Click here for Wall St. Week Ahead by Reuters.

Click here for stocks in focus for Monday by MarketWatch.Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Saturday, May 16, 2009

Friday, May 15, 2009

Weekly Scoreboard*

Indices

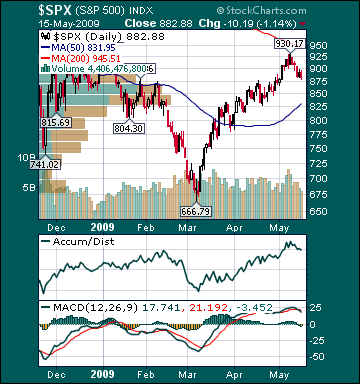

S&P 500 882.88 -4.99%

DJIA 8,268.64 -3.57%

NASDAQ 1,680.14 -3.39%

Russell 2000 475.84 -7.03%

Wilshire 5000 8,928.51 -5.26%

Russell 1000 Growth 387.37 -3.72%

Russell 1000 Value 452.62 -6.62%

Morgan Stanley Consumer 542.05 -3.34%

Morgan Stanley Cyclical 514.70 -10.72%

Morgan Stanley Technology 408.59 -2.60%

Transports 3,053.01 -8.90%

Utilities 329.80 -5.89%

MSCI Emerging Markets 30.13 -3.71%

Sentiment/Internals

NYSE Cumulative A/D Line 28,751 -11.86%

Bloomberg New Highs-Lows Index -53 -82.76%

Bloomberg Crude Oil % Bulls 20.0 -47.37%

CFTC Oil Large Speculative Longs 170,991 -2.54%

Total Put/Call .79 -9.20%

OEX Put/Call 1.24 -28.32%

ISE Sentiment 115.0 %-15.44%

NYSE Arms 2.27 +194.81%

Volatility(VIX) 33.12 +3.33%

G7 Currency Volatility (VXY) 14.14 +5.68%

Smart Money Flow Index 8,172.10 -.07%

AAII % Bulls 43.81 -.64%

AAII % Bears 35.24 +5.73%

Futures Spot Prices

Crude Oil 56.34 -3.92%

Reformulated Gasoline 168.06 -1.26%

Natural Gas 4.10 -5.79%

Heating Oil 141.88 -6.52%

Gold 931.30 +1.51%

Base Metals 132.32 -6.02%

Copper 201.75 -6.31%

Agriculture 325.40 -1.24%

Economy

10-year US Treasury Yield 3.13% -16 basis points

10-year TIPS Spread 1.52% -5 basis points

TED Spread 67.0 -10 basis points

N. Amer. Investment Grade Credit Default Swap Index 156.86 +9.02%

Emerging Markets Credit Default Swap Index 413.99 +6.27%

Citi US Economic Surprise Index +42.70 +15.41%

Fed Fund Futures imply 82.0% chance of no change, 18.0% chance of 25 basis point cut on 6/24

Iraqi 2028 Govt Bonds 61.09 +5.59%

4-Wk MA of Jobless Claims 630,500 +1.0%

Average 30-year Mortgage Rate 4.86% +2 basis points

Weekly Mortgage Applications 895,600 -8.58%

Weekly Retail Sales +.30%

Nationwide Gas $2.29/gallon +.12/gallon

US Cooling Demand Next 7 Days 8.0% below normal

ECRI Weekly Leading Economic Index 111.0 +1.19%

US Dollar Index 82.95 +.51%

Baltic Dry Index 2,544 +14.90%

CRB Index 236.24 -2.87%

Best Performing Style

Large-Cap Growth -3.72%

Worst Performing Style

Small-cap Value -8.17%

Leading Sectors

Education +8.72%

Software +1.67%

Drugs +1.01%

Computer Services -.67%

Biotech -.77%

Lagging Sectors

Steel -12.44%

Coal -13.18%

Gaming -13.31%

Oil Tankers -13.98%

Banks -16.21%

***Alert***

Bull Radar

Style Outperformer:

Small-cap Growth (+.05%)

Sector Outperformers:

Road & Rail (+2.75%), Software (+1.51%) and Restaurants (+1.29%)

Stocks Rising on Unusual Volume:

TTEC, NVTL, ERTS, PALM, ELMG, ANW, MICC, CLMT, IOC, BCS, MIDD, SFLY, GHDX, FELE, CORE, AAWW, MGLN, DDRV, CMTL, MNRO, TKLC, MRTN, ODFL, ABFS, CHDN, LORL, PETM, SRCL, MSTR, ENR, PL, AWR, HGR, VAL, JWN, MFB and HIG

Stocks With Unusual Call Option Activity:

1) ONNN 2) VAR 3) JWN 4) JCP 5) GENZ

Links of Interest

Market Performance Summary

Style Performance

Sector Performance

WSJ Data Center

Top 20 Biz Stories

IBD Breaking News

Movers & Shakers

Upgrades/Downgrades

In Play

NYSE Unusual Volume

NASDAQ Unusual Volume

Hot Spots

Option Dragon

NASDAQ 100 Heatmap

Chart Toppers

Real-Time Intraday Quote/Chart

HFR Global Hedge Fund Indices