BOTTOM LINE: Manufacturing growth in NY state slowed more than forecast this month as new orders and sales deteriorated, Bloomberg said. The Outlook component of the index fell to 32.5 from 41.9 in December. The New Orders component fell to 10.3 versus 22.5 in December. The Employment component fell to 6.9 versus 18.6 in December. The Prices Paid component bounced back to 35.1 from 28.1 the prior month. I continue to believe manufacturing will improve modestly later this year as auto production cutbacks subside and housing continues to stabilize at relatively high levels.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Tuesday, January 16, 2007

New York Manufacturing Decelerates

- The Empire Manufacturing Index for January fell to 9.1 versus estimates of 19.3 and a reading of 22.2 in December.

Monday, January 15, 2007

Tuesday Watch

Weekend Headlines

Bloomberg:

- Moving toward US “energy independence” is emerging as one of the few areas where President Bush may find common ground with the congressional Democrats. Administration officials say Bush’s seventh annual address to Congress on Jan. 23 will reiterate his vow to cut Middle Eastern oil imports by 75% by 2025 and curb what he describes as a national “addiction” to oil. Democrats and the White House are likely to agree to boost support for biofuels, increase federal funding for electric-powered vehicles and sweeten incentives for the use of solar and wind power, lobbyists and industry experts say.

- OPEC needs to address excess oil production of “close to” 1 million barrels a day in global markets to stem a price slump, Nigerian Oil Minister Edmund Daukoru said. Rising non-OPEC output is affecting prices, Daukoru said.

- Leaders of the 10 nations of Asean, meeting in Cebu, the Philippines, today agreed to draw up a charter that will give the group rules and the power to enforce them. They also signed a legally binding accord to combat terrorism, and accelerated plans to form an Asean common trade market for a population of 550 million people.

- The US dollar climbed to a 13-month high against the yen this week and the strongest since November versus the euro as signs the US economy is quickening cooled speculation the Fed will lower interest rates.

- Kmart Corp. expanded its 90-day prescription drug program to 225 products, including the generic form of Zocor used to treat cholesterol.

- Venezuelan President Hugo Chavez today asked Congress to grant him temporary executive powers to rule by decree as he seeks to speed the implementation of his so-called socialist economic reforms.

- “There are all sorts of horrible things happening to the Canadian dollar,” said John Taylor, chairman of FX Concepts, a NY firm that manages $12 billion in currencies. “Crude oil, lumber, and copper markets look ugly at this time. Most of the hedge funds are out of the Canadian-dollar trade, and I don’t see any sign that they’ll come back soon.”

- PetroChina Co., the nation’s largest oil and gas company, said output increased 5.2% last year to a record after it expanded exploration in fields in western China.

- In reasserting state control over their economies, the leaders of Venezuela and Russia are bucking the very capital flows and expanded markets that buoyed their oil-producing nations in the first place by delivering record energy prices and the strongest global growth in a generation.

- AOL, Time Warner’s(TWX) Internet unit, agreed to acquire Sweden’s TradeDoubler AB for $900 million to further expand in Europe.

- Japan’s 30-year bonds are attractive as contained global inflation caps the number of times the central bank will raise interest rates this year, Pimco Japan Ltd. said.

- Crude oil is falling back below $53/bbl. in NY amid doubts OPEC can cut output enough to support prices.

- Chile, the world’s biggest copper producer, said its exports of the metal plunged 23% in December to an eight-month low amid signs of weakening demand.

- Shares of Tullow Oil Plc, an oil and gas explorer on three continents, had their biggest gain in three months after its partner in a Ugandan license found additional petroleum deposits at an exploration well.

- Indonesia, Southeast Asia’s biggest oil producer, plans to ease commitments it requires from oil and gas explorers in the eastern part of the country as it seeks to boost oil and gas output 30% by 2009.

Wall Street Journal:

- Exxon Mobil Corp.(XOM) and Lockheed Martin(LMT) stopped paying country-club dues for its executives Jan. 1 as new SEC compensation-disclosure laws took effect.

- General Electric(GE) is close to an agreement to buy the aerospace division of Smiths Group Plc for $4.9 billion.

- Deutsche Telekom AG’s T-Mobile USA unit will release today a white version of Research in Motion’s(RIMM) BlackBerry Pearl mobile phone, as telecom makers and carriers seek to compete with Apple’s(AAPL) iPhone.

USA Today:

- The US military says more than 1,800 people applied for Iraqi police jobs in Ramadi in the past six weeks, an increase from a “few dozen” in September.

NY Times:

- US employers including Sprint(S), Toyota Motor(TM) and Pepsi Bottling Group(PBG) have health-care clinics for employees in an effort to cut medical-insurance premiums.

- Hollywood studios are in negotiations with Google’s(GOOG) YouTube on licensing agreements that would make their content legally available of the Web site.

- Citigroup(C) would shorten its name to “Citi” and introduce a redesigned logo under a branding plan that will be presented to the company’s board this week.

Newsweek:

- OJ Simpson, drenched in blood and holding a knife, doesn’t reveal how his ex-wife and her companion were killed in his fictional account of the murders, according to a chapter of the canceled book “If I Did It” obtained by Newsweek.

Boston Globe:

- High-energy CNBC program, Mad Money, has developed a cult following on college campuses.

Reuters:

- Google(GOOG) has increased its share of the US Web search market to 47.4% with a gain of .4% during December, while No.2 ranked Yahoo!(YHOO) also edged higher. Google has gained share in 16 of the last 17 months in the United States, the world’s largest Internet market, according to comScore data.

- Cuban leader Fidel Castro was in serious condition after three failed surgeries on his large intestine.

AP:

- Saddam Hussein’s half brother and another associate of the former Iraqi leader were executed today for their role in the 1982 murders of Shiite Muslims.

EE Times:

- According to a report from FBR Research, the Apple(AAPL) iPhone winners include Samsung, Marvell Tech(MRVL), Infineon Technologies, Broadcom(BRCM) and CSR plc among others. So how many core processors from ARM Holdings plc(ARMHY) does that represent?

Financial Times:

- BP Plc(BP) CEO Browne will join private equity firm Apax Partners Worldwide LLP as chairman of Apax’s advisory board after he steps down from BP.

- UK business confidence is at its highest level for over 12 years despite recent interest rate increases by the Bank of England, citing a Lloyds TSB Group Plc report.

- Egyptian officials have arrested a producer with Al Jazeera, an Arab satellite-tv network, claiming that she fabricated scenes of police torture.

- YouTube Inc., MySpace.com and other user-generated video Web sites’ advertising revenues will account for 15% of the total online video advertising budget by 2010, citing a study by media analysis company Screen Digest.

Globe and Mail:

- Canadian pharmacist organizations asked the government to ban the export of prescription drugs to the US after it introduced a bill last week that would allow pharmacies and wholesalers to import drugs from Canada.

Svenska Dagbladet:

- Volvo AB may start manufacturing its hybrid engine for trucks, busses, and construction machines in 2009 after testing this year and next year, citing CEO Johansson.

Le Monde:

- German Chancellor Angela Merkel said she’s “quite worried” about attempts in France to blame the euro for inflation and a declining standard of living.

Business Times:

- Genting Bhd., a Malaysian owner of casinos and plantations, plans to spend as much as $3 billion to set up biofuel plants in Indonesia.

Al-Hayat:

- Iraq plans to forma a government body to develop the energy industry after almost four years of conflict has paralyzed the development of the industry, citing an Irai oil ministry official.

Weekend Recommendations

Barron's:

- Made positive comments on (XRX), (YRCW), (KMB) and (TM).

Citigroup:

- Reiterated Buy and raised estimates on (SBUX), target $45

- Reiterated Buy on (KLAC), target $65.

Morgan Stanley:

- Upgraded Biotech Sector to Attractive.

Night Trading

Asian indices are -.25% to +.50% on average.

S&P 500 indicated +.10%.

NASDAQ 100 indicated +.13%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (CBH)/.40

- (FRX)/.66

- (FCX)/2.12

- (INTC)/.25

- (LLTC)/.34

- (MI)/.82

- (AMTD)/.22

- (TSS)/.26

- (USB)/.67

- (WFC)/.64

Upcoming Splits

- None of note

Economic Releases

8:30 pm EST

- Empire Manufacturing for January is estimated to fall to 19.5 versus a reading of 23.1 in December.

Bloomberg:

- Moving toward US “energy independence” is emerging as one of the few areas where President Bush may find common ground with the congressional Democrats. Administration officials say Bush’s seventh annual address to Congress on Jan. 23 will reiterate his vow to cut Middle Eastern oil imports by 75% by 2025 and curb what he describes as a national “addiction” to oil. Democrats and the White House are likely to agree to boost support for biofuels, increase federal funding for electric-powered vehicles and sweeten incentives for the use of solar and wind power, lobbyists and industry experts say.

- OPEC needs to address excess oil production of “close to” 1 million barrels a day in global markets to stem a price slump, Nigerian Oil Minister Edmund Daukoru said. Rising non-OPEC output is affecting prices, Daukoru said.

- Leaders of the 10 nations of Asean, meeting in Cebu, the Philippines, today agreed to draw up a charter that will give the group rules and the power to enforce them. They also signed a legally binding accord to combat terrorism, and accelerated plans to form an Asean common trade market for a population of 550 million people.

- The US dollar climbed to a 13-month high against the yen this week and the strongest since November versus the euro as signs the US economy is quickening cooled speculation the Fed will lower interest rates.

- Kmart Corp. expanded its 90-day prescription drug program to 225 products, including the generic form of Zocor used to treat cholesterol.

- Venezuelan President Hugo Chavez today asked Congress to grant him temporary executive powers to rule by decree as he seeks to speed the implementation of his so-called socialist economic reforms.

- “There are all sorts of horrible things happening to the Canadian dollar,” said John Taylor, chairman of FX Concepts, a NY firm that manages $12 billion in currencies. “Crude oil, lumber, and copper markets look ugly at this time. Most of the hedge funds are out of the Canadian-dollar trade, and I don’t see any sign that they’ll come back soon.”

- PetroChina Co., the nation’s largest oil and gas company, said output increased 5.2% last year to a record after it expanded exploration in fields in western China.

- In reasserting state control over their economies, the leaders of Venezuela and Russia are bucking the very capital flows and expanded markets that buoyed their oil-producing nations in the first place by delivering record energy prices and the strongest global growth in a generation.

- AOL, Time Warner’s(TWX) Internet unit, agreed to acquire Sweden’s TradeDoubler AB for $900 million to further expand in Europe.

- Japan’s 30-year bonds are attractive as contained global inflation caps the number of times the central bank will raise interest rates this year, Pimco Japan Ltd. said.

- Crude oil is falling back below $53/bbl. in NY amid doubts OPEC can cut output enough to support prices.

- Chile, the world’s biggest copper producer, said its exports of the metal plunged 23% in December to an eight-month low amid signs of weakening demand.

- Shares of Tullow Oil Plc, an oil and gas explorer on three continents, had their biggest gain in three months after its partner in a Ugandan license found additional petroleum deposits at an exploration well.

- Indonesia, Southeast Asia’s biggest oil producer, plans to ease commitments it requires from oil and gas explorers in the eastern part of the country as it seeks to boost oil and gas output 30% by 2009.

Wall Street Journal:

- Exxon Mobil Corp.(XOM) and Lockheed Martin(LMT) stopped paying country-club dues for its executives Jan. 1 as new SEC compensation-disclosure laws took effect.

- General Electric(GE) is close to an agreement to buy the aerospace division of Smiths Group Plc for $4.9 billion.

- Deutsche Telekom AG’s T-Mobile USA unit will release today a white version of Research in Motion’s(RIMM) BlackBerry Pearl mobile phone, as telecom makers and carriers seek to compete with Apple’s(AAPL) iPhone.

USA Today:

- The US military says more than 1,800 people applied for Iraqi police jobs in Ramadi in the past six weeks, an increase from a “few dozen” in September.

NY Times:

- US employers including Sprint(S), Toyota Motor(TM) and Pepsi Bottling Group(PBG) have health-care clinics for employees in an effort to cut medical-insurance premiums.

- Hollywood studios are in negotiations with Google’s(GOOG) YouTube on licensing agreements that would make their content legally available of the Web site.

- Citigroup(C) would shorten its name to “Citi” and introduce a redesigned logo under a branding plan that will be presented to the company’s board this week.

Newsweek:

- OJ Simpson, drenched in blood and holding a knife, doesn’t reveal how his ex-wife and her companion were killed in his fictional account of the murders, according to a chapter of the canceled book “If I Did It” obtained by Newsweek.

Boston Globe:

- High-energy CNBC program, Mad Money, has developed a cult following on college campuses.

Reuters:

- Google(GOOG) has increased its share of the US Web search market to 47.4% with a gain of .4% during December, while No.2 ranked Yahoo!(YHOO) also edged higher. Google has gained share in 16 of the last 17 months in the United States, the world’s largest Internet market, according to comScore data.

- Cuban leader Fidel Castro was in serious condition after three failed surgeries on his large intestine.

AP:

- Saddam Hussein’s half brother and another associate of the former Iraqi leader were executed today for their role in the 1982 murders of Shiite Muslims.

EE Times:

- According to a report from FBR Research, the Apple(AAPL) iPhone winners include Samsung, Marvell Tech(MRVL), Infineon Technologies, Broadcom(BRCM) and CSR plc among others. So how many core processors from ARM Holdings plc(ARMHY) does that represent?

Financial Times:

- BP Plc(BP) CEO Browne will join private equity firm Apax Partners Worldwide LLP as chairman of Apax’s advisory board after he steps down from BP.

- UK business confidence is at its highest level for over 12 years despite recent interest rate increases by the Bank of England, citing a Lloyds TSB Group Plc report.

- Egyptian officials have arrested a producer with Al Jazeera, an Arab satellite-tv network, claiming that she fabricated scenes of police torture.

- YouTube Inc., MySpace.com and other user-generated video Web sites’ advertising revenues will account for 15% of the total online video advertising budget by 2010, citing a study by media analysis company Screen Digest.

Globe and Mail:

- Canadian pharmacist organizations asked the government to ban the export of prescription drugs to the US after it introduced a bill last week that would allow pharmacies and wholesalers to import drugs from Canada.

Svenska Dagbladet:

- Volvo AB may start manufacturing its hybrid engine for trucks, busses, and construction machines in 2009 after testing this year and next year, citing CEO Johansson.

Le Monde:

- German Chancellor Angela Merkel said she’s “quite worried” about attempts in France to blame the euro for inflation and a declining standard of living.

Business Times:

- Genting Bhd., a Malaysian owner of casinos and plantations, plans to spend as much as $3 billion to set up biofuel plants in Indonesia.

Al-Hayat:

- Iraq plans to forma a government body to develop the energy industry after almost four years of conflict has paralyzed the development of the industry, citing an Irai oil ministry official.

Weekend Recommendations

Barron's:

- Made positive comments on (XRX), (YRCW), (KMB) and (TM).

Citigroup:

- Reiterated Buy and raised estimates on (SBUX), target $45

- Reiterated Buy on (KLAC), target $65.

Morgan Stanley:

- Upgraded Biotech Sector to Attractive.

Night Trading

Asian indices are -.25% to +.50% on average.

S&P 500 indicated +.10%.

NASDAQ 100 indicated +.13%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (CBH)/.40

- (FRX)/.66

- (FCX)/2.12

- (INTC)/.25

- (LLTC)/.34

- (MI)/.82

- (AMTD)/.22

- (TSS)/.26

- (USB)/.67

- (WFC)/.64

Upcoming Splits

- None of note

Economic Releases

8:30 pm EST

- Empire Manufacturing for January is estimated to fall to 19.5 versus a reading of 23.1 in December.

BOTTOM LINE: Asian Indices are mostly higher, boosted by technology shares in the region. I expect US stocks to open mixed and to rally into the afternoon, finishing modestly higher. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for The Week Ahead by Reuters

There are some economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - US Markets Closed

Tues. - Empire Manufacturing

Wed. - MBA Mortgage Applications, Producer Price Index, Net Long-term TIC Flows, Industrial Production, Capacity Utilization, NAHB Housing Market Index, Fed’s Beige Book

Thur. - Consumer Price Index, Initial Jobless Claims, Housing Starts, Building Permits, Philly Fed

Fri. - Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - US Markets Closed

Tues. - Commerce Bancorp(CBH), Forest Labs(FRX), Freeport-McMoRan(FCX), Intel Corp.(INTC), Linear Tech(LLTC), TD Ameritrade(AMTD), US Bancorp(USB), Wells Fargo(WFC)

Wed. - Apple Inc.(AAPL), CIT Group(CIT), JPMorgan Chase(JPM), Kinder Morgan(KMI), Lam Research(LRCX), Lennar Corp.(LEN), Mellon Financial(MEL), Progressive Corp.(PGR), Southwest Air(LUV), State Street Corp.(STT), Washington Mutual(WM)

Thur. - Amdocs(DOX), AMR Corp.(AMR), Bank of NY(BK), Capital One Financial(COF), Charles Schwab(SCHW), Comerica(CMA), Continental Air(CAL), E*Trade Financial(ET), Fifth Third Bancorp(FITB), Harley-Davidson(HDI), IBM(IBM), International Game Technologies(IGT), Merrill Lynch(MER), SLM Corp.(SLM), UnitedHealth Group(UNH), Xilinx Inc.(XLNX)

Fri. - Citigroup Inc.(C), Fastenal(FAST), General Electric(GE), Johnson Controls(JCI), Keycorp(KEY), Motorola(MOT), Schlumberger Ltd(SLB), SunTrust Banks(STI)

Other events that have market-moving potential this week include:

Mon. - US Markets Closed

Tue. - Goldman Sachs Energy Conference

Wed. - Goldman Sachs Energy Conference, Fed’s Yellen speaking, Fed’s Poole speaking

Thur. - Fed’s Pianalto speaking, Fed’s Bernanke speaking, Goldman Sachs Energy Conference, Deutsche Bank Real Estate Conference

Fri. - (MDT) Analyst Meeting, (PII) Analyst Meeting, (MOT) Analyst Meeting, Fed’s Lacker speaking, Fed’s Hoenig speaking

There are some economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - US Markets Closed

Tues. - Empire Manufacturing

Wed. - MBA Mortgage Applications, Producer Price Index, Net Long-term TIC Flows, Industrial Production, Capacity Utilization, NAHB Housing Market Index, Fed’s Beige Book

Thur. - Consumer Price Index, Initial Jobless Claims, Housing Starts, Building Permits, Philly Fed

Fri. - Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - US Markets Closed

Tues. - Commerce Bancorp(CBH), Forest Labs(FRX), Freeport-McMoRan(FCX), Intel Corp.(INTC), Linear Tech(LLTC), TD Ameritrade(AMTD), US Bancorp(USB), Wells Fargo(WFC)

Wed. - Apple Inc.(AAPL), CIT Group(CIT), JPMorgan Chase(JPM), Kinder Morgan(KMI), Lam Research(LRCX), Lennar Corp.(LEN), Mellon Financial(MEL), Progressive Corp.(PGR), Southwest Air(LUV), State Street Corp.(STT), Washington Mutual(WM)

Thur. - Amdocs(DOX), AMR Corp.(AMR), Bank of NY(BK), Capital One Financial(COF), Charles Schwab(SCHW), Comerica(CMA), Continental Air(CAL), E*Trade Financial(ET), Fifth Third Bancorp(FITB), Harley-Davidson(HDI), IBM(IBM), International Game Technologies(IGT), Merrill Lynch(MER), SLM Corp.(SLM), UnitedHealth Group(UNH), Xilinx Inc.(XLNX)

Fri. - Citigroup Inc.(C), Fastenal(FAST), General Electric(GE), Johnson Controls(JCI), Keycorp(KEY), Motorola(MOT), Schlumberger Ltd(SLB), SunTrust Banks(STI)

Other events that have market-moving potential this week include:

Mon. - US Markets Closed

Tue. - Goldman Sachs Energy Conference

Wed. - Goldman Sachs Energy Conference, Fed’s Yellen speaking, Fed’s Poole speaking

Thur. - Fed’s Pianalto speaking, Fed’s Bernanke speaking, Goldman Sachs Energy Conference, Deutsche Bank Real Estate Conference

Fri. - (MDT) Analyst Meeting, (PII) Analyst Meeting, (MOT) Analyst Meeting, Fed’s Lacker speaking, Fed’s Hoenig speaking

BOTTOM LINE: I expect US stocks to finish the week modestly higher on mostly positive economic data, buyout speculation, seasonal strength, stable long-term rates, a firmer US dollar, mostly positive earnings reports, constructive Fed comments, bargain-hunting and short-covering. My trading indicators are giving bullish signals and the Portfolio is 100% net long heading into the week.

Sunday, January 14, 2007

Market Week in Review

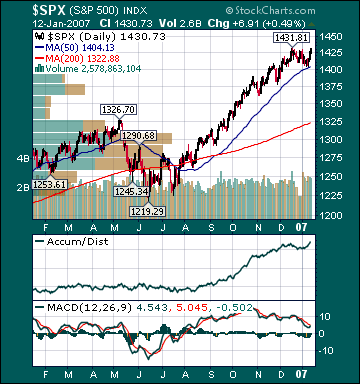

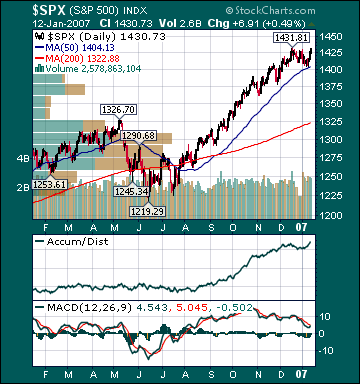

S&P 500 1,430.73 +1.49%*

Click here for the Weekly Wrap by Briefing.com.

*5-day % Change

Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was bullish. The advance/decline line rose, most sectors gained and volume was heavy on the week. Measures of investor anxiety were mostly lower. However, the AAII percentage of Bulls fell to 44.44% this week from 49.14% the prior week. This reading is now slightly below average levels. The AAII percentage of Bears rose to 34.3% this week from 29.31% the prior week. This reading is now above-average levels. The 10-week moving average of the percentage of Bears is currently 36.8%, an above-average level. The 10-week moving average of the percentage of Bears peaked at 43.0% at the major bear market low during 2002. Moreover, the 50-week moving average of the percentage of Bears is 37.0%, a very high level seen during only two other periods in U.S. history.

I continue to believe that steadfastly high bearish sentiment in many quarters is mind-boggling, considering the S&P 500's 18.2% rise in less than seven months, one of the best August/September/October runs in U.S. history, economic data is improving, the fact that the Dow made another all-time high last week and that we are in the early stages of what is historically a very strong period for U.S. stocks after a midterm election. Despite recent gains, the forward P/E on the S&P 500 is a very reasonable 16.3 due to the historic run of double-digit profit growth increases, which are poised to continue in the fourth quarter. Bears still remain stunningly complacent, in my opinion. As I have said many times over the last few months, every pullback is seen as a major top and every move higher is just another shorting/selling opportunity. Even most bulls have raised cash of late, anticipating an imminent correction after the recent surge.

As well, there are many other indicators registering high levels of investor skepticism regarding recent stock market gains. The 50-day moving average of the ISE Sentiment Index just crossed above the 200-day moving average for the first time since November 2005 recently and is already rolling over again. The ISE Sentiment Index plunged to a very depressed 78.0 on Wednesday. Nasdaq and NYSE short interests are very close to record highs. Moreover, public short interest continues to soar to record levels, and U.S. stock mutual funds have seen outflows for most of the last year, according to AMG Data Services. 90%, or $140 billion, of all mutual fund inflows went to international funds last year. The percentage of U.S. mutual fund assets invested in domestic stocks fell to 78% last year, the lowest since at least 1984, as the mania for emerging market stocks intensified with parabolic moves in most commodity prices. Moreover, U.S. equity funds were on track to receive $14.7 billion of new cash inflows for 2006, the lowest in 17 years for a period in which the S&P 500 gained, according to ICI. Finally, investment blogger bullish sentiment is hovering just above record lows at 25% Bulls/40% Bears. There is still a high wall of worry for stocks to climb substantially from current levels as the public remains very skeptical of this bull market.

I continue to believe this is a direct result of the strong belief by the herd that the U.S. is in a long-term trading range or secular bear environment. There is still overwhelming evidence that investment sentiment by the general public regarding U.S. stocks has never been this poor in history, with the Dow registering all-time highs almost weekly. I still expect the herd to finally embrace the current bull market this year, which should result in another substantial move higher in the major averages as the S&P 500 breaks out to an all-time high to join the Dow and Russell 2000. Only in a "negativity bubble" could Wall Street strategists' consensus predictions of a 7% gain for the S&P 500 this year be characterized as "very bullish" by the many bearish pundits. As well, many of the so-called bullish U.S. investors are only "really bullish" on commodity stocks and U.S. companies with substantial emerging markets exposure, not the broad U.S. stock market. Finally, how many investors are bullish on "growth" stocks? There are relatively few true "growth" investors left after six-years of underperformance.

Based on the action during the first few days of this year, I suspect even more cash has piled up on the sidelines and some of that cash will be deployed into true growth companies as their outperformance gains steam throughout the year. I continue to believe the coming bullish shift in long-term sentiment with respect to U.S. stocks will result in the "mother of all short-covering rallies."

The average 30-year mortgage rate rose 3 basis points to 6.21%, which is 59 basis points below July highs. I still believe housing is in the process of stabilizing at relatively high levels. The Fed’s Minehan said recently that data suggest a “bottoming” in real estate. A belief shared by former Fed Chairman Alan Greenspan, current Fed Chairman Ben Bernanke and several current Fed members. Mortgage applications soared 16.6% this week, the largest gain since June 2005, and continue to trend higher with the decline in mortgage rates and healthy job market. The Mortgage Bankers Association said last month that the US housing market will “fully regain its footing” by the middle of this year. Moreover, the California Building Industry Association recently gave an upbeat forecast for housing this year, saying production would be near last year’s brisk levels.

As well, housing inventories have been trending lower and homebuilding equities have been moving higher. The Housing Index(HGX) has risen 23.4% from July lows. The Case-Schiller housing futures have improved substantially and are now projecting a 1.9% decline in the average home price by May, up from projections of a 5.2% decline a couple of months ago. Considering the median house has appreciated over 50% during the last few years with record high US home ownership, this would be considered a “soft landing.” The overall negative effects of housing on the US economy and the potential for significant price drops are still being exaggerated by the many bears in hopes of dissuading buyers from stepping up, in my opinion. Housing and home equity extractions have been slowing substantially for almost 2 years and have been mostly offset by many other very positive aspects of the US economy.

Home values are more important than stock prices to the average American, but the median home has barely declined in value after a historic run-up, while the S&P 500 has risen 13.2% over the last year and 93.1% since the Oct. 4, 2002 low. Americans’ median net worth is still very close to or at record high levels as a result, a fact that is generally unrecognized or minimized by the record number of stock market participants that feel it is in their financial and/or political interests to paint a bleak picture of America. Moreover, energy prices are down significantly, consumer spending remains healthy, unemployment is low by historic standards, interest rates are very low, inflation is below average rates, stocks are surging and wages are rising. The economy has created 840,000 jobs in the last five months. Challenger, Gray & Christmas reported last week that December job cuts plunged 49.3% from year-ago levels. As well, the Monster Employment Index is just off record highs. Moreover, the unemployment rate is a historically low 4.5%, down from 5.1% in September 2005, notwithstanding fewer real estate-related jobs and significant auto production cutbacks.

The Consumer Price Index for November rose 2.0% year-over-year, down from a 4.7% increase in September of 2005. This is substantially below the long-term average of around 3%. Moreover, the CPI has only been lower during 4 other periods since the mid-1960s. Many other measures of inflation have recently shown substantial deceleration. The Producer Price Index for November rose a historically low .9% year-over-year. Most measures of Americans’ income growth are now more than twice the rate of inflation. Americans’ Average Hourly Earnings rose 4.2% in December, substantially above the 3.2% 20-year average. The recent plunge in many commodities should eventually result in the complete debunking of the problematic inflation myth that so many have perpetuated endlessly over the last couple of years.

The benchmark 10-year T-note yield rose 12 basis points on signs of accelerating US economic activity. In my opinion, investors’ continuing fears over an economic “hard landing” are misplaced. The ISM Manufacturing Index improved in December and is now registering expansion. Moreover, the ISM’s semi-annual forecast was released recently and gave an upbeat assessment of expected manufacturing activity this year. The ISM Non-Manufacturing Index, which is a gauge of the vast majority of U.S. economic activity, came in at a healthy 57.1 for December. Manufacturing accounts for roughly 12% of US economic growth, while consumer spending accounts for about 70% of growth.

U.S. GDP growth came in at 1.1% and 0.7% during the first two quarters of 1995. The ISM Manufacturing Index fell below 50, which signals a contraction in activity, during May 1995. It stayed below 50, reaching a low of 45.5, until August 1996. During that period, the S&P 500 soared 31% as the P/E multiple expanded from 16.0 to 17.2. This was well before the stock market bubble began to inflate. As well, manufacturing was more important to overall US economic growth at that time. Stocks can and will rise as P/E multiples expand, even with more average economic and earnings growth. The S&P 500's P/E has contracted for three straight years. A recent Morgan Stanley report concluded that the S&P 500's P/E has only contracted for four consecutive years twice since 1905. The report said that each point of multiple expansion is equivalent to a 6.6% gain in the S&P 500. As I have said many times before, P/E multiple expansion is the bears' worst nightmare.

Weekly retail sales rose an average 3.4% for the week. Spending is poised to remain strong on lower energy prices, very low long-term interest rates, a rising stock market, healthy job market, decelerating inflation and more optimism. The current conditions component of the December Univ. of Mich. Consumer Confidence Index, which gauges whether or not consumers feel it is a good time to buy big-ticket items, rose to its highest level since March. As well, the Conference Board’s Consumer Confidence reading for December came in at the second highest this cycle. I expect new cycle highs for both measures of consumer sentiment over the next few months.

Just take a look at commodity charts, gauges of commodity sentiment and inflows into commodity-related funds over the last couple of years. There has been a mania for commodities. However, the CRB Commodities Index, the main source of inflation fears, is now in bear market territory, declining 13.7% over the last 12 months and down 20.5% from May highs despite a historic flood of capital into commodity funds and numerous potential upside catalysts. Oil has declined $25/bbl from July highs. Last year, oil rose $2.05/bbl. on the first trading day of the year and $7.40/bbl. through the first three weeks of trading as commodity funds, flush with new capital, drove futures prices higher. I suspect, given the average commodity hedge fund fell around double-digits last year as the CRB Index dropped 7.4%, that many energy-related funds saw outflows at year-end. Oil has declined 13.2% or $8.02/bbl. already this year.

The commodity mania has pumped air into the current “negativity bubble.” That is why it is so easy for most to believe that housing was in a bubble, but then act shocked when commodities plunge. I continue to believe inflation fears have peaked for this cycle as global economic growth slows to average levels, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies rose substantially more than expectations again even as refinery utilization increased only slightly. U.S. gasoline supplies are at high levels for this time of the year. Gasoline futures fell substantially for the week and have plunged 50.7% from September 2005 highs even as some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. The still very elevated level of gas prices, related to crude oil production disruption speculation by investment funds, will further dampen global fuel demand, sending gas prices still lower over the intermediate-term.

The 10-week moving-average of US oil inventories is approaching 8-year highs. Since December 2003, global oil demand is only up 2%, despite booming global growth, while global supplies have increased 6%, according to the Energy Intelligence Group. OPEC said recently that global crude oil supply would exceed demand by 100 million barrels by the second quarter of this year. Moreover, worldwide oil inventories are poised to begin increasing at an accelerated rate over the next year. One of the main reasons I believe OPEC has been slow to actually meet their pledged cuts has been the fear of losing market share to non-OPEC countries. Moreover, OPEC actually needs lower prices to prevent any further long-term demand destruction. I continue to believe oil is priced at elevated levels on record speculation by investment funds, not fundamentals.

The Amaranth Advisors hedge fund blow-up is a prime example of the extent to which many investment funds have been speculating on ever higher energy prices through futures contracts, thus driving the price of the underlying commodity to absurd levels. Amaranth, a multi-strategy hedge fund, lost about $6.5 billion of its $9.5 billion under management in less than two months speculating mostly on higher natural gas prices. I continue to believe a number of other funds will experience similar fates over the coming months after managers “pressed their bets” in hopes of making up for recent poor performance, which will further pressure energy prices as these funds unwind their leveraged long positions to meet rising investor redemptions.

Recently, Cambridge Energy Research, one of the most respected energy research firms in the world, put out a report that drills gaping holes in the belief by most investors of imminent "peak oil" production. Cambridge said that its analysis indicates that the remaining global oil base is actually 3.74 trillion barrels, three times greater than "peak oil" theory proponents say and that the "peak oil" theory is based on faulty analysis. I suspect the contango that still exists in energy futures, which encourages hoarding, will begin to reverse over the coming months as more investors come to the realization that the "peak oil" theory is hugely flawed, global storage fills, and Chinese/US demand slows.

A major top in oil is already in place as global crude oil storage capacity utilization is running around 98%. Recent OPEC production cuts are resulting in a complete technical breakdown in crude futures. Demand destruction is already pervasive globally and will only intensify over the coming years as many more alternative energy projects come to the fore. Moreover, many Americans feel as though they are helping fund terrorism or hurting the environment every time they fill up their gas tanks. I do not believe we will ever again see the demand for gas-guzzling vehicles that we saw in recent years, even if gas prices plunge further from current levels, as I expect. If OPEC actually implements all their announced production cuts, with oil still at very high levels and weakening global growth, it will only further deepens resentment towards the cartel and result in even greater long-term demand destruction. Finally, as the fear premium in oil dissipates back to more reasonable levels, global growth slows and supplies continue to rise, crude oil should continue heading meaningfully lower over the intermediate-term, notwithstanding OPEC production cuts. Oil has already begun another significant downturn and I suspect crude will eventually fall to levels that most investors deemed unimaginable just a few months ago during the next significant global economic downturn.

Natural gas inventories fell slightly more than expectations this week. Prices for the commodity rose as historic investment fund speculation continues despite the fact that supplies are now 18.0% above the 5-year average and at all-time high levels for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have collapsed 58.2% since December 2005 highs. Notwithstanding this decline, natural gas anywhere near current prices is ridiculous with absolute inventories poised to hit new records this year. The long-term average price of natural gas is $4.63 with inventories at much lower than current levels.

Gold rose on the week on short-covering even as demand from India, the world’s largest buyer of the metal, continues to moderate and inflation is poised to decelerate further on the decline in other commodities. Gold, natural gas, oil and copper still look both fundamentally and technically weak. The US dollar gained on stronger US economic data and more short-covering. The monthly budget statement was significantly better-than-expected once again. The US budget deficit is now 1.5% of GDP, well below the 40-year average of 2.3% of GDP. I continue to believe there is very little chance of another Fed rate hike anytime soon. An eventual cut is likely this year as inflation continues to decelerate substantially. A Fed rate cut should actually boost the dollar as currency speculators anticipate faster US economic growth. Moreover, last month’s net long-term TIC flows report showed foreign investors’ demand for US securities remains very strong despite last year’s dollar weakness.

Airline stocks outperformed significantly for the week on ticket price increases and plunging energy prices. “Growth” stocks again outpaced “value” shares. Wireless stocks underperformed as the introduction of Apple Inc.’s(AAPL) new iPhone dramatically increased competition in the space. S&P 500 profit growth for the third quarter came in around 20% versus a long-term historical average of 7%, according to Thomson Financial. This marks the 17th straight quarter of double-digit profit growth, the best streak since recording keeping began in 1936. Moreover, another double-digit gain is likely for the fourth quarter. Just a few months ago many investors expected profit growth to fall to the low single digits. Despite a 93.1% total return(which is equivalent to a 16.6% average annual return) for the S&P 500 since the October 2002 bottom, its forward p/e has contracted relentlessly and now stands at a very reasonable 16.3. The 20-year average p/e for the S&P 500 is 23.0.

Current stock prices are still providing longer-term investors very attractive opportunities, in my opinion. In my entire investment career, I have never seen the best “growth” companies in the world priced as cheaply as they are now relative to the broad market. By contrast, “value” stocks are quite expensive in many cases. A CSFB report late last year confirmed this view. The report concluded that on a price-to-cash flow basis growth stocks are cheaper than value stocks for the first time since at least 1977. The entire decline in the S&P 500’s p/e, since the bubble burst in 2000, is attributable to growth stock multiple contraction. I still expect the most overvalued economically sensitive and emerging market stocks to continue underperforming over the intermediate-term as the manias for those shares subside as global growth slows to more average rates. I continue to believe a chain reaction of events has begun that will result in a substantial increase in demand for US stocks.

In my opinion, the market is still factoring in way too much bad news at current levels, notwithstanding recent gains. One of the characteristics of the current “negativity bubble” is that most potential positives are undermined, downplayed or completely ignored, while almost every potential negative is exaggerated, trumpeted and promptly priced in to stock prices. Furthermore, this “irrational pessimism” by investors is resulting in a dramatic decrease in the supply of stock as companies buy back shares, IPOs are pulled and secondary stock offerings are canceled. Booming merger and acquisition activity is also greatly constricting the supply of stock. Many commodity funds, which have received a historic flood of capital inflows over the last few years are likely now seeing redemptions as the CRB Index is in bear market territory. Some of this capital will likely find its way back to US stocks. As well, money market funds are brimming with cash. There is massive bull firepower available on the sidelines for US equities at a time when the supply of stock has contracted.

Considering the overwhelming majority of investment funds failed to meet the S&P 500's 15.8% return last year, I suspect most portfolio managers have a very low threshold of pain this year for falling substantially behind their benchmark once again. Rising optimism for a Fed rate cut, a stronger US dollar, lower commodity prices, seasonal strength, decelerating inflation readings, a pick-up in consumer spending, lower long-term rates, increased consumer/investor confidence, short-covering, investment manager performance anxiety, rising demand for US stocks and the realization that economic growth is poised to accelerate back to around average levels in the second half of the year should provide the catalysts for another substantial push higher in the major averages over the intermediate-term as p/e multiples expand substantially. A recent Citigroup report says that the total value of U.S. shares dropped last year, despite rising stock prices, by the most in 22 years. Last year, supply contracted, but demand for U.S. equities was muted. I suspect accelerating demand for U.S. stocks, combined with shrinking supply, will make for a lethally bullish combination this year. Finally, the ECRI Weekly Leading Index surged this week to a new cycle high and is forecasting a modest acceleration in US economic activity.

*5-day % Change

Friday, January 12, 2007

Weekly Scoreboard*

Indices

S&P 500 1,430.73 +1.49%

DJIA 12,556.08 +1.27%

NASDAQ 2,502.82 +2.82%

Russell 2000 794.26 +2.37%

Wilshire 5000 14,365.62 +1.75%

Russell 1000 Growth +2.37%

Russell 1000 Value +.94%

Morgan Stanley Consumer 705.26 +1.52%

Morgan Stanley Cyclical 909.42 +2.58%

Morgan Stanley Technology 583.22 +1.68%

Transports 4,760.27 +3.21%

Utilities 445.16 -.56%

MSCI Emerging Markets 111.19 +.11%

S&P 500 Cum A/D Line 11,301 +6%

Bloomberg Crude Oil % Bulls 23.0 -14.8%

CFTC Oil Large Speculative Longs 164,334 -2.0%

Put/Call .74 -15.91%

NYSE Arms .86 -11.34%

Volatility(VIX) 10.15 -16.39%

ISE Sentiment 154.0 +2.67%

AAII % Bulls 44.44 -9.56%

AAII % Bears 34.26 +16.89%

US Dollar 85.02 +.45%

CRB 290.62 -.17%

ECRI Weekly Leading Index 141.80 +1.87%

Futures Spot Prices

Crude Oil 52.99 -5.88%

Reformulated Gasoline 143.20 -4.09%

Natural Gas 6.60 +5.72%

Heating Oil 150.36 -3.92%

Gold 626.90 +3.16%

Base Metals 227.07 +1.14%

Copper 261.40 +2.99%

10-year US Treasury Yield 4.77% 2.58%

Average 30-year Mortgage Rate 6.21% +.49%

Leading Sectors

Airlines +8.42%

I-Banks +5.88%

Gaming +5.20%

Retail +4.91%

REITs +4.23%

Lagging Sectors

Networking -.27%

Oil Service -.51%

Utilities -.55

Energy -.80%

Wireless -1.47%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

S&P 500 1,430.73 +1.49%

DJIA 12,556.08 +1.27%

NASDAQ 2,502.82 +2.82%

Russell 2000 794.26 +2.37%

Wilshire 5000 14,365.62 +1.75%

Russell 1000 Growth +2.37%

Russell 1000 Value +.94%

Morgan Stanley Consumer 705.26 +1.52%

Morgan Stanley Cyclical 909.42 +2.58%

Morgan Stanley Technology 583.22 +1.68%

Transports 4,760.27 +3.21%

Utilities 445.16 -.56%

MSCI Emerging Markets 111.19 +.11%

S&P 500 Cum A/D Line 11,301 +6%

Bloomberg Crude Oil % Bulls 23.0 -14.8%

CFTC Oil Large Speculative Longs 164,334 -2.0%

Put/Call .74 -15.91%

NYSE Arms .86 -11.34%

Volatility(VIX) 10.15 -16.39%

ISE Sentiment 154.0 +2.67%

AAII % Bulls 44.44 -9.56%

AAII % Bears 34.26 +16.89%

US Dollar 85.02 +.45%

CRB 290.62 -.17%

ECRI Weekly Leading Index 141.80 +1.87%

Futures Spot Prices

Crude Oil 52.99 -5.88%

Reformulated Gasoline 143.20 -4.09%

Natural Gas 6.60 +5.72%

Heating Oil 150.36 -3.92%

Gold 626.90 +3.16%

Base Metals 227.07 +1.14%

Copper 261.40 +2.99%

10-year US Treasury Yield 4.77% 2.58%

Average 30-year Mortgage Rate 6.21% +.49%

Leading Sectors

Airlines +8.42%

I-Banks +5.88%

Gaming +5.20%

Retail +4.91%

REITs +4.23%

Lagging Sectors

Networking -.27%

Oil Service -.51%

Utilities -.55

Energy -.80%

Wireless -1.47%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

Subscribe to:

Comments (Atom)