Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, July 23, 2007

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Sunday, July 22, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- Shares of Williams-Sonoma(WSM) surged the most in almost three years today on speculation the biggest gourmet-cookware retailer in the

- China’s government shut down three companies whose tainted products were used in medicine and pet food, amid efforts to address concerns about the Asian nation’s food safety.

- HIV drugs will be given to people who don’t have the virus by US scientists to determine whether the medicines can protect those at greatest risk of catching the AIDS-causing disease.

-

- Borders Group(BGP) sold 1.2 million copies of “Harry Potter and the Deathly Hallows” yesterday, giving the 1,200-store chain the highest single-day sales of any title in its history.

- Ev3 Inc.(EVVV), a maker of catheter-based devices to treat vascular diseases, agreed to buy FoxHollow Technologies(FOXH), the maker of a device to treat arterial blockage, for $780 million in cash and stock.

- Crude oil is falling a second day in NY on signs fuel stockpiles will increase as refiners increase output.

- Treasuries Attract Pension Funds Overflowing With Stock Gains.

- Bear Stearns(BSC) Shares Show Cayne’s Dummy ‘Body Blow’ Won’t Hurt.

-

Wall Street Journal:

- Trying to cash in on investors’ fascination with alternative investments, Wall Street is pitching a complex new product that aims to mimic hedge-fund performance while avoiding the gigantic fees that real ones charge.

- Barclays Plc is trying to recover $400 million it invested in a Bear Stearns(BSC) fund, a conflict that could lead to arbitration or litigation.

- Technology demand is showing an unexpected surge, driven by rapidly falling prices for components such as computer chips and disk drives, business spending and a rush by people around the world to get on the Internet.

- Numbers Game: Why ‘Guidance’ May Not Matter.

- States Aim to Stem Tide of Home Foreclosures with Funds for Refinancing.

NY Times:

- A record number of fires, power failures, leaks, spills and breakdowns at US oil refineries this year has caused disruptions that have pushed up wholesale gasoline prices 35%.

- General Electric CEO Immelt faces pressure from stockholders to boost the company’s shares.

- Podcasters Unite to Figure Out a Role for Ads.

Business Week:

- The Best Product Design of 2007.

- The Dow's sprint isn't over. One big reason: Of the index's 30 components, at least nine are trading way below their fair market, or intrinsic, value, according to some valuation studies.

AP:

- Iranian and

Washington Post:

- Presidential candidates, including Democratic Senator Hillary Rodham Clinton and Republican Senator John McCain, have made stops at Google’s(GOOG) headquarters in an effort to show they are in touch with the company that has come to represent innovation in

Crain’s

- The Chicago Board Options Exchange has barred about 600 members of the Chicago Board of Trade who haven’t exercised their CBOE trading rights from the exchange.

EE Times:

- Apple flash memory demand triggers shortage fears.

Star-Ledger of

- New Jersey Democratic Governor Jon Corzine urged United Parcel Service to obey state law and give benefits to partners in same-sex relationships.

Daily Telegraph:

- Facebook Inc., a social-networking Web site, is getting 150,000 new members a day.

- China has indefinitely postponed the release of a so-called “Green GDP” because of bureaucratic infighting and local authorities’ opposition, citing Wang Jinnan, who devised the plan.

Hong Kong Commercial Broadcasting:

-

Weekend Recommendations

Barron's:

- Made positive comments on (BBBY), (M), (KSS), (VIA), (KDN), (BBY) and (LVS).

Night Trading

Asian indices are -.75% to unch. on average.

S&P 500 futures -.01%.

NASDAQ 100 futures -.07%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (ALTR)/.21

- (AXP)/.86

- (ACI)/.27

- (ATHR)/.22

- (AV)/.15

- (CGNX)/.11

- (GNTX)/.21

- (HAL)/.56

- (HAS)/.18

- (LNCR)/.62

- (MRK)/.72

- (NFLX)/.24

- (SGP)/.35

- (STN)/.55

- (TASR)/.04

- (TXN)/.42

- (WFT)/.70

Upcoming Splits

- None of note

Economic Releases

- None of note

Today’s Other Potential Market Movers

- None of note

Weekly Outlook

Click here for The Week Ahead by Reuters.

Click here for Stocks in Focus for Monday by MarketWatch.com.

There are some economic reports of note and a number of significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – Richmond Fed Index, weekly retail sales

Wed. – Weekly EIA energy inventory data, weekly MBA Mortgage Applications report, Existing Home Sales, Fed’s Beige Book

Thur. – Durable Goods Orders, Initial Jobless Claims, New Home Sales

Fri. – Advance 2Q GDP, Advance 2Q Personal Consumption, Advance 2Q GDP Price Index, Advance 2Q Core PCE,

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Altera Corp.(ALTR), American Express(AXP), Atheros Communications(ATHR), Avaya Inc.(AV), Halliburton(HAL), Hasbro(HAS), Lincare(LNCR), Merck(MRK), Schering-Plough(SGP), Station Casinos(STN), Taser Intl.(TASR), Texas Instruments(TXN)

Tues. – Aflac(AFL), Amazon.com(AMZN), AT&T(T), Biogen Idec(BIIB), BJ Services(BJS), Bowater(BOW), Burlington Northern(BNI), CDW Corp.(CDWC), Centex Corp.(CTX), Cerner Corp.(CERN), Cheesecake Factory(CAKE), Chubb Corp.(CB), Countrywide Financial(CFC), Domino’s Pizza(DPZ), Eli Lilly(LLY), EMC Corp.(EMC), Energizer Holdings(ENR), Illumina Inc.(ILMN), Kimberly-Cark(KMB), Lam Research(LRCX), Legg Mason(LM), Lexmark Intl.(LXK), Linear Tech(LLTC), Lockheed Martin(LMT), McDonald’s(MCD), Nabors Industries(NBR), Northrop Grumman(NOC), Panera Bread(PNRA), PepsiCo(PEP), Raymond James(RJF), Stanley Works(SWK), United Parcel Service(UPS)

Wed. – Akamai Technologies(AKAM), Alcon(ACL), Allegheny Technologies(ATI), Anheuser-Busch(BUD), Apple Inc.(AAPL), Baidu.com(BIDU), Boeing Co.(BA), Colgate-Palmolive(CL), ConocoPhillips(COP), Corning Inc.(GLW), E*Trade(ETFC), F5 Networks(FFIV), Freeport-McMoRan(FCX), General Dynamics(GD), Genzyme Corp.(GENZ), LSI Coprp.(LSI), Norfolk Southern(NSC), PF Chang’s(PFCB), Pulte Homes(PHM), Qualcomm Inc.(QCOM), Ryland Group(RYL), Sealed Air(SEE), Symantec(SYMC), Terex Corp.(TEX), Timberland(TBL), Tractor Supply(TSCO), Tribune(TRB), Zimmer Holdings(ZMH)

Thur. – 3M Co.(MMM), Aetna(AET), AmerisourceBergen(ABC), Amgen(AMGN), Apache Corp.(APA), Beazer Homes(BZH), Becton Dickinson(BDX), Black & Decker(BDX), Bristol-Myers(BMY), CB Richard Ellis(CBG), Celgene(CELG), Cummins(CMI), Deckers(DECK), Dow Chemical(DOW), DR Horton(DHI), Exxon Mobil(XOM), Flextronics(FLEX), Ford(F), Ingram Micro(IM), Intercontinental Exchange(ICE), Kellogg(K), KLA-Tencor(KLAC), L-3(LLL), Level 3(LVLT), MBIA(MBI), McAfee(MFE), McKesson(MCK), Office Depot(ODP), QLogic(QLGC), Raytheon(RTN), Riverbed(RVBD), Royal Caribbean(RCL), Tidewater(TDW), VeriSign(VRSN), Wendy’s(WEN), Western Digital(WDC), XM Satellite(XMSR)

Fri. – Baker Hughes(BHI), Chevron Corp.(CVX), Clear Channel(CCU), Fortune Brands(FO), ITT Corp.(ITT), Medco Health(MHS)

Other events that have market-moving potential this week include:

Mon. – None of note

Tue. – The Fed’s Mishkin speaking, Fed’s

Wed. – The Fed’s

Thur. – (MSFT) Analyst Meeting

Fri. – None of note

Saturday, July 21, 2007

Friday, July 20, 2007

Weekly Scoreboard*

Indices

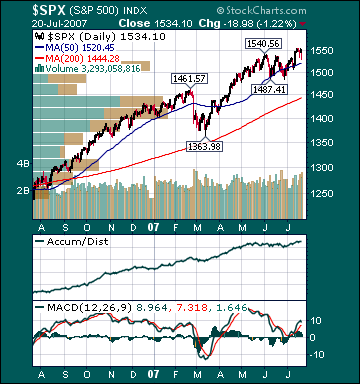

S&P 500 1,534.10 -1.18%

DJIA 13,851.08 -.40%

NASDAQ 2,687.60 -.72%

Russell 2000 836.44 -2.26%

Wilshire 5000 15,459.50 -1.24%

Russell 1000 Growth 614.51 -.60%

Russell 1000 Value 867.45 -1.76%

Morgan Stanley Consumer 730.74 -1.87%

Morgan Stanley Cyclical 1,109.91 -1.34%

Morgan Stanley Technology 653.23 +.58%

Transports 5,359.82 -.18%

Utilities 511.85 -.71%

MSCI Emerging Markets 141.34 -.63%

Sentiment/Internals

NYSE Cumulative A/D Line 76,081 -2.1%

Bloomberg New Highs-Lows Index +440 -37.0%

Bloomberg Crude Oil % Bulls 36.0 -19.0%

CFTC Oil Large Speculative Longs 246,844 -.88%

Total Put/Call 1.23 +32.26%

NYSE Arms 2.14 +201.41%

Volatility(VIX) 16.95 +11.88%

ISE Sentiment 132.0 -27.1%

AAII % Bulls 41.77 -4.3%

AAII % Bears 36.71 +22.4%

Futures Spot Prices

Crude Oil 75.82 +2.36%

Reformulated Gasoline 216.58 -2.67%

Natural Gas 6.39 -4.11%

Heating Oil 209.22 -.73%

Gold 683.50 +2.59%

Base Metals 267.19 +4.1%

Copper 369.50 +2.86%

Economy

10-year US Treasury Yield 4.95% -15 basis points

4-Wk MA of Jobless Claims 312,000 -2.0%

Average 30-year Mortgage Rate 6.73% unch.

Weekly Mortgage Applications 631.60 +.86%

Weekly Retail Sales +2.70%

Nationwide Gas $3.00/gallon -.05/gallon

US Cooling Demand Next 7 Days 6.0% below normal

ECRI Weekly Leading Economic Index 143.90 unch.

US Dollar Index 80.28 -.36%

CRB Index 324.44 -.20%

Best Performing Style

Large-Cap Growth -.59%

Small-Cap Value -2.71%

Disk Drives +4.05%

Computer Services +3.6%

Computer Hardware +2.76%

Oil Service +2.39%

Semis +2.22%

Lagging Sectors

Banks -3.11%

Oil Tankers -3.44%

Homebuilders -4.86%

I-Banks -4.99%

Coal -7.67%

One-Week High-Volume Losers