Bloomberg:

- The 94% Plunge That Shows Abenomics Is Losing Global Investors. Foreign investors have had just about enough of Abenomics. After pumping record amounts of cash into Japanese shares last year, they’ve hardly added to holdings in 2014. Inflows are down 94 percent this year to 898 billion yen ($7.5 billion), on pace for the smallest annual amount since the 2008 global financial crisis. The month of April 2013 alone registered almost three times as much foreign investment in the stock market as all of 2014.

- Ukraine Tightens Controls Along Borders With Russia, Rebel Areas. Ukraine halted transportation links with Crimea, which was annexed by Russia in March, and stepped up checks along its borders on concern that saboteurs might attempt to enter the country from breakaway areas. “Very intensive saboteur and reconnaissance actions are being carried out now,” Ukrainian military spokesman Andriy Lysenko told reporters today in Kiev. “This measure is temporary. It won’t be permanent.”

- China’s Industrial Profits Drop Most in Two Years Amid Slowdown. China’s industrial profits fell the most in two years last month, the latest data to show a deepening slowdown in the world’s second-biggest economy as pressure grows on the nation’s central bank to ease monetary conditions. Total profits of China’s industrial enterprises in November dropped 4.2 percent from a year earlier, the National Bureau of Statistics said today in Beijing. That followed October’s 2.1 percent decline and a 0.4 percent increase in September. It’s the biggest slide since August 2012, when profits slumped 6.2 percent.

- AirAsia Drops Most Since 2011 After Flight to Singapore Vanishes. AirAsia Bhd. (AIRA) shares headed for the biggest tumble in three years after the Malaysian budget carrier’s flight QZ8501 disappeared en route from Indonesia to Singapore yesterday. The stock slid as much as 13 percent to 2.56 ringgit and was 8.2 percent lower at 9:38 a.m. local time. Shares were cut to a trading sell from buy at Hong Leong Investment Bank Bhd., which lowered its price target to 2.64 ringgit from 3.15 ringgit. AirAsia X Bhd., the long-haul arm of AirAsia, fell 6.6 percent. The FTSE Bursa Malaysia KLCI Index lost 0.6 percent.

- Euro Near Two-Year Low Amid Greek Elections Concern; Yen Weakens. The euro traded 0.2 percent from a two-year low as Greece’s prime minister attempts to get his presidential candidate confirmed and avoid an early parliamentary election that risks severing the nation’s international lifeline.

- Asian Stocks Climb as Oil Rises While Euro Maintains Loss. Asian stocks rose with markets from Sydney to Hong Kong resuming trading following the Christmas holiday break. The euro traded near a two-year low while oil advanced. The MSCI Asia Pacific Index climbed 0.1 percent by 10:15 a.m. in Tokyo. Japan’s Topix index gained 0.2 percent, set for its highest close since Dec. 9. The Kospi gauge fell 0.5 percent in Seoul as Samsung Electronics Co. traded without the right to a dividend. AirAsia Bhd (AIRA) tumbled as much as 13 percent after one of its planes went missing.

- Iron‑Ore Slump Failing to End Glut as Mines Expand. The collapse in global iron-ore prices isn’t chasing Gina Rinehart away from the red soil of Western Australia that made her a billionaire. Like producers in Brazil and some in China, she can still profit from the metal.

- Copper Near Four-Year Low Amid Signs of Slowdown in China. Copper in London traded near a four-year low after Chinese industrial profits fell and before a manufacturing gauge for the country, the largest metals consumer. The London Metal Exchange resumed trading after the Christmas break. Copper dropped as much as 1.1 percent after closing at the lowest since June 2010 on Dec. 24.

- Fees Get Leaner on Private Equity. Under Pressure From Investors, Regulators, Firms Give Up Claim on Some Revenue. Facing pressure from investors and heightened scrutiny from federal regulators, some of the largest private-equity firms are giving up their claim to fees that generated hundreds of millions of dollars for them over the years.

- Families wait as search resumes for missing AirAsia plane carrying 162. A massive search is underway for the missing AirAsia plane carrying 162 people that disappeared on Sunday just after the pilot requested a change in course to avoid bad weather. Rescuers are scouring the Java Sea after their search was halted at night fall late Sunday, Indonesia’s transport ministry told the Star in Malaysia.

Business Insider:

New York Times:

Telegraph:- As Medicaid Rolls Swell, Cuts in Payments to Doctors Threaten Access to Care. Just as millions of people are gaining insurance through Medicaid, the program is poised to make deep cuts in payments to many doctors, prompting some physicians and consumer advocates to warn that the reductions could make it more difficult for Medicaid patients to obtain care. The Affordable Care Act provided a big increase in Medicaid payments for primary care in 2013 and 2014. But the increase expires on Thursday — just weeks after the Obama administration told the Supreme Court that doctors and other providers had no legal right to challenge the adequacy of payments they received from Medicaid. The impact will vary by state, but a study by the Urban Institute, a nonpartisan research organization, estimates that doctors who have been receiving the enhanced payments will see their fees for primary care cut by 43 percent, on average.

- North Korean Internet, 3G mobile network "paralyzed" - Xinhua. North Korea's Internet and 3G mobile networks were paralyzed again on Saturday evening, China's official Xinhua news agency reported on Saturday, with the North Korean government blaming the United States for systemic instability in the country's networks.

- China zombie factories kept open to give illusion of prosperity. “If you cut down the big tree, all the small trees around it will die,” says 69-year-old Wang Peiqing, referring to the collapse of Highsee Iron and Steel Group, which operated the foundries before its recent closure devastated the economy of a once-prosperous corner of Shanxi province in central China. “The entire region relied on the steel mill; now the young people have to go and look for work across China.” Highsee stopped paying its 10,000 employees six months ago. Local officials estimate the plant supported indirectly the livelihood of about a quarter of Wenxi county’s population of 400,000. Across the vast expanses of China, similar experiences are playing out, with thousands of companies in heavy industrial sectors plagued by chronic overcapacity that should be going bust instead being propped up by local governments.

- Russia's crisis has no end in sight as $50 oil looms, says OECD. Russia is moving towards autarky in the face of falling oil prices and tensions with the West that have left no end in sight for the country's economic woes, says OECD chief economist.

- Merkel Adviser Opposes ECB Govt Bond Purchases at Present. There is no reason for the ECB to currently buy government bonds, citing Christoph Schmidt, head of German Chancellor Angela Merkel's council of economic advisers, as saying in an interview. Points to high risk of buying government bonds; says France, Italy could postpone again necessary reforms.

- Weidmann: ECB Mustn't Bow to Markets' Bond-Buying Pressure. ECB Governing Council member Jens Weidmann says in interview it shouldn't be decisive for the bank's decision-making that markets have been pushing for and expect ECB bond purchases. Weidmann, who's also Bundesbank President said: Cheap oil is acting like a stimulus package, "so why put monetary policy measures on top of that?" The euro region's central banks would be liable together for any losses from bond purchases, and in the end the taxpayers would foot the bill.

- China Researcher Sees No Economic Hard Landing Next Year. Infrastructure investment will continue to support China's economic growth, citing former PBOC adviser Yu Yongding. Growth will fall "significantly" as the economy enters a new development phase, Yu said.

- Asian indices are unch. to +1.25% on average.

- Asia Ex-Japan Investment Grade CDS Index 103.50 unch.

- Asia Pacific Sovereign CDS Index 64.5 unch.

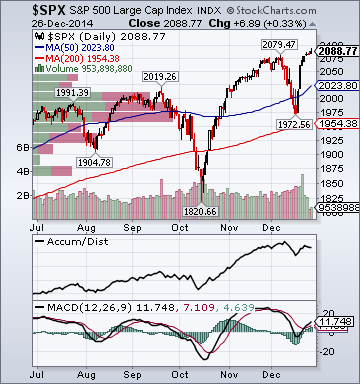

- S&P 500 futures +.09%.

- NASDAQ 100 futures +.20%.

Earnings of Note

Company/Estimate

- None of note

10:30 am EST

- Dallas Fed Manufacturing Activity for December is estimated to fall to 9.0 versus 10.5 in November.

- (HAIN) 2-for-1

- The German Retail Sales report could also impact trading today.