There are some economic reports of note and a number of significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - Empire Manufacturing, Industrial Production, Capacity Utilization

Tues. - Producer Price Index, Net Foreign Security Purchases, NAHB Housing Market Index

Wed. - Consumer Price Index, Housing Starts, Building Permits, Bernanke Report on Economy & Fed Policy

Thur. - Initial Jobless Claims, Leading Indicators, Philly Fed., FOMC Minutes

Fri. - None of note

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - Charles Schwab(SCH), Citigroup(C), Commerce Bancorp(CBH), Eaton Corp.(ETN), Harley-Davidson(HDI), Mattel Inc.(MAT)

Tues. - AmSouth Bancorp(ASO), BlackRock Inc.(BLK), Coca-Cola(KO), Forest Labs(FRX), Freeport-McMoRan(FRX), IBM(IBM), Johnson & Johnson(JNJ), Merrill Lynch(MER), Southern Copper(PCU), State Street(STT), TD Ameritrade(AMTD), Teradyne(TER), US Bancorp(USB), Wells Fargo(WFC), Yahoo!(YHOO)

Wed. - Abbott Labs(ABT), Allstate Corp.(ALL), AMR Corp.(AMR), Apple Computer(AAPL), Bank of America(BAC), Cheesecake Factory(CAKE), E*Trade Financial(ET), eBay Inc.(EBAY), General Dynamics(GD), Intel Corp.(INTC), JPMorgan(JPM), Juniper Networks(JNPR), Kinder Morgan(KMI), Lam Research(LRCX), Motorola(MOT), Novellus Systems(NVLS), Qualcomm(QCOM), Ryland Group(RYL), Seagate Technology(STX), Southwest Airlines(LUV), St. Jude Medical(STJ), SunTrust Banks(STI), UnitedHealth Group(UNH), Washington Mutual(WM)

Thur. - Advanced Micro Devices(AMD), Amgen Inc.(AMGN), Baxter Intl.(BAX), Broadcom Corp.(BRCM), Capital One Financial(COF), Cerner Corp.(CERN), Comerica(CMA), Domino’s Pizza(DPZ), DR Horton(DHI), F5 Networks(FFIV), Ford Motor(F), Gilead Sciences(GILD), Google Inc.(GOOG), ImClone Systems(IMCL), Intl. Game Tech(IGT), Medimmune(MEDI), Microsoft(MSFT), Peabody Energy(BTU), Pfizer Inc.(PFE), Union Pacific(UNP), Wachovia Corp.(WB), Wyeth(WYE), Xilinx(XLNX)

Fri. - Caterpillar(CAT), Eli Lilly(LLY), Halliburton(HAL), Hershey(HSY), McDonald’s(MCD), Nucor(NUE), RadioShack(RSH), Schlumberger(SLB), Sybase(SY)

Other events that have market-moving potential this week include:

Mon. - None of note

Tue. - None of note

Wed. - None of note

Thur. - None of note

Fri. - None of note

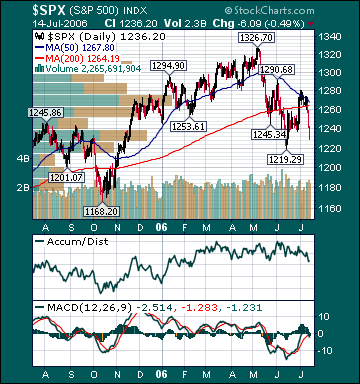

BOTTOM LINE: I expect US stocks to finish the week higher on mostly positive earnings reports, increased speculation for a Fed “pause”, a calming in Middle Eastern tensions, short-covering and bargain hunting. My trading indicators are giving mostly bearish signals and the Portfolio is 75% net long heading into the week.