Bloomberg:

- 'Grexit' Is Back: A Greek Exit From the Euro Raises Fears of Fiscal Contagion. (video) Mario Draghi’s July 2012 pledge to do “whatever it takes” to keep the euro intact has kept speculators at bay for almost three years. Bond yields fell from Dublin to Athens, giving governments room to cut budgets and start revamping their economies. While it’s not been a period of robust growth, the talk of crisis has abated and even Greece’s six-year recession ended. What’s not changed is the risk entailed by Greece’s potential departure from the 19-nation currency bloc. What Citigroup Inc.’s Ebrahim Rahbari termed “Grexit” is back in play and it remains the worst possible

outcome in the view of economists at Berenberg Bank and ING-DiBa AG.

- Samaras Faces Greeks Skeptical of His Euro-Exit Warnings.

“It’s all propaganda meant to scare people,” Moschou said on Jan. 2 as

she served Greek wine and brandy to customers at Vrettos, a 106-year-old

distillery tucked away in the old town of Athens below the Acropolis.

“I don’t believe it.”

- Ruble Starts New Year With Plunge as Oil Declines to 2009 Low. The ruble picked up right where it left off

last year, weakening as oil prices extended declines. Russia’s

currency slid 7.2 percent to 60.37 per dollar at 8:06 p.m. in Moscow, in

its first day of trading of 2015 after a 46 percent decline last year.

Government bonds fell, with the five-year yield climbing 16 basis points

to 15.63 percent.

- EU’s Fractured Politics Is Biggest 2015 Risk, Eurasia Group Says. The

success of anti-European Union parties

and fraying bonds among EU nations are the biggest risks facing

investors in 2015, Eurasia Group said. The stand-off over Ukraine

between Russia and the U.S. and its European allies, China’s slowing

economy and Islamic State’s designs outside of its Iraqi and Syrian

bases are among the New

York-based Eurasia Group’s leading threats for this year,

according to its annual Top Risks report released today.

- German Inflation, Weakest Since 2009, Raises Pressure on ECB. German consumer prices are close to stagnating, adding to signs that

euro-area inflation is turning negative and potentially bolstering the case for more European Central Bank stimulus.

Inflation in the region’s largest economy slowed to 0.1 percent in

December, the Federal Statistics office said today. That’s the lowest

rate since October 2009 and below the median forecast of 0.2 percent in a Bloomberg survey of economists.

- Get Used to Higher Stock Volatility, Deutsche Bank Says: Options. While unanimity is the buzzword for

strategists forecasting gains in the U.S. stock market this

year, another consensus is developing among options analysts. Deutsche Bank AG became at least the third major bank

telling equity derivatives clients to prepare for more frequent

bouts of turbulence in 2015 as the Standard & Poor’s 500 Index (VIX)’s bull market approaches its seventh year. The opinion came before the benchmark gauge plunged as much as 1.9 percent today and the

Chicago Board Options Volatility Index increased for the fifth

time in six days.

- Aurelius Pushes Petrobras Debt Claim as Default Odds Soar.

Aurelius Capital Management LP’s bid to declare Petroleo Brasileiro SA

(PETR4) in default underscores just how far the state-controlled oil

producer has fallen in the eyes of

bond investors. The cost to protect against a Petrobras non-payment for one

year has soared to the highest since the aftermath of the

financial crisis, after the New York-based hedge fund said in a

letter obtained by Bloomberg News last week that the company had

violated debt contracts by failing to report third-quarter

results.

- Emerging Stocks Decline With Currencies on Greece; Ruble Weakens.

Emerging-market stocks fell for a third day

and currencies weakened as speculation that Greece may drop the euro

reduced demand for riskier assets. A gauge of 20 developing-nation

currencies slid 0.6 percent to a 12-year low. Sasol Ltd. (SOL), world’s

biggest maker of motor fuel-from-coal, dropped the most in a month in

Johanesberg. Petroleo Brasileiro SA paced a slump in Brazilian stocks.

Dubai’s DFM General Index led losses in the Gulf region as Brent crude

touched the lowest level since May 2009. The ruble tumbled 6.2 percent.

Turkish

bonds and stocks climbed after a report showed the nation’s

inflation rate dropped more than economists forecast.

The MSCI Emerging Market Index slid 1.3 percent to 941.35

at 11:05 a.m. in New York.

- Europe Stocks Slide Most in More Than Three Years on Oil, Greece.

A slump in energy shares and concern that Greece may leave the European

currency union sent euro-area stocks to their biggest slump in more

than three years. The Euro Stoxx 50 Index slid 3.7 percent to

3,023.14, and the Stoxx Europe 600 Index dropped 2.2 percent to 333.99

at the close of trading. Greek lenders posted some of the biggest losses on the

Stoxx 600, as the ASE slid 5.6 percent to its lowest close since

November 2012. Piraeus Bank SA slumped 5.2 percent, National

Bank of Greece SA dropped 7.4 percent, Alpha Bank AE slid 5.7

percent and Eurobank Ergasias SA declined 6.9 percent.

- WTI Falls Below $50 a Barrel First Time in 5 1/2 Years.

WTI slid as much as 5.2 percent in New York. Brent fell below $55 in

London for the first time since May 2009. Russia’s output rose to a

post-Soviet high while Iraq, the second-largest producer in OPEC, plans

to boost crude exports to a record this month.

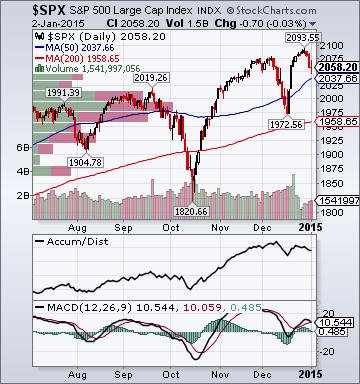

- Bears go missing in S&P 500 forecasts.

Two years of stocks going straight up have chased just about every

skeptic from the U.S. market. Among professional forecasters on Wall

Street, none

tracked by Bloomberg sees a retreat in 2015, with the average estimate

calling for an 8.1 percent advance. At the same time, buyers of

exchange-traded funds ended an obsession with bonds last quarter,

sending four times as much cash to U.S. shares. Pessimism, the constant companion of a bull market

poised to become the second-longest since the Kennedy administration, is

suddenly nowhere to be found after the Standard & Poor’s 500 Index

climbed 44 percent since 2012. While strategists are predicting a rally

that would rank as the smallest in four years, the threat of higher

interest rates and weakening prospects for global growth aren’t creating

any full-blown bears after the U.S. beat all but four of the largest

developed markets in 2014.

Wall Street Journal:

- France and Germany Push Athens on Bailout Commitments. French President Francois Hollande Raises Possibility of Greece Leaving Eurozone. France and Germany on Monday stepped up pressure on Greece to meet

the terms of its two international bailouts, returning to the

brinkmanship of the eurozone debt crisis as the shared currency dropped

to a nine-year low.

MarketWatch.com:

CNBC:

ZeroHedge:

Business Insider:

Telegraph:

Style Underperformer:

Sector Underperformers:

- 1) Oil Tankers -6.76% 2) Coal -5.93% 3) Energy -4.85%

Stocks Falling on Unusual Volume:

- IGOV, CHRW, LOCK, NOC, USM, AVX, VNCE, ARMK, SSL, FLS, E, WTW, TOT, CIB, PEO, APOG, BTI, ESL, PHG, SNY, BBL, GDV, BP, NNI, NRX, AB, SEM, CAT, WTW and SCHN

Stocks With Unusual Put Option Activity:

- 1) BBY 2) XLF 3) EWG 4) KRE 5) DO

Stocks With Most Negative News Mentions:

- 1) CAT 2) MS 3) AKAM 4) COP 5) JPM

Charts:

Style Outperformer:

Sector Outperformers:

- 1) REITs +.17% 2) Gold & Silver -.41% 3) Biotech -.43%

Stocks Rising on Unusual Volume:

- CNAT, CEMP, ISIS, KITE, CMCM, LOCO, ICPT and SGMS

Stocks With Unusual Call Option Activity:

- 1) BBBY 2) CSX 3) KO 4) OCR 5) ISIS

Stocks With Most Positive News Mentions:

- 1) CME 2) GPS 3) ZMH 4) REGN 5) CEMP

Charts:

Weekend Headlines

Bloomberg:

- Samaras Warns of Euro Exit Risk as Greek Campaign Starts.

Greece’s political parties embarked on a

flash campaign for elections in less than three weeks that Prime

Minister Antonis Samaras said will determine the fate of the

country’s membership in the euro currency area. Samaras used a Jan. 2

speech to warn that victory for the

main opposition Syriza party would cause default and Greece’s

exit from the 19-member euro region, while Syriza leader Alexis Tsipras

said his party would end German-led austerity. Der Spiegel magazine

reported Chancellor Angela Merkel is ready to accept a Greek exit, a

development Berlin sees as inevitable and

manageable if Syriza wins, as polls suggest.

- China’s Cities Face Judgment Day on Debts as Costs Soar.

China’s local government bond issuers face judgment day as authorities

in the world’s second-largest economy decide which debt they will or

won’t support. Borrowing costs soared by a record amount last month

before today’s deadline for classifying liabilities, on speculation

some local government financing vehicles will lose government support

after the finance ministry starts reviewing regional authorities’ debt

reports. Yield premiums on one-year AA notes, the most common ranking

for such issuers, jumped a record 98 basis points in December. Premier

Li Keqiang has stepped up curbs on local borrowings

just as LGFVs prepare to repay 558.7 billion yuan ($89.7

billion) of bonds this year amid economic growth that’s set for

the slowest pace in more than two decades.

- Dubai Shares Lead Gulf Declines as Oil Rout Extends Into 2015. Dubai and Abu Dhabi stocks fell on

speculation sliding oil prices will curb revenue for a region that accounts for about a third of the world’s crude reserves. Dubai’s

DFM General Index (DFMGI) dropped 2.3 percent to close at 3,689.06, its

lowest in more than two weeks, as markets reopened after the

end-of-year holidays. Emirates NBD PJSC (EMIRATES) and Dubai Islamic Bank PJSC (DIB) led Dubai’s drop. The

ADX General Index (ADSMI) in Abu Dhabi, home to about 6 percent of the

world’s proven oil reserves, lost 1.7 percent while Qatar’s gauge

declined 0.5 percent. Saudi Arabian stocks fell 0.6 percent in Riyadh.

- Euro Extends Slide on ECB Outlook; Asian Stocks, Oil Slip.

The euro weakened to an almost nine-year

low, Asian stocks fell and U.S. index futures dropped amid

concern Greece will exit the currency union. Oil slumped to its

lowest level since 2009, while silver climbed.

The euro depreciated 0.4 percent to $1.1957 at 11:01 a.m.

in Tokyo, after touching its weakest level since March 2006. The dollar

gained against 14 of its 16 major peers, while the yen advanced. The MSCI Asia Pacific Index (MXAP) declined 0.8 percent.

- Euro Drops to Lowest Since March 2006 as ECB Splitting From Fed.

The euro slumped to the weakest in almost nine years after the European

Central Bank signaled it will embark on large-scale government-bond

purchases as the Federal Reserve moves closer to raising interest rates.

The 19-nation common currency extended declines today after falling for

a third week as ECB President Mario Draghi said he can’t rule out

deflation in the euro area. The greenback strengthened versus all 10

major developed-market peers. The Australian dollar fell to a 5 1/2 year

low as the yield on the

nation’s 15-year bonds dropped to an all-time low.

- Copper Trades Near Four-Year Low on Weaker China Demand Concern.

Copper for delivery in three months on the London Metal Exchange slid

0.1 percent to $6,250 a metric ton at 10:25 a.m. in Shanghai. Prices fell 0.7 percent to $6,255 a ton on Jan. 2, the lowest since June 2010.

The metal dropped 14 percent in 2014, the biggest annual loss in three

years. In New York, copper futures for March declined 0.2 percent to

$2.813 a pound. The March contract on the Shanghai Futures Exchange

dropped 1.2 percent to 45,250 yuan ($7,276) a ton.

- Mester Says Pace of Tightening More Important Than Liftoff Date.

Federal Reserve Bank of Cleveland President

Loretta Mester said that while interest rates could rise in the first

half of this year, the pace of tightening is more important than the

date of the initial increase. “In some sense, when exactly liftoff is

-- a meeting here or a meeting there -- is probably not the right

question,” she said in an interview in Boston. Mester, who doesn’t vote

on policy this year, said she expects the benchmark federal funds rate

to rise to 3.75 percent -- the level that fed officials forecast for the

longer run -- over the next three years.

- New York City Police Turn Backs on Mayor at Second Funeral.

Police officers again protested against New York Mayor Bill de Blasio

by turning their backs as he paid tribute to slain cop Wenjian Liu as a

man who represented “the very best” of New York City, at a funeral

attended by thousands

of mourners.

Wall Street Journal:

- CFPB Sets Sights on Payday Loans. U.S. officials are taking their first crack at writing rules for payday

loans, responding to concerns that the short-term, high-rate debt can

trap consumers in a cycle of borrowing they can’t afford.

Fox News:

Telegraph:

Welt:

- Merkel Adviser Bofinger Says Greek Exit Risk to Euro Area. Greek

exit from euro area would mean "very high risk" for stability of

currency union, citing Peter Bofinger, an economic adviser to German

Chancellor Angela Merkel, as saying in an interview. While the situation

in Greece isn't comparable to that in other states, an exit would

result in a situation that would be difficult to manage, Bofinger says.

Estado:

- Brazil Vehicle Sales Drop 7.1% in 2014, Worst in 12 Years.

Night Trading

- Asian indices are -.5% to +.5% on average.

- Asia Ex-Japan Investment Grade CDS Index 109.0 unch.

- Asia Pacific Sovereign CDS Index 68.25 +1.0 basis point.

- NASDAQ 100 futures +.11%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

Afternoon:

- Wards Total Vehicle Sales for December are estimated to fall to 16.9M versus 17.08M in November.

Upcoming Splits

Other Potential Market Movers

- The

China HSBC PMI, Australia Trade Balance report, RBC Consumer Outlook

Index for January, ISM New York for December, (F) Dec. sales conference

call and the Citi Internet/Media/Telecom conference could

also impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by real estate and financial shares in the region. I expect US stocks to open modestly higher and to weaken into the afternoon, finishing modestly lower. The Portfolio is 25% net long heading into the week.

Week Ahead by Bloomberg.

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on global

growth worries, rising European/Emerging Markets/US High-Yield debt

angst, earnings concerns, profit-taking, technical selling and yen

strength. My intermediate-term trading indicators are giving neutral

signals and the Portfolio is 25% net long heading into the week.