Market Snapshot

Detailed Market Summary

Quick Summary

Economic Commentary

Movers & Shakers

Today in IBD

NYSE OrderTrac

I-Watch Sector Overview

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Option Dragon

Intraday Chart/Quote

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, March 19, 2007

Sunday, March 18, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- Barton Biggs, who runs the $1.3 billion Traxis Partners LLC hedge fund, said US stocks may be approaching a “bottom” and the S&P will climb as much as 15% this year. “The markets are digging in here and are in the process of making a bottom,” Biggs said. “I’m bullish longer term and I’m bullish short term.” Biggs also said the slump in the so-called subprime mortgage market was “just another bubble bursting” and that a recession in the US is “unlikely.” “Big-cap stocks in the US are as cheap as they’ve been compared to everything else in the entire post-World War II era,” he said. “The best performing part of the big-cap universe is going to be big-cap tech.” Computer-related companies in the S&P 500 are valued at 24 times earnings. That’s less than half the five-year average of 50.0.

- Palestinian President Mahmoud Abbas rejected “all forms” of violence and pledged a negotiated peace with Israel as he sought the approval of lawmakers for a national unity government that would end a yearlong struggle for power.

- China raised interest rates for the third time in 11 months to curb inflation and asset bubbles. The one-year benchmark lending rate will be raised to 6.939% from 6.12%, starting March 18.

- Defense Secretary Robert Gates said the Bush administration’s strategy to stabilize Baghdad with more troops is beginning to show results.

- China, India and Russia are losing their allure for stock investors because corporate profits are showing signs of flagging. Stock markets in the three countries are among the 10 worst performers this year. Together with Brazil, they’ve fallen twice as much as developing nations as a whole.

- The Australian dollar fell on speculation the nation’s exporters will be hurt by an increase in China’s benchmark interest rate.

- The US and North Korea agreed on releasing funds frozen in a Macau bank, a move that will boost progress on implementing a six-nation accord that will end the communist state’s nuclear weapons program.

- Qualcomm Inc.(QCOM) dropped two patent infringement lawsuits that sought to prevent Broadcom Corp.(BRCM) from entering the market.

- Developers Diversified Realty(DDR), the owner of more than 500 retail properties, will replace Caremark Rx(CMX) in the S&P 500.

- US steel inventories are near a record high, and a glut in China, which makes 30% of the world’s metal, may cause prices to fall by the second half, according to UBS AG, Europe’s larges bank. Zurich-based CSFB says the risks of a drop in steel prices are mounting. Shares of the world’s 62 largest steelmakers are trading at 11 times estimated earnings, 32% more than the average during the past two years. Steel stocks have advanced a record 590% in the past four years.

Wall Street Journal:

- Blackstone Group LP will sell a 10% stake in an IPO that will value the company at about $40 billion.

Business 2.0:

- 25 startups to watch.

NY Times:

- Iran is increasingly becoming intertwined in Iraq’s economy, with many of its goods and services going to Iraq.

NY Observer:

- Neil Binder has been in New York real estate since 1979, and this is the first year that a reason escapes him when it comes to explaining a market boom. “The market is extremely strong across the board,” Mr. Binder, a principal at Bellmarc Realty said.

MIT Review:

- 10 emerging technologies.

Financial Times:

- The American Stock Exchange, the third-largest US equity market, may set up a second-tier US stock market, similar to the London Stock Exchange’s Alternative Investment market, similar to the London Stock Exchange’s Alternative Investment Market, which would avoid Sarbanes-Oxley Act rules.

- Forty-four percent of Europe’s citizens think life has become worse since their countries joined the European Union, citing an FT/Harris poll. Only 25% of people questioned judged that life in their countries had improved since they joined the EU.

Sunday Telegraph:

- Coca-Cola(KO) is developing Lumae, a tea-based drink with ingredients benefiting consumers’ skin.

Rheinishe Post:

- Germany, raisin its growth forecast for 2007, expects the economy to grow at least 1.9%, citing deputy Chancellor and Labor Minister Franz Muentefering.

Gas Industry:

- OAO Gazprom, the world’s largest natural-gas company, fully replaced its crude oil and natural gas reserves last year as it stepped up exploration, company executive Vasily Podyuk said.

Weekend Recommendations

Barron's:

- Made positive comments on (TXT), (R), (SWN), (BBG) and (SKS).

Citigroup:

- Reiterated Buy on (ESRX), raised target to $96.

- Reiterated Buy on (LIZ), target $54.

- Reiterated Buy on (NT), target $35.

Morgan Stanley:

- Most investors have underestimated China’s decisiveness to tighten its still overheated economy, and have almost become blind to the messages that Beijing keeps signaling. The rate rise resumption in will bring tightening back into focus, and the already vulnerable market sentiment in China is likely to take another hit. Reiterate Cautious Chinese market view.

Night Trading

Asian indices are +.50% to +.75% on average.

S&P 500 indicated +.20%.

NASDAQ 100 indicated +.23%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- None of note

Upcoming Splits

- (CSL) 2-for-1

Economic Releases

1:00 pm EST

- The NAHB Housing Market Index for March is estimated to fall to 38 from 40 in February.

Bloomberg:

- Barton Biggs, who runs the $1.3 billion Traxis Partners LLC hedge fund, said US stocks may be approaching a “bottom” and the S&P will climb as much as 15% this year. “The markets are digging in here and are in the process of making a bottom,” Biggs said. “I’m bullish longer term and I’m bullish short term.” Biggs also said the slump in the so-called subprime mortgage market was “just another bubble bursting” and that a recession in the US is “unlikely.” “Big-cap stocks in the US are as cheap as they’ve been compared to everything else in the entire post-World War II era,” he said. “The best performing part of the big-cap universe is going to be big-cap tech.” Computer-related companies in the S&P 500 are valued at 24 times earnings. That’s less than half the five-year average of 50.0.

- Palestinian President Mahmoud Abbas rejected “all forms” of violence and pledged a negotiated peace with Israel as he sought the approval of lawmakers for a national unity government that would end a yearlong struggle for power.

- China raised interest rates for the third time in 11 months to curb inflation and asset bubbles. The one-year benchmark lending rate will be raised to 6.939% from 6.12%, starting March 18.

- Defense Secretary Robert Gates said the Bush administration’s strategy to stabilize Baghdad with more troops is beginning to show results.

- China, India and Russia are losing their allure for stock investors because corporate profits are showing signs of flagging. Stock markets in the three countries are among the 10 worst performers this year. Together with Brazil, they’ve fallen twice as much as developing nations as a whole.

- The Australian dollar fell on speculation the nation’s exporters will be hurt by an increase in China’s benchmark interest rate.

- The US and North Korea agreed on releasing funds frozen in a Macau bank, a move that will boost progress on implementing a six-nation accord that will end the communist state’s nuclear weapons program.

- Qualcomm Inc.(QCOM) dropped two patent infringement lawsuits that sought to prevent Broadcom Corp.(BRCM) from entering the market.

- Developers Diversified Realty(DDR), the owner of more than 500 retail properties, will replace Caremark Rx(CMX) in the S&P 500.

- US steel inventories are near a record high, and a glut in China, which makes 30% of the world’s metal, may cause prices to fall by the second half, according to UBS AG, Europe’s larges bank. Zurich-based CSFB says the risks of a drop in steel prices are mounting. Shares of the world’s 62 largest steelmakers are trading at 11 times estimated earnings, 32% more than the average during the past two years. Steel stocks have advanced a record 590% in the past four years.

Wall Street Journal:

- Blackstone Group LP will sell a 10% stake in an IPO that will value the company at about $40 billion.

Business 2.0:

- 25 startups to watch.

NY Times:

- Iran is increasingly becoming intertwined in Iraq’s economy, with many of its goods and services going to Iraq.

NY Observer:

- Neil Binder has been in New York real estate since 1979, and this is the first year that a reason escapes him when it comes to explaining a market boom. “The market is extremely strong across the board,” Mr. Binder, a principal at Bellmarc Realty said.

MIT Review:

- 10 emerging technologies.

Financial Times:

- The American Stock Exchange, the third-largest US equity market, may set up a second-tier US stock market, similar to the London Stock Exchange’s Alternative Investment market, similar to the London Stock Exchange’s Alternative Investment Market, which would avoid Sarbanes-Oxley Act rules.

- Forty-four percent of Europe’s citizens think life has become worse since their countries joined the European Union, citing an FT/Harris poll. Only 25% of people questioned judged that life in their countries had improved since they joined the EU.

Sunday Telegraph:

- Coca-Cola(KO) is developing Lumae, a tea-based drink with ingredients benefiting consumers’ skin.

Rheinishe Post:

- Germany, raisin its growth forecast for 2007, expects the economy to grow at least 1.9%, citing deputy Chancellor and Labor Minister Franz Muentefering.

Gas Industry:

- OAO Gazprom, the world’s largest natural-gas company, fully replaced its crude oil and natural gas reserves last year as it stepped up exploration, company executive Vasily Podyuk said.

Weekend Recommendations

Barron's:

- Made positive comments on (TXT), (R), (SWN), (BBG) and (SKS).

Citigroup:

- Reiterated Buy on (ESRX), raised target to $96.

- Reiterated Buy on (LIZ), target $54.

- Reiterated Buy on (NT), target $35.

Morgan Stanley:

- Most investors have underestimated China’s decisiveness to tighten its still overheated economy, and have almost become blind to the messages that Beijing keeps signaling. The rate rise resumption in will bring tightening back into focus, and the already vulnerable market sentiment in China is likely to take another hit. Reiterate Cautious Chinese market view.

Night Trading

Asian indices are +.50% to +.75% on average.

S&P 500 indicated +.20%.

NASDAQ 100 indicated +.23%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- None of note

Upcoming Splits

- (CSL) 2-for-1

Economic Releases

1:00 pm EST

- The NAHB Housing Market Index for March is estimated to fall to 38 from 40 in February.

BOTTOM LINE: Asian Indices are higher, boosted by technology and drug shares in the region. I expect US stocks to open mixed and to rally into the afternoon, finishing modestly higher. The Portfolio is 75% net long heading into the week.

Weekly Outlook

Click here for The Week Ahead by Reuters

Click here for Stocks in Focus for Monday by MarketWatch

There are a number of economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - NAHB Housing Market Index

Tues. - Housing Starts, Building Permits, weekly retail sales

Wed. - weekly MBA Mortgage Applications, FOMC Rate Decision

Thur. - Initial Jobless Claims, Continuing Claims, Leading Indicators

Fri. - Existing Home Sales

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - None of note

Tues. - Adobe Systems(ADBE), Chaparral Steel(CHAP), Cintas Corp.(CTAS), Commercial Metals(CMC), Darden Restaurants(DRI), Factset Research(FDS), Oracle Corp.(ORCL), Shuffle Master(SHFL), Sonic Corp.(SONC)

Wed. - Charming Shoppes(CHRS), FedEx(FDX), Morgan Stanley(MS), Ross Stores(ROST)

Thur. - Barnes & Noble(BKS), Borders Group(BGP), ConAgra Foods(CAG), General Mills(GIS), Georgia Gulf(GGC), Herman Miller(MLHR), KB Home(KBH), Nike Inc.(NKE), Palm Inc.(PALM), Williams-Sonoma(WSM)

Fri. - Apollo Group(APOL), Family Dollar(FDO), Freddie Mac(FRE)

Other events that have market-moving potential this week include:

Mon. - Lehman Brothers Global Healthcare Conference, the Bank of Japan Policy Meeting

Tue. - Lehman Brothers Global Healthcare Conference, AG Edwards Energy Conference, (CAKE) analyst day

Wed. - Lehman Brothers Global Healthcare Conference, JPMorgan Insurance Conference, JPMorgan Aviation & Transport Conference, AG Edwards Energy Conference, Merrill Lynch Retailing Leaders Conference, BB&T Manufacturing & Materials Conference, JPMorgan Gaming/Lodging/Restaurant Conference

Thur. - BB&T Manufacturing & Materials Conference, JPMorgan Aviation & Transport Conference, Merrill Lynch Retailing Leaders Conference, JPMorgan Gaming/Lodging/Restaurant Conference, (ADP) analyst meeting

Fri. - (BEAV) analyst meeting, the Fed’s Plosser speaking

Click here for Stocks in Focus for Monday by MarketWatch

There are a number of economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - NAHB Housing Market Index

Tues. - Housing Starts, Building Permits, weekly retail sales

Wed. - weekly MBA Mortgage Applications, FOMC Rate Decision

Thur. - Initial Jobless Claims, Continuing Claims, Leading Indicators

Fri. - Existing Home Sales

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - None of note

Tues. - Adobe Systems(ADBE), Chaparral Steel(CHAP), Cintas Corp.(CTAS), Commercial Metals(CMC), Darden Restaurants(DRI), Factset Research(FDS), Oracle Corp.(ORCL), Shuffle Master(SHFL), Sonic Corp.(SONC)

Wed. - Charming Shoppes(CHRS), FedEx(FDX), Morgan Stanley(MS), Ross Stores(ROST)

Thur. - Barnes & Noble(BKS), Borders Group(BGP), ConAgra Foods(CAG), General Mills(GIS), Georgia Gulf(GGC), Herman Miller(MLHR), KB Home(KBH), Nike Inc.(NKE), Palm Inc.(PALM), Williams-Sonoma(WSM)

Fri. - Apollo Group(APOL), Family Dollar(FDO), Freddie Mac(FRE)

Other events that have market-moving potential this week include:

Mon. - Lehman Brothers Global Healthcare Conference, the Bank of Japan Policy Meeting

Tue. - Lehman Brothers Global Healthcare Conference, AG Edwards Energy Conference, (CAKE) analyst day

Wed. - Lehman Brothers Global Healthcare Conference, JPMorgan Insurance Conference, JPMorgan Aviation & Transport Conference, AG Edwards Energy Conference, Merrill Lynch Retailing Leaders Conference, BB&T Manufacturing & Materials Conference, JPMorgan Gaming/Lodging/Restaurant Conference

Thur. - BB&T Manufacturing & Materials Conference, JPMorgan Aviation & Transport Conference, Merrill Lynch Retailing Leaders Conference, JPMorgan Gaming/Lodging/Restaurant Conference, (ADP) analyst meeting

Fri. - (BEAV) analyst meeting, the Fed’s Plosser speaking

BOTTOM LINE: I expect US stocks to finish the week modestly higher on buyout speculation, constructive FOMC comments, mostly positive earnings reports, short-covering and bargain-hunting. My trading indicators are giving mixed signals and the Portfolio is 75% net long heading into the week.

Saturday, March 17, 2007

Friday, March 16, 2007

Weekly Scoreboard*

Indices

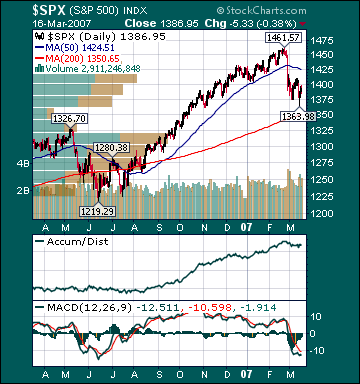

S&P 500 1,386.95 -1.13%

DJIA 12,110.41 -1.35%

NASDAQ 2,372.66 -.62%

Russell 2000 778.77 -.81%

Wilshire 5000 13,999.05 -1.10%

Russell 1000 Growth 548.52 -.87%

Russell 1000 Value 798.22 -1.38%

Morgan Stanley Consumer 685.47 -1.15%

Morgan Stanley Cyclical 934.88 -.65%

Morgan Stanley Technology 552.78 -.73%

Transports 4,781.63 -1.0%

Utilities 478.56 +.49%

MSCI Emerging Markets 110.89 -.80%

Sentiment/Internals

NYSE Cumulative A/D Line 65,809 +2.0

Bloomberg New Highs-Lows Index -30 +21.0%

Bloomberg Crude Oil % Bulls 49.0 +48.4%

CFTC Oil Large Speculative Longs 172,387 +.2%

Total Put/Call 1.22 +6.1%

NYSE Arms 1.35 +6.0%

Volatility(VIX) 16.79 +19.8%

ISE Sentiment 93.0 +36.7%

AAII % Bulls 32.99 -7.9%

AAII % Bears 45.36 +1.05%

Futures Spot Prices

Crude Oil 57.10 -4.9%

Reformulated Gasoline 190.32 +.52%

Natural Gas 6.93 -1.91%

Heating Oil 169.10 -1.33%

Gold 653.0 +.33%

Base Metals 247.72 +4.7%

Copper 301.40 +8.1%

Economy

10-year US Treasury Yield 4.54% -5 basis points

4-Wk MA of Jobless Claims 329,300 -3.0%

Average 30-year Mortgage Rate 6.14% unch.

Weekly Mortgage Applications 690.50 +2.81%

Weekly Retail Sales +3.4%

Nationwide Gas $2.55/gallon +.03/gallon

US Heating Demand Next 7 Days 4.0% below normal

ECRI Weekly Leading Economic Index 140.30 +.07%

US Dollar Index 83.23 -1.22%

CRB Index 304.44 -1.2%

Leading Sectors

Wireless +1.3%

HMOs +1.3%

Hospitals +.64%

Disk Drives +.41%

Lagging Sectors

Alternative Energy -2.1%

Insurance -2.1%

Steel -2.2%

I-Banks -3.1%

Homebuilders -3.7%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day Change

S&P 500 1,386.95 -1.13%

DJIA 12,110.41 -1.35%

NASDAQ 2,372.66 -.62%

Russell 2000 778.77 -.81%

Wilshire 5000 13,999.05 -1.10%

Russell 1000 Growth 548.52 -.87%

Russell 1000 Value 798.22 -1.38%

Morgan Stanley Consumer 685.47 -1.15%

Morgan Stanley Cyclical 934.88 -.65%

Morgan Stanley Technology 552.78 -.73%

Transports 4,781.63 -1.0%

Utilities 478.56 +.49%

MSCI Emerging Markets 110.89 -.80%

Sentiment/Internals

NYSE Cumulative A/D Line 65,809 +2.0

Bloomberg New Highs-Lows Index -30 +21.0%

Bloomberg Crude Oil % Bulls 49.0 +48.4%

CFTC Oil Large Speculative Longs 172,387 +.2%

Total Put/Call 1.22 +6.1%

NYSE Arms 1.35 +6.0%

Volatility(VIX) 16.79 +19.8%

ISE Sentiment 93.0 +36.7%

AAII % Bulls 32.99 -7.9%

AAII % Bears 45.36 +1.05%

Futures Spot Prices

Crude Oil 57.10 -4.9%

Reformulated Gasoline 190.32 +.52%

Natural Gas 6.93 -1.91%

Heating Oil 169.10 -1.33%

Gold 653.0 +.33%

Base Metals 247.72 +4.7%

Copper 301.40 +8.1%

Economy

10-year US Treasury Yield 4.54% -5 basis points

4-Wk MA of Jobless Claims 329,300 -3.0%

Average 30-year Mortgage Rate 6.14% unch.

Weekly Mortgage Applications 690.50 +2.81%

Weekly Retail Sales +3.4%

Nationwide Gas $2.55/gallon +.03/gallon

US Heating Demand Next 7 Days 4.0% below normal

ECRI Weekly Leading Economic Index 140.30 +.07%

US Dollar Index 83.23 -1.22%

CRB Index 304.44 -1.2%

Leading Sectors

Wireless +1.3%

HMOs +1.3%

Hospitals +.64%

Disk Drives +.41%

Lagging Sectors

Alternative Energy -2.1%

Insurance -2.1%

Steel -2.2%

I-Banks -3.1%

Homebuilders -3.7%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day Change

Stocks Lower into Final Hour, Weighed Down by I-Banks

BOTTOM LINE: The Portfolio is slightly lower into the final hour on losses in my Retail longs and Internet longs. I covered my remaining (IWM)/(QQQQ) hedges this morning, thus leaving the Portfolio 100% net long. The tone of the market is negative as the advance/decline line is lower, most sectors are falling and volume is very heavy. Oil is now trading .50 lower today despite a weaker dollar and strength in other commodities, giving up this morning's gains. I am hearing from a number of sources that energy-related commodity funds are seeing substantial redemptions. Moreover, Bloomberg is saying today that some of this money is flowing into energy-related equity hedge funds due to their lower volatility and better performance. In my opinion, oil is still very elevated, even after its 27% plunge, given the deteriorating fundamentals for the commodity. I still believe this is almost solely a result of the frenzied and historic speculation by investment funds. It is interesting to note that if enough investors yank their money from commodity funds investing in oil, oil will likely drop further, thus eventually resulting in a substantial fall in energy-related equities. I expect US stocks to trade mixed-to-higher into the close from current levels on bargain-hunting, falling energy prices and short-covering.

Subscribe to:

Posts (Atom)