Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, November 19, 2007

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Sunday, November 18, 2007

Monday Watch

Weekend Headlines

Bloomberg:

- Genentech Inc.(DNA), the largest US maker of cancer drugs, said its Avastin medicine slowed the spread of brain tumors in a study, offering a potential option against a disease that has resisted therapy for 25 years.

- Crude oil prices aren’t high and the commodity is sold for a paltry sum, Iranian President Mahmoud Ahmadinejad said today in

-

- Former Fed Chairman Greenspan said the dollar’s decline hasn’t affected the global economy and is a “market phenomenon.”

- The death toll from tropical cyclone Sidr in Bangladesh rose to more than 2,000, with more than 1.5 million people living in temporary shelters after homes were flattened and low-lying areas flooded, disaster management officials said.

- Celgene Corp.(CELG), the maker of thalidomide-based cancer drugs, will acquire Pharmion Corp.(PHRM) for $2.9 billion in cash and stock to expand its product lineup of treatments for blood diseases and cancer.

- Copper futures were little changed near an eight-month low in

Wall Street Journal:

- General Motors(GM), looking to speak year-end demand, has launched a new “Red Tag Event” incentive campaign that offers 0% financing for 60 months on several 2007 models and discounts on many newly launched 2008 models.

- Chrysler, looking to return to profitability by 2009, is considering branding changes that would further simplify its product portfolio while helping to cut as many as 1,000 dealers.

- China’s government has ordered commercial banks to freeze lending through the end of this year in an attempt to rein in surging investment and cool economic growth.

NY Times:

- A Clinton Friend’s Role Sets Off Intense Criticism of CNN and a Re-examination. CNN, which sponsored the Democratic presidential debate Nov. 15, should have more fully disclosed commentator James Carville’s relationship to candidate Hillary Rodham Clinton, citing network President Jonathan Klein.

- The

MarketWatch.com:

- The travel purse is still plentiful for Thanksgiving. Despite fuel costs and more airport headaches, Americans are on the move.

- Garmin(GRMN) quits Tele Atlas battle, but might win GPS war.

- Top-performing newsletter turns bearish on Chinese stocks.

IBD:

- Microsoft(MSFT) Starting to Deliver Servers for the Home.

- IBM(IBM) Beefs Up Storage Offerings.

Newsweek:

- Interpol, the world police organization, has issued so-called red notices for the arrest of three Iranian officials, including Deputy Defense Minister Ahmad Vahidi, alerting customs and border authorities worldwide that they are wanted on terrorism charges. The three men have been charged in

Business Week:

- The Greatest Givers. BusinessWeek’s Special Report on individual and corporate philanthropy.

- Google’s(GOOG) Solo Wireless Bid. The king of search will bid alone at January’s auction of wireless airwaves, but it’s likely to need a partner to develop a network.

- S&P’s latest stock screen finds 8 top-ranked names whose shares are being snapped up by company insiders.

- Ethanol makers consider coast-to-coast pipeline.

CNNMoney.com:

- Who’s at the top of your holiday list? A foodie? A sports nut? A child? We’ve got you covered. A complete holiday gift guide.

- 7 year-end tax-saving moves.

- Safest cars: 11 new models.

- McDonald’s(MCD) Eyes Ballooning Coffee Market.

Reuters:

- Financial market turmoil may last some time, but US Treasury Secretary Henry Paulson told G20 members on Sunday he was confident that the US economy will keep growing.

- Japan’s prime minister said on Sunday that he believes the US economy is not in a poor state and that problems caused by the subprime mortgage crisis would be resolved soon.

- AT&T(T) may bid for EchoStar(DISH) by year’s end.

Financial Times:

- Merrill Lynch(MER) and Citigroup(C) may consider selling minority stakes in their brokerage arms to help boost their stock prices and balance sheets.

- OPEC unites behind higher prices.

- Yahoo!(YHOO) staff have been given until the first quarter of 2008 to revamp the poorly performing parts of its European business – or they will be closed down or sold.

- Support for SIV superfund grows.

Independent:

- BHP Billiton Ltd.(BHP) must add $15 billion to its offer for Rio Tinto Group(RTP) for the takeover to succeed, citing Jane Coffey at Royal London Asset Management.

Berlingske Tidende:

- Lego A/S is predicting that sales of the company’s toys may rise as much as 10% in the Christmas season compared with last year, citing Mads Nipper, head of Lego Markets and Products. The increase would make 2007 one of the best years in Lego’s history.

Le Monde:

- Iranian President Mahmoud Ahmadinejad said French President Nicolas Sarkozy was “young and inexperienced” and criticized his decision to push for sanctions against

BBC:

- Former US President Bill Clinton raised about $250,000 for his wife Hillary’s presidential campaign fund by appearing at a function in

WirtschaftsWoche:

- Software AG,

Nikkei English News:

- Nippon Oil Corp., Toyota Motor and 14 other Japanese companies will jointly develop technology to produce bioethanol from plants and used construction materials.

- AU Optronics Group(AUO) will boost sales at least 30% next year, citing Chairman K.Y. Lee.

Weekend Recommendations

Barron's:

- Made negative comments on (MGM), (WYNN), (LVS), (LLY) and (ADM).

Citigroup:

- Upgraded (NMX) to Buy, target raised to $150.

Night Trading

Asian indices are unch. to +.5% on avg.

S&P 500 futures +.17%.

NASDAQ 100 futures +.34%

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (LOW)/.42

- (CPB)/.72

- (MDT)/.57

- (PERY)/.55

- (FMCN)/.43

- (JWN)/.52

- (DY)/.34

- (HPQ)/.82

- (LEAP)/-.07

- (TWB)/.46

Upcoming Splits

- None of note

Economic Data

1:00 pm EST

- The NAHB Housing Market Index for November is estimated to fall to 17 versus 18 in October.

Other Potential Market Movers

- The (LMAT) analyst meeting, (RAI) analyst meeting and Bank of America Defense Day could also impact trading today.

Weekly Outlook

Click here for the Wall St. Week Ahead by Reuters.

Click here for Stocks in Focus for Monday by MarketWatch.com.

There are a few economic reports of note and some significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – NAHB Housing Market Index

Tues. – Weekly retail sales reports, Housing Starts, Building Permits, Oct. FOMC Minutes

Wed. – Weekly EIA energy inventory report, weekly MBA Mortgage Applications report, Initial Jobless Claims,

Thur. –

Fri. – US stock market 1pm EST close

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – Lowe’s(LOW), Campbell Soup(CPB), Medtronic(MDT), Hewlett-Packard(HPQ), Nordstrom(JWN), Focus Media(FMCN), Perry Ellis(PERY), Leap Wireless(LEAP)

Tues. – Dick’s Sporting Goods(DKS), GameStop(GME), Freddie Mac(FRE), Barnes & Noble(BKS), Stage Stores(SSI), BJ’s Wholesale(BJ), Hormel Foods(HRL), Aruba Networks(ARUN), Ltd Brands(LTD), Borders Group(BGP), Aspen Tech(AZPN), Hibbett Sports(HIBB), Whole Foods Market(WFMI), Hott Topic(HOTT), Target Corp.(TGT), Mothers Work(MWRK), DR Horton(DHI), Ross Stores(ROST), Gymboree(GYMB), J Crew(JCG), Office Depot(ODP), Zoltek(ZOLT), Foot Locker(FL), Pall Corp(PLL), Zale Corp.(ZLC), Eaton Vance(EV), Saks Inc.(SKS)

Wed. – Charming Shoppes(CHRS), Patterson Cos(PDCO), Children’s Place(PLCE), Gap Inc.(GPS), Deere & Co.(DE), Buckle Inc.(BKE), Abercrombie & Fitch(ANF)

Thur. –

Fri. –

Other events that have market-moving potential this week include:

Mon. – (LMAT) analyst meeting, (RAI) analyst meeting, Bank of America Defense Day

Tue. – (IART) analyst meeting, Bank of America Defense Day, Scotia Capital Telecom & Tech Conference

Wed. – None of note

Thur. –

Fri. – None of note

Friday, November 16, 2007

Weekly Scoreboard*

Indices

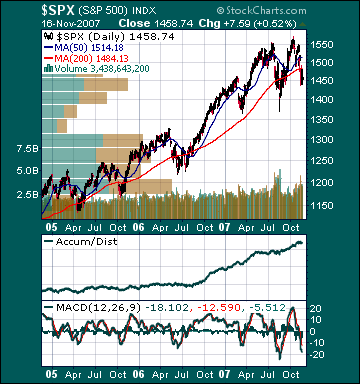

S&P 500 1,458.74 +.34%

DJIA 13,176.79 +1.03%

NASDAQ 2,637.24 +.35%

Russell 2000 769.50 -.39%

Wilshire 5000 14,667.84 +.15%

Russell 1000 Growth 604.74 +.56%

Russell 1000 Value 794.84 -.22%

Morgan Stanley Consumer 743.38 +1.89%

Morgan Stanley Cyclical 975.45 -1.98%

Morgan Stanley Technology 619.47 +.45%

Transports 4,563.84 -.87%

Utilities 520.25 -.80%

MSCI Emerging Markets 153.28 -1.38%

Sentiment/Internals

NYSE Cumulative A/D Line 61,912 -5.25%

Bloomberg New Highs-Lows Index -626 -16.57%

Bloomberg Crude Oil % Bulls 36.7 -36.7%

CFTC Oil Large Speculative Longs 225,232 -10.6%

Total Put/Call 1.28 +3.2%

NYSE Arms .70 -3.5%

Volatility(VIX) 25.5 -11.3%

ISE Sentiment 68.0 -43.70%

AAII % Bulls 33.01 -8.8%

AAII % Bears 49.5 -3.7%

Futures Spot Prices

Crude Oil 95.10 -1.3%

Reformulated Gasoline 237.80 -3.2%

Natural Gas 8.02 +1.4%

Heating Oil 259.25 -1.11%

Gold 787.70 -5.7%

Base Metals 230.93 -3.0%

Copper 319.0 +.79%

Economy

10-year US Treasury Yield 4.16% -5 basis points

4-Wk MA of Jobless Claims 330,000 unch.

Average 30-year Mortgage Rate 6.24% unch.

Weekly Mortgage Applications 707.30 +5.5%

Weekly Retail Sales +2.4%

Nationwide Gas $3.11/gallon +.01/gallon

US Heating Demand Next 7 Days 9% below normal

ECRI Weekly Leading Economic Index 140.0 -.2%

US Dollar Index 75.81 +.57%

CRB Index 349.43 -1.44%

Best Performing Style

Large-cap Growth +.55%

Worst Performing Style

Mid-cap Value -.96%

Leading Sectors

Airlines +5.7%

Computer Services +2.7%

Retail +1.8%

Software +1.5%

Drugs +1.5%

Lagging Sectors

Oil Service -4.0%

Oil Tankers -5.2%

Gold -6.8%

Coal -7.3%

Construction -8.1%