Bloomberg:

- Spanish Yield Jumps Past 7% as Spotlight Shifts Back From Greece. Spanish bonds slid, propelling 10- year yields to more than 7 percent, after yesterday's Greek election failed to convince investors that politicians will be able to tame Europe's financial woes. Italian debt also fell and German bunds rose, reversing earlier declines. Spain's yields climbed to euro-era records as a report today showed the nation's bad loans increased in April. The securities tumbled last week after the bloc's fourth-largest economy requested as much as 100 billion euros ($126 billion) of aid on June 9 to support its banks. Greek bonds rose after pro- bailout parties won enough seats to control parliament. "The spotlight is now back on Spain," said Christian Reicherter, a Frankfurt-based analyst at DZ Bank AG. "The market is worried about the bad loans at the Spanish lenders, which is pressuring the bonds. This goes to show that the European debt crisis isn't solved and we expect bunds to remain well supported." Spain's 10-year yield climbed 35 basis points to 7.22 percent at 1:38 p.m. London time, the most since the euro was introduced in 1999.

- Spanish Bad Loans Jump, Adding to Concerns. More Spanish loans went unpaid in April, suggesting the country’s recession is forcing more companies and consumers into default as the government struggles to restore investor confidence. Bad loans as a proportion of total lending jumped to 8.72 percent in April, the highest since 1994, from 8.37 percent in March and 6.36 percent a year ago as 4.8 billion euros ($6.1 billion) of credit soured in the month, according to data published today by the Bank of Spain in Madrid. Spain’s 10-year government bond yields today reached a euro-era record as concern the region’s debt crisis may deepen outweighed optimism about the results of Greece’s election. Euro finance chiefs called for a new government to emerge “swiftly” from yesterday’s contest, which showed the pro-bailout New Democracy party in a position to form a coalition. “Major steps are necessary at the euro-zone level to protect Spain and Italy from fresh bouts of contagion in the future,” said Nick Kounis, head of macro research at ABN Amro in Amsterdam. “Judging by past form, European politicians tend to take their foot off the gas when the pressure has gone. It is to be hoped that this time will prove different, but there is a significant risk that progress will be slower than hoped.” The bad-loans ratio on consumer loans rose to 7.43 percent in March from 6.86 percent in December and to 3.01 percent for mortgages from 2.74 percent, the Spanish regulator said.

- Euro Crisis Shifts to Spain as Merkel Faces G-20 Pressure. Europe’s financial crisis deepened and enveloped Spain, raising pressure on German Chancellor Angela Merkel at a meeting of world leaders to shift her stance on measures to shield the global economy. President Barack Obama, who has blamed the crisis for a slowdown in U.S. employment growth, is due to hold talks with Merkel in the Mexican resort of Los Cabos at 1:30 p.m. today local time, a White House official said. Merkel and her fellow euro-area leaders will then hold more talks with Obama this evening at the president’s request. Group of 20 chiefs began a two-day meeting in Mexico today as Spanish borrowing costs soared to a euro-era record. With elections in Greece failing to damp the threat of contagion, policy makers are discussing ways to stimulate the world economy if necessary, a Canadian official said. Merkel, who last week criticized U.S. debt levels, said June 15 she’ll press the G-20 to hold to prudent government spending. “It’s not a complete beating up session, but Germany is the recipient of fairly caustic criticism from other members of the G-20,” Rob Carnell, chief international economist at ING Bank NV in London, said by telephone. “The pressure will be on Germany to give more ground and behind closed doors Merkel may well be more accommodative. There is ground for the euro zone to move, but just what it does depends on how much Germany digs its heels in.”

- EU Commission Has Scant Flexibility On Greece, Handelsblatt Says. The European Commission has only narrow scope to offer Greece more flexibility regarding its fulfillment of bailout conditions, the EU Budget Commissioner Janusz Lewandowski told the Handelsblatt newspaper. The commission has already shown flexibility toward Greece and the country must adhere to its savings targets to receive more aid, Lewandowski is cited as saying in an interview.

- Greek Election Leaves Pyrrhic Victory Risk As Aid Talks Near. Greece survived to fail another day, say economists at Royal Bank of Scotland Group Plc and Citigroup Inc. An election result yesterday that defused expectations of an imminent euro exit by Greece left the threat hanging over the global economy and put European leaders under pressure to speed efforts to protect the rest of the region. Spanish 10-year bond yields soared above 7 percent for the first time in the euro era, showing investor concern of the relentless financial turmoil.

- Bond-Swap Divide Deepens Amid Europe Distortion: Credit Markets. Investors seeking shelter from the debt crisis that started in Greece and forced Spain to seek a bailout are distorting credit markets by fueling record disparities between bonds and derivatives. The cost of credit-default swaps insuring investment-grade European companies from steelmaker ArcelorMittal to cement maker Holcim Ltd. (HOLN) exceeded a measure of bond yields by as much as 61 basis points in May and 44 last week, according to Morgan Stanley. That compares with an all-time low of minus 135 in 2008. There was almost no difference in January. Traders are accumulating bond insurance on concern Greece’s exit from the euro would traumatize Europe’s economy and as this weekend’s elections leave the nation’s future in the balance. A shortage of corporate bonds is at the same time driving down yields as banks and investors take advantage of the liquidity from the European Central Bank’s lending program to snap up the notes as an alternative to government debt. “The CDS view is much more realistic because it’s correlated with sovereigns,” said Jochen Felsenheimer, a managing director in Munich at Assenagon Credit Management, which oversees 1.85 billion euros ($2.3 billion). “The distortion provided by the ECB is fully reflected in cash bond spreads, so cash is wrong.”

- Crude Falls for First Time in Three Days on European Debt. Oil dropped for the first time in three days on concern that the worsening European debt crisis will slow global economic growth and reduce demand for crude. Prices declined as much as 2.4 percent as Spanish borrowing costs rose to a euro-era high. More Spanish loans went unpaid in April, Bank of Spain data showed, suggesting the country’s recession is forcing more companies and consumers into default. The weekend elections in Greece eased concern that the country will exit the euro. “Although the Greek news was positive, people are more concerned now about Spain,” said Michael Lynch, president of Strategic Energy & Economic Research in Winchester, Massachusetts. “There is a bearish economic contagion in Europe and it’s essentially bringing prices down.” Oil for July delivery fell 86 cents, or 1 percent, to $83.17 a barrel at 11:55 a.m. on the New York Mercantile Exchange. Prices are down 19 percent in the second quarter and 16 percent this year. Brent oil for August settlement dropped $1.56, or 1.6 percent, to $96.05 a barrel on the London-based ICE Futures Europe exchange.

- Dollar Shortage Seen in $2 Trillion Gap Says Morgan Stanley. Central banks rebuilding foreign- exchange reserves at the fastest pace since 2004 are crowding out private investors seeking U.S. dollars, boosting demand even as the Federal Reserve considers printing more currency. After falling to an all-time low of 60.5 percent in the second quarter of last year, the dollar’s share of global reserves rose 1.6 percentage points to 62.1 percent in December, the latest International Monetary Fund figures show. The buying has left the private sector with $2 trillion less than it needs, according to investment-flow data by Morgan Stanley, which sees the dollar gaining 8.2 percent in 2012, the most in seven years.

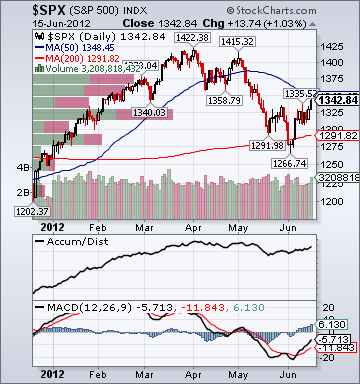

- Biggest Stocks Beat S&P 500 Most In 13 Years As P/Es Fall.

MarketWatch:

- Bundesbank Rejects Bond-Redemption-Fund Plan. Germany's conservative central bank said Monday it opposes a proposed bond redemption fund, first put forward by the country's Council of Economic Advisers, that would allow euro-zone states to share liability for debts above 60% of GDP. Whether the idea could be implemented under existing European treaties and be compatible with German constitutional law "appears very questionable," the bank said in its June bulletin. The bank said that the euro zone's bailout funds, the EFSF and the ESM, are better tools for addressing fiscally weak states in the 17-nation currency bloc as these are linked with strict conditions and penalty interest rates on loans. It also cautioned a mutualization of debts would lower the pressure on states with higher financing costs to engage in sound fiscal policies and could ultimately damage Germany's credit rating. Comprehensive shared liability would "throw liability and monitoring considerably out of balance," wrote the bank, adding that reform proposals failed to beef up European authorities' right to intervene in the budgetary policies of individual member states. Leading policy makers in Germany have taken a skeptical stance toward any sharing of debt in the euro zone that is not accompanied by strict and enforceable rules regulating the fiscal deficits the region's countries can run.

CNBC.com:

- Google(GOOG): Government Censorship Requests 'Alarming'. Google has received more than 1,000 requests from authorities to take down content from its search results or YouTube video in the last six months of 2011, the company said Monday, denouncing what it said was an alarming trend.

- Weak Jobs Market Hits Homebuilder Confidence. A stall in job growth hit home builder confidence in June. A monthly confidence index from the National Association of Home Builders saw just a one point gain after posting a 4 point spike in May. The survey now sits at 29, with 50 the line between positive and negative sentiment. “While the June HMI is in keeping with our forecast for gradually improving single-family home sales this year, recent economic reports have shown some weakening in the pace of recovery likely factored into the marginal gain,” said NAHB chief economist David Crowe in a written release. “In addition, builders across the country continue to report that overly tight lending conditions and inaccurate appraisals are major obstacles to completing sales at this time.”

Business Insider:

- GREEK SHIPPER: I Am Taking My Family Out Of Athens To Avoid The Coming Unrest.

- A Chinese Company Plans To Build The World's Tallest Building In Just 90 Days.

- Facebook(FB) Buys Facial Recognition Startup Face.com.

- 17 Facts You Need To Know About The Controversial Islamist Group That Just Took The Egyptian Presidency.

- WILLEM BUITER: Spain And Italy Will Both Need Sovereign Bailouts.

- Russia Is Reportedly Filling Two Of These Assault Ships With Marines And Rushing Them To Syria.

Zero Hedge:

- As Italy Hints Of Subordination, Did Rome Just Request A "Semi" Bailout?

- Spain May Not Be Uganda, But Germany Is Chile. (graph)

- Merkel Just Says "Nein".

- Complete European Sovereign Event And PIIGS Bond Issuance Calendar - June And July.

Reuters:

- Fitch Cuts India Rating Outlook to Negative. Fitch Ratings cut its credit outlook for India to negative from stable, nearly two months after rival Standard & Poor's made a similar call, citing risks that India's growth outlook could deteriorate if policymaking and governance don't improve. "A significant loosening of fiscal policy, which leads to an increase in the gross general government debt/GDP ratio, would result in a downgrade of India's sovereign ratings," Fitch said in a statement on Monday. The agency estimated general government debt for India of 66 percent of GDP at the end of the most recent fiscal year, compared with a median of 39 percent for BBB-rated countries. India's economy grew just 5.3 percent in the March quarter, the weakest in nine years, but earlier on Monday the central bank unexpectedly left interest rates on hold, sending bonds, stocks and the rupee lower. The rupee weakened further to 55.94 per dollar from around 55.82 before the Fitch statement. Bond yields were range-bound, while stocks were already shut for the day.

- Intel(INTC) to Buy InterDigital(IDCC) Patents for $375 Million. InterDigital Inc said on Monday it had agreed to sell to Intel Corp about 1,700 wireless technology patents for $375 million, sending InterDigital shares up 27 percent.

Telegraph:

- Greek agony drags on as Asphyxiation Bloc wins. Europe’s establishment is delighted by the victory of New Democracy and pro-asphyxiation bloc. This relief is unlikely to last much beyond today, if that. Greece’s new leaders have a mandate from Hell. Almost 52pc of the popular vote went to parties that opposed the bail-out Memorandum in one way or another. There is no national acceptance of the Troika’s austerity policies whatsoever. The hard-Left Syriza party of Alexis Tsipras is arguably more dangerous in opposition, now fortified with big bloc of seats in Parliament. He can lacerate the government without responsibility as the state sheds 150,000 public sector workers, a fifth of the total.

- G20: don't expect any solutions from the international junketing in Mexico. It's Monday, so it must be time for another international summit. Gathered in the Mexican seaside resort of Los Cabos, G20 leaders will already be wondering why they've made the trip.

China Finance:

- The slowing of China's economy growth will end in the second half of this year, but won't rebound noticeably, Zhang Liqun, a researcher at the Development Research Center of the State Council, wrote.