Style Outperformer:

Large-cap Growth (+4.71%)

Sector Outperformers:

Steel (+12.15%), Construction (+11.57%) and Computer Hardware (+6.75%)

Stocks Rising on Unusual Volume:

CHK, FCX, CLF, CRK, BAC, HES, SU, KTC, CHU, JPM, EHTH, NETL, THOR, SNDA, AFAM, STRL, PSMT, ASTE, CREE, EZCH, ITRI, AMSC, BIDU, INDM, FSTR, QSII, BJRI, SXCI, INSU, PKB, PUW, KCE, VIV, MLM, WF, ASI, RTP and XOP

Stocks With Unusual Call Option Activity:

1) ALL 2) PWR 3) MTW 4) GNW 5) CEPH

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, December 08, 2008

Bull Radar

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

Exchange Volume vs. Average

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Real-Time Intraday Quote/Chart

Dow Jones Hedge Fund Indexes

Sunday, December 07, 2008

Monday Watch

Weekend Headlines

Bloomberg:

- The Markit iTraxx

- Stocks have fallen so far that 2,267 companies around the globe are offering profits to investors for free. That’s eight times as many as at the end of the last bear market, when shares rose 115% over the next year. Companies in the MSCI World Index trade for an average $1.17 per dollar of net assets, the lowest since at least 1995, and 39% sell at a discount to shareholder equity, data compiled by Bloomberg show. The MSCI World’s 47% plummet this year is the biggest since the gauge started in 1970. The slump left prices in the global measure at 1.17 times companies’ so-called book value on Nov. 20, the lowest on record, data compiled by Bloomberg show. Businesses with reserves will be cushioned from insolvency and may even benefit from deflation because buying power and the value of dividends increases as prices retreat, said Arlene Rockefeller, chief investment officer for global equities at State Street Global Advisors, which overseas $1.7 trillion. Yields on three-month Treasury bills fell to .01% last week as investors paid a premium for the safest, most liquid assets. The level was the lowest since 1940, according to monthly figures compiled by the Fed.

Wall Street Journal:

MarketWatch.com:

NY Times:

IBD:

- Masimo(MASI): Biomed Firm Has High Hopes For Real-Time Bloodless Blood Test.

The Tennessean:

- Lower rates spark wave of refinancing. Mortgage bankers find selves busy as people rush to save.

Forbes.com:

TheStreet.com:

Imweekly.com:

ZDNet:

ByteandSwitch:

NY Post:

CNNMoney.com:

IDDmagazine.com:

CalculatedRisk:

AP:

- OPEC President Chakib Khelil says financial markets should prepare for a surprise announcement on oil production cuts when the cartel meets later this month. Khelil said a consensus had formed among the 13-member group for a significant reduction in output. OPEC meets next in

Reuters:

Financial Times:

Telegraph:

Daily Mail:

Der Spiegel:

- Deutsche Boerse AG is holding talks with NYSE Euronext(NYX) on a merger. The enlarged company would be led by Deutsche Boerse CEO Reto Francioni and would have eight board members and an 18-member directorate. The new company would control share trading from

-

Folha de S. Paulo:

-

livemint.com:

Nikkei:

- Lending by the Bank of Tokyo-Mitsubishi UFJ, Mizuho Bank and four other leading Japanese banks had the highest growth in more than 17 years. The loan balance rose by 4.7% from a year earlier to $2.06 trillion at the end of November.

Economic Observer:

- Mazda Motor Corp. has abandoned its 2010 sales target of 300,000 cars in

Weekend Recommendations

Barron's:

- Made positive comments on (CBST), (JCG), (TIF), (ZRAN), (CCK), (OI), (CME), (LUK), (NYX), (AVAV) and (LMNX).

Citigroup:

- Reiterated Buy on (GOOG), target $450. Unprecedented Macro trumps all. But Long-Term Thesis intact. Excluding FX, GOOG is likely a mid-teens revenue grower in ’09, during the most severe economic conditions most of us have ever experienced. What does that say about GOOG’s revenue growth post the recession. And then layer in material new revenue opportunities in

- Most retailers indicated strong sales on Black Friday, however traffic and sales deteriorated during the weekend following Black Friday and it appears December is off to a slow start. While traffic may remain weak in first 1-3 weeks of December, we expect an acceleration in the last 1-2 weeks of the month to drive improving sales for December vs. November. We believe consumers will likely remain resilient when there is a purpose at hand. We expect Children’s retailers to show the greatest resilience. Additionally, e-Commerce sales from Thanksgiving, Black Friday, and Cyber Monday have been pushed into December(revenue recognized upon customer receipt) and should benefit total sales. Best December comp results expected at (HOTT), (PLCE), (ROST), (TJX) and (ARO).

Night Trading

Asian indices are +1.0% to +5.0% on avg.

S&P 500 futures +1.64%.

NASDAQ 100 futures +1.70%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Upgrades/Downgrades

Rasmussen Business/Economy Polling

Earnings of Note

Company/Estimate

- (NSM)/.22

- (HRB)/-.40

Upcoming Splits

- None of note

Economic Releases

- None of note

Other Potential Market Movers

- The (MET) investor day, Illinois Tool Works analyst meeting, IBC Life Sciences Biopharma Manufacturing and Development Summit and UBS Media/Communications Conference could also impact trading today.

BOTTOM LINE: Asian indices are sharply higher, boosted by technology and financial shares in the region. I expect US stocks to open higher and to maintain gains into the afternoon. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for a weekly market preview by MarketWatch.

Click here for stocks in focus for Monday by MarketWatch.

There are some economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – Weekly retail sales reports, IBD/TIPP Economic Optimism Index, Pending Home Sales

Wed. – Weekly EIA energy inventory data, weekly MBA mortgage applications report, Wholesale Inventories, Monthly Budget Statement

Thur. – Trade Balance, Import Price Index, Initial Jobless Claims

Fri. – Producer Price Index, Advance Retail Sales,

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – National Semi(NSM), H&R Block(HRB)

Tues. – Autozone(AZO), Toro Co.(TTC), John Wiley(JW/A), Cooper Cos(COO), Kroger

Wed. – Korn/Ferry(KFY)

Thur. – Ciena Corp.(CIEN), Martek Biosciences(MATK), Costco Wholesale(COST)

Fri. – None of note

Other events that have market-moving potential this week include:

Mon. – (MET) investor day, Illinois Tool Works analyst meeting, IBC Life Sciences Biopharma Manufacturing and Development Summit, UBS Media/Communications Conference

Tue. – Campbell Soup analyst meeting, UMH Properties investor forum, Sonoco Products analyst meeting, Delta Air analyst meeting, ArvinMeritor analyst day, Agilent analyst meeting, IBC Life Sciences Biopharma Manufacturing and Development Summiut, Merrill Lynch Small-cap investor forum, UBS Media/Communications Conference, Barclays Tech Conference

Wed. – Owens & Minor investor day, Parker Hannifin analyst meeting, VistaPrint analyst meeting, Principal Financial Group analyst meeting, Yum! Brands analyst conference, UBS Media/Communications Conference, RBC Healthcare Conference, Goldman Sachs Financial Services Conference, Barclays Tech Conference

Thur. – Belden Analyst Day, Dreamworks Animation analyst day, Danaher analyst meeting, Regency Centers analyst day, United Technologies investor day, Procter & Gamble analyst meeting, Barclays Tech Conference, RBC Healthcare Conference, Goldman Sachs Financial Services Conference, Keybanc Engineering/Construction Conference

Fri. – Harsco Corporation analyst meeting

Saturday, December 06, 2008

Friday, December 05, 2008

Weekly Scoreboard*

Indices

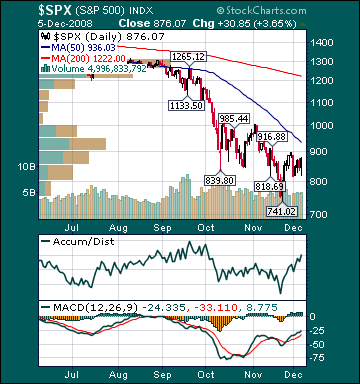

S&P 500 876.07 -2.25%

DJIA 8,635.42 -2.19%

NASDAQ 1,509.31 -1.71%

Russell 2000 461.09 -2.55%

Wilshire 5000 8,708.95 -2.43%

Russell 1000 Growth 353.43 -3.26%

Russell 1000 Value 474.73 -1.52%

Morgan Stanley Consumer 536.69 -1.66%

Morgan Stanley Cyclical 456.18 -3.03%

Morgan Stanley Technology 326.47 -1.52%

Transports 3,433.33 -2.25%

Utilities 361.44 -5.44%

MSCI Emerging Markets 21.94 -3.94%

Sentiment/Internals

NYSE Cumulative A/D Line 15,952 unch.

Bloomberg New Highs-Lows Index -802 -230.04%

Bloomberg Crude Oil % Bulls 23.0 -27.2%

CFTC Oil Large Speculative Longs 180,960 +.91%

Total Put/Call .92 -36.55%

OEX Put/Call 1.59 -24.64%

ISE Sentiment 112.0 -18.25%

NYSE Arms .40 -60.0%

Volatility(VIX) 59.93 +8.41%

G7 Currency Volatility (VXY) 20.0 +1.57%

Smart Money Flow Index 6,890.59 +2.29%

AAII % Bulls 26.67 -14.66%

AAII % Bears 47.78 +6.44%

Futures Spot Prices

Crude Oil 40.81 -25.84%

Reformulated Gasoline 90.12 -26.28%

Natural Gas 5.74 -11.11%

Heating Oil 142.65 -18.39%

Gold 752.20 -8.16%

Base Metals 104.03 -13.13%

Copper 137.35 -17.51%

Agriculture 246.85 -13.58%

Economy

10-year US Treasury Yield 2.71% -21 basis points

10-year TIPS Spread .44% +8 basis points

TED Spread 2.18 unch.

N. Amer. Investment Grade Credit Default Swap Index 285.99 +19.76%

Emerging Markets Credit Default Swap Index 814.21 +11.91%

Citi US Economic Surprise Index -140.60 -19.56%

Fed Fund Futures imply 78.0% chance of 75 basis point cut, 22.0% chance of 50 basis point cut on 12/16

Iraqi 2028 Govt Bonds 41.0 -8.89%

4-Wk MA of Jobless Claims 524,500 +1.2%

Average 30-year Mortgage Rate 5.53% -44 basis points

Weekly Mortgage Applications 857,700 +112.09%

Weekly Retail Sales -.9%

Nationwide Gas $1.77/gallon -.07/gallon

US Heating Demand Next 7 Days 7.0% above normal

ECRI Weekly Leading Economic Index 109.90 +2.81%

US Dollar Index 87.12 +70%

Baltic Dry Index 663 -7.27%

CRB Index 208.60 -13.87%

Best Performing Style

Mid-cap Value -1.49%

Worst Performing Style

Mid-cap Growth -3.70%

Leading Sectors

Homebuilders +9.59%

Airlines +9.40%

Restaurants +6.64%

Retail +4.66%

Insurance +4.07%

Lagging Sectors

Steel -7.78%

Gold -11.10%

Energy -12.94%

Coal -20.62%

Oil Service -22.54%