The Weekly Wrap by Briefing.com.

*5-Day Change

Indices

- Russell 2000 1,215.21 +1.93%

- S&P 500 High Beta 34.55 +1.29%

- Wilshire 5000 21,712.70 +1.44%

- Russell 1000 Growth 975.23 +1.29%

- Russell 1000 Value 1,041.78 +1.50%

- S&P 500 Consumer Staples 509.71 +1.35%

- Solactive US Cyclical 142.83 +1.80%

- Morgan Stanley Technology 1,036.03 +1.81%

- Transports 9,199.65 +2.75%

- Bloomberg European Bank/Financial Services 104.41 +4.17%

- MSCI Emerging Markets 39.05 +1.89%

- HFRX Equity Hedge 1,178.18 +1.30%

- HFRX Equity Market Neutral 987.91 +.28%

Sentiment/Internals

- NYSE Cumulative A/D Line 232,014 +1.04%

- Bloomberg New Highs-Lows Index 53 +189

- Bloomberg Crude Oil % Bulls 31.43 n/a

- CFTC Oil Net Speculative Position 284,079 n/a

- CFTC Oil Total Open Interest 1,475,862 n/a

- Total Put/Call .72 -17.24%

- OEX Put/Call 2.06 +142.35%

- ISE Sentiment 96.0 +41.18%

- Volatility(VIX) 14.50 -13.74%

- S&P 500 Implied Correlation 64.52 +.58%

- G7 Currency Volatility (VXY) 9.74 +2.96%

- Emerging Markets Currency Volatility (EM-VXY) 10.79 -1.91%

- Smart Money Flow Index 17,222.46 -1.21%

- ICI Money Mkt Mutual Fund Assets $2.713 Trillion +.76%

- ICI US Equity Weekly Net New Cash Flow -$4.179 Billion

Futures Spot Prices

- Reformulated Gasoline 150.87 -1.97%

- Heating Oil 190.79 -2.47%

- Bloomberg Base Metals Index 180.99 -.17%

- US No. 1 Heavy Melt Scrap Steel 309.0 USD/Ton unch.

- China Iron Ore Spot 66.94 USD/Ton -3.22%

- UBS-Bloomberg Agriculture 1,256.61 +.08%

Economy

- ECRI Weekly Leading Economic Index Growth Rate -3.3% -20 basis points

- Philly Fed ADS Real-Time Business Conditions Index .6459 unch.

- S&P 500 Blended Forward 12 Months Mean EPS Estimate 125.61 -.31%

- Citi US Economic Surprise Index 38.60 +7.1 points

- Citi Eurozone Economic Surprise Index 3.30 +4.1 points

- Citi Emerging Markets Economic Surprise Index -13.90 -1.1 points

- Fed Fund Futures imply 50.0% chance of no change, 50.0% chance of 25 basis point cut on 1/28

- US Dollar Index 90.03 +.93%

- Euro/Yen Carry Return Index 153.14 +.31%

- Yield Curve 151.0 -1.0 basis point

- 10-Year US Treasury Yield 2.25% +9.0 basis points

- Federal Reserve's Balance Sheet $4.462 Trillion unch.

- U.S. Sovereign Debt Credit Default Swap 16.04 +.08%

- Illinois Municipal Debt Credit Default Swap 182.0 +1.99%

- Western Europe Sovereign Debt Credit Default Swap Index 26.68 -9.47%

- Asia Pacific Sovereign Debt Credit Default Swap Index 64.44 -5.04%

- Emerging Markets Sovereign Debt CDS Index 300.86 -1.24%

- Israel Sovereign Debt Credit Default Swap 74.84 -.88%

- Iraq Sovereign Debt Credit Default Swap 377.21 -.22%

- Russia Sovereign Debt Credit Default Swap 438.87 -2.83%

- China Blended Corporate Spread Index 338.50 -1.38%

- 10-Year TIPS Spread 1.68% -1.0 basis point

- TED Spread 25.5 +3.25 basis points

- 2-Year Swap Spread 18.5 -4.25 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -14.25 -.25 basis point

- N. America Investment Grade Credit Default Swap Index 63.95 -1.77%

- America Energy Sector High-Yield Credit Default Swap Index 633.0 +1.0%

- European Financial Sector Credit Default Swap Index 62.29 -5.60%

- Emerging Markets Credit Default Swap Index 325.54 -.29%

- CMBS AAA Super Senior 10-Year Treasury Spread to Swaps 88.0 unch.

- M1 Money Supply $2.892 Trillion unch.

- Commercial Paper Outstanding 1,074.0 unch.

- 4-Week Moving Average of Jobless Claims 290,250 -8,500

- Continuing Claims Unemployment Rate 1.8% unch.

- Average 30-Year Mortgage Rate 3.83% +3 basis points

- Weekly Mortgage Applications 363.10 +.86%

- Bloomberg Consumer Comfort 43.1 +1.4 points

- Weekly Retail Sales +4.40% +40 basis points

- Nationwide Gas $2.32/gallon -.13/gallon

- Baltic Dry Index 782.0 -5.44%

- China (Export) Containerized Freight Index 1,044.99 +.83%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 32.50 -7.14%

- Rail Freight Carloads 272,961 -2.63%

Best Performing Style

Worst Performing Style

Leading Sectors

Lagging Sectors

Weekly High-Volume Stock Gainers (23)

- IMDZ, PETX, ZFGN, OVAS, VRNS, RDUS, INGN, VSAR, ENTA, VNDA, MDLY, MGNX, CIVI, MCS, INCR, CTAS, FMI, EXAM, ALLY and SPOK

Weekly High-Volume Stock Losers (12)

- WGO, MLHR, ICON, ATRA, DERM, ACHN, DNKN, CAMP, GILD, WOR, FINL and OCN

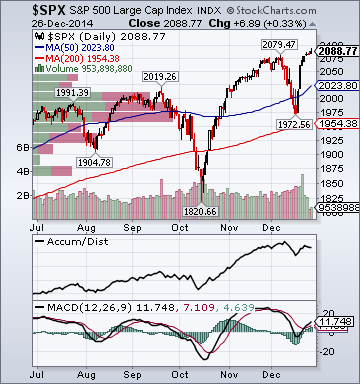

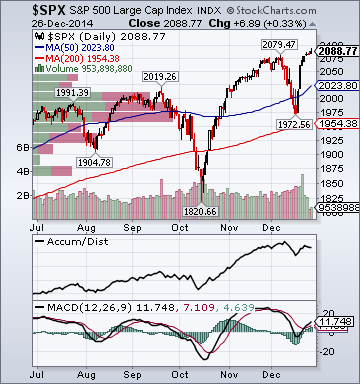

Weekly Charts

ETFs

Stocks

*5-Day Change

Broad Equity Market Tone:

- Advance/Decline Line: Higher

- Sector Performance: Most Sectors Rising

- Market Leading Stocks: Performing In Line

Equity Investor Angst:

- Volatility(VIX) 14.58 +1.45%

- Euro/Yen Carry Return Index 153.04 -.15%

- Emerging Markets Currency Volatility(VXY) 10.89 -.82%

- S&P 500 Implied Correlation 64.37 -4.17%

- ISE Sentiment Index 111.0 +117.65%

Credit Investor Angst:

- North American Investment Grade CDS Index 64.08 -.357%

- America Energy Sector High-Yield CDS Index 633.0 +.16%

- European Financial Sector CDS Index 62.29 +.18%

- Western Europe Sovereign Debt CDS Index 26.68 -.26%

- Asia Pacific Sovereign Debt CDS Index 64.44 -.19%

- Emerging Market CDS Index 325.55 -.04%

- China Blended Corporate Spread Index 338.50 -.36%

- 2-Year Swap Spread 18.5 -.25 basis point

- TED Spread 25.5 +2.0 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -14.25 +.5 basis point

Economic Gauges:

- 3-Month T-Bill Yield .00% unch.

- Yield Curve 151.0 -2.0 basis points

- China Import Iron Ore Spot $66.94/Metric Tonne n/a

- Citi US Economic Surprise Index 38.60 unch.

- Citi Eurozone Economic Surprise Index 3.30 +.7 point

- Citi Emerging Markets Economic Surprise Index -13.90 -.2 point

- 10-Year TIPS Spread 1.68 unch.

Overseas Futures:

- Nikkei Futures: Indicating +165 open in Japan

- DAX Futures: Indicating +6 open in Germany

Portfolio:

- Higher: On gains in my biotech/retail/tech sector longs

- Disclosed Trades: Covered some of my (IWM)/(QQQ) hedges, then added them back

- Market Exposure: 50% Net Long

Bloomberg:

- Russia Hardens Military Doctrine Amid NATO Standoff Over Ukraine. Russia hardened its military doctrine,

identifying new threats after tensions with its Cold War foe

NATO increased over the conflict in Ukraine. The revised document posted today on the Kremlin website

names attempts to overthrow neighboring governments as a major

threat, as well as the North Atlantic Treaty Organization’s

buildup close to the country’s borders. The previous draft was

published in 2010. Russia also cited as threats information campaigns aimed at

corrupting the Russian population, sabotage by foreign

intelligence, the deployment of missile-defense components and

high-precision conventional weapons, and the use of information

technology for military purposes.

- Russia May Burn Wealth Funds in 3 Years Without Budget Revision.

Russia, poised to enter a recession, will burn through its rainy-day

funds in three years if the government doesn’t change the budget

structure, according to Finance Minister Anton Siluanov. With oil

prices at $60 a barrel, Russia’s economy may contract about 4 percent

next year and have a budget deficit of morethan 3 percent of output,

Siluanov told reporters in Moscow

today. The ministry will use these estimates and an exchange

rate of 51 rubles per dollar to review the 2015 budget.

- Oil Heads for Fifth Weekly Loss on Global Glut Concern. Brent for February settlement slipped 40 cents, or 0.7 percent, to

$59.84 a barrel at 12:03 p.m. New York time on the London-based ICE Futures Europe exchange. The volume of all futures was 89 percent below the 100-day average with much of Europe on holiday after Christmas.

- Copper Slumps to Three-Week Low on U.S. Interest-Rate Outlook.

Copper futures for March delivery fell 1.4 percent to

settle at $2.814 a pound at 1:16 p.m. on the Comex in New York.

Earlier, the price touched $2.804, the lowest for a most-active

contract since Dec. 1. The metal declined for a fourth straight

session, the longest slump since Nov. 28.

- Natural Gas Futures Drop Below $3 for First Time Since 2012. Natural gas futures slumped below $3 per million British thermal

units for the first time since 2012 on speculation that record

production will overwhelm demand for the heating fuel. Futures

have plunged 27 percent in December, heading for the biggest one-month

drop since July 2008, as mild weather and record production erased a

surplus to year-ago levels for the first time in two years. Temperatures will

be mostly above average in the eastern half of the U.S. through Dec. 30,

according to Commodity Weather Group LLC.

- Xbox, PlayStation Networks Attacked, Hackers Claim Credit. Microsoft Corp. (MSFT)’s Xbox Live and Sony Corp. (6758)’s PlayStation Network, Internet services that video gamers use to

play online, were hit by connection failures on Christmas Day,

with the hackers Lizard Squad claiming responsibility.

Wall Street Journal:

CNBC:

- Russian ruble slides 4 percent after official says it has stabilized. The

Russian currency on Friday ended its five-day rally and declined 4

percent as the markets remain jittery over the outlook of the Russian

economy. The ruble has been the worst performing

currency this year along with the Ukrainian hryvnia, having lost nearly

half of its value against the dollar.

ZeroHedge:

Business Insider:

Reuters:

- Mexican factory exports post biggest drop in nearly 2 years. Mexican factory exports

posted their biggest decline in nearly two years in November,

pushing the country into a trade deficit, official data showed

on Friday. Adjusted for seasonal swings, factory exports declined by

5.0 percent from October, the biggest monthly drop since January

2013, according to figures from the national statistics office. Total exports were down by 4.8 percent in adjusted terms

after a rise of 3.8 percent the previous month. By contrast,

total imports increased by 0.6 percent, the second consecutive

monthly advance, the office data showed.

Style Underperformer:

Sector Underperformers:

- 1) Steel -.45% 2) Hospitals -.32% 3) Oil Service -.30%

Stocks Falling on Unusual Volume:

- CUBA, KNOP, BIS, REMY, CALM, BDSI, GLP, OCN and VNOM

Stocks With Unusual Put Option Activity:

- 1) DD 2) IBB 3) XLU 4) DDD 5) GPRO

Stocks With Most Negative News Mentions:

- 1) PBR 2) JCP 3) RCP 4) VSLR 5) VOLC

Charts:

Style Outperformer:

Sector Outperformers:

- 1) Gold & Silver +2.73% 2) Biotech +1.66% 3) Alt Energy +1.15%

Stocks Rising on Unusual Volume:

Stocks With Unusual Call Option Activity:

- 1) RPTP 2) SO 3) VA 4) KKR 5) GRPN

Stocks With Most Positive News Mentions:

- 1) GPRO 2) IBM 3) NKE 4) GILD 5) H

Charts: