Weekend Headlines

Bloomberg:

- Barack Obama, who won the Iowa caucuses, leads Hillary Clinton in New Hampshire by 12 percentage points among likely voters in the Jan. 8 Democratic presidential primary, according to an American Research Group poll.

- European Central Bank President Trichet and his Group of 10 colleagues may signal today that their efforts to calm money markets are making headway.

- Venezuelan President Hugo Chavez said he’ll have to slow his plan to implement “21st-century socialism” after voters rejected his proposal to overhaul the constitution.

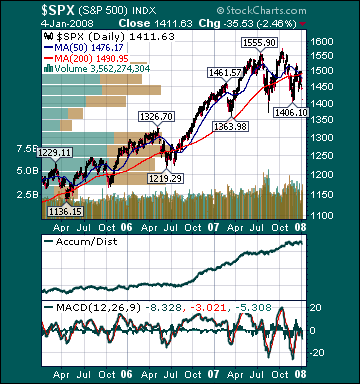

- Citigroup’s(C) Tobias Levkovich and Goldman Sachs’(GS) Abby Joseph Cohen see 14% advance for S&P 500 this year.

- President Bush said he will press for progress in the Israeli-Palestinian peace process during his trip to the Middle East next week, and he will reassure Arab allies of US support.

- OPEC is supplying the international market with enough crude and can’t be blamed for record prices, the group’s new president, Chakib Khelil, said. OPEC seems happy with prices as they are,” said John Hall, managing director of UK-based John Hall Assoc. energy consultants. “Otherwise, it would be thinking of increasing output to help the global economy and to meet rising demand from China and India.

- Federal Reserve Vice Chairman Donald Kohn said the central bank has increased its communication on policy views to the public in the wake of the financial-market “turmoil” that began in August.

- Ford Motor Co.(F) plans to introduce a new, more fuel-efficient engine as the company tries to halt a sales slide in its home market.

- The yen fell against all 16 of the world’s most-active currencies as Japanese investors put money into funds seeking higher yields overseas.

Wall Street Journal:

- LG Develops Way to Transmit Digital TV Signals to Gadgets.

- Clinton Camp’s Challenge: How Hard to Hit Obama?

TradingMarkets.com:

- Sigma(SIGM) Media Processor to Power Sharp’s Aquos Blu-ray Disc Players, Recorders.

NY Times:

- President Bush’s 2003 plan to help the hardest-hit nations in Africa and the Caribbean cope with the AIDS epidemic has blunted the disease’s spread, citing the administration, doctors and even his political opponents.

- Many US workers use computers to watch news and entertainment clips from Web sites as CNN.com and Google’s YouTube as lunch-break diversions, and companies are responding to those viewers.

- Clorox Co.(CLX) will use its purchase of lip balm and soap maker Burt’s Bees to create environmentally friendly products and business practices.

- Yale’s Cash Sets Agenda for Urban Infrastructure.

- Pessimism about globalization seems downright un-American. It is also fundamentally illogical.

- Money managers are betting on what has often been a riskier segment of the market: growth stocks.

CNBC.com:

- The Consumer Electronics Show, the industry’s largest exposition in the US, kicked off on Sunday with a flurry of announcements by such giants as Sony, Sharp, Panasonic and Toshiba. Here are some of the highlights.

- S&P’s 40 PowerPicks Stocks for 2008.

- Warner Brothers: Going All The Way With Blu-ray.

MarketWatch.com:

- Declines right after New Year’s don’t necessarily spell big trouble.

- Some unexpected winners and losers will likely emerge from the Beijing games this summer in a corporate sense, that is if the experience of previous nations that have hosted the Olympics is any indication.

- ‘Digital lifestyle’ still focus for electronics makers. CES set for more ‘evolution than revolution,” but Apple(AAPL) again casts a shadow.

- The electrical equipment industry is surging.

TheStreet.com:

- Potential Short-Squeeze Plays for the New Year.

- The Mortgage Crisis Is One of Confidence.

SmartMoney:

- Fundamentals Favor Another Good Year for Tech.

Business Week:

- Apple(AAPL): More Than a Pretty Face.

- Stars Align for Renewable Energy. Around the world, investment in renewable energy projects is skyrocketing.

- Washington state bank robberies dropped to a 20-year low last year after companies such as Bank of America(BAC) implemented FBI suggestions about more actively greeting customers.

- Solar power systems arrive in more stores.

- Kids need financial lessons early and often, parents tell us.

- Q&A: Intel CEO sets sights on consumer electronics.

- Language group pick’s ‘subprime’ as Word of the Year.

CNNMoney.com:

- PlayStation 3 is big holiday hit. Sony said 1.2 million of its PS3 game consoles were sold in North America during the holiday shopping season, boosting the strength of the electronics giant’s Blu-ray next generation video format.

- GM(GM) touts driverless cars.

- Gadgetmania. A look at some of the technology that will be unveiled at the Consumer Electronics Show in Las Vegas this week.

Forbes.com:

- State oil giant Saudi Aramco is on track to hit its oil production capacity target of 12 million barrels per day in 2009, an Aramco official said. Aramco aims to increase the recovery rate of oil from its fields to 70% from 50% through the use of advanced technology. That would help add around another 80 billion barrels to recoverable reserves in the next 20 years. Total discovered oil resources – including proven, produced and oil in the ground currently seen as unrecoverable – stands at 722 billion barrels. The kingdom plans to raise this figure to 900 billion barrels through exploration over the next 20 years.

Reuters:

- Saudi Arabia says market determines oil prices.

ByteandSwitch:

- Border security, gaming, and cities’ anti-terrorist plans will all swallow storage this year.

Financial Times:

- Private equity interest in financial services, particularly in the mid-market, looks set to continue in 2008.

AFP:

- A team of officers from

Nikkei:

-.Sony Computer Entertainment Inc. will team up with Skype Technologies SA to add an Internet phone service to its PlayStation Portable gaming device.

Yomiuri:

-

Weekend Recommendations

Barron's:

- Made positive comments on (PLD).

Citigroup:

- Smartphones will increasingly displace voice-centric handsets and should grow 50-60% over the next few years compared to Citigroup’s Global Handset forecast of 14% in 07, 11% in 08 and 9% in 09. We expect smarphones to capture 22% of 2009 market versus 8.5% in 06. We view messaging, WiFi, and GPS as key enterprise drivers and converged functionality and broadband access as consumer drivers. (RIMM) will benefit from Prosumer adoption, intl. expansion, and software/services revenues, driving revenue/EPS growth of 50% with 31% operating margins. RIM can grow units at 50%+ through 09 and still be 2% of total market, 7% of smartphones. (AAPL)’s iPhone is the style setter; we expect 10M unit in CY08 helping to drive 25-30% EPS growth through 2010. (NOK) is a key beneficiary with 50% share in smartphones compared to 40% overall share; should benefit from high smartphone growth. Segment dominance, higher ASP/gross margins will drive continued EPS growth. (TXN) should see above seasonal 2H08 growth as handset share loss hands off to (MOT) and (SNE)-(ERIC) ramp. (ALTR) has potential to beat consensus as comms-related demand shows signs of bottoming. (IFX) should see a recovery in Comm’s unit profitability driven by wins at Tier 1 OEMs. (BRCM) will benefit from increasing handset connectivity. Applications processors and increasing NAND used in smartphones should benefit (MRVL) and (SNDK), respectively. (MSFT) is challenged by carrier/OEM need to minimize costs associated with OS layer, but will still double shipments in 08 to 20M units. Handsets are potentially game changing opportunity for (WIND), but faces uncertainty on monetization/timing.

- Maintain Buy on (SNDK), target $57.

- Reiterated Buy on (CBEY), target $53.

- Reiterated Buy on (GLBC), target $25.

- Reiterated Buy on (EQIX), target $139.

- With buyers still on the sidelines given macro demand concerns major semiconductor equipment stocks like (AMAT), (KLAC), (LRCX), (NVLS), (TER) as a group are now back to being as inexpensive relative to the S&P 500 as in 2001 and have only ever traded at a larger discount to the market in the fall of 1998.

Night Trading

Asian indices are -2.5% to -.50% on avg.

S&P 500 futures +.28%.

NASDAQ 100 futures +.25%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (SCHN)/1.07

- (LWSN)/.07

- (BLUD)/.23

Upcoming Splits

- None of note

Economic Data

- None of note

Other Potential Market Movers

- The Consumer Electronics Show, JPMorgan Healthcare Conference and JPMorgan Tech Forum could also impact trading today.