Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, November 12, 2007

Links of Interest

Sunday, November 11, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- China ordered banks to put aside more reserves for the ninth time this year to cool an economy that expanded 11.5% in the third quarter and to damp speculation in stocks and real estate.

- Canada’s dollar fell, snapping its longest streak of weekly gains in 10 years, as Canadian officials said they were concerned over the currency’s climb to a record high.

- President Bush said Pakistan’s President Pervez Musharraf has assured the US he will take the “positive steps” of relinquishing his post as head of the army and holding parliamentary elections.

- Boeing Co.(BA) won an order for 12 of its 777 aircraft valued at $3.2 billion from Emirates as the biggest Arab airline expands long-haul routes.

- Democratic presidential candidate Barack Obama said he would raise the cap on Social Security payroll taxes to fix what he called the single most important social program in the

- Pakistan’s President Pervez Musharraf said general elections will be held by Jan. 9 and emergency rule will continue in order to help fight terrorism after a deadly bomb attack on his opposition last month.

- Spanish King Tells Venezuela’s Chavez to ‘Shut Up’.

Wall Street Journal:

- Honeywell Intl.(HON) is developing technology that lets computers monitor the brainwaves of analysts viewing US surveillance images.

- Saudi Aramco is on track to raise crude oil output to 12 million barrels per day by 2009.

- Intel(INTC) Shifts From Silicon To Lift Chip Performance.

NY Times:

- The Federal Communications Commission has determined the cable industry has grown too large and plans to impose new regulations to open the market for independent programmers and video services.

- US Banks Agree on Credit Backup Fund.

- Giving to Charity, Through Real Estate. A way to help a cause, save on taxes and maybe still get a monthly check.

MarketWatch.com:

- Investors who believe that China’s soaring stock market is due for crash now have a new tool to put their money where their mouth is.

IBD:

- Clinical Trial Firms Pass Test on Wall Street.

- High oil prices are fueling one of the biggest transfers of wealth in history. Oil consumers are paying $4 billion to $5 billion more for crude oil every day than they did just five years ago, pumping more than $2 trillion into the coffers of oil companies and oil-producing nations this year alone.

- The Newest Bubble: Oil. The fact is that supply of known reserves is 1.4 trillion barrels, which is larger than it has been at any time in the last 30 years. And thanks to improved technology, the recovery rate from reservoirs has already increased from 20 to 35%, on is way to 50%. According to industry estimates, demand actually fell in the United States last year and is growing globally by less than 1%. Since the summer, open crude oil futures contracts held by financial players are up 50%.

- China confirms toxic ‘date-rape’ substance on toys.

CNNMoney.com:

- Eni SpA(E) CEO Paolo Scaroni said he believes the oil price is more likely to fall than rise further, adding much of the recent price hikes are due to speculative pressure. ‘For each real physical barrel of oil demand, there are a hundred on paper,’ he said referring to futures market activity that is driven by investment funds.

Financial Times:

- Super-SIV clear to sign more banks.

- Daimler and Ford to pursue fuel cell venture. The two carmakers have given the partnership momentum by buying Ballard Power Systems’ troubled automotive fuel cell business, including numerous patents and 150 employees.

- China enjoys banner year in gold production.

- US strike on Iran ‘not being prepared.’

- New Citi chief to get free hand on strategy.

Sunday Telegraph:

- Former US President Bill Clinton will travel to

Sunday Business Post:

- Former President Bill Clinton will raise as much as $300,000 for his wife, Democratic presidential candidate Hillary Rodham Clinton, by addressing a fundraising dinner in

AFP:

-

Finanz & Wirtschaft:

- Toyota Motor’s(TM) auto-financing business in the

EFE:

- Brazilian President Luis Inacio Lula da Silva wants his country to join OPEC following a 5- to 8-billion-barrel oil discovery.

Xinhua News Agency:

- More than two-thirds of Chinese enterprises said the country has either some or serious excess capacity in their industry, citing a survey by the

Nihon Keizai:

- Walt Disney(DIS) will begin mobile phone services in

-

Haaretz:

- Israeli government officials believe that the country’s sovereign credit rating may be raised for the first time since 1995 as the nation’s ratio of debt to gross domestic product falls.

Weekend Recommendations

Barron's:

- Made positive comments on (C), (CVD), (PPDI) and (QCOM).

Citigroup:

- Upgraded (ALTR) to Buy, target $25.

- Reiterated Buy on (MON), target $114.

- Downgraded (ETFC) to Sell, target $7.50.

- Reiterated Buy on (CF), target $108.

Morgan Stanley:

- Reiterated Overweight on (MMM).

Night Trading

Asian indices are -3.25% to -1.25% on avg.

S&P 500 futures -.09%.

NASDAQ 100 futures -.43%

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (BX)/.30

- (TSN)/.09

- (HEW)/.36

- (BOBE)/.39

Upcoming Splits

- (MPR) 4-for-3

- (TNP) 2-for-1

- (CRS) 2-for-1

- (APAGF) 4-for-1

Economic Data

- None of note

Other Potential Market Movers

- The (CWST) analyst day, (TSN) analyst meeting, (TSS) investor presentation, (SIMG) analyst meeting, (UFI) investor meeting, Citigroup Biotech Conference, Oppenheimer Digital Media Conference, Deutsche Bank Gaming Forum and Piper Jaffray Industrial Growth & Business Services Symposium could also impact trading today.

Weekly Outlook

Click here for the Wall St. Week Ahead by Reuters.

Click here for Stocks in Focus for Monday by MarketWatch.com.

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – None of note

Tues. – Weekly retail sales reports, IDB/TIPP Economic Optimism Index, Monthly Budget Statement, Pending Home Sales

Wed. – Weekly EIA energy inventory report, weekly MBA Mortgage Applications report, Producer Price Index, Advance Retail Sales, Business Inventories

Thur. – Consumer Price Index, Empire Manufacturing, Initial Jobless Claims, Philly Fed

Fri. – Net Long-term TIC Flows, Industrial Production, Capacity Utilization

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Tyson Foods(TSN), Blackstone Group(BX), Bob Evans Farms(BOBE), Echo Star Communications(DISH)

Tues. – Fossil Inc.(FOSL), Home Depot(HD), Wal-Mart Stores(WMT), Sears Holdings(SHLD), Pilgrim’s Pride(PPC), PEP Boys(PBY), Big Lots(BIG), TJX Cos(TJX)

Wed. – Network Appliance(NTAP), Sina Corp.(SINA), Applied Materials(AMAT), Macy’s Inc.(M), Hilton Hotels(HLT), First Data(FDC), Long Drug Stores(LDG)

Thur. – Tyco International(TYC), Nuance Communications(NUAN), Suntech Power(STP), Williams-Sonoma(WSM), Green Mountain Coffee(GMCR), Hillenbrand Industries(HB), Intuit(INTU), PetSmart(PETM), Autodesk(ADSK), Salesforce.com(CRM), Kohl’s Corp.(KSS), LDK Solar(LDK), Agilent Technologies(A), JC Penney(JCP), Shaw Group(SGR), Starbucks(SBUX), BEA Systems(BEAS)

Fri. – JM Smucker(SJM), AnnTaylor Stores(ANN), Beazer Homes(BZH), Jack in the Box(JBX)

Other events that have market-moving potential this week include:

Mon. – (CWST) analyst day, (TSN) analyst meeting, (SIMG) analyst meeting, (UFI) investor meeting, Citigroup Biotech Conference, Oppenheimer Digital Media Conference, Deutsche Bank Gaming Forum, Piper Jaffray Industrial Growth/Business Services Symposium

Tue. – (TSS) analyst presentation, (MCD) analyst meeting, (AMP) analyst meeting, (ITT) analyst day, CSFB Healthcare Conference, Piper Jaffary Global Internet Summit, Deutsche Bank Gaming Investment Forum, Morgan Stanley Global Consumer & Retail Conference, Piper Jaffray Industrial Growth/Business Services Symposium, UBS Global Tech and Services Conference, Goldman Sachs Global Shipping Conference, Bear Stearns SMid Cap Conference, Merrill Lynch Banking & Financial Conference

Wed. – (SE) analyst meeting, (SMOD) analyst meeting, (TLM) analyst meeting, (LEG) analyst meeting, (LXK) analyst day, (PCL) analyst day, (QCOM) analyst meeting, (UFI) investor meeting, (SE) analyst meeting, (GWW) analyst meeting, (CSAR) analyst meeting, Morgan Stanley Global Consumer & Retail Conference, CSFB Insurance & Asset Management Conference, Merrill Lynch Banking & Financial Services Investor Conference, CSFB Healthcare Conference, Stephens Investment Conference, Bear Stearns SMid Cap Conference, Piper Jaffray, UBS Global Tech & Services Conference

Thur. – (IWOV) analyst meeting, (SRDX) analyst meeting, (HAS) analyst meeting, (SCHW) business update, Morgan Stanley Global Consumer & Retail Conference, UBS Global Tech & Services Conference, CSFB Insurance & Asset Management Conference, Bank of America Energy Conference, CSFB Healthcare Conference, Merrill Lynch Banking & Financial Services Conference, Stephens Investment Conference

Fri. – Bank of America Energy Conference, CSFB Insurance & Asset Management Conference, (GIB) investor day

Friday, November 09, 2007

Weekly Scoreboard*

Indices

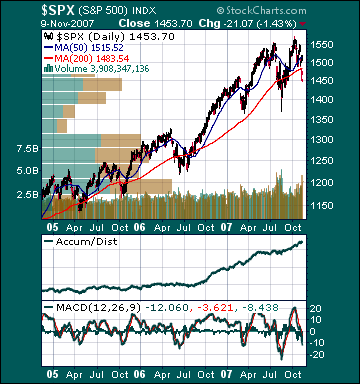

S&P 500 1,453.70 -3.6%

DJIA 13,042.74 -4.01%

NASDAQ 2,627.94 -6.41%

Russell 2000 772.38 -3.34%

Wilshire 5000 14,645.14 -3.59%

Russell 1000 Growth 601.40 -4.38%

Russell 1000 Value 796.58 -2.79%

Morgan Stanley Consumer 729.57 -1.03%

Morgan Stanley Cyclical 995.16 -4.65%

Morgan Stanley Technology 616.64 -8.35%

Transports 4,603.92 -4.01%

Utilities 524.27 -.12%

MSCI Emerging Markets 155.43 -3.28%

Sentiment/Internals

NYSE Cumulative A/D Line 65,194 -5.6%

Bloomberg New Highs-Lows Index -823 -317.77%

Bloomberg Crude Oil % Bulls 36.7 -38.3%

CFTC Oil Large Speculative Longs 251,944 +2.3%

Total Put/Call 1.08 -6.09%

NYSE Arms .86 -22.52%

Volatility(VIX) 28.50 +23.86%

ISE Sentiment 118.0 -13.24%

AAII % Bulls 36.19 -19.06%

AAII % Bears 51.43 +41.02%

Futures Spot Prices

Crude Oil 96.20 +.62%

Reformulated Gasoline 245.60 +.93%

Natural Gas 7.88 -6.31%

Heating Oil 261.25 +1.93%

Gold 834.0 +3.22%

Base Metals 238.19 -3.11%

Copper 314.60 -5.71%

Economy

10-year US Treasury Yield 4.21% -10 basis points

4-Wk MA of Jobless Claims 329,800 +.6%

Average 30-year Mortgage Rate 6.24% -2 basis points

Weekly Mortgage Applications 670.60 -1.63%

Weekly Retail Sales +2.1%

Nationwide Gas $3.08/gallon +.14/gallon

US Heating Demand Next 7 Days 27% below normal

ECRI Weekly Leading Economic Index 140.10 +.5%

US Dollar Index 75.39 -1.23%

CRB Index 354.54 +.27%

Best Performing Style

Small-cap Value -2.34%

Worst Performing Style

Large-cap Growth -4.4%

Leading Sectors

Hospitals +1.93%

HMOs +.43%

Utilities -.29%

Gaming -1.11%

Alternative Energy -1.29%

Lagging Sectors

Networking -7.06%

Internet -8.01%

Software -8.02%

Computer Hardware -9.4%

Airlines -11.7%