There are a number of economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - Wholesale Inventories

Tues. - Trade Balance, Monthly Budget Statement, FOMC Rate Decision, IBD/TIPP Economic Optimism

Wed. - Advance Retail Sales, Business Inventories

Thur. - Import Price Index, Initial Jobless Claims

Fri. - Consumer Price Index, Empire Manufacturing, Total Net TIC Flows, Industrial Production, Capacity Utilization

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - None of note

Tues. - ADC Telecom(ADCT), Best Buy(BBY), CKE Restaurants(CKR), Cooper Cos(COO), Dollar General(DG), Goldman Sachs(GS), Martek Biosciences(MATK)

Wed. - Children’s Place(PLCE)

Thur. - Adobe Systems(ADBE), Bear Stearns(BSC), Ciena Corp.(CIEN), Freddie Mac(FRE), Lehman Brothers(LEH), Quiksilver(ZQK), Winnebago(WGO)

Fri. - Carnival Corp.(CCL), Pier 1 Imports(PIR), UTStarcom(UTSI)

Other events that have market-moving potential this week include:

Mon. - (TXN) Mid-quarter update, (HPQ) analyst meeting, (A) analyst meeting

Tue. - Goldman Financial Services Conference, RBC Healthcare Conference, JPMogan Software Forum, Raymond James IT Supply Chain Conference

Wed. - Goldman Financial Services Conference, Raymond James IT Supply Chain Conference, UBS Enterprise Tech Forum, CSFB Small/Mid Cap Software Conference, RBC Healthcare Conference, JPMorgan Software Forum

Thur. - JPMorgan Software Forum

Fri. - None of note

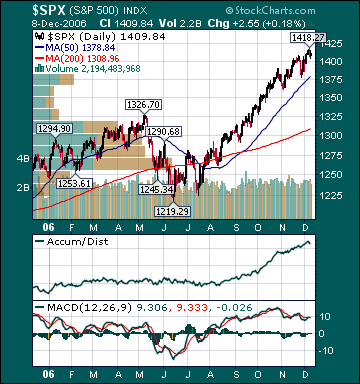

BOTTOM LINE: I expect US stocks to finish the week modestly higher on mostly positive economic data, a stronger US dollar, lower energy prices, seasonal strength, strong corporate profits, bargain-hunting, investment manager performance anxiety and short-covering. My trading indicators are still giving bullish signals and the Portfolio is 100% net long heading into the week.