There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - Wholesale Inventories, Consumer Credit

Tues. - None of note

Wed. - Trade Balance

Thur. - Initial Jobless Claims, Continuing Claims, Monthly Budget Statement

Fri. - Import Price Index, Advance Retail Sales, Univ. of Mich. Consumer Confidence, Business Inventories

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Alcoa Inc.(AA), Shaw Group(SGR)

Tues. - Flowserve(FLS), Genentech(DNA), Ruby Tuesday(RI)

Wed. - Chaparral Steel(CHAP), Commerce Bancshares(CBSH), Fastenal(FAST), Gannett Co.(GCI), Genzyme Corp.(GENZ), Resources Connection(RECN)

Thur. - Cintas Corp.(CTAS), Marriott Intl.(MAR), Polaris Industries(PII), Progressive Corp.(PGR), Texas Industries(TXI), Tribune Co.(TRB)

Fri. - EW Scripts(SSP), General Electric(GE), Rambus Inc.(RMBS), Regions Financial(RF)

Other events that have market-moving potential this week include:

Mon. - SEMICON West

Tue. - SEMICON West, CIBC Consumer Growth Conference

Wed. - CIBC Consumer Growth Conference, SEMICON West

Thur. - SEMICON West

Fri. - SEMICON West

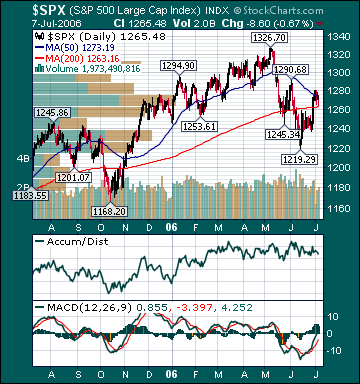

BOTTOM LINE: I expect US stocks to finish the week mixed as continuing worries over slowing economic growth offset short-covering, lower energy prices and bargain hunting. My trading indicators are still giving neutral signals and the Portfolio is 50% net long heading into the week.