Week Ahead by Bloomberg.

Wall St. Week Ahead by Reuters.

Stocks to Watch Monday by MarketWatch.

Weekly Economic Calendar by Briefing.com.

BOTTOM LINE: I expect US stocks to finish the week modestly lower on global

growth worries, Russia/Ukraine tensions, rising European/Emerging

Markets debt angst, profit-taking and technical selling. My

intermediate-term trading indicators are giving neutral signals and the

Portfolio is 50% net long heading into the week.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Sunday, November 30, 2014

Friday, November 28, 2014

Weekly Scoreboard*

Indices

ETFs

Stocks

*5-Day Change

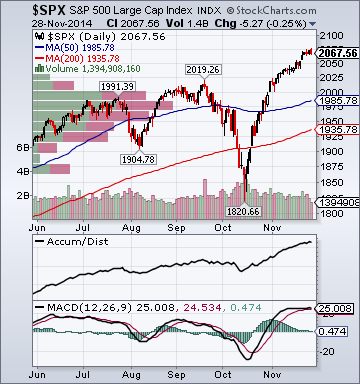

- S&P 500 2,067.56 +.72%

- DJIA 17,828.24 +.62%

- NASDAQ 4,791.63 +1.91%

- Russell 2000 1,173.23 +.21%

- S&P 500 High Beta 34.43 +.18%

- Wilshire 5000 21,463.11 +.68%

- Russell 1000 Growth 972.69 +1.32%

- Russell 1000 Value 1,024.03 +.09%

- S&P 500 Consumer Staples 506.50 +2.04%

- Solactive US Cyclical 143.37 -.08%

- Morgan Stanley Technology 1,019.24 +2.67%

- Transports 9,198.20 +1.60%

- Utilities 599.70 +1.0%

- Bloomberg European Bank/Financial Services 108.05 +2.43%

- MSCI Emerging Markets 41.73 +1.33%

- HFRX Equity Hedge 1,186.23 +.95%

- HFRX Equity Market Neutral 984.45 +.22%

- NYSE Cumulative A/D Line 231,815 +1.57%

- Bloomberg New Highs-Lows Index 25 +110

- Bloomberg Crude Oil % Bulls 22.73 -29.74%

- CFTC Oil Net Speculative Position 255,363 n/a

- CFTC Oil Total Open Interest 1,459,175 n/a

- Total Put/Call .74 n/a

- OEX Put/Call 7.80 +622.22%

- ISE Sentiment 74.0 -10.84%

- NYSE Arms 1.24 +29.17%

- Volatility(VIX) 13.33 -1.84%

- S&P 500 Implied Correlation 68.53 (new maturities)

- G7 Currency Volatility (VXY) 8.77 +.92%

- Emerging Markets Currency Volatility (EM-VXY) 8.03 +3.35%

- Smart Money Flow Index 17,547.81 +.16%

- ICI Money Mkt Mutual Fund Assets $2.662 Trillion +.32%

- ICI US Equity Weekly Net New Cash Flow -$3.622 Billion

- AAII % Bulls 52.2 +6.2%

- AAII % Bears 20.8 -12.7%

- CRB Index 254.37 -5.14%

- Crude Oil 66.15 -12.47%

- Reformulated Gasoline 182.76 -9.88%

- Natural Gas 4.09 -8.38%

- Heating Oil 216.12 -9.67%

- Gold 1,175.50 -1.55%

- Bloomberg Base Metals Index 191.91 -2.50%

- Copper 284.60 -5.60%

- US No. 1 Heavy Melt Scrap Steel 339.0 USD/Ton -8.9%

- China Iron Ore Spot 71.32 USD/Ton +1.44%

- Lumber 327.70 -.03%

- UBS-Bloomberg Agriculture 1,239.63 -.63%

- ECRI Weekly Leading Economic Index Growth Rate -2.3% +10 basis points

- Philly Fed ADS Real-Time Business Conditions Index -.1719 +.116%

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 127.58 +.04%

- Citi US Economic Surprise Index 6.10 -13.8 points

- Citi Eurozone Economic Surprise Index -21.50 +14.5 points

- Citi Emerging Markets Economic Surprise Index -.9 +.1 point

- Fed Fund Futures imply 44.0% chance of no change, 56.0% chance of 25 basis point cut on 12/17

- US Dollar Index 88.36 +.09%

- Euro/Yen Carry Return Index 154.20 +1.17%

- Yield Curve 170.0 -11.0 basis points

- 10-Year US Treasury Yield 2.16% -17.0 basis points

- Federal Reserve's Balance Sheet $4.446 Trillion -.15%

- U.S. Sovereign Debt Credit Default Swap 16.47 -1.29%

- Illinois Municipal Debt Credit Default Swap 176.0 +1.82%

- Western Europe Sovereign Debt Credit Default Swap Index 28.11 -8.43%

- Asia Pacific Sovereign Debt Credit Default Swap Index 62.35 -2.41%

- Emerging Markets Sovereign Debt CDS Index 250.11 +2.51%

- Israel Sovereign Debt Credit Default Swap 76.33 -5.57%

- Iraq Sovereign Debt Credit Default Swap 340.72 -3.16%

- Russia Sovereign Debt Credit Default Swap 314.31 +11.07%

- China Blended Corporate Spread Index 323.87 -.50%

- 10-Year TIPS Spread 1.80% -7.0 basis points

- TED Spread 22.0 -1.25 basis points

- 2-Year Swap Spread 20.75 -1.0 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -11.25 -1.75 basis points

- N. America Investment Grade Credit Default Swap Index 61.47 -3.77%

- European Financial Sector Credit Default Swap Index 59.42 -7.63%

- Emerging Markets Credit Default Swap Index 273.58 +1.35%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 87.0 +1.0 basis point

- M1 Money Supply $2.841 Trillion -.51%

- Commercial Paper Outstanding 1,090.70 unch.

- 4-Week Moving Average of Jobless Claims 294,000 +6,500

- Continuing Claims Unemployment Rate 1.7% -10 basis points

- Average 30-Year Mortgage Rate 3.97% -2 basis points

- Weekly Mortgage Applications 374.50 -4.29%

- Bloomberg Consumer Comfort 40.7 +2.2 points

- Weekly Retail Sales +4.0% +20 basis points

- Nationwide Gas $2.79/gallon -.05/gallon

- Baltic Dry Index 1,187 -10.35%

- China (Export) Containerized Freight Index 1,047.04 -.75%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 32.50 +8.33%

- Rail Freight Carloads 269,373 -1.58%

- Large-Cap Growth +1.3%

- Small-Cap Value -.3%

- Airlines +6.2%

- Biotech +3.4%

- REITs +2.4%

- Medical Equipment +2.4%

- Networking +1.9%

- Construction -4.3%

- Coal -6.6%

- Oil Tankers -8.0%

- Energy -8.5%

- Oil Service -11.5%

- FPRX, KIRK, VEEV, EIGI, BWS, NGVC, CVTI, CBPX, POST, ZAYO, BLOX, PANW, HIBB, BERY, OUTR, AVID, AERI, LORL, LQ, FIVE, CTRN, MTSI and SCAI

- LQDT, LOCO, DCI, GMCR, ARUN, GME and WAIR

ETFs

Stocks

*5-Day Change

Friday Watch

Evening Headlines

Bloomberg:

Evening Recommendations

Earnings of Note

Company/Estimate

Bloomberg:

- Russian Recession Risk Seen at Record as Oil Saps Economy. Russia will sink into recession at a Urals price of $80 a barrel, seven years after its economy grew 8.5 percent when its chief export oil blend averaged near $70, according to a Bloomberg survey of analysts. Urals at $80, or about $3 cheaper than its average in the month through November 15, will tip Russia into a contraction, according to the median estimate of 32 economists. The probability of a recession in the next 12 months rose to 75 percent, the highest since the first such survey more than two years ago, according to another poll.

- Abe Tested by Weak Retail Sales as Japan Election Looms: Economy. Japan’s inflation slowed for a third month and retail sales fell more than forecast, showing the economy continues to struggle from a sales-tax increase as Prime Minister Shinzo Abe heads into an election next month. The Bank of Japan’s key price gauge increased 2.9 percent in October from a year earlier, equivalent to a 0.9 percent gain when the effects of April’s tax bump are excluded. Retail sales dropped 1.4 percent from September, more than a 0.5 percent decline forecast in a Bloomberg News survey.

- Kuroda’s Easing ‘Incomprehensible’ to Ex-BOJ Chief Economist. Prime Minister Shinzo Abe has tied the Bank of Japan’s hands with a delay in a sales-tax increase that’s hurt confidence in the nation’s finances, a former chief economist at the central bank said. Damaged trust in Abe’s pledge to cut the deficit will make it “extremely difficult” for the BOJ to exit record stimulus without risking a bond yield surge, Hideo Hayakawa said in an interview yesterday. More easing would also be tough because Governor Haruhiko Kuroda effectively has made fiscal improvement a premise for further monetary stimulus, he said.

- Record China Downgrades Test PBOC as More Defaults Seen. Rating companies say defaults in China will spread as the central bank’s interest rate cut will do little to stop a wave of maturities from worsening record debt downgrades. Chinese credit assessors slashed grades on 83 firms this year, already matching the record number in all of 2013, according to data compiled by Shenzhen-based China Investment Securities Co. Companies must repay 2.1 trillion yuan ($342 billion) in the first six months of 2015, the most for any half, data compiled by Bloomberg show.

- Cameron to Set Out Plan to Cut Migration, Raising EU Exit Threat. David Cameron will raise the prospect of Britain leaving the European Union if fellow leaders don’t agree to let him restrict access to welfare payments for migrants. In a speech in central England today, the prime minister will demand that Europeans arriving in the U.K. receive no welfare payments or state housing until they’ve been resident for four years. He’ll say they shouldn’t receive unemployment benefits and should be removed from the country if they don’t find work within six months.

- Yen Falls Toward Seven-Year Low as Spending Slides; Aussie Drops. The yen tumbled toward a seven-year low and two-year Japanese government bond yields slid below zero after data showed household spending fell and inflation slowed.

- Commodities Slump to Five-Year Low as Crude Oil Drops on OPEC. Commodities retreated to a five-year low as crude oil tumbled after OPEC refrained from cutting output to ease a global glut. Gold and copper also declined. The Bloomberg Commodity Index (BCOM) of 22 raw materials dropped as much as 1.9 percent to 115.2838, the lowest since July 2009, before trading at 115.29 by 1:26 p.m in Singapore. The index resumed trading today after the U.S. Thanksgiving holiday yesterday when Brent crude dropped 6.7 percent after a meeting of the Organization of Petroleum Exporting Countries in Vienna took no action to relieve the supply glut.

- "Now That's What I Call A Bubble". (graph)

Evening Recommendations

- None of note

- Asian equity indices are -.50% to +.50% on average.

- Asia Ex-Japan Investment Grade CDS Index 101.0 -1.5 basis points.

- Asia Pacific Sovereign CDS Index 62.50 unch.

- FTSE-100 futures -.27%.

- S&P 500 futures +.01%.

- NASDAQ 100 futures +.28%.

Earnings of Note

Company/Estimate

- None of note

- None of note.

- None of note

- The Eurozone CPI report could also impact trading today.

Wednesday, November 26, 2014

Stocks Close Slightly Higher on Central Bank Hopes, Seasonal Strength, Short-Covering, Biotech/Tech Sector Strength

Broad Equity Market Tone:

- Advance/Decline Line: Modestly Higher

- Sector Performance: Mixed

- Volume: Light

- Market Leading Stocks: Outperforming

- Volatility(VIX) 12.o7 -1.47%

- Euro/Yen Carry Return Index 153.65 -.02%

- Emerging Markets Currency Volatility(VXY) 7.63 +.66%

- S&P 500 Implied Correlation 30.38 n/a

- ISE Sentiment Index 114.0 +2.70%

- Total Put/Call .84 -13.40%

- NYSE Arms .29 -28.42%

- North American Investment Grade CDS Index 60.30 -.71%

- European Financial Sector CDS Index 62.25 -.60%

- Western Europe Sovereign Debt CDS Index 29.79 +2.87%

- Asia Pacific Sovereign Debt CDS Index 62.63 +.16%

- Emerging Market CDS Index 269.75 +.42%

- China Blended Corporate Spread Index 323.88 +.34%

- 2-Year Swap Spread 20.25 +1.0 basis point

- TED Spread 22.0 -.75 basis point

- 3-Month EUR/USD Cross-Currency Basis Swap -9.0 -1.0 basis point

- 3-Month T-Bill Yield .01% -1 basis point

- Yield Curve 173.0 -2.0 basis points

- China Import Iron Ore Spot $68.49/Metric Tonne -1.57%

- Citi US Economic Surprise Index 6.20 -10.2 points

- Citi Eurozone Economic Surprise Index -22.90 +.8 point

- Citi Emerging Markets Economic Surprise Index .8 +.5 point

- 10-Year TIPS Spread 1.84 -2.0 basis points

- Nikkei Futures: Indicating -28 open in Japan

- DAX Futures: Indicating +3 open in Germany

- Higher: On gains in my tech/biotech/medical sector longs

- Disclosed Trades: None

- Market Exposure: 50% Net Long

Bull Radar

Style Outperformer:

- Small-Cap Growth +.08%

- 1) Semis +1.12% 2) Telecom +.51% 3) Defense +.37%

- CUB, VEEV, TASR and ADI

- 1) TMUS 2) TASR 3) PBI 4) TIBX 5) ASHR

- 1) TASR 2) ADI 3) BDX 4) PEP 5) BLOX

Subscribe to:

Comments (Atom)