BOTTOM LINE: The Portfolio is higher into the final hour on gains in my Semi and Medical longs. I have not traded today, thus leaving the Portfolio 100% net long. The tone of the market is slightly negative today as the advance/decline line is slightly lower, sector performance is mixed and volume is above average. Google (GOOG) is breaking higher today on above-average volume. The stock has risen almost 15% since July lows on relatively little new news. I suspect this is a result of P/E multiple expansion, especially in the growth stock arena. Google has been severely under-priced, in my opinion, relative to its fundamentals. I still believe the stock is in the early stages of another substantial move higher. It remains my largest long position, with Apple Computer (AAPL) now a close second. It isn't too late to buy either, in my opinion. I expect US stocks to trade modestly higher into the close from current levels on short-covering and bargain hunting.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, September 18, 2006

Stocks Slightly Lower into Final Hour on Profit Taking, Technical Selling

Today's Headlines

Bloomberg:

- Amaranth Advisors LLC, a hedge-fund manager with $9.5 billion in assets, told investors its two main funds fell almost 50% this month because of a plunge in natural gas prices. Last month, MotherRock LP, a $400 million fund run by former NY Merc President Robert “Bo” Collins, went bust after natural-gas futures fell 68% from their Dec. 13 peak.

- Confidence among US homebuilders dropped again this month as sales slowed and profits dropped, according to a private survey released today.

- Ed Keon, chief investment strategist at Prudential Equity Group LLC forecasts the S&P 500 will rise to 1,600 in 2007, a 21% gain from current levels.

- Iran warned the UN Security Council that “hostile” actions prompted by the country’s nuclear work will trigger a reduction in cooperation with the UN.

- Shares of Freescale Semi(FSL) gained after the maker of mobile-phone chips, agreed to be bought for $17.6 billion by investors led by Blackstone Group LP in the biggest technology buyout ever.

- Aeneas Capital Management LP, the hedge fund company run by former SAC Capital Advisors LLC money manager Thomas Grossman, is under investigation by regulators in the US and Malaysia after bets on Malaysian stocks caused losses of about 60% in on of its funds.

- German investor confidence probably dropped to the lowest in more than five years in September as higher interest rates and a planned tax increase dimmed the outlook for economic growth, a survey of economists showed.

Wall Street Journal:

- RealNetworks(RNWK), a maker of Internet music and video software, will announce today an agreement with SanDisk(SNDK) to sell a digital music device that competes with Apple Computer’s(AAPL) iPod.

- DaimlerChrysler AG’s(DCX) “Dr. Z” advertising campaign in the US, which feature TV commercials starring Dieter Zetsche, the carmaker’s CEO, is failing to attract buyers and should be axed, according to advertising analysts.

- US credit card issuers including JPMorgan Chase(JPM) are giving customers more choice in the way they collect loyalty rewards.

- The US already has a form of temporary immigrant work permit in place using resident green cards that offers a model for the kind of program now being debated.

- Sageview Capital LLC, an investment company started by two former Kohlberg Kravis Roberts employees, will say today that it’s bought a stake in Guitar Center(GTRC).

- A degree from a top US college isn’t needed to succeed in business because becoming head of a company is often more the result of personal ambition than schooling.

- World leaders should support the International Compact for Iraq, an Iraqi plan to become financially independent within 5 years, Robert Kimmitt, US deputy Treasury secretary, wrote.

NY Times:

- Researchers at Intel Corp.(INTC) and the Univ. of California, Santa Barbara, have created a silicon-based chip that can produce laser beams.

- Research in Motion(RIMM), which became dominant in the handheld device market with its BlackBerry for business people, is introducing the Pear, a version for consumers.

- Twenty-five of about 31 tribes in Iraq’s strife-torn Anbar province have agreed to join forces and fight al-Qaeda loyalists and other foreign-born insurgents.

Washington Times:

- A top special operations policy maker at the US Dept. of Defense said he will step down in the coming months, a move Bush administration officials say resulted from the reorganization in Defense Secretary Rumsfeld’s office.

NY Post:

- The first NYC school testing program revealed that almost 10% of teenage girls are infected with a sexually transmitted disease and many don’t know it.

Harvard Crimson:

- Alumni giving to Harvard College, the university’s undergraduate core, fell to a 17-year low in the fiscal year that ended June 30.

Newsweek:

- Royal Dutch Shell Plc CEO Van Der Veer said future oil prices will fall significantly because crude-oil inventories are normal and there’s no physical shortage. Multinational companies such as Shell are able to compete with state-owned energy businesses because they can use technology to get oil and gas from unconventional sources such as oil sands, oil shale and deepwater reserves.

Milliyet:

- Turkish President Ahmet Necdet Sezer called for non-government run religious schools and courses to be abolished. Such schools, often run by congregations or sects, were using “dogma and false beliefs” to influence students.

al-Hayat:

- Iraq may increase crude oil exports by 200,000 barrels a day during the next two months.

- Amaranth Advisors LLC, a hedge-fund manager with $9.5 billion in assets, told investors its two main funds fell almost 50% this month because of a plunge in natural gas prices. Last month, MotherRock LP, a $400 million fund run by former NY Merc President Robert “Bo” Collins, went bust after natural-gas futures fell 68% from their Dec. 13 peak.

- Confidence among US homebuilders dropped again this month as sales slowed and profits dropped, according to a private survey released today.

- Ed Keon, chief investment strategist at Prudential Equity Group LLC forecasts the S&P 500 will rise to 1,600 in 2007, a 21% gain from current levels.

- Iran warned the UN Security Council that “hostile” actions prompted by the country’s nuclear work will trigger a reduction in cooperation with the UN.

- Shares of Freescale Semi(FSL) gained after the maker of mobile-phone chips, agreed to be bought for $17.6 billion by investors led by Blackstone Group LP in the biggest technology buyout ever.

- Aeneas Capital Management LP, the hedge fund company run by former SAC Capital Advisors LLC money manager Thomas Grossman, is under investigation by regulators in the US and Malaysia after bets on Malaysian stocks caused losses of about 60% in on of its funds.

- German investor confidence probably dropped to the lowest in more than five years in September as higher interest rates and a planned tax increase dimmed the outlook for economic growth, a survey of economists showed.

Wall Street Journal:

- RealNetworks(RNWK), a maker of Internet music and video software, will announce today an agreement with SanDisk(SNDK) to sell a digital music device that competes with Apple Computer’s(AAPL) iPod.

- DaimlerChrysler AG’s(DCX) “Dr. Z” advertising campaign in the US, which feature TV commercials starring Dieter Zetsche, the carmaker’s CEO, is failing to attract buyers and should be axed, according to advertising analysts.

- US credit card issuers including JPMorgan Chase(JPM) are giving customers more choice in the way they collect loyalty rewards.

- The US already has a form of temporary immigrant work permit in place using resident green cards that offers a model for the kind of program now being debated.

- Sageview Capital LLC, an investment company started by two former Kohlberg Kravis Roberts employees, will say today that it’s bought a stake in Guitar Center(GTRC).

- A degree from a top US college isn’t needed to succeed in business because becoming head of a company is often more the result of personal ambition than schooling.

- World leaders should support the International Compact for Iraq, an Iraqi plan to become financially independent within 5 years, Robert Kimmitt, US deputy Treasury secretary, wrote.

NY Times:

- Researchers at Intel Corp.(INTC) and the Univ. of California, Santa Barbara, have created a silicon-based chip that can produce laser beams.

- Research in Motion(RIMM), which became dominant in the handheld device market with its BlackBerry for business people, is introducing the Pear, a version for consumers.

- Twenty-five of about 31 tribes in Iraq’s strife-torn Anbar province have agreed to join forces and fight al-Qaeda loyalists and other foreign-born insurgents.

Washington Times:

- A top special operations policy maker at the US Dept. of Defense said he will step down in the coming months, a move Bush administration officials say resulted from the reorganization in Defense Secretary Rumsfeld’s office.

NY Post:

- The first NYC school testing program revealed that almost 10% of teenage girls are infected with a sexually transmitted disease and many don’t know it.

Harvard Crimson:

- Alumni giving to Harvard College, the university’s undergraduate core, fell to a 17-year low in the fiscal year that ended June 30.

Newsweek:

- Royal Dutch Shell Plc CEO Van Der Veer said future oil prices will fall significantly because crude-oil inventories are normal and there’s no physical shortage. Multinational companies such as Shell are able to compete with state-owned energy businesses because they can use technology to get oil and gas from unconventional sources such as oil sands, oil shale and deepwater reserves.

Milliyet:

- Turkish President Ahmet Necdet Sezer called for non-government run religious schools and courses to be abolished. Such schools, often run by congregations or sects, were using “dogma and false beliefs” to influence students.

al-Hayat:

- Iraq may increase crude oil exports by 200,000 barrels a day during the next two months.

Current Account Deficit Widens, Net Foreign Security Purchases Decelerate

- The 2Q Current Account Balance widened to -$218.4 billion versus estimates of -$214.0 billion and -$213.2 billion the prior quarter.

- Net Foreign Security Purchases for July fell to $32.9 billion versus estimates of $70.0 billion and $75.1 billion in June.

- Net Foreign Security Purchases for July fell to $32.9 billion versus estimates of $70.0 billion and $75.1 billion in June.

BOTTOM LINE: The US current-account deficit widened more than forecast last quarter as the trade gap widened and more interest was paid to overseas investors, Bloomberg reported. US investors received less income on their holdings of international securities than foreigners received in the US, which helped widen the deficit. I expect the current account deficit to improve only modestly over the intermediate-term as falling commodity prices are mostly offset by the US economy’s relative strength versus other industrialized economies.

International investors slowed purchases of US securities in July as demand for Treasury notes fell after yields declined, Bloomberg reported. International purchases of US stocks rose $10.4 billion versus a $4 billion decline in June. UK holdings of US securities, which many believe are investors that funnel money from Middle East oil economies through British banks, declined by $11.2 billion. I expect foreign demand for US assets to increase going forward as commodities fall further, inflation decelerates and US relative economic strength increases.

Sunday, September 17, 2006

Monday Watch

Weekend Headlines

Bloomberg:

- Pope Benefict XVI apologized today for offence caused by comments he made in a university lecture this week implicitly linking Islam to violence.

- Henry Paulson, who left Goldman Sachs(GS) in May to become the US Treasury Secretary, said he was surprised to learn the extent to which Iranian front companies had infiltrated the financial system, prompting him to organize an “education” program for banks and governments.

- General Motors(GM), trying to improve its image among environmentalists and consumers looking for better mileage, will build more than 100 hydrogen-fuel vehicles next year.

- National Intelligence Director Negroponte suggested interrogations of suspected terrorists have been curtailed because of legal concerns raised by a US Supreme Court ruling on the treatment of enemy combatants.

- When some of the world’s smartest investors earlier this year said buying sugar was the easiest way to make money in 2006, they would have been better off buying stocks in Jordan where the Amman SE General Index is down 23%. Sugar fell 34% from March 31 to the end of August.

- “The cyclical story in commodities is behind us,” said Jack Ablin, CIO at Harris Private Bank in Chicago, which manages $50 billion and sold its investment in commodities. The CRB Index just had its worst 3-week loss in almost 26 years.

Wall Street Journal:

- Symbol Technologies(SBL) is close to completing an auction of itself, which could result in the sale of the $3.2 billion wireless-equipment company in a matter of days.

- Steven Cohen, who runs the $10 billion hedge-fund firm SAC Capital Advisors LLC, holds stocks longer now and makes bigger bets when he does purchase them.

NY Times:

- Many US farmers have decided to profit from demand for ethanol by planting corn instead of wheat.

- At least nine US states have passed laws extending the age limits for health-insurance coverage parents can provide for their children.

Washington Post:

- The head of FEMA, under the US Dept. of Homeland Security, will get direct access to the president during a crisis and an increased budget as part of an agreement being negotiated by congressional lawmakers.

San Francisco Chronicle:

- Google Inc.(GOOG) executive Chris Sacca complained about the slow pace of negotiating a final agreement to provide free wireless Internet access in San Francisco.

Fortune.com:

- Frank Quattrone is reputed to be developing a new, $5 billion venture and stands to collect $120 million in back pay from CSFB.

AP:

- Saudi Arabia’s religious police, known as the Muttawa, issued a decree restricting the sale of cats and dogs as pets, regarded as a sign of Western influence. The mandate, which doesn’t state whether current pets would be confiscated, hasn’t been enforced yet.

Middle East Economic Digest:

- Royal Dutch Shell’s Oman venture expects bids this month for a contract to boost output from the Qarn Alam oil field, after it re-tendered the project when initial bids came in over budget.

Yonhap:

- A niece of North Korean leader Kim Jong Il committed suicide in Paris because she did not want to return to the communist state, citing North Korean officials.

Yomiuri:

- Japan asked China to cut its steel output capacity earlier this month on concern an oversupply of products will result in a sharp price decline.

Weekend Recommendations

Barron's:

- Made positive comments on (EMR), (CLF) and (IVGN).

- Made negative comments on (OVTI).

Citigroup:

- Reiterated Buy on (SNDK), target $69.

Night Trading

Asian indices are +.25% to +1.0% on average.

S&P 500 indicated +.05%

NASDAQ 100 indicated +.08%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- None of note

Upcoming Splits

- None of note

Economic Releases

8:30 am EST

- The 2Q Current Account Deficit is estimated to widen to -$214.0 billion versus -$208.7 billion in 1Q.

9:00 am EST

- Net Foreign Security Purchases for July are estimated to come in at $70.0 billion versus $75.1 billion in June.

1:00 pm EST

- NAHB Housing Market Index for September fell to 31 versus a reading of 32 in August.

Bloomberg:

- Pope Benefict XVI apologized today for offence caused by comments he made in a university lecture this week implicitly linking Islam to violence.

- Henry Paulson, who left Goldman Sachs(GS) in May to become the US Treasury Secretary, said he was surprised to learn the extent to which Iranian front companies had infiltrated the financial system, prompting him to organize an “education” program for banks and governments.

- General Motors(GM), trying to improve its image among environmentalists and consumers looking for better mileage, will build more than 100 hydrogen-fuel vehicles next year.

- National Intelligence Director Negroponte suggested interrogations of suspected terrorists have been curtailed because of legal concerns raised by a US Supreme Court ruling on the treatment of enemy combatants.

- When some of the world’s smartest investors earlier this year said buying sugar was the easiest way to make money in 2006, they would have been better off buying stocks in Jordan where the Amman SE General Index is down 23%. Sugar fell 34% from March 31 to the end of August.

- “The cyclical story in commodities is behind us,” said Jack Ablin, CIO at Harris Private Bank in Chicago, which manages $50 billion and sold its investment in commodities. The CRB Index just had its worst 3-week loss in almost 26 years.

Wall Street Journal:

- Symbol Technologies(SBL) is close to completing an auction of itself, which could result in the sale of the $3.2 billion wireless-equipment company in a matter of days.

- Steven Cohen, who runs the $10 billion hedge-fund firm SAC Capital Advisors LLC, holds stocks longer now and makes bigger bets when he does purchase them.

NY Times:

- Many US farmers have decided to profit from demand for ethanol by planting corn instead of wheat.

- At least nine US states have passed laws extending the age limits for health-insurance coverage parents can provide for their children.

Washington Post:

- The head of FEMA, under the US Dept. of Homeland Security, will get direct access to the president during a crisis and an increased budget as part of an agreement being negotiated by congressional lawmakers.

San Francisco Chronicle:

- Google Inc.(GOOG) executive Chris Sacca complained about the slow pace of negotiating a final agreement to provide free wireless Internet access in San Francisco.

Fortune.com:

- Frank Quattrone is reputed to be developing a new, $5 billion venture and stands to collect $120 million in back pay from CSFB.

AP:

- Saudi Arabia’s religious police, known as the Muttawa, issued a decree restricting the sale of cats and dogs as pets, regarded as a sign of Western influence. The mandate, which doesn’t state whether current pets would be confiscated, hasn’t been enforced yet.

Middle East Economic Digest:

- Royal Dutch Shell’s Oman venture expects bids this month for a contract to boost output from the Qarn Alam oil field, after it re-tendered the project when initial bids came in over budget.

Yonhap:

- A niece of North Korean leader Kim Jong Il committed suicide in Paris because she did not want to return to the communist state, citing North Korean officials.

Yomiuri:

- Japan asked China to cut its steel output capacity earlier this month on concern an oversupply of products will result in a sharp price decline.

Weekend Recommendations

Barron's:

- Made positive comments on (EMR), (CLF) and (IVGN).

- Made negative comments on (OVTI).

Citigroup:

- Reiterated Buy on (SNDK), target $69.

Night Trading

Asian indices are +.25% to +1.0% on average.

S&P 500 indicated +.05%

NASDAQ 100 indicated +.08%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- None of note

Upcoming Splits

- None of note

Economic Releases

8:30 am EST

- The 2Q Current Account Deficit is estimated to widen to -$214.0 billion versus -$208.7 billion in 1Q.

9:00 am EST

- Net Foreign Security Purchases for July are estimated to come in at $70.0 billion versus $75.1 billion in June.

1:00 pm EST

- NAHB Housing Market Index for September fell to 31 versus a reading of 32 in August.

BOTTOM LINE: Asian Indices are higher, boosted by technology shares in the region. I expect US stocks to open modestly higher and to maintain gains into the afternoon. The Portfolio is 100% net long heading into the week.

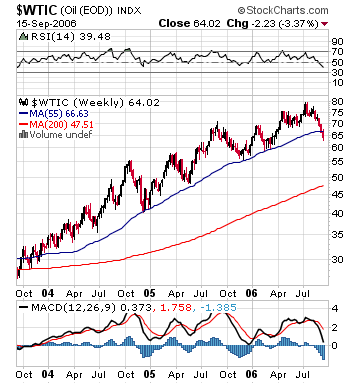

Chart of Interest(Crude Oil)

Subscribe to:

Comments (Atom)