Week Ahead by Bloomberg.

Wall St. Week Ahead by Reuters.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on Russia/Ukraine tensions, global

growth fears, rising European/Emerging Markets debt angst,

profit-taking, yen strength and technical selling. My intermediate-term

trading indicators are giving

neutral signals and the Portfolio is 50% net long heading into the week.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, February 16, 2015

Friday, February 13, 2015

Weekly Scoreboard*

Indices

ETFs

Stocks

*5-Day Change

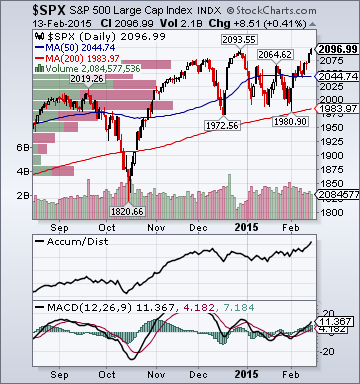

- S&P 500 2,096.99 +2.02%

- DJIA 18,019.35 +1.09%

- NASDAQ 4,893.84 +3.15%

- Russell 2000 1,223.13 +1.47%

- S&P 500 High Beta 34.82 +3.48%

- Goldman 50 Most Shorted 139.01 +1.73%

- Wilshire 5000 21,875.95 +1.99%

- Russell 1000 Growth 995.90 +2.50%

- Russell 1000 Value 1,034.93 +1.54%

- S&P 500 Consumer Staples 509.04 +.96%

- Solactive US Cyclical 142.83 +2.97%

- Morgan Stanley Technology 1,042.45 +3.79%

- Transports 9,034.06 +1.14%

- Utilities 593.83 -3.24%

- Bloomberg European Bank/Financial Services 108.25 +1.90%

- MSCI Emerging Markets 40.43 +.77%

- HFRX Equity Hedge 1,182.32 +.43%

- HFRX Equity Market Neutral 986.62 -.31%

- NYSE Cumulative A/D Line 235,569 +.17%

- Bloomberg New Highs-Lows Index 283 +214

- Bloomberg Crude Oil % Bulls 20.51 -34.4%

- CFTC Oil Net Speculative Position 271,527 -.25%

- CFTC Oil Total Open Interest 1,717,593 -.23%

- Total Put/Call .96 -6.80%

- OEX Put/Call 1.11 -58.89%

- ISE Sentiment 100.0 +58.73%

- NYSE Arms .87 +19.17%

- Volatility(VIX) 14.69 -15.04%

- S&P 500 Implied Correlation 63.97 -6.24%

- G7 Currency Volatility (VXY) 10.82 +3.05%

- Emerging Markets Currency Volatility (EM-VXY) 10.79 -92%

- Smart Money Flow Index 17,293.22 +.21%

- ICI Money Mkt Mutual Fund Assets $2.690 Trillion +.16%

- ICI US Equity Weekly Net New Cash Flow +$3.534 Billion

- AAII % Bulls 40.0 +12.7%

- AAII % Bears 20.3 -37.3%

- CRB Index 229.19 +1.93%

- Crude Oil 52.66 +.57%

- Reformulated Gasoline 162.30 +3.69%

- Natural Gas 2.80 +8.91%

- Heating Oil 197.14 +6.69%

- Gold 1,229.20 -.32%

- Bloomberg Base Metals Index 171.85 -.62%

- Copper 260.15 +.54%

- US No. 1 Heavy Melt Scrap Steel 324.0 USD/Ton unch.

- China Iron Ore Spot 63.19 USD/Ton +1.12%

- Lumber 312.20 -1.20%

- UBS-Bloomberg Agriculture 1,184.93 +.84%

- ECRI Weekly Leading Economic Index Growth Rate -4.3% -30 basis points

- Philly Fed ADS Real-Time Business Conditions Index .2619 +3.8%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 122.0 +.05%

- Citi US Economic Surprise Index -37.20 -11.9 points

- Citi Eurozone Economic Surprise Index 43.70 +18.9 points

- Citi Emerging Markets Economic Surprise Index -8.80 -3.5 points

- Fed Fund Futures imply 52.0% chance of no change, 48.0% chance of 25 basis point cut on 3/18

- US Dollar Index 94.19 -.50%

- Euro/Yen Carry Return Index 141.32 +.38%

- Yield Curve 141.0 +10.0 basis points

- 10-Year US Treasury Yield 2.05% +9.0 basis points

- Federal Reserve's Balance Sheet $4.463 Trillion +.04%

- U.S. Sovereign Debt Credit Default Swap 17.18 -5.46%

- Illinois Municipal Debt Credit Default Swap 190.0 -1.73%

- Western Europe Sovereign Debt Credit Default Swap Index 26.44 +5.99%

- Asia Pacific Sovereign Debt Credit Default Swap Index 67.90 +1.35%

- Emerging Markets Sovereign Debt CDS Index 319.52 -2.44%

- Israel Sovereign Debt Credit Default Swap 77.0 +2.25%

- Iraq Sovereign Debt Credit Default Swap 375.88 +8.56%

- Russia Sovereign Debt Credit Default Swap 473.42 -11.20%

- iBoxx Offshore RMB China Corporates High Yield Index 113.32 -.28%

- 10-Year TIPS Spread 1.70% -2.0 basis points

- TED Spread 25.25 +.75 basis point

- 2-Year Swap Spread 26.75 unch.

- 3-Month EUR/USD Cross-Currency Basis Swap -20.75 -1.5 basis points

- N. America Investment Grade Credit Default Swap Index 64.68 -.83%

- America Energy Sector High-Yield Credit Default Swap Index 710.0 -3.07%

- European Financial Sector Credit Default Swap Index 63.94 +1.64%

- Emerging Markets Credit Default Swap Index 367.24 -2.74%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 90.0 -1.5 basis points

- M1 Money Supply $2.986 Trillion unch.

- Commercial Paper Outstanding 994.90 +.60%

- 4-Week Moving Average of Jobless Claims 289,750 -3,000

- Continuing Claims Unemployment Rate 1.8% unch.

- Average 30-Year Mortgage Rate 3.69% +10 basis points

- Weekly Mortgage Applications 501.80 -8.96%

- Bloomberg Consumer Comfort 44.3 -1.2 points

- Weekly Retail Sales +2.10% -130 basis points

- Nationwide Gas $2.24/gallon +.07/gallon

- Baltic Dry Index 540.0 -3.40%

- China (Export) Containerized Freight Index 1,078.69 +1.22%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 35.0 unch.

- Rail Freight Carloads 237,915 -4.80%

- Small-Cap Value +3.8%

- Mid-Cap Value +2.6%

- Oil Service +8.4%

- I-Banks +7.9%

- Steel +7.3%

- Banks +6.9%

- Homebuilders +6.4%

- REITs -1.5%

- Education -1.6%

- Biotech -1.7%

- Gold & Silver -3.1%

- Utilities -3.7%

- PFNX, CBM, XLS, SCOR, OWW, MLM, TRIP, INTL, CHRS, QLYS, MTSI, MOH, AKAM, NSP, HRS, RLD, CR, TMH, EIGI, FWRD, VSAT, ORA, SKX, DNB, SPSC, VNTV and FSLR

- TAP, ATRA, CAKE, CAB, MPAA, AOL, ENSG, VVI, CPLA, PNRA, NILE, THS, BG, ACOR, ENT, CTRL, EDE, JONE, YELP, DV, MKTO, ZU, COUP, RENT and PIR

ETFs

Stocks

*5-Day Change

Stocks Slightly Higher into Final Hour on Less European/Emerging Markets Debt Angst, Central Bank Hopes, Oil Bounce, Commodity/Gaming Sector Strength

Broad Equity Market Tone:

- Advance/Decline Line: Modestly Higher

- Sector Performance: Mixed

- Volume: Slightly Below Average

- Market Leading Stocks: Underperforming

- Volatility(VIX) 15.21 -.85%

- Euro/Yen Carry Return Index 141.26 -.38%

- Emerging Markets Currency Volatility(VXY) 11.16 -1.41%

- S&P 500 Implied Correlation 64.02 +.38%

- ISE Sentiment Index 110.0 -14.06%

- Total Put/Call .98 +13.95%

- NYSE Arms .89 +37.80%

- North American Investment Grade CDS Index 65.23 -1.27%

- America Energy Sector High-Yield CDS Index 709.0 -1.28%

- European Financial Sector CDS Index 63.96 -2.81%

- Western Europe Sovereign Debt CDS Index 26.44 -2.07%

- Asia Pacific Sovereign Debt CDS Index 68.21 unch.

- Emerging Market CDS Index 366.93 -1.68%

- iBoxx Offshore RMB China Corporates High Yield Index 113.32 +.02%

- 2-Year Swap Spread 26.75 unch.

- TED Spread 25.25 unch.

- 3-Month EUR/USD Cross-Currency Basis Swap -20.75 unch.

- 3-Month T-Bill Yield .01% unch.

- Yield Curve 138.0 +2.0 basis points

- China Import Iron Ore Spot $63.19/Metric Tonne +1.48%

- Citi US Economic Surprise Index -37.20 -.3 point

- Citi Eurozone Economic Surprise Index 43.70 +12.6 points

- Citi Emerging Markets Economic Surprise Index -8.80 -.6 point

- 10-Year TIPS Spread 1.69 +2.0 basis points

- Nikkei Futures: Indicating +165 open in Japan

- DAX Futures: Indicating +7 open in Germany

- Slightly Higher: On gains in my tech/retail/biotech/medical sector longs

- Disclosed Trades: None

- Market Exposure: 50% Net Long

Today's Headlines

Bloomberg:

@LOggOl:

AFP:

- EU Warns Russia of More Sanctions. (video)

- Greece Locked in Talks With Creditors in Search for Compromise. Greece and its official creditors are extending talks over the weekend aimed at reaching a deal at a Monday meeting of finance ministers in Brussels on future financing for Europe’s most-indebted country. Greece’s new anti-austerity government led by Alexis Tsipras wants to exit the current bailout program, which it blames for the country’s economic hardships, and replace it with a new plan while obtaining bridge financing to avoid defaulting on its international debt. The plan, which would include raising wages and reinstating government workers, is not getting much support from the country’s creditors. “You can only spend money when you have it,” Dutch Finance Minister Jeroen Dijsselbloem, who also presides over euro-area finance ministers’ meetings, told reporters in The Hague on Friday. “Greece wants a lot but has very little money to do that. That’s really a problem.”

- Italy's Economy Fails to Rebound. Italy’s economy stagnated in the three months through December, failing to rebound from its longest recession on record. Gross domestic product was unchanged from the previous quarter when it dropped 0.1 percent, national statistics institute Istat said in a preliminary report in Rome Friday. The median forecast in a Bloomberg News survey of 19 economists called for a drop of 0.1 percent. From a year earlier, GDP fell 0.3 percent.

- European Stocks Advance With DAX as German Economy Accelerates. European stocks climbed with Germany’s DAX Index after a report showed the nation’s economy accelerated. The Stoxx Europe 600 Index added 0.6 percent to 377.07 at the close of trading, paring gains of as much as 0.8 percent.

- Wall Street’s Bond Dealers Brace for Top-Rated Credit to Tumble. Wall Street’s biggest bond dealers are finding less and less to like about top-rated U.S. corporate bonds. So much so that they’re betting against some of them, with primary dealers turning the most bearish in 2015 on debt maturing in five to 10 years last week, Federal Reserve data show. The detail on banks’ more-granular positions only covers January and February because the Fed just started reporting it. In any event, it appears the fervent flight to the safety of high-quality corporate debt is coming to an abrupt end.

- U.S. Rigs Are Being Idled, but the Oil Boom Is Not Ending. The U.S. drilling frenzy is over. What’s not is the boom in oil production. While companies have idled 151 rigs in five shale formations since reaching a peak of 1,157 in October, they’ll need to park another 200 for growth to stall, according to data from the U.S. Energy Information Administration. Output there will reach a record 5.47 million barrels a day in March even though the number of rigs exploring for oil is the lowest since 2013.

- Nigerian President Wants U.S. Troops to Fight Boko Haram. Goodluck Jonathan Says Militants Have Ties to Islamic State. President Goodluck Jonathan said Friday that he has asked the U.S. military to dispatch troops to northern Nigeria, the region where Islamist militants have captured territory, suggesting that Boko Haram had established links with Islamic State.

- Chart Of The Day - Europe. (graph)

@LOggOl:

AFP:

- Dijsselbloem 'pessimistic' about a quick deal with Greece. "At this stage I'm very pessimistic about it," Dijsselbloem told the NOS public broadcaster when asked whether he thought concrete steps will be taken on Monday at the talks between Greece and its fellow single currency countries in the Eurogroup. "The Greeks have sky-high ambitions. The possibilities, given the state of the Greek economy, are limited," said Dijsselbloem, who is the Dutch finance minister, ahead of a cabinet meeting on Friday.

- conomic conditions are “getting closer and closer to those where it makes sense to really start thinking seriously about starting this process of normalization,” Williams told the FT in an interview.

The newspaper said Williams said the Fed might have to hike borrowing costs "much more dramatically" than otherwise if it waited too long, saying it was better to move sooner and raise rates "gradually, thoughtfully." - See more at: http://www.thefiscaltimes.com/latestnews/2015/02/10/Feds-Williams-says-rate-hike-getting-closer-and-closer-FT#sthash.8HLK2bPs.dpufEconomic conditions are “getting closer and closer to those where it makes sense to really start thinking seriously about starting this process of normalization,” Williams told the FT in an interview.Creating a pretext for a prolonged war – Russians launch massive missile attack on Luhansk.

The newspaper said Williams said the Fed might have to hike borrowing costs "much more dramatically" than otherwise if it waited too long, saying it was better to move sooner and raise rates "gradually, thoughtfully." - See more at: http://www.thefiscaltimes.com/latestnews/2015/02/10/Feds-Williams-says-rate-hike-getting-closer-and-closer-FT#sthash.8HLK2bPs.dpuf

- Germany's surprise growth spurt leaves slowing France behind. GDP growth in the eurozone's two economic giants diverged in the final quarter of the year, with German GDP growth picking up while the French economy ground to a halt

- Minsk ceasefire in balance while fighting continues in eastern Ukraine. Intense fighting continued near two cities in eastern Ukraine on Friday, raising further doubts about whether a ceasefire deal agreed in Minsk has any chance of success. According to the Minsk plan the ceasefire will start on Sunday but, rather than abating, the conflictappeared to escalate on Friday.

Bear Radar

Style Underperformer:

- Mid-Cap Value -.36%

- 1) Utilities -2.30% 2) Homebuilders -.92% 3) I-Banks -.73%

- SFLY, PRO, AXP, KN, BT, HPY, TCO, DVA, RRGB, CQP, AIZ, BCOR, SSTK, SIR, CUDA, MRKT, RSG, AAP, SDRL, PNRA, AMBA, HOLI, CAG, IPHI, WM, OPK, EXC, DTE, IRWD, DLR, BCOR, UBNT and TCO

- 1) SMH 2) XLI 3) CELG 4) AXP 5) GREK

- 1) GPS 2) CI 3) WM 4) FIVE 5) MOV

Subscribe to:

Comments (Atom)