 100 futures -.81%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (SWK)/1.10

- (ENR)/2.22

- (HAL)/.69

- (BDK)/1.03

- (FPL)/.67

- (GLW)/.39

- (SYY)/.42

- (MCD)/.70

- (VZ)/.62

- (TSN)/.04

- (ATHR)/.30

- (AXP)/.71

- (SNDK)/.65

- (VMW)/.24

- (PAY)/.37

- (XMSR)/-.63

- (OSG)/.63

Upcoming Splits

- (BTJ) 3-for-2

- (KWK) 2-for-1

Economic Data

10:00 am EST

- New Home Sales for December are estimated to fall to 645K versus 647K in November.

Other Potential Market Movers

- The (YRCW) analyst meeting could also impact trading today.

Weekly Outlook

Click here for Wall St Week Ahead by Reuters.

Click here for Stocks in focus Monday by MarketWatch.

There are a number of economic reports of note and many significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – New Home Sales

Tues. – Durable Goods Orders, S&P CaseShiller Home Price Index, Consumer Confidence, FOMC Meeting, weekly retail sales reports

Wed. – Weekly MBA Mortgage Applications report, weekly EIA energy inventory report, ADP Employment Change, Advance 4Q GDP, Advance 4Q Personal Consumption, Advance GDP Price Index, Advance 4Q Core PCE, FOMC Rate Decision

Thur. – Personal Income, Personal Spending, PCE Core, Initial Jobless Claims, 4Q Employment Cost Index, Chicago Purchasing Manager

Fri. – Change in Non-farm Payrolls, Unemployment Rate, Average Hourly Earnings,

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Energizer(ENR), McDonald’s(MCD), Stanley Works(SWK), Halliburton(HAL), SYSCO Corp.(SYY), Black & Decker(BDK), Corning(GLW), Verizon(VZ), Tyson Foods(TSN), Atheros(ATHR), SanDisk(SNDK), VMware(VMW), American Express(AXP), XM Satellite(XMSR)

Tues. – Valero(VLO), Corinthian Colleges(COCO), Eli Lilly(LLY), 3M Co(MMM), Cardinal Health(CAH), Unisys Corp.(UIS), Lexmark Intl(LXK), Polaris(PII), Dow Chemical(DOW), Burlington Northern(BNI), Countrywide(CFC), Sherwin Williams(SHW), Allstate Corp.(ALL), Yahoo!(YHOO), Chubb Corp.(CB), Centex Corp.(CTX), Flextronics(FLEX), Robert Half(RHI), Travelers(TRV), US Steel(X), Zimmer Holdings(ZMH), EMC Corp(EMC), Occidental Petroleuam(OXY)

Wed. – Kellogg(K), Baker Hughes(BHI), Legg Mason(LM), Kraft Foods(KFT), Eastman Kodak(EK), Boeing Co(BA), Hess Corp.(HES), United Parcel Service(UPS), Illinois Tool Works(ITW), Starbucks(SBUX), Pulte Homes(PHM), MBIA Inc.(MBI), Altria Group(MO), Estee Lauder(EL), Royal Caribbean(RCL), Novellus Systems(NVLS), Aflac(AFL), Amazon.com(AMZN), Merck(MRK)

Thur. – Starwood Hotels(HOT), Bristol-Myers(BMY), Burger King(BKC), Mastercard(MA), Goodrich(GR), L-3 Communications(LLL), American Superconductor(AMSC), Mattel(MAT), CVS Caremark(CVS), Lear Corp.(LEA), Under Armour(UA), Raytheon(RTN), Hologic(HOLX), McKesson(MCK), Verisign(VRSN), CA Inc.(CA), Omnicell Inc.(OMCL), Stanley Inc.(SXE), Dolby Labs(DLB), Electronic Arts(ERTS), Monster Worldwide(MNST), Digital River(DRIV), YRC Worldwide(YRCW), Massey Energy(MEE), Google Inc.(GOOG), Trident Microsystems(TRID), Cerner Corp.(CERN), Altera(ALTR), Bebe Stores(BEBE), Safeco(SAF), JDS Uniphase(JDSU), ImClone Systems(IMCL), Apache Corp.(APA), Colgate-Palmolive(CL), Anheuser-Busch(BUD), Intuitive Surgical(ISRG), Procter & Gamble(PG), IntercontinentalExchange(ICE), Wyeth(WYE), Avid Technology(AVID), Celgene(CELG)

Fri. – Chevron(CVX), Arch Coal(ACI), Automatic Data(ADP), Tidewater(TDW), Ryder System(R), Nymex Holdings(NMX), Manpower(MAN), Cummins(CMI), Exxon Mobil(XOM), Gannett(GCI)

Other events that have market-moving potential this week include:

Mon. – (YRCW) analyst meeting

Tue. – Wachovia Healthcare Conference, Banc of America Gaming Conference, Citigroup Financial Services Conference, (NNDS) investor day, (BLC) analyst meeting, (VDSI) investor conference, (CLWR) investor day

Wed. – Wachovia Healthcare Conference, Banc of America Gaming Conference, Citigroup Financial Services Conference, (TEC) analyst meeting

Thur. – Raymond James Growth Airline Conference, Wachovia Healthcare Conference, Banc of

Fri. – None of note

Friday, January 25, 2008

Weekly Scoreboard*

Indices

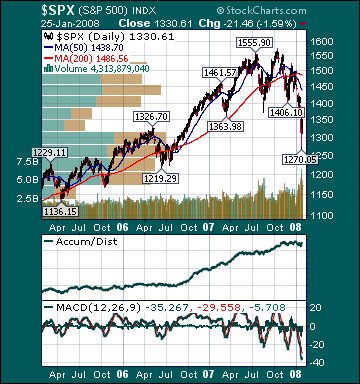

S&P 500 1,330.61 -.19%

DJIA 12,207.17 +.39%

NASDAQ 2,326.20 -.88%

Russell 2000 688.60 +1.18%

Wilshire 5000 13,361.93 +.16%

Russell 1000 Growth 549.17 -.52%

Russell 1000 Value 727.80 +.72%

Morgan Stanley Consumer 671.84 -1.9%

Morgan Stanley Cyclical 918.46 +4.94%

Morgan Stanley Technology 535.22 -1.94%

Transports 4,474.82 +8.1%

Utilities 484.14 -5.33%

MSCI Emerging Markets 134.79 -.90%

Sentiment/Internals

NYSE Cumulative A/D Line 56,575 -2.2%

Bloomberg New Highs-Lows Index -347

Bloomberg Crude Oil % Bulls 18.0 +83.7%

CFTC Oil Large Speculative Longs 200,595 -11.98%

Total Put/Call 1.05 -28.1%

NYSE Arms 2.09 +22.08%

Volatility(VIX) 29.08 +2.2%

ISE Sentiment 101.0 +66.67%

AAII % Bulls 25.1 +3.6%

AAII % Bears 59.0 +8.4%

Futures Spot Prices

Crude Oil 90.60 +1.47%

Reformulated Gasoline 231.82 +2.29%

Natural Gas 7.97 -1.66%

Heating Oil 251.91 +.85%

Gold 913.90 +4.03%

Base Metals 222.98 +1.21%

Copper 317.85 +.77%

Economy

10-year US Treasury Yield 3.56% -7 basis points

4-Wk MA of Jobless Claims 314,800 -4.3%

Average 30-year Mortgage Rate 5.48% -21 basis points

Weekly Mortgage Applications 981,500 +8.3%

Weekly Retail Sales +.8%

Nationwide Gas $2.99/gallon -.04/gallon

US Heating Demand Next 7 Days 5% below normal

ECRI Weekly Leading Economic Index 135.8 -1.2%

US Dollar Index 75.96 -.26%

CRB Index 361.64 +.06%

Best Performing Style

Small-cap Value +2.2%

Worst Performing Style

Large-cap Growth -.52%

Leading Sectors

Homebuilders +16.3%

Road & Rail +10.2%

Banks +9.8%

Retail +9.1%

REITs +7.4%

Lagging Sectors

Hospitals -3.65%

Utilities -5.3%

Drugs -7.1%

HMOs -7.8%

Biotech -8.7%