Style Underperformer:

Sector Underperformers:

- 1) Coal -.64% 2) Homebuilders -.52% 3) Airlines -.47%

Stocks Falling on Unusual Volume:

- CBMG, DM, OVAS, MTB, MYRG, USAK, FIX, ABTL, ALTR, RCPT, MSI, GCI, HCHC, YRCW, APOL, KMX, YDLE, SPB, SSP, NNI, BIDU, LNN, SAFM, UAL and AGCO

Stocks With Unusual Put Option Activity:

- 1) COP 2) HYG 3) EMR 4) BBBY 5) EWW

Stocks With Most Negative News Mentions:

- 1) SKYW 2) JNJ 3) CNX 4) AGCO 5) GRMN

Charts:

Style Outperformer:

Sector Outperformers:

- 1) Gold & Silver +3.33% 2) Oil Service +1.55% 3) Utilities +1.41%

Stocks Rising on Unusual Volume:

- QURE, EPAM, CWCO, TSLA, CLDN, CHMT, MAT, MTDR and EVEP

Stocks With Unusual Call Option Activity:

- 1) SLCA 2) MTG 3) WWAV 4) GRPN 5) MAT

Stocks With Most Positive News Mentions:

- 1) MAT 2) LL 3) VMW 4) L 5) VTR

Charts:

Weekend Headlines

Bloomberg:

- Netanyahu: More Sanctions Would Get Better Iran Nuke Deal. Israeli Prime Minister Benjamin Netanyahu said the U.S. and world

powers should increase sanctions on Iran to negotiate a better deal on

Tehran’s nuclear program, advice quickly rejected by the White House. Netanyahu used appearances on three U.S. Sunday television talk shows

to drive home his opposition to what he called a bad deal with Iran

that would leave the Persian Gulf nation able to produce “many nuclear

bombs” within years. Unless the agreement is changed, he said, “This deal is a dream deal for Iran and a nightmare deal for the world.”

- Ukrainian Truce Challenged as Car Blasts Kill Government Troops. Six Ukrainian soldiers were killed and two wounded in a pair of car

explosions on Sunday after President Petro Poroshenko vowed to push for

international peacekeepers to help secure a truce in the

rebel-controlled east. “If peacekeepers help to come to a political resolution and

reintegration of these occupied territories into Ukraine, we have to go

this way,” Poroshenko said in an interview with Channel 5 TV on

Saturday, according to a transcript from his office. Foreign ministers

of Russia, Ukraine, Germany and France may meet soon to discuss details

and timing of the proposed peacekeeping mission, he said.

- Russia Said to Plan No Aid to Greece, May Ease Curbs on Food. Russia isn’t considering any financial assistance for Greece as

Prime Minister Alexis Tsipras plans to visit Moscow next week, according

to three Russian government officials with knowledge of the

discussions. Even so, Russia is ready to discuss easing restrictions on Greek food

products, which were imposed as as part of the retaliation for European

Union sanctions levied over the conflict in Ukraine, said two of the

three officials, who asked not to be identified because the information

is confidential.

- Saudis Raise Crude Oil Pricing to Asia on Signs of Demand Growth. Saudi Arabia, the world’s largest crude exporter, raised pricing for

all May sales to Asia, after the country’s oil minister said global

demand was improving. State-owned Saudi Arabian Oil Co. narrowed the discount for its Arab

Light grade to Asia to the least since December, setting the crude at a

discount of 60 cents a barrel to the regional benchmark, the company

said in an e-mailed statement. The May pricing is 30 cents higher than

in April. The company known as Saudi Aramco also increased the pricing

of the other four grades it ships to Asia.

Wall Street Journal:

- As Tensions With West Rise, Russia Increasingly Rattles Nuclear Saber. Bellicose rhetoric has soared since start of Ukraine conflict to rival Cold War levels. It wasn’t an ordinary Valentine’s Day for the students from across

Russia arriving at a military institute outside Moscow. Their date was

with a Topol, the intercontinental ballistic missile at the heart of the

country’s nuclear arsenal....

- Political Battle Ramps Up Over Iran. President Obama must overcome skeptical Republicans as well as some Democrats in Congress. President Barack Obama’s bet on a diplomatic agreement to deter Iran

from acquiring a nuclear weapon faces an immediate test at home, where

he must overcome the politics of skeptical Republicans as well as some

Democrats in Congress. The political struggle—part of the most complex battle of Mr. Obama’s presidency...

Fox News:

- Netanyahu urges US to seek better deal with Iran over its nuclear program. Israeli Prime Minister Benjamin Netanyahu urged the U.S. to seek a

better deal with Iran Sunday over its nuclear program and said that he’s

"not trying to kill any deal,” just a “bad deal.” “It could be a historic bad deal because it leaves the preeminent

terrorist state of our time a vast nuclear infrastructure,” Netanyahu

said on NBC’s “Meet the Press.” “Thousands of centrifuges will be left,

not a singular facility, including underground facilities will be shut

down.” Netanyahu added that the deal leaves Iran with “the capacity to produce material for many nuclear bombs.” Netanyahu also warned on ABC’s “This Week” that the deal could “spark

a nuclear arms race among the Sunni countries in the middle east.”

Business Insider:

- China targets the dollar. Now even Israel – joined at the hip to the US though the relationship

has run into rough waters – has applied to become a founding member of

the China-led Asian Infrastructure Investment Bank. Despite US gyrations to keep them from it, over 40 countries,

including bosom buddies Australia, Britain, and Germany, have signed up

to join. Japan is still wavering politely.

Reuters:

Financial Times:

- Frustrated officials want Greek premier to ditch Syriza far left. Eurozone

authorities’ frustration with Greece has grown so intense that a change

in the current Athens government’s make-up, however far-fetched, has

become a frequent topic of conversation on the sidelines of bailout

talks. Many officials — up to and including some eurozone finance

ministers — have suggested privately that only a decision by Alexis

Tsipras, Greek prime minister, to jettison the far left of his governing

Syriza party can make a bailout agreement possible.

Night Trading

- Asian indices are -,25% to +.50% on average.

- Asia Ex-Japan Investment Grade CDS Index 110.0 -.5 basis point.

- Asia Pacific Sovereign CDS Index 58.50 -1.0 basis point.

- NASDAQ 100 futures -.66%.

Morning Preview Links

Earnings of Note

Company/Estimate

Economic Releases

9:45 am EST

- The Final Markit US Services PMI for March is estimated at 58.6 versus a prior estimate of 58.6.

10:00 am EST

- The ISM Non-Manufacturing Composite for March is estimated to fall to 56.5 versus 56.9 in February.

Upcoming Splits

Other Potential Market Movers

- The RBA rate decision, Labor Market Conditions Index for March and Medicare Advantage rate announcements could

also impact trading today.

BOTTOM LINE: Asian indices are mostly higher, boosted by consumer and technology shares in the region. I expect US stocks to open lower and to maintain losses into the afternoon. The Portfolio is 50% net long heading into the week.

Wall St. Week Ahead by Reuters.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on Fed

rate hike worries, global growth fears, European/Emerging Markets/US

High-Yield debt angst, technical selling, yen strength and earnings

concerns. My intermediate-term trading indicators are giving neutral

signals and the Portfolio is 50% net long heading into the week.

The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 1,255.66 +1.92%

- S&P 500 High Beta 34.40 +.88%

- Goldman 50 Most Shorted 135.22 +1.71%

- Wilshire 5000 21,705.61 +.74%

- Russell 1000 Growth 993.68 +.51%

- Russell 1000 Value 1,014.86 +.77%

- S&P 500 Consumer Staples 504.81 +1.32%

- Solactive US Cyclical 136.91 +.53%

- Morgan Stanley Technology 1,000.73 -.12%

- Transports 8,605.31 -.84%

- Bloomberg European Bank/Financial Services 118.17 +1.68%

- MSCI Emerging Markets 40.89 +3.39%

- HFRX Equity Hedge 1,207.92 -.32%

- HFRX Equity Market Neutral 1,003.0 +.22%

Sentiment/Internals

- NYSE Cumulative A/D Line 238,752 +1.04%

- Bloomberg New Highs-Lows Index -43 +169

- Bloomberg Crude Oil % Bulls 51.43% +105.72%

- CFTC Oil Net Speculative Position 206,887 n/a

- CFTC Oil Total Open Interest 1,748,067 n/a

- Total Put/Call 1.12 +15.46%

- ISE Sentiment 68.0 +3.03%

- Volatility(VIX) 14.67 -7.15%

- S&P 500 Implied Correlation 64.15 +.69%

- G7 Currency Volatility (VXY) 10.85 +3.03%

- Emerging Markets Currency Volatility (EM-VXY) 10.24 -3.13%

- Smart Money Flow Index 17,682.13 +.42%

- ICI Money Mkt Mutual Fund Assets $2.634 Trillion-1.76%

- ICI US Equity Weekly Net New Cash Flow -$4.464 Billion

Futures Spot Prices

- Reformulated Gasoline 176.13 -5.73%

- Heating Oil 168.80 -2.62%

- Bloomberg Base Metals Index 170.81 -2.43%

- US No. 1 Heavy Melt Scrap Steel 226.67 USD/Ton unch.

- China Iron Ore Spot 47.08 USD/Ton -11.4%

- UBS-Bloomberg Agriculture 1,138.38 +1.80%

Economy

- ECRI Weekly Leading Economic Index Growth Rate -2.5% +70 basis points

- Philly Fed ADS Real-Time Business Conditions Index .0693 n/a

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 123.0 +.08%

- Citi US Economic Surprise Index -47.3 +15.6 points

- Citi Eurozone Economic Surprise Index 63.10 +10.0 points

- Citi Emerging Markets Economic Surprise Index 4.90 +6.3 points

- Fed Fund Futures imply 50.0% chance of no change, 50.0% chance of 25 basis point cut on 4/29

- US Dollar Index 97.57 +.21%

- Euro/Yen Carry Return Index 135.91 +.27%

- 10-Year US Treasury Yield 1.91% -5.0 basis points

- Federal Reserve's Balance Sheet $4.444 Trillion +.04%

- U.S. Sovereign Debt Credit Default Swap 16.61 +1.69%

- Illinois Municipal Debt Credit Default Swap 179.0 -.75%

- Western Europe Sovereign Debt Credit Default Swap Index 22.57 -1.48%

- Asia Pacific Sovereign Debt Credit Default Swap Index 58.68 -4.30%

- Emerging Markets Sovereign Debt CDS Index 337.39 -1.76%

- Israel Sovereign Debt Credit Default Swap 75.26 -1.16%

- Iraq Sovereign Debt Credit Default Swap 351.67 -1.56%

- Russia Sovereign Debt Credit Default Swap 337.15 -8.46%

- iBoxx Offshore RMB China Corporates High Yield Index 114.58 +.35%

- 10-Year TIPS Spread 1.81% +3.0 basis points

- TED Spread 26.0 +1.75 basis points

- 2-Year Swap Spread 25.5 +1.25 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -23.25 +.75 basis point

- N. America Investment Grade Credit Default Swap Index 62.57 -2.96%

- America Energy Sector High-Yield Credit Default Swap Index 1,092.0 +7.44%

- European Financial Sector Credit Default Swap Index 68.55 +2.18%

- Emerging Markets Credit Default Swap Index 311.21 -2.0%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 90.0 unch.

- M1 Money Supply $2.979 Trillion +.16%

- Commercial Paper Outstanding 1,010.60 -2.10%

- 4-Week Moving Average of Jobless Claims 285,500 -11,500

- Continuing Claims Unemployment Rate 1.7% -10 basis points

- Average 30-Year Mortgage Rate 3.70% +1.0 basis point

- Weekly Mortgage Applications 457.0 +4.55%

- Bloomberg Consumer Comfort 46.2 +.7 point

- Weekly Retail Sales +2.80% +10 basis points

- Nationwide Gas $2.40/gallon -.03/gallon

- Baltic Dry Index 596.0 -.33%

- China (Export) Containerized Freight Index 994.83 -1.54%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 27.50 unch.

- Rail Freight Carloads 278,345 +.18%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (21)

- ICEL, DYAX, ASPX, MOV, OXM, ALTR, CTRX, ROLL, LEVY, HIFR, NCFT, OLN, FRPT, CAG, CONN, GTN, HRS, SCAI, ENVA, KRFT and HPTX

Weekly High-Volume Stock Losers (7)

- MYL, SNX, CJES, WWE, NATH, BDSI and OVAS

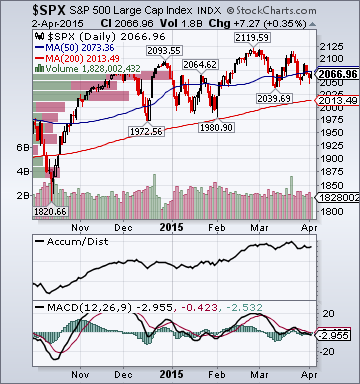

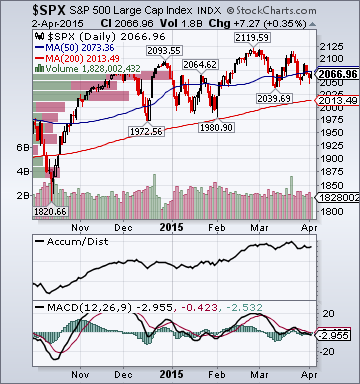

Weekly Charts

ETFs

Stocks

*5-Day Change