Bloomberg:

- Parisians Wary of More Attacks After Shootings. Three days of gunshots, killings, car chases, hostage-taking and police raids have traumatized a city better known for its art, culture and cuisine. The immediate crisis that began Jan. 7 with the massacre of 12 people at weekly magazine Charlie Hebdo and the separate killing of a policewoman ended yesterday with police raids on two sites that killed three suspects.

- Russia Cut to One Step Above Junk by Fitch on Oil, Sanctions. Russia’s credit rating was cut to the lowest investment grade by Fitch Ratings after plummeting oil prices and the conflict over Ukraine triggered the worst currency crisis since the country’s 1998 default. Fitch, which last downgraded Russia in 2009, cut the sovereign one step to BBB-, according to a statement issued Friday in New York. The grade, on par with India and Turkey, has a negative outlook. “The economic outlook has deteriorated significantly since mid-2014 following sharp falls in the oil price and the ruble, coupled with a steep rise in interest rates,” Fitch said in the statement. “Plunging oil prices have exposed the close link between growth and oil.”

- Russia’s Soaring Misery Index. Russians may be more miserable than the data suggest. The CHART OF THE DAY shows the Misery Index -- inflation plus unemployment -- for Russia climbed 39 percent last year to 16.6, moving it closer to similar gauges in Greece and Turkey. While Russian consumer prices surged last year, pushing up the index, official data showed that the jobless rate fell even as slumping oil exports and international sanctions pushed the economy toward a recession.

- Samaras Still Trails Syriza 14 Days Before Greek Election. Greek Prime Minister Antonis Samaras entered the two-week countdown to Jan. 25 elections with opinion polls showing he has so far failed to narrow the lead held by his main opponent, Alexis Tsipras of Syriza. Separate polls by Kapa Research and Alco put Syriza’s lead over Samaras’s New Democracy party at 2.6 percentage points and 3.2 percentage points respectively, both little changed. The Kapa poll for yesterday’s To Vima newspaper, which ran under the front-page headline, “The Left’s Opportunity,” gave Syriza 28.1 percent support to 25.5 percent for New Democracy.

- Charlene Chu Says China’s Credit Risks Worsening. Charlene Chu, the former Fitch Ratings Ltd. analyst known for her warnings over China’s debt risks, said that the dangers are increasing as the outlook for the nation’s growth deteriorates. “We’ve got the biggest debt bubble that the world has ever seen and credit is continuing to grow twice as fast” as the economy, Chu, 43, a partner of Autonomous Research Asia Ltd., said in an interview in Hong Kong today with Bloomberg Television’s Angie Lau. “We’ve got deflation looming on the horizon.” The nation’s accumulation of debt from record borrowing has prompted some analysts to draw comparisons with Japan before its “lost decade” of economic stagnation and with Asian nations tipped into crisis in the late 1990s. Debt in China was equivalent to 251 percent of gross domestic product, according to a June estimate from Standard Chartered Plc.

- It’s Amateur Hour in the Booming Chinese Stock Market. As Chinese retail investors pour back into the world’s hottest stock market, they’re leaving their fingerprints all over the place. The most telltale sign: The Chinese equivalent of penny stocks, assets that have long held an allure for amateurs, are trouncing the benchmark index. Shares in China’s CSI 300 Index that were quoted below 5 yuan (81 cents) at the end of September have since jumped an average 63 percent. That compares with a 35 percent gain for all index stocks and 11 percent for those priced above 50 yuan. That outsized rally reflects the growing market impact of inexperienced investors in a country where new stock accounts are opening at the fastest pace since 2007 and individuals comprise about 80 percent of equity trading. While professional investors measure a stock’s worth relative to the company’s assets or earnings prospects, it’s the price appearing on computer screens that matters most to people like 35-year-old housewife He Mei. As she sees it, the math is simple -- low price equals low risk and lots of value.

- Oil Falls as Goldman Cuts Outlook While Venezuela Seeks Recovery. Oil extended losses from the lowest level in more than 5 1/2 years as Goldman Sachs Group Inc. reduced its price forecasts and Venezuela called on OPEC producers to work together to spur a recovery. Futures slid as much as 2.1 percent in London after a seventh weekly drop. Crude has to “stay lower for longer” if investment in shale is to be curtailed to re-balance the global market, according to Goldman analysts.

- Oil Producers Betting on Price Drop With OPEC Not Curbing Output. The oil industry was listening as OPEC talked down crude prices to a more than five-year low. Drillers, refiners and other merchants increased bets on lower prices to the most in three years in the week ended Jan. 6, government data show. Producers idled the most rigs since 1991, with some paying to break leases on drilling equipment. Producers are hedging more and drilling less on concern that the biggest plunge in prices since 2008 will continue.

- Copper Holds Losses Near Five-Year Low on Demand Growth Concern. Copper in London held losses near the weakest in more than five years on speculation demand growth my falter amid signs of uneven economic growth in the U.S., Germany and China, the largest metals consumers. Copper was little changed after ending last week at the lowest since October 2009. The biggest drop in U.S. hourly wages since records began in 2006 overshadowed a steeper-than-forecast payrolls increase, while German industrial production in November unexpectedly fell for the first time in three months, data showed Jan. 9. China’s factory-gate prices last month dropped the most in two years, extending a record stretch of declines.

- Gold Extends Gain to One-Month High as U.S. Wages Stall Dollar. Bullion for immediate delivery advanced as much as 0.3 percent to $1,226.95 an ounce, the highest price since Dec. 12, and traded at $1,226.94 at 9:20 a.m. in Singapore, according to Bloomberg generic pricing. The metal climbed 1.2 percent on Jan. 9 to cap the biggest weekly gain since June as assets in the SPDR Gold Trust, the world’s largest exchange-traded product backed by bullion, rose the most since July.

- John Paulson Hit by 2014 Losses as Advantage Plus Fund Falls 36%. Billionaire John Paulson posted 2014 losses in most of his hedge funds after wrong-way bets on energy securities added to declines from a failed merger and investments in Fannie Mae and Freddie Mac. The 59-year-old manager’s Advantage Plus Fund fell 36 percent last year after a 3.1 percent loss in December, two people with knowledge of the returns said.

- Apple(AAPL) Changes App Pricing Worldwide, Spurred by Currency Swings. Apple Inc. (AAPL) changed the prices of software applications from Canada to Europe today, in one of the company’s more comprehensive global responses to currency swings in recent years. With the U.S. dollar rising, Apple earlier this week told software makers selling programs through its online App Store that it’s increasing app prices in the European Union, Norway, Canada and Russia because of foreign exchange rates and taxes. The changes took effect today, with the entry-level price for apps in Canada rising to $1.19 from 99 cents. In Europe, the basic app price jumped to 0.99 euro from 0.89 euro.

- The Coming Wave of New Cancer Fighting Drugs. The hottest area in cancer drugs is going mainstream this year. If 2014 proved that the most promising new group of oncology drugs in generations could work, 2015 brings a crowded field that sees winners and losers in a market eventually worth $30 billion a year or more in the next decade.

- Paris Displays Defiance With Huge Rally. (pic) World Leaders Gather With Crowds to Show Solidarity After Terror Attacks. France, joined by world leaders locked arm-in-arm, mounted its largest-ever demonstration on Sunday in a defiant, if fragile, display of unity against terrorist attacks that tore through its capital last week. More than three million people of different political and religious stripes marched in rallies across the country. Nearly half of them flooded the streets of Paris, transforming its manicured avenues into human rivers.

- GM(GM) Readies Electric Rival to Tesla(TSLA). Auto Maker to Show Concept of Family-Size Car That Gets 200 Miles on a Charge.

- Nasdaq Looks to Operate Dark Pools for Banks. Move Follows Years of Trying to Coax Trading Back Onto Exchanges.

- Commodities Fall as Stockpiles Mount Up. Some Producers Carry on Despite Declines; Trouble in the Far North. Two years ago, Daniel Nilsson’s family bought a hotel in the town of Pajala, Sweden, some 50 miles above the Arctic Circle. The nearby Kaunisvaara iron-ore mine had just started production, and the Nilssons installed new meeting facilities and revamped the nightclub.

- ‘Grexit’ Could Happen by Accident. Greek Crisis Testing Eurozone to the Limit. Since the eurozone’s inception, its survival has rested on a paradox. On the one hand, the stability of the single currency hinges on the market’s faith in its irreversibility. It was to restore this faith that European Central Bank President Mario Draghi promised in 2012 to do “whatever it takes” to keep the bloc together.

- European Central Bank’s Bond-Buying Plans Face Doubt. Some Economists Say the Move Will Do Little to Stimulate Limp Economy. The European Central Bank is widely expected to follow the U.S. Federal Reserve’s lead this month with a new program of bond purchases meant to stimulate the eurozone’s limp economy. Whether it works is another matter.

- Holder, top US official in Paris for terror talks, not seen at unity march. Attorney General Eric Holder is in Paris to attend a meeting on fighting terrorism, but did not participate in a march with world leaders Sunday to honor the 17 people killed last week in France. More than 40 world leaders marched arm in arm through Paris to rally for unity and freedom of expression and to honor the victims of the three days of terrorist attacks.

- Foreign ownership of U.S. equities hits 69- year high. The U.S. stock markets are globalizing, and the British and Canadians are leading the charge. Foreign ownership of U.S. stocks totaled 16% in 2014, the highest in 69 years since such records have been kept, according to a Goldman Sachs report.

CNBC:

- Shire, NPS Pharma(NPSP) to merge in $5.2 billion deal. Shire said it will acquire NPS Pharmaceuticals in an all-stock transaction for about $5.2 billion, the companies said in a joint statement on Sunday. Shire will pay $46.00 per NPS share, representing a premium of about 7.2 percent over NPS' Friday close.

Zero Hedge:

- What Hath QE Wrought? (graph)

- A Permabull Throws In The Towel: "Stocks Are Massively Overvalued", Key Multiples Are Post-War Records. None other than Jim Paulsen has just thrown in the permabull towel and in a letter to Wells Capital clients titled "Median NYSE Price/Earnings Multiple at Post-War RECORD", admits that the market is about as overvalued as ever, based on numerous criteria but mostly due to the median (not average) P/E multiple surging to fresh all time highs!

- Arson Attack On German Newspaper After Printing Charlie Hebdo Cartoons As Thousands Take To The Streets In France.

- Credit Giving Equities A Red Flag. (graph)

Business Insider:

NY Post:

Telegraph:- NYPD Put on High Alert after ISIS Releases New Video. NYPD cops were put on high alert Saturday night after ISIS released a propaganda video urging the killing of “intelligence officers, police officers, soldiers, and civilians” in the US. “Strike their police, security, and intelligence members, as well as their treacherous agents,” the vile video (pictured), released on Twitter by ISIS spokesman Abu Mohammad Al-Adnani, urges. “If you are assigned to a fixed post, do not sit together in the RMP [police car],” members of the Sergeants Benevolent Association were instructed in an e-mail obtained by The Post. “At least one officer must stand outside the vehicle at all times. Pay attention to your surroundings. Officers must pay close attention to approaching vehicles . . . Pay close attention to people as they approach. Look for their hands.”

- More losses loom for Russian bonds as credit rating heads back to junk. Russia's credit rating looks set to tumble into junk for the first time in more than a decade, a move that would exclude its bonds from a couple of high-profile indexes and may set off another wave of capital outflows. The Fitch agency cut its rating on Russia to 'BBB minus' from 'BBB' on Friday, citing a significant deterioration in the country's economic outlook due to the slump in oil prices and falling value of the rouble.

- Source: Terror cells activated in France. French law enforcement officers have been told to erase their social media presence and to carry their weapons at all times because terror sleeper cells have been activated over the last 24 hours in the country, a French police source who attended a briefing Saturday told CNN terror analyst Samuel Laurent. Ahmedy Coulibaly, a suspect killed Friday during a deadly kosher market hostage siege, had made several phone calls about targeting police officers in France, according to the source.

- Suicide bombing by '10-year-old girl in Nigeria kills at least 10'. A girl, thought to be 10 years old, blows herself up in the northeast Nigerian city of Maiduguri.

- BMW Projects Slowing China Growth in 2015. China growth rate to converge with that of the U.S. this year, citing BMW sales director Ian Robertson. Robertson says he expects single-digit growth rates in both markets this year.

- Russia May Seek Early Repayment of Ukraine's $3b Bond. Ukraine violating number of conditions of bailout bond sold to Russia in December 2013, citing a Russian govt. source. Russia will "likely" demand repayment of note in "near future," according to the report.

- Bad Loans at Banks Rebound in China's Wenzhou. Wenzhou city is trying to control private financing risks and handle the rebound of bad loans at banks, citing Vice Mayor Wang Yi.

- China Stock Investor Confidence Rises to Record. An A-share investor confidence index rose 28.1% y/y to a record 71.2 in December, according to a survey by China Securities Investor Protection Fund. A reading above 50 indicates investors are optimistic, the report said. Over 60% of investors polled expect a strong market.

- Asian indices are -.75% to unch. on average.

- Asia Ex-Japan Investment Grade CDS Index 118.0 +4.0 basis points.

- Asia Pacific Sovereign CDS Index 73.75 +3.0 basis points.

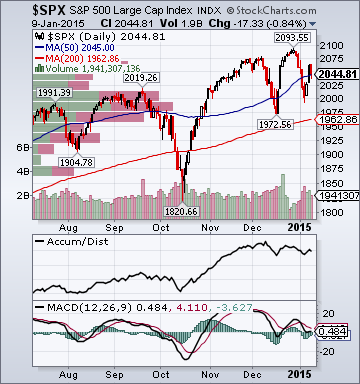

- S&P 500 futures -.08%.

- NASDAQ 100 futures -.08%.

Earnings of Note

Company/Estimate

- (AA)/.27

- None of note

- None of note

- The Fed's Lockhart speaking, Labor Market Conditions Index for December, 3Y T-Note auction, WASDE Crop report, (HXL) investor meeting and the (TIF) sales update could also impact trading today.