Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, October 22, 2007

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Sunday, October 21, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- Just when many investors are acknowledging the sudden swoon of US stocks as a sign of a market top, some of Europe’s biggest money managers are anticipating a profit rebound for American companies and slowing earnings growth at home.

- Mobile-phone shipments worldwide this year will probably increase 20%, more than previously though estimated, because of higher Nokia Oyj sales and demand in China and India, JPMorgan Chase(JPM) said.

- Axel Weber, a member of the European Central Bank’s governing council, said the bank may have to raise interest rates further to quell inflation as the euro-region’s economy maintains its expansion.

- US Treasury Secretary Henry Paulson said the World Bank should focus on lending to poor countries and trim funds for China, India and other middle-income nations that are luring private capital.

- Federal Reserve Governor Frederic Mishkin said inflation measures that exclude food and energy costs are a “better guide” to underlying changes in prices.

- Johnson & Johnson(JNJ) and Boston Scientific(BSX) reported new safety data today for drug-coated stents that may help revive sales depressed by prior reports linking the devices to a higher risk of heart attacks.

- Russian Finance Minister Alexei Kudrin suggested the price of gold may decline because of a potential increase in production after the Natalka field was confirmed as the world’s third-largest deposit of the precious metal.

- Turkey’s military probably won’t attack Kurdish rebels in northern Iraq in the immediate future, US Defense Secretary Robert Gates said, after meeting his Turkish counterpart.

NY Times:

- The Gloomsayers Should Look Up.

- As Apple(AAPL) Gains PC Market Share, Jobs Talks of a Decade of Upgrades.

- Lottomatica SpA’s Gtech Holdings(GTK) and Scientific Games Corp.(SGMS), the two dominant suppliers of equipment and products to US state lotteries, plan to expand into other countries.

- Fight Against Coal Plants Is Creating Diverse Partnerships.

MarketWatch.com:

- US venture deals fewer in number, bigger in size.

- The end of Microsoft as we know it? Commentary: A holding company in the mold of KKR, Berkshire Hathaway.

CNNMoney.com:

- Apple’s(AAPL) Earnings Preview: Firing On All Cylinders.

MSNBC.com:

- Commercial real estate market outlook upbeat.

AP:

-

-

- Half of likely

Gulfnews.com:

-

Al-Arabiya:

-

Weekend Recommendations

Barron's:

- Made positive comments on (MMC), (VAR), (SHLD) and (MNST).

Citigroup:

- Reiterated Buy on (ADBE), target raised to $56.

Night Trading

Asian indices are -3.25% to -1.75% on average.

S&P 500 futures -.83%.

NASDAQ 100 futures -.88%

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (CHKP)/.37

- (HAL)/.65

- (HAS)/.71

- (MRK)/.70

- (SGP)/.30

- (AXP)/.85

- (AAPL)/.84

- (KMB)/1.06

- (RCL)/1.78

- (TXN)/.50

Upcoming Splits

- (ARD) 2-for-1

- (CSNT) 2-for-1

Economic Data

- None of note

Other Potential Market Movers

- The Fed’s Kroszner speaking, (WSO) analyst meeting and (NCI) investor day could also impact trading today.

Weekly Outlook

Click here for the Wall St. Week Ahead by Reuters.

Click here for Stocks in Focus for Monday by MarketWatch.com.

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – Weekly retail sales reports, Richmond Fed Manufacturing Index

Wed. – Weekly MBA Mortgage Applications report, weekly EIA energy inventory data, Existing Home Sales

Thur. – Durable Goods Orders, Initial Jobless Claims, New Home Sales

Fri. –

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Halliburton(HAL), Hasbro(HAS), Merck(MRK), Schering-Plough(SGP), American Express(AXP), Apple Inc.(AAPL), Kimberly-Clark(KMB), Royal Carribean(RCL),

Tues. – Biogen Idec(BIIB), Brinker Intl.(EAT),

Wed. – Autonation(AN),

Thur. – Apache Corp.(APA), Black & Decker(BDK), Comcast Corp.(CMCSA), Goodrich Corp.(GR), Intercontinental Exchange(ICE), L-3 Communications(LLL), Starwood Hotels(HOT), XM Satellite Radio(XMSR), Zimmer Holdings(ZMH), Aetna Inc.(AET), Motorola Inc.(MOT), Raytheon(RTN), Southern Co.(SO), Kla-Tencor(KLAC), Baidu.com(BIDU), Ingram Micro(IM), Kenneth Cole(KCP), McAfee Inc.(MFE), Microsoft Corp.(MSFT), CB Richard Ellis(CBG), Celegene(CELG), Cummins Inc.(CMI), Deckers Outdoor(DECK), Diamond Offshore(DO), Dow Chemical(DOW), EMC Corp.(EMC), Estee Lauder(EL), General Motors(GM), Harrah’s Entertainment(HET), ImClone Sytems(IMCL), MBIA Inc.(MBI), Sybase Inc.(SY), Wendy’s International(WEN)

Fri. – Baker Hughes(BHI), Countrywide Financial(CFC), Tidewater Inc.(TDW), BearingPoint(BE), Fortune Brands(FO), Ingersoll-Rand(IR), ITT Corp.(ITT), Southern Copper(PCU)

Other events that have market-moving potential this week include:

Mon. – Fed’s Kroszner speaking, (WSO) analyst meeting, (NCI) Investor Day

Tue. – (BSX) analyst meeting, (WMT) analyst meeting

Wed. – (ARTC) analyst meeting, (EW) analyst lunch, (GOOG) analyst day

Thur. – None of note

Fri. – None of note

Friday, October 19, 2007

Weekly Scoreboard*

Indices

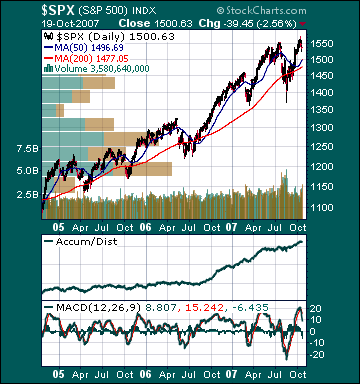

S&P 500 1,500.63 -3.92%

DJIA 13,522.02 -4.05%

NASDAQ 2,725.16 -2.87%

Russell 2000 798.79 -5.04%

Wilshire 5000 15,105.35 -3.91%

Russell 1000 Growth 614.54 -3.32%

Russell 1000 Value 829.92 -4.46%

Morgan Stanley Consumer 728.55 -3.42%

Morgan Stanley Cyclical 1,038.62 -4.62%

Morgan Stanley Technology 665.26 -3.43%

Transports 4,801.36 -2.82%

Utilities 498.66 -3.99%

MSCI Emerging Markets 154.18 -2.57%

Sentiment/Internals

NYSE Cumulative A/D Line 68,204 -7.01%

Bloomberg New Highs-Lows Index -226 -271.2%

CFTC Oil Large Speculative Longs 251,001 +1.5%

Bloomberg Crude Oil % Bulls 13.8 -39.7%

Total Put/Call 1.13 +48.68%

NYSE Arms 3.52 +255.55%

Volatility(VIX) 22.96 +29.50%

ISE Sentiment 101.0 -38.41%

AAII % Bulls 41.96 -23.21%

AAII % Bears 35.71 +38.57%

Futures Spot Prices

Crude Oil 88.60 +5.84%

Reformulated Gasoline 216.87 +3.82%

Natural Gas 7.04 +.84%

Heating Oil 233.06 +3.67%

Gold 768.40 +1.95%

Base Metals 252.66 -.59%

Copper 355.15 -2.76%

Economy

10-year US Treasury Yield 4.40% -29 basis points

4-Wk MA of Jobless Claims 316,500 +1.9%

Average 30-year Mortgage Rate 6.40% unch.

Weekly Mortgage Applications 656.30 +.66%

Weekly Retail Sales +2.6%

Nationwide Gas $2.81/gallon +.01/gallon

US Cooling Demand Next 7 Days 21.0% above normal

ECRI Weekly Leading Economic Index 139.90 -.36%

US Dollar Index 77.41 -1.04%

CRB Index 340.1 +1.98%

Best Performing Style

Large-Cap Growth -3.32%

Worst Performing Style

Small-cap Value -5.90%

Leading Sectors

Steel +.51%

Road & Rail -.09%

Computer Hardware -.37%

HMOs -.65%

Restaurants -1.20%

Lagging Sectors

Insurance 6.34%

Oil Service -6.74%

Retail -6.75%

Homebuilders -7.12%

I-Banks -7.64%