Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Tuesday, January 22, 2008

Links of Interest

Market Snapshot Commentary

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

DJIA Quick Charts

Chart Toppers

Intraday Chart/Quote

Dow Jones Hedge Fund Indexes

Monday, January 21, 2008

Tuesday Watch

Weekend Headlines

Bloomberg:

- Asian stocks tumbled, extending a global sump that has wiped more than $5 trillion from stock markets this year, on concern world economic growth is faltering.

- US Energy Secretary Samuel Bodman said a rise in OPEC production would be a “constructive response” to the short-term impact high oil prices are having on the US economy.

- It’s only a matter of time before the euro starts to imitate the dollar, thanks to train engineers and ticket-takers.

- The euro fell to a five-month low against the yen as European stocks plunged by the most since 2001 on concern the global economy is slowing.

- Gold fell to a two-week low in London as the US dollar strengthened and investors sold commodities to cover losses in equities.

- Oil fell $2/bbl. to $88.57/bbl. on a strengthening US dollar, worries over global demand, record global production and less speculation by investment funds.

- Cia. Vale do Rio Doce said it held talks to buy Xstrata Plc, a takeover that would be worth at least $60.5 billion at current prices, making it the second-largest mining acquisition ever.

- Venture capitalists pumped a record $9.1 billion into privately held US biotechnology and medical device companies last year, in hopes of making discoveries they can sell to larger drugmakers.

- President Bush urged Congress to work with his administration to enact an economic stimulus plan “as soon as possible” to counter growing threats to an economic expansion that is now in its seventh year.

- Venezuelan President Hugo Chavez raised the regulated price for unprocessed milk and threatened to seize dairies that try to charge more as he attempts to increase supply amid widespread shortgages.

- ACA Capital Holdings(ACA) convinced its trading partners to give the bond insurer more time to get out of $60 billion in credit-default swap contracts that it can’t pay.

- Microsoft Corp.(MSFT) bought Calista Technologies and expanded a partnership with Citrix Systems(CTRX) to compete in the growing market for so-called virtualization technology.

- The decline in Iraq violence following an increase in US forces has opened a “window of opportunity” for political gains, the top UN envoy to the country said.

- Democratic presidential candidate Barack Obama said former President Bill Clinton is making misleading statements and carrying his support for Hillary Rodham Clinton to a “troubling” level.

- The yen declined, erasing gains, on speculation an advance to the strongest in 2 ½ years against the dollar was excessive.

Wall Street Journal:

- Investor Edward Lampert, who runs Sears Holdings Corp.(SHLD), plans to change the business structure of the retailer.

- Los Angeles Times editor James O’Shea was fired just 14 months after he assumed the post.

- The average US-stock mutual fund held 7.3% of assets in cash through the end of last year, the highest year-end figure since 2000, according to Morningstar Inc.

- The supply shortages in the liquid-crystal-display market may well last throughout the remainder of this year, forcing some of Asia’s biggest panel manufacturers to fast-forward their capital-spending plans to meet demand, analysts say.

NY Times:

- Foreign investors, including sovereign wealth funds in China and the Middle East, bought a record $414 billion in American assets last year, and are buying more in 2008, citing Thomson Financial.

- Too much caffeine during pregnancy may increase the risk of miscarriage, a new study says, and the authors suggest that pregnant women may want to reduce their intake or cut it out entirely.

- Getty Images(GYI) Up for Sale, Could Fetch $1.5 Billion.

Dow Jones:

- Venezuelan Oil and Energy Minister Rafael Ramirez said he sees no reason for OPEC to increase output to lower oil prices.

Business Week:

- The iPhone: Going Corporate?

CNNMoney.com:

- Venture capital at 6-year high. Investments rise to $29.4 billion in 2007, indicating optimism in the face of recession fears.

SmartMoney.com:

- Sifting Market Wreckage for Tech Bargains.

- Two value hunters with sterling records share their top picks.

Financial Times:

- Israel will set out plans on Monday to cut drastically its dependence on oil imports, with a private-sector initiative for a nationwide electric car network.

Bangkokpost.com:

- Advanced Info Service has joined with strategic partner Singapore Telecom to bring Apple’s(AAPL) much-touted iPhone to the region, including Thailand.

Al Arabiya TV:

-

Emirates Business 24/7:

- Tatweer, a unit of government-owned Dubai Holding LLC, may buy a stake in DreamWorks Animation SKG, citing Mohammed al-Habbai, Tatweer’s vp of entertainment and leisure.

Weekend Recommendations

Barron's:

- Made positive comments on (ACOR), (IHP) and (MBI).

Citigroup:

- Maintained Buy on (DE), target $92.

Night Trading

Asian indices are -5.0% to -2.75% on avg.

S&P 500 futures -4.3%.

NASDAQ 100 futures -4.0%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Pre-market Stock Quote/Chart

Before the Bell CNBC Video(bottom right)

Global Commentary

WSJ Intl Markets Performance

Commodity Movers

Top 25 Stories

Top 20 Business Stories

Today in IBD

In Play

Bond Ticker

Economic Preview/Calendar

Daily Stock Events

Macro Calls

Upgrades/Downgrades

Rasmussen Business/Economy Polling

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (ADTN)/.27

- (PCP)/1.72

- (ETN)/1.71

- (WB)/.33

- (JEC)/.71

- (BAC)/.21

- (UAUA)/-.97

- (RF)/.29

- (BJS)/.59

- (JNJ)/.86

- (UNH)/.92

- (KEY)/-.03

- (CSX)/.64

- (ABK)/-3.86

- (DD)/.50

- (TLAB)/.01

- (FAST)/.36

- (AKS)/.58

- (DOX)/.56

- (CREE)/.11

- (TXN)/.52

- (ACF)/.24

- (NSC)/.90

- (AAPL)/1.61

- (WAT)/1.06

- (FIC)/.46

- (NWK)/.06

Upcoming Splits

- (MHS) 2-for-1

Economic Data

- None of note

Other Potential Market Movers

- The Richmond Fed Manufacturing report, JPMorgan High Yield Conference and weekly retail sales reports could also impact trading today.

Weekly Outlook

Click here for the

Click here for Tuesday’s

There are some economic reports of note and a few significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. – US Markets Closed

Tues. – Richmond Fed Manufacturing Index, weekly retail sales reports

Wed. – Weekly MBA Mortgage Applications report

Thur. – Initial Jobless Claims, Existing Home Sales, Weekly EIA energy inventory report

Fri. – None of note

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. – US Markets Closed

Tues. – Precision Castparts(PCP), Bank of

Wed. – Coach Inc.(COH), SLM Corp.(SLM), Freeport-McMoRan(FCX), Pfizer(PFE), SunTrust Banks(STI), Parametric Technology(PMTC), Abbott Labs(ABT), Brinker Intl.(EAT), Ethan Allen(ETH), United Technologies(UTX), Piper Jaffray(PJC), Checkpoint Software(CHKP), Praxair(PX), Rockwell Automation(ROK), St. Jude Medical(STJ), ConocoPhillips(COP), Qualcomm Inc.(QCOM), Stryker Corp.(SYK), Capital One Financial(COF), Gilead Sciences(GILD), Teradyne Inc.(TER), Ryland Group(RYL), F5 Networks(FFIV), QLogic Corp.(QLGC), Noble Corp.(NE), Western Digital(WDC), NetFlix(NFLX), WellPoint(WLP), Exelon Corp.(EXC), AllianceBernstein(AB), Raymond James(RJF), Delta Air(DAL), Southwest Airlines(LUV), Symantec Corp.(SYMC), eBay Inc.(EBAY), Kimberly-Clark(KMB), General Dynamics(GD), Jeffries Group(JEF), Allegheny Technologies(ATI), Motorola(MOT)

Thur. – AmerisourceBergen(ABC), Deluxe Corp.(DLX), Lennar Corp.(LEN), Northrop Grumman(NOC), Hershey Co.(HSY), Xerox Corp.(XRX), Ford Motor(F), Rockwell Collins(COL), AT&T(T), Franklin Resources(BEN), Kla-Tencor(KLAC), E*Trade Financial(ETFC), Juniper Networks(JNPR), Microsoft(MSFT), Amgen Inc.(AMGN), Broadcom(BRCM), Microchip Tech(MCHP), Sybase Inc.(SY), Baxter International(BAX), National City(NCC), Consolidated Edison(ED), MEMC Electronics(WFR), Emulex Corp.(ELX), Becton Dickinson(BDX), Lockheed Martin(LMT), Nucor Corp.(NUE), Lam Research(LRCX)

Fri. – Honeywell(HON), Harley-Davidson(HOG), Caterpillar(CAT), Southern Copper(PCU), Dow Jones(DJ), Microstrategy(MSTR), Legg Mason(LM), Fortune Brands(FO), ImClone Systems(IMCL)

Other events that have market-moving potential this week include:

Mon. – US Markets Closed

Tue. – JPMorgan High Yield Conference

Wed. – JPMorgan High Yield Conference, (HS) investor day, (SPW) investor meeting

Thur. – (CRXX) analyst meeting, (KMP) analyst meeting

Fri. – None of note

Saturday, January 19, 2008

Friday, January 18, 2008

Weekly Scoreboard*

Indices

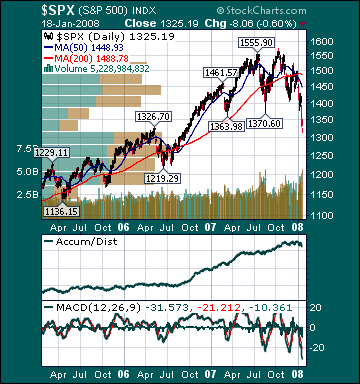

S&P 500 1,325.19 -5.41%

DJIA 12,099.30 -4.02%

NASDAQ 2,340.02 -4.09%

Russell 2000 673.18 -4.47%

Wilshire 5000 13,258 -5.3%

Russell 1000 Growth 551.22 -4.81%

Russell 1000 Value 715.23 -6.06%

Morgan Stanley Consumer 680.48 -4.63%

Morgan Stanley Cyclical 878.66 -3.93%

Morgan Stanley Technology 547.39 -2.14%

Transports 4,179.70 -.19%

Utilities 503.92 -7.27%

MSCI Emerging Markets 136.61 -7.46%

Sentiment/Internals

NYSE Cumulative A/D Line 55,625 -6.2%

Bloomberg New Highs-Lows Index -1,235

Bloomberg Crude Oil % Bulls 9.8 -57.6%

CFTC Oil Large Speculative Longs 227,907 -5.9%

Total Put/Call 1.31 +43.96%

NYSE Arms .84 -44.29%

Volatility(VIX) 27.2 +14.78%

ISE Sentiment 79.0 -11.2%

AAII % Bulls 24.26 +23.6%

AAII % Bears 54.4 -7.5%

Futures Spot Prices

Crude Oil 90.58 -2.47%

Reformulated Gasoline 230.55 -.99%

Natural Gas 7.95 -2.94%

Heating Oil 251.0 -1.48%

Gold 883.50 -1.43%

Base Metals 220.32 -1.19%

Copper 323.10 -2.03%

Economy

10-year US Treasury Yield 3.63% -15 basis points

4-Wk MA of Jobless Claims 328,500 -3.5%

Average 30-year Mortgage Rate 5.69% -18 basis points

Weekly Mortgage Applications 906,400 +28.39%

Weekly Retail Sales +.9%

Nationwide Gas $3.03/gallon -.06/gallon

US Heating Demand Next 7 Days 13.0% above normal

ECRI Weekly Leading Economic Index 137.40 +.88%

US Dollar Index 76.43 +.53%

CRB Index 360.87 -1.17%

Best Performing Style

Small-cap Value -4.05%

Worst Performing Style

Large-cap Value -6.06%

Leading Sectors

Airlines +4.5%

Computer Services +2.98%

Semis +2.79%

Retail +1.14%

Foods -1.1%

Lagging Sectors

Banks -7.67%

Insurance -8.24%

Energy -8.57%

Gold -9.05%

Oil Service -9.9%