Click here for The Week Ahead by Reuters

Click here for Stocks in Focus for Monday by MarketWatch

There are some economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – Monthly Budget Statement, IDB/TIPP Economic Optimism, weekly retail sales report

Wed. – Weekly MBA Mortgage Applications, Import Price Index, Advance Retail Sales, Business Inventories, Fed’s Beige Book, weekly EIA energy inventory report

Thur. – Producer Price Index, Initial Jobless Claims, Mortgage Delinquencies

Fri. – Consumer Price Index, Empire Manufacturing, Current Account Balance, Net Long-term TIC Flows, Industrial Production, Capacity Utilization, Univ. of Mich. Consumer Confidence

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Comverse Technology(CMVT), JOS A Bank Clothiers(JOSB), Take-Two(TTWO)

Tues. – Finisar Corp.(FNSR), Lehman Brothers(LEH), Sapient Corp.(SAPE)

Wed. – Doral Financial(DRL)

Thur. – Adobe Systems(ADBE), Bear Stearns(BSC), Del Monte(DLM), Forrester Research(FORR), Freddie Mac(FRE), Goldman Sachs(GS), John Wiley(JW/A), Pier 1 Imports(PIR)

Fri. – AES Corp.(AES), Carnival Corp.(CCL), Computer Sciences(CSC), Fannie Mae(FNM), Fleetwood Enterprises(FLE), Fossil Inc.(FOSL), Intl Rectifier(IRF), Winnebago Industries(WGO)

Other events that have market-moving potential this week include:

Mon. – JPMorgan Basics & Industrials Conference, Goldman Sachs Global Healthcare Conference, Bear Stearns Tech/Communications/Internet Conference, (TXN) Mid-quarter Conference Call, Fed’s Pinalto speaking, Fed’s Moskow speaking

Tue. – JPMorgan Basics & Industrials Conference, Goldman Sachs Global Healthcare Conference, Bear Stearns Tech/Communications/Internet Conference

Wed. –

Thur. – BOJ Policy Meeting, Merrill Lynch Global Transport Conference, Bank of America Homebuilding Conference, Goldman Sachs Global Healthcare Conference, Needham Biotech/Medical Tech Conference, Thomas Weisel Alternative Energy Conference, RBC Global Mining/Materials Conference, (SYMC) Analyst Meeting, (MAT) Analyst Meeting, (GD) Analyst Meeting

Fri. – BOJ Policy Meeting

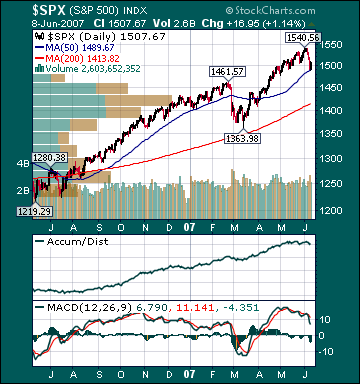

BOTTOM LINE: I expect US stocks to finish the week modestly higher on buyout speculation, lower energy prices, lower long-term rates, bargain hunting, investment manager performance anxiety, better-than-expected I-banking earnings reports and short-covering. My trading indicators are giving mostly bullish signals and the Portfolio is 100% net long heading into the week.