Broad Market Tone: - Advance/Decline Line: Higher

- Sector Performance: Most Sectors Rising

- Volume: Below Average

- Market Leading Stocks: Underperforming

Equity Investor Angst: - VIX 22.14 +2.17%

- ISE Sentiment Index 117.0 -18.75%

- Total Put/Call 1.04 +.97%

- NYSE Arms .58 -2.12%

Credit Investor Angst:- North American Investment Grade CDS Index 118.27 -1.84%

- European Financial Sector CDS Index 278.94 -2.46%

- Western Europe Sovereign Debt CDS Index 317.37 -1.49%

- Emerging Market CDS Index 286.37 -.36%

- 2-Year Swap Spread 27.75 -2.25 basis points

- TED Spread 38.25 +1.25 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -50.25 +3.75 basis point

Economic Gauges:- 3-Month T-Bill Yield .09% -1 basis point

- Yield Curve 131.0 -2 basis points

- China Import Iron Ore Spot $135.0/Metric Tonne +.22%

- Citi US Economic Surprise Index -60.60 -6.1 points

- 10-Year TIPS Spread 2.13 +3 basis points

Overseas Futures: - Nikkei Futures: Indicating a +59 open in Japan

- DAX Futures: Indicating +15 open in Germany

Portfolio:

- Higher: On gains in my tech, medial, retail and biotech sector longs

- Disclosed Trades: Covered some of my (IWM)/(QQQ) hedges and some of my (EEM) short, then added them back

- Market Exposure: 50% Net Long

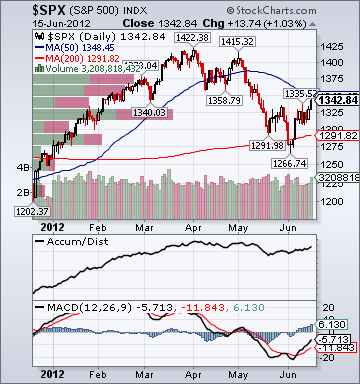

BOTTOM LINE: Today's overall market action is bullish as the S&P 500 trades near session highs despite Eurozone debt angst, more disappointing US economic data and rising global growth fears. On the positive side, Coal, Alt Energy, Steel, Software, Disk Drives, Oil Service and Computer Service shares are especially strong, rising more than +1.25%. Small-cap and cycilcal shares have outperformed throughout the day. As well, tech and financial shares have been relatively strong. Oil is falling -.25% and Copper is gaining +1.5%. Major Asian indices were mostly higher, led by a +2.3% gain in Hong Kong. Major European indices are mostly higher, boosted by a +2.2% gain in Italian shares. The Bloomberg European Bank/Financial Services Index is rising +1.5%. The Germany sovereign cds is down -2.1% to 103.83 bps, the France sovereign cds is down -1.5% to 197.35 bps and the Italy sovereign cds is down -1.04% to 544.0 bps. Moreover, the European Investment Grade CDS is falling -3.2% to 174.83 bps. On the negative side, Oil Tanker, Gaming, Airline, REIT and Construction shares are lower-to-flat on the day

. Lumber is falling -.85% and Gold is gaining +.12%. The Japan sovereign cds is gaining +1.3% to 91.47 bps and the Saudi sovereign cds is rising .8% to 130.35 bps.

Weekly retail sales have decelerated to a sluggish rate. US Rail Traffic continues to soften.

The Philly Fed ADS Real-Time Business Conditions Index continues to trend lower from its late-December peak.

Moreover, the Citi US Economic Surprise Index has fallen back to late-Aug. levels. Lumber is -7.0% since its Dec. 29th high despite improving sentiment towards homebuilders and the broad equity rally ytd. Moreover, the weekly MBA Home Purchase Applications Index has been around the same level since May 2010 despite expectations for a strong spring home selling season. The Baltic Dry Index has plunged around -60.0% from its Oct. 14th high and is now down around -50.0% ytd. China Iron Ore Spot has plunged -25.0% since Sept. 7th of last year. Shanghai Copper Inventories have risen +153.0% ytd.

The CRB Commodities Index is now technically in a bear market, having declined -26.0% since May 2nd of last year.

Overall, recent credit gauge deterioration remains a big worry as most key sovereign cds remain technically strong. The euro currency continues to trade poorly despite today's bounce higher. Oil, lumber and copper also trade poorly given global central bank stimulus hopes and recent stock gains. As well, the 10Y continues to trade too well as the yield fell another -6 bps to 1.58% today.

I still believe the level of complacency among US investors regarding the rapidly deteriorating situation in Europe is fairly high. Some key economies in the region are likely accelerating their contractions right now. As well,

the European debt crisis is really beginning to bite emerging market economies now, which will also further pressure exports from the region and further raise the odds of more sovereign/bank downgrades.

As well, the "US fiscal cliff "will become more and more of a focus for investors as the year progresses.

The upcoming earnings season could proving more challenging than usual for big multi-nationals given US dollar strength and the precipitous declines in some key parts of the global economy during the quarter. Global central bank stimulus hopes have been propping up stocks, but I still believe there is too much uncertainty on the horizon to conclude a durable stock market low is in place. The backdrop for equities ahead of the Greek election is not ideal. The market has worked off its technically oversold state and some gauges of investor sentiment are registering a significant increase in bullishness. I also suspect a fair amount of short-covering has occurred over the last 10 days. Moreover, some well-known pundits are warning of how scared the bears should be, which is also a bit concerning. I suspect the market will trade higher early next week, however any rally may prove short-lived as investors turn their focus away from central bank stimulus hopes and towards Spain/Italy, deteriorating economic data and the US fiscal cliff.

The “solutions” for the European debt crisis I still hear being bandied about are only bigger kick-the-cans that will eventually lead to an even bigger catastrophe as Germany is engulfed, in my opinion. For this year's equity advance to regain traction, I would expect to see a resumption in European credit gauge improvement, a subsiding of hard-landing fears in key emerging markets, a rising 10-year yield, better volume, stable-to-lower energy prices, a US "fiscal cliff" solution and higher-quality stock market leadership. I expect US stocks to trade modestly lower into the close from current levels on more disappointing US economic data, rising global growth fears, Eurozone debt angst and more shorting.