Bloomberg:

- Fed Governor Mishkin said inflation is poised to recede gradually to 2%.

- The number of Americans surviving for years after a heart attack is rising, thanks to drugs now prescribed to control long-term risks.

- Abbott Laboratories’(ABT) experimental heart stents may threaten the market dominance of Boston Scientific(BSX) and Johnson & Johnson(JNJ) based on positive results from two studies released today.

- The United Nations Security Council voted unanimously for a resolution freezing the assets of a state-owned Iranian bank and imposing penalties on some military commanders, to push Iran to suspend its nuclear program.

- Venezuela President Hugo Chavez said the government seized 16 private farms and ranches it considers unused, and plans to use the land to raise cattle for meat and milk production. “This is an attack by the state and the people on large land holdings,” Chavez said.

- China is likely to raise interest rates again at least once in the next six months to rein in the supply of money to curb asset bubbles, inflation and excessive investment in factories.

- Copper-mining capacity will grow at an average annual rate of 4.6% from 2006 through 2011, the International Copper Study Group said.

- Ensco International Inc.(ESV), a US oil and natural-gas driller, expects slower growth this year in the rents paid by oil companies for rigs, CEO Rabun said. “You won’t see acceleration of rates you saw in the last 18 months,” Rabun said.

- Mohamed al-Hamli, president of OPEC, said “markets are well supplied” and OPEC will continue to ensure “adequate” oil supplies.

- China’s production of crude steel will rise 13% in 2007, down from 18% last year, as the country’s demand slows, said Luo Binsheng, executive vice-chairman and secretary general of China Iron and Steel Association.

- Chinese President Hu Jintao visits Moscow today, seeking access to Russian oil and natural gas to help cut China’s reliance on the Middle East.

- Intel Corp.(INTC) plans to build its first computer-chip manufacturing plant in China, a $2.5 billion investment that may spur rivals to follow.

Wall Street Journal:

- Tribune Co.(TRB) is likely to accept a buyout proposal from Sam Zell.

- Bulldog Investors founder Philip Goldstein sued Massachusetts securities regulators, alleging the fund’s free-speech rights were violated when it was stopped from giving information on the Internet.

- Senator Hillary Rodham Clinton is struggling to attract support from fundraisers in California’s Silicon Valley who earlier backed husband Bill Clinton.

State Street:

- Hedge Fund Research Study March 2007.

NY Times:

- Executive pay filings show that more boards are requiring so-called clawbacks, which allow companies to recover gains made during periods of financial misconduct.

- Apple will not release the iPhone until June, but Leander Kahney, the writer of “The Cult of Mac” blog, posited this week on Wired News that the new phone is already partly responsible for a major change in how the company is perceived. After nearly three decades, Apple is finally being taken seriously not just by the true believers, but by just about everybody.

LA Times:

- Google Inc.(GOOG) is tutoring political activists and campaigners on how to better use its products, such as YouTube, for campaigns.

MarketWatch.com:

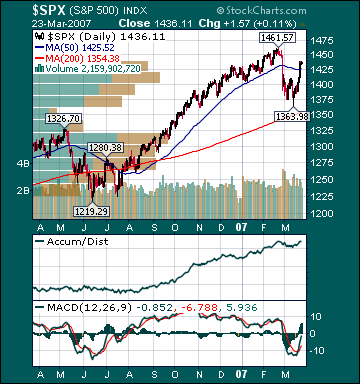

- The stock market is now 4% above its March low, as judged by the Dow Jones Wilshire 5000 Index, however the average NASDAQ timing newsletter is now short the market, according to the Hulbert Stock Newsletter Sentiment Index. This leads contrarians to suspect that more upside is forthcoming.

Sacramento Bee:

- California businesses added 27,600 employees to their payrolls in February, the most since October of last year.

Financial Times:

- DaimlerChrysler AG(DCX) is likely to receive three bids for its Chrysler unit next week after adviser JPMorgan Chase(JPM) asked for initial offers that include business plans and a price by the end of March.

- DreamWorks Animation SKG’s(DWA) decision to produce all its new films using three-dimensional technology from 2009 is an example of how Hollywood studios are planning on boosting box office takings using the once-maligned format.

- UK energy suppliers will be unable to meet the rising demand for renewable energy from their corporate customers this year, citing research by Datamonitor. The shortage means environmental energy restrictions could be relaxed to include nuclear energy.

Economic Daily News:

- United Microelectronics’ solar-cell affiliate NexPower Technology will invest $61 million in a new facility this year.

- Wistron Corp. may stop producing Microsoft’s(MSFT) Xbox games console next year.

Investir:

- Carbone Lorraine SA, the world’s biggest maker of brushes for electric motors, has not witnessed any slowing in demand from the US.

Xinhua:

- China Petroleum & Chemical Corp. is drilling an oil well in southwest China that at 8,875 meters is the deepest in Asia, citing Zhang Xiaopeng, deputy chief engineer of the company’s Southwest China oil and gas unit.

Weekend Recommendations

Barron's:

- Made positive comments on (SBUX), (ORGN), (NLY), (ANH), (OPX) and (RSH).

Citigroup:

- Reiterated Buy on Managed Care, especially those with strong Medicare Advantage franchises, (HUM), (UNH), CVH), (WLP) and (HNT).

Night Trading

Asian indices are unch. to +.50% on average.

S&P 500 indicated -.08%.

NASDAQ 100 indicated -.11%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Conference Calendar

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (CKP)/.39

- (DG)/.38

- (PVH)/.44

- (SHFL)/.07

- (TIF)/1.05

- (TSAI)/.30

- (TWP)/-.66

- (WAG)/.61

Upcoming Splits

- (KMX) 2-for-1

- (HSC) 2-for-1

Economic Releases

10:00 am EST

- New Home Sales for February are estimated at 990K versus 937K in January.

BOTTOM LINE: Asian Indices are mostly higher, boosted by commodity and technology shares in the region. I expect US stocks to open modestly lower and to rally into the afternoon, finishing mixsed. The Portfolio is 100% net long heading into the week.