The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 1,144.72 -.60%

- S&P 500 High Beta 33.31 +.24%

- Wilshire 5000 20,626.50 -.05%

- Russell 1000 Growth 916.38 +.10%

- Russell 1000 Value 1,000.07 -.06%

- S&P 500 Consumer Staples 460.63 -.82%

- Solactive US Cyclical 136.63 -.46%

- Morgan Stanley Technology 975.16 +.26%

- Transports 8,428.15 +.51%

- Bloomberg European Bank/Financial Services 108.08 +3.13%

- MSCI Emerging Markets 44.68 +1.41%

- HFRX Equity Hedge 1,178.78 +.50%

- HFRX Equity Market Neutral 969.84 +.01%

Sentiment/Internals

- NYSE Cumulative A/D Line 228,227 -.17%

- Bloomberg New Highs-Lows Index 344 +393

- Bloomberg Crude Oil % Bulls 44.74 -8.17%

- CFTC Oil Net Speculative Position 371,444 -7.05%

- CFTC Oil Total Open Interest 1,642,836 -4.58%

- Total Put/Call .94 +4.44%

- OEX Put/Call 2.52 +170.97%

- ISE Sentiment 88.0 -6.38%

- Volatility(VIX) 12.69 +5.22%

- S&P 500 Implied Correlation 55.74 +11.7%

- G7 Currency Volatility (VXY) 5.46 +1.87%

- Emerging Markets Currency Volatility (EM-VXY) 5.89 -1.17%

- Smart Money Flow Index 11,664.26 +.81%

- ICI Money Mkt Mutual Fund Assets $2.563 Trillion -.09%

- ICI US Equity Weekly Net New Cash Flow -$3.951 Billion

Futures Spot Prices

- Reformulated Gasoline 286.53 +.21%

- Heating Oil 291.57 +2.44%

- Bloomberg Base Metals Index 206.57 +2.86%

- US No. 1 Heavy Melt Scrap Steel 356.67 USD/Ton -.04%

- China Iron Ore Spot 94.30 USD/Ton -2.38%

- UBS-Bloomberg Agriculture 1,323.77 -.12%

Economy

- ECRI Weekly Leading Economic Index Growth Rate 4.2% -20 basis points

- Philly Fed ADS Real-Time Business Conditions Index .2626 -1.61%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 126.81 +.40%

- Citi US Economic Surprise Index -24.50 -6.5 points

- Citi Emerging Markets Economic Surprise Index -.6 +4.2 points

- Fed Fund Futures imply 38.0% chance of no change, 62.0% chance of 25 basis point cut on 7/30

- US Dollar Index 81.03 +.65%

- Euro/Yen Carry Return Index 142.78 -.19%

- Yield Curve 198.0 -2.0 basis points

- 10-Year US Treasury Yield 2.47% -1.0 basis point

- Federal Reserve's Balance Sheet $4.368 Trillion +.29%

- U.S. Sovereign Debt Credit Default Swap 15.50 -2.12%

- Illinois Municipal Debt Credit Default Swap 165.0 +1.85%

- Western Europe Sovereign Debt Credit Default Swap Index 33.77 -7.21%

- Asia Pacific Sovereign Debt Credit Default Swap Index 71.07 -.80%

- Emerging Markets Sovereign Debt CDS Index 203.05 +1.78%

- Israel Sovereign Debt Credit Default Swap 87.50 +.57%

- Iraq Sovereign Debt Credit Default Swap 345.31 -1.83%

- Russia Sovereign Debt Credit Default Swap 221.16 +7.19%

- China Blended Corporate Spread Index 300.69 -2.24%

- 10-Year TIPS Spread 2.27% +5.0 basis points

- TED Spread 21.0 -1.25 basis points

- 2-Year Swap Spread 20.25 +1.0 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -8.75 +1.25 basis points

- N. America Investment Grade Credit Default Swap Index 59.15 +.57%

- European Financial Sector Credit Default Swap Index 67.50 -2.33%

- Emerging Markets Credit Default Swap Index 245.05 +2.91%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 83.0 unch.

- M1 Money Supply $2.858 Trillion +1.78%

- Commercial Paper Outstanding 1,025.90 -.20%

- 4-Week Moving Average of Jobless Claims 302,000 -7,000

- Continuing Claims Unemployment Rate 1.9% unch.

- Average 30-Year Mortgage Rate 4.13% unch.

- Weekly Mortgage Applications 349.40 +2.43%

- Bloomberg Consumer Comfort 37.6 +.1 point

- Weekly Retail Sales +3.90% -20 basis points

- Nationwide Gas $3.54/gallon -.05/gallon

- Baltic Dry Index 732.0 unch.

- China (Export) Containerized Freight Index 1,092.24 +.38%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 30.0 +9.09%

- Rail Freight Carloads 267,675 +4.46%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (20)

- PBYI, TRLA, INO, ISRG, STLD, VDSI, SWKS, CMG, PII, CROX, CIT, SKX, HLX, FBRC, HLF, RFMD, EMC, WAT, PETS and CHE

Weekly High-Volume Stock Losers (11)

- HXL, RMBS, GOV, BXS, CNMD, TUP, UIS, CPHD, XLNX, DFRG and RP

Weekly Charts

ETFs

Stocks

*5-Day Change

Broad Equity Market Tone:

- Advance/Decline Line: Lower

- Sector Performance: Most Sectors Declining

- Market Leading Stocks: Performing In Line

Equity Investor Angst:

- Volatility(VIX) 12.59 +6.33%

- Euro/Yen Carry Return Index 142.73 -.25%

- Emerging Markets Currency Volatility(VXY) 5.89 +1.55%

- S&P 500 Implied Correlation 55.47 +2.32%

- ISE Sentiment Index 103.0 +11.96%

- Total Put/Call .92 +1.10%

Credit Investor Angst:

- North American Investment Grade CDS Index 59.14 +.41%

- European Financial Sector CDS Index 67.50 +1.34%

- Western Europe Sovereign Debt CDS Index 33.77 -3.13%

- Asia Pacific Sovereign Debt CDS Index 70.96 +1.31%

- Emerging Market CDS Index 247.66 +3.36%

- China Blended Corporate Spread Index 309.69 -.91%

- 2-Year Swap Spread 20.25 unch.

- TED Spread 20.75 -.75 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -8.75 -2.25 basis points

Economic Gauges:

- 3-Month T-Bill Yield .03% +1.0 basis point

- Yield Curve 198.0 -4.0 basis points

- China Import Iron Ore Spot $94.30/Metric Tonne +.75%

- Citi US Economic Surprise Index -24.50 +1.5 points

- Citi Emerging Markets Economic Surprise Index -.6 +.1 point

- 10-Year TIPS Spread 2.27 +3.0 basis points

Overseas Futures:

- Nikkei Futures: Indicating -10 open in Japan

- DAX Futures: Indicating -5 open in Germany

Portfolio:

- Slightly Lower: On losses in my biotech/retail/tech sector longs

- Disclosed Trades: Added to my (IWM)/(QQQ) hedges

- Market Exposure: Moved to 25% Net Long

Bloomberg:

- Ukraine Trades Accusations With Russia of Shelling. Ukraine

and Russia traded accusations of cross-border shelling as tensions

between the ex-Soviet neighbors intensified. “Ukraine’s

border checkpoint at Marynivka in the Donetsk region was attacked from

Russian territory by mortars, Grad missile systems and artillery,” at 6

p.m. and 11 p.m. local time yesterday, damaging infrastructure and

equipment, a Ukrainian Defense Ministry spokesman, Andriy Lysenko, said

in Kiev today. Rossiya 24 state television said about 40 artillery

shells landed in the Rostov region of southern Russia from across the

border and one woman may have been injured. It showed pictures of

unexploded shells near a border post. While both countries have

swapped such accusations before, the latest allegations come as the

pro-Russian rebel stronghold of Donetsk, less than 100 kilometers (60

miles) from the border, awaits a possible onslaught by Ukrainian

government forces.

- EU Vows Russia Action as Merkel Said to See Sanctions Next Week. The European Union said it’ll work

“swiftly” to hit Russian industries with sanctions as support

grows for the package of trade restrictions outlined this week. German Chancellor Angela Merkel is pushing her colleagues to sign off on the measures by the end of next week and is

prepared to accept curbs on her country’s technology exports to

win support, according to two German government officials, who

asked not to be named because the discussions are private.

- Australia Risks Tension With Ukraine Rebels Sending Armed Police.

Australian Prime Minister Tony Abbott’s plan to deploy armed police

officers to the site of the Malaysian Air crash risks increasing tension

in the Ukrainian

territory held by Russian-backed rebels, according to political

analysts based in Berlin and Brussels.

- Russia Unexpectedly Raises Key Rate Third Time on Ukraine.

Russia’s central bank unexpectedly increased borrowing costs for a

third time this year as the intensifying conflict over Ukraine and the

threat of wider sanctions squeeze the economy and undercut the ruble. The central bank in Moscow increased its one-week auction rate to 8 percent from 7.5 percent, according to a statement on its website today.

- Norway on High Alert Amid Warnings of Attack Next Week. Police

in Norway are on high alert after receiving intelligence that nationals

returning from Syria may be plotting a terrorist attack within days

against the

Scandinavian country. Information obtained by Norway’s security service, PST,

suggests an attack could be imminent, the unit’s chief,

Benedicte Bjoernland, said yesterday. Authorities have

strengthened their presence at Norway’s borders, airports and

train stations, and police in all districts are at a heightened

state of preparedness.

- China Credit Trust Delays Payment on $210 Million Product. China

Credit Trust Co. delayed payments on a 1.3 billion-yuan ($210 million)

high-yield trust product backed by coal-mining assets after the borrower

failed to raise funds to repay investors. The Beijing-based company

will extend the maturity of Credit Equals Gold No. 2, which was

scheduled to expire today, according to a statement distributed to

investors in the product and seen by Bloomberg News. China Credit Trust

aims to sell

assets held by the product within 15 months to repay investors,

the July 24 statement showed.

- Bond ETFs Swelling in Europe as Trading Debt Gets Tougher. Bond

buyers are pouring record

amounts of money into exchange-traded funds in Europe that buy debt as

central bank largess boosts demand and makes investors less willing to

part with their fixed-income assets. Investors deposited more than $16

billion into ETFs that purchase debt from high-yielding corporate notes

to sovereign bonds, almost quadruple the amount in the same period

last year, according to data compiled by Bloomberg. BlackRock Inc.

(BLK), the world’s biggest provider of ETFs, estimates bond-fund inflows

will climb to about $20 billion by year-end.

- European Stocks Fall as LVMH Leads Luxury Retailers Lower. European stocks fell the most in a week, extending losses in the

final half hour of trading, as companies including LVMH Moet Hennessy

Louis Vuitton SA and Statoil (STL) ASA posted earnings that missed forecasts.

LVMH fell the most since August 2011 after the world’s largest

luxury-goods company also said demand weakened in Asia. Air France-KLM

Group climbed 2.6 percent after reporting second-quarter profit that

beat estimates. Sky Deutschland AG added 1.4 percent after

British Sky Broadcasting Group Plc offered to buy the German

broadcaster. Royal Bank of Scotland Group Plc rallied the most in more

than four years after saying first-half profit almost doubled. The Stoxx Europe 600 Index slid 0.7 percent to 341.95 at the close of trading.

Wall Street Journal:

MarketWatch.com:

CNBC:

ZeroHedge:

Business Insider:

Reuters:

Telegraph:

Style Underperformer:

Sector Underperformers:

- 1) Internet -2.51% 2) Homebuilders -2.03% 3) Semis -1.85%

Stocks Falling on Unusual Volume:

- INFA, WCG, IDXX, MXIM, WIRE, MGLN, AMZN, SWFT, SOXX, COLM, NTGR, MWIV, BBEP, NCN, GSK, TPX, QRE, E, CBI, AIMC, BAS, SLAB, PCP, NBL, FSL, CB, ENTG, KN, EQT, INVN, V, MOH, FCS, CNC, AAOI, PBYI, GIMO, EPR and P

Stocks With Unusual Put Option Activity:

- 1) JNK 2) AMZN 3) ALTR 4) SBUX 5) V

Stocks With Most Negative News Mentions:

- 1) WCG 2) AON 3) TEX 4) XOM 5) PCH

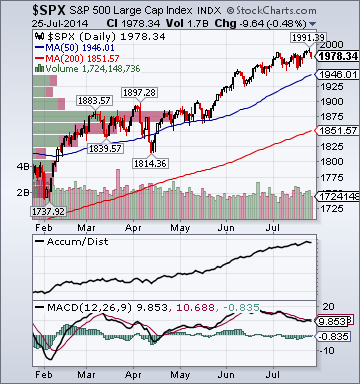

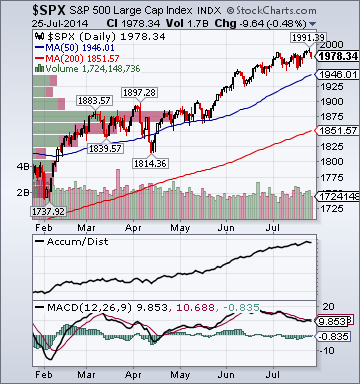

Charts: