Bloomberg:

- Warren Buffett’s Berkshire Hathaway reduced a bet against the US dollar after losing more than $900 million on the incorrect trade this year.

- The compensation of recent business school graduates from Harvard, Dartmouth and Stanford rose at least 9.5% from a year earlier, fueling by increased hiring at investment banks and consulting firms.

- Alec Litowitz, a former trading executive at hedge fund company Citadel Investment Group LLC, raised $1.7 billion for his first fund even as industry returns lag behind the S&P’s 500 Index.

- EnCana Corp., Canada’s largest natural-gas producer, said it could increase production from its oil-sands deposit 12-fold in the next decade and has received approaches from companies seeking to join the development.

- Guidant Corp. sued to force Johnson & Johnson to complete a $25.4 billion purchase of the troubled medical-devices maker and reported a plunge in quarterly profit.

- Crude oil, heating oil and natural gas are falling again on higher-than-normal temperatures and a demand cut forecast by the IEA.

- US Treasuries snapped a four-day slide on speculation falling energy prices will reduce future inflation readings.

Wall Street Journal:

- The US could draw steel imports from China and other countries because its prices for the metal are higher than elsewhere.

- Yahoo and Google plan to introduce wireless services that take advantage of advanced networks and cell phones to provide features similar to those available on computers.

- Share buybacks by technology companies are approaching an annual record.

- Energy production in the Gulf of Mexico is making a slow recovery after Hurricane Rita hit in late September, as important communications systems remain disabled.

- Japan’s Toyota Motor may build the Lexus RX400h sports utility vehicle as a hybrid in North America, along with it Toyota Prius.

- Starwood Hotels & Resorts Worldwide and casino-company Harrah’s Entertainment will develop a $2 billion Bahamas resort and casino.

NY Times:

- Microsoft has emerged as the top contender for buying a stake in Time Warner’s AOL unit.

- More people are leaving California after a decade of increasing home prices.

- Microsoft’s Xbox 360 video game console will offer users the option of purchasing small arcade-style games that can be downloaded from the Internet.

- The US Senate Intelligence Committee so far hasn’t found evidence of “political manipulation or pressure” in the use of prewar intelligence on Iraq.

AppleInsider:

- CBS, the television broadcasting unit of Viacom, has held talks with Apple Computer to offer TV shows over the new video Ipod, citing a CBS executive.

Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Monday, November 07, 2005

Sunday, November 06, 2005

Monday Watch

Weekend Headlines

Bloomberg:

- French police arrested 349 people overnight as gangs burned cars and buildings for the 10th consecutive night in Paris suburbs, other cities around France, and, for the first time, within the city of Paris itself. Almost 1,300 vehicles were set ablaze across the nation.

- Wal-Mart Stores said November sales at its US stores are rising within its forecast, led by groceries.

- The US dollar surged to an 18-month high against the euro this week on increasing optimism over US economic growth.

- Refco Inc., the US futures broker, said it received five offers for all or some of its assets that will be sold at a bankruptcy court auction next week.

- The Chinese government’s attempts to revive its stock market are failing, and more losses may lie ahead in the absence of further action.

- Senator Biden said he and his fellow Democrats are unlikely to block the Supreme Court nomination of Samuel Alito Jr. by using a filibuster to prevent a vote of the full Senate.

- Crude oil is falling for a second day in NY on expectations rising production in the Gulf of Mexico and warmer-than-usual weather will help bolster US fuel stockpiles before winter.

Barron’s:

- Berkshire Hathaway, Exxon Mobil and Microsoft are among companies with hefty cash reserves on their balance sheets because of robust earnings and conservative capital spending.

- Hythiam has to prove to investors through controlled study or peer review that its “Prometa” outpatient system can treat drug and alcohol addiction.

Business Week:

- The next tidal wave of advances will be in biotech, and the person who leads the way stands to reap immense wealth.

Wall Street Journal:

- JPMorgan Chase has put its life insurance and annuity business up for auction.

- Connecticut Attorney General Richard Blumenthal is forming a task force of regulators and hedge-fund executives to come up with recommendations for rules for funds operating in the state.

- Low interest rates and companies flush with cash are fueling the highest level of mergers and acquisitions activity worldwide since the 1990s.

NY Times:

- Estee Lauder is seeking to win more young customers with a new line of cosmetics and a fragrance designed by Tom Ford.

- The US government is considering the benefits of having home testing available for HIV, since rapid testing and counseling have been used to try to prevent the spread of AIDS.

- FEMA said 60,000 houses in New Orleans and other places hit by Hurricane Katrina are damaged beyond repair.

- FEMA said it will give as much as $26,200 to each of 60,000 homeowners and renters in the Louisiana and Mississippi areas hardest hit by Hurricane Katrina.

- Google has drawn attention and caution from many companies, including Wal-Mart Stores, as they watch to see what technology it develops next.

- The US Interior Department’s National Wildlife Health Center is recruiting hundreds of veterinarians, ornithologists, park rangers and amateur bird-watchers to test birds and water samples for signs of avian influenza.

San Francisco Chronicle:

- Sun Microsystems shareholders Thursday approved a non-binding measure to abolish the company’s takeover defense provision.

Washington Post:

- China and the US have reached a tentative agreement that would resolve a textile dispute.

AP:

- A Carnival Corp. cruise ship was attacked by pirates firing rocket-propelled grenades and machine guns off the east coast of Africa today.

Financial Times:

- Wal-Mart Stores plans to open a banking branch in Utah to handle credit and debit card-payment processing, despite opposition from financial institutions.

The Observer:

- China is to hire British engineers to help build several so-called eco-cities that are self-sufficient in energy, water and most food products.

- The NYSE is considering a bid for London Stock Exchange Plc.

Weekend Recommendations

Barron's:

- Had positive comments on MEE, SONO, ASH and ACW.

Goldman Sachs:

- Reiterated Outperform on FDC.

- Reiterated Underperform on HBAN.

Night Trading

Asian indices are -1.0% to -.50% on average.

S&P 500 indicated -.14%.

NASDAQ 100 indicated -.12%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

ADRX/.05

EP/.15

PPC/1.08

Upcoming Splits

DNR 2-for-1

Economic Releases

3:00 pm EST

- Consumer Credit for September is estimated to rise to $5.9B versus $4.9B in August.

Bloomberg:

- French police arrested 349 people overnight as gangs burned cars and buildings for the 10th consecutive night in Paris suburbs, other cities around France, and, for the first time, within the city of Paris itself. Almost 1,300 vehicles were set ablaze across the nation.

- Wal-Mart Stores said November sales at its US stores are rising within its forecast, led by groceries.

- The US dollar surged to an 18-month high against the euro this week on increasing optimism over US economic growth.

- Refco Inc., the US futures broker, said it received five offers for all or some of its assets that will be sold at a bankruptcy court auction next week.

- The Chinese government’s attempts to revive its stock market are failing, and more losses may lie ahead in the absence of further action.

- Senator Biden said he and his fellow Democrats are unlikely to block the Supreme Court nomination of Samuel Alito Jr. by using a filibuster to prevent a vote of the full Senate.

- Crude oil is falling for a second day in NY on expectations rising production in the Gulf of Mexico and warmer-than-usual weather will help bolster US fuel stockpiles before winter.

Barron’s:

- Berkshire Hathaway, Exxon Mobil and Microsoft are among companies with hefty cash reserves on their balance sheets because of robust earnings and conservative capital spending.

- Hythiam has to prove to investors through controlled study or peer review that its “Prometa” outpatient system can treat drug and alcohol addiction.

Business Week:

- The next tidal wave of advances will be in biotech, and the person who leads the way stands to reap immense wealth.

Wall Street Journal:

- JPMorgan Chase has put its life insurance and annuity business up for auction.

- Connecticut Attorney General Richard Blumenthal is forming a task force of regulators and hedge-fund executives to come up with recommendations for rules for funds operating in the state.

- Low interest rates and companies flush with cash are fueling the highest level of mergers and acquisitions activity worldwide since the 1990s.

NY Times:

- Estee Lauder is seeking to win more young customers with a new line of cosmetics and a fragrance designed by Tom Ford.

- The US government is considering the benefits of having home testing available for HIV, since rapid testing and counseling have been used to try to prevent the spread of AIDS.

- FEMA said 60,000 houses in New Orleans and other places hit by Hurricane Katrina are damaged beyond repair.

- FEMA said it will give as much as $26,200 to each of 60,000 homeowners and renters in the Louisiana and Mississippi areas hardest hit by Hurricane Katrina.

- Google has drawn attention and caution from many companies, including Wal-Mart Stores, as they watch to see what technology it develops next.

- The US Interior Department’s National Wildlife Health Center is recruiting hundreds of veterinarians, ornithologists, park rangers and amateur bird-watchers to test birds and water samples for signs of avian influenza.

San Francisco Chronicle:

- Sun Microsystems shareholders Thursday approved a non-binding measure to abolish the company’s takeover defense provision.

Washington Post:

- China and the US have reached a tentative agreement that would resolve a textile dispute.

AP:

- A Carnival Corp. cruise ship was attacked by pirates firing rocket-propelled grenades and machine guns off the east coast of Africa today.

Financial Times:

- Wal-Mart Stores plans to open a banking branch in Utah to handle credit and debit card-payment processing, despite opposition from financial institutions.

The Observer:

- China is to hire British engineers to help build several so-called eco-cities that are self-sufficient in energy, water and most food products.

- The NYSE is considering a bid for London Stock Exchange Plc.

Weekend Recommendations

Barron's:

- Had positive comments on MEE, SONO, ASH and ACW.

Goldman Sachs:

- Reiterated Outperform on FDC.

- Reiterated Underperform on HBAN.

Night Trading

Asian indices are -1.0% to -.50% on average.

S&P 500 indicated -.14%.

NASDAQ 100 indicated -.12%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

ADRX/.05

EP/.15

PPC/1.08

Upcoming Splits

DNR 2-for-1

Economic Releases

3:00 pm EST

- Consumer Credit for September is estimated to rise to $5.9B versus $4.9B in August.

BOTTOM LINE: Asian Indices are lower, pressured by commodity stocks in the region. I expect US stocks to open mixed and to rise modestly later in the day. The Portfolio is 100% net long heading into the week.

Weekly Outlook

There are some important economic reports and significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - Consumer Credit

Tues. - None of note

Wed. - Wholesale Inventories

Thur. - Trade Balance, Import Price Index, Initial Jobless Claims, Univ. of Mich. Confidence, Monthly Budge Statement

Fri. - None of note

A few of the more noteworthy companies that release quarterly earnings this week are:

Mon. - El Paso Corp.(EP)

Tues. - Alcan(AL), Cablevision Systems(CVC), EchoStar Communications(DISH), MBIA Inc.(MBI), McKesson Corp.(MCK), Transocean Inc.(RIG)

Wed. - Cisco Systems(CSCO), DR Horton(DHI), Federated Department Store(FD), JDS Uniphase(JDSU), Whole Foods(WFMI)

Thur. - Dell Inc.(DELL), International Game Technology(IGT), Kohl’s(KSS), Pacific Sunwear(PSUN), Target Corp.(TGT), Urban Outfitters(URBN)

Fri. - None of note

Other events that have market-moving potential this week include:

Mon. - CIBC Healthcare Conference, Goldman Software & IT Services Conference, Bear Stearns Smid-Cap Conference

Tue. - Goldman Software & IT Services Conference, Bear Stearns Smid-Cap Conference, CIBC Healthcare Conference

Wed. - Morgan Stanley Global Consumer & Retail Conference, the Fed’s Santomero speaking, the Fed’s Poole speaking, Oppenheimer Restaurant Conference, Citigroup Transportation Conference, CIBC Healthcare Conference, the Fed’s Pianalto speaking

Thur. - Citigroup Transportation Conference, the Fed’s Bies speaking

Fri. - None of note

Economic reports for the week include:

Mon. - Consumer Credit

Tues. - None of note

Wed. - Wholesale Inventories

Thur. - Trade Balance, Import Price Index, Initial Jobless Claims, Univ. of Mich. Confidence, Monthly Budge Statement

Fri. - None of note

A few of the more noteworthy companies that release quarterly earnings this week are:

Mon. - El Paso Corp.(EP)

Tues. - Alcan(AL), Cablevision Systems(CVC), EchoStar Communications(DISH), MBIA Inc.(MBI), McKesson Corp.(MCK), Transocean Inc.(RIG)

Wed. - Cisco Systems(CSCO), DR Horton(DHI), Federated Department Store(FD), JDS Uniphase(JDSU), Whole Foods(WFMI)

Thur. - Dell Inc.(DELL), International Game Technology(IGT), Kohl’s(KSS), Pacific Sunwear(PSUN), Target Corp.(TGT), Urban Outfitters(URBN)

Fri. - None of note

Other events that have market-moving potential this week include:

Mon. - CIBC Healthcare Conference, Goldman Software & IT Services Conference, Bear Stearns Smid-Cap Conference

Tue. - Goldman Software & IT Services Conference, Bear Stearns Smid-Cap Conference, CIBC Healthcare Conference

Wed. - Morgan Stanley Global Consumer & Retail Conference, the Fed’s Santomero speaking, the Fed’s Poole speaking, Oppenheimer Restaurant Conference, Citigroup Transportation Conference, CIBC Healthcare Conference, the Fed’s Pianalto speaking

Thur. - Citigroup Transportation Conference, the Fed’s Bies speaking

Fri. - None of note

BOTTOM LINE: I expect US stocks to finish the week modestly higher, spurred by lower energy prices, stabilizing long-term rates, decelerating inflation data, short-covering and increasing optimism. My trading indicators are giving bullish signals and the Portfolio is 100% net long heading into the week.

Saturday, November 05, 2005

Market Week in Review

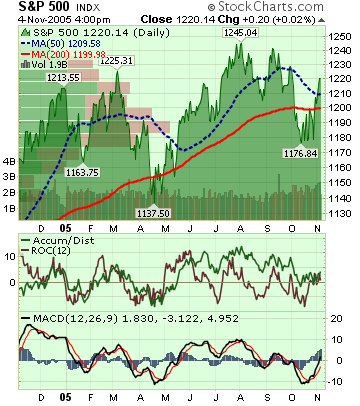

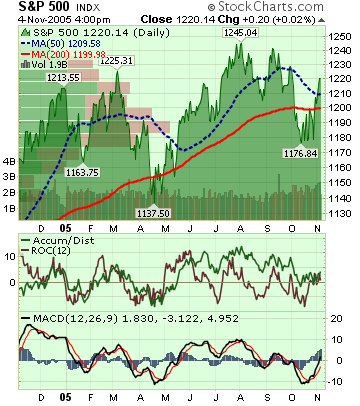

S&P 500 1,220.14 +1.81%*

Click here for the Weekly Wrap by Briefing.com.

*5-day % Change

Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was very positive considering another rise in long-term rates, another Fed rate hike and an earnings warning from Dell Inc. The advance/decline line rose, almost every sector gained and volume was heavy on the week. Measures of investor anxiety were mostly lower. The AAII % Bulls rose for the week and is now at around average levels. The average 30-year mortgage rate rose to 6.31% which is 110 basis points above all-time lows set in June 2003 and the highest since June of last year. The benchmark 10-year T-note yield rose 9 basis points on the week as investors shifted from bonds to stocks and economic data were mostly positive. This also boosted small-caps, tech and cyclicals. The US dollar rose on the week, spurred by expectations of higher interest rates and optimism over US economic growth relative to that of other developed nations. Strength in the dollar and lower inflation readings led to more profit-taking in gold. Unleaded Gas futures have collapsed, falling almost 45% since September highs even as refinery utilization remains well below normal. Moreover, natural gas saw another inventory build even as a substantial amount of daily Gulf of Mexico production remains shut-in. Natural Gas plunged 12.5% for the week on this news and unseasonably warm weather. It is now down 22.8% from September highs. Natural Gas supplies are now about 3% above the five-year average for this time of the year heading into the winter. In my opinion, global energy demand destruction, which began a number of months ago, has accelerated meaningfully over the last couple of months and will send energy prices substantially lower over the intermediate-term. I continue to believe the major stock averages have seen their intermediate-term lows. I expect the S&P 500 to end the year strongly, finishing with around a 10% gain for the year.

*5-day % Change

Subscribe to:

Comments (Atom)