Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was mildly bearish. The advance/decline line fell, most sectors declined and volume was below average on the week. Measures of investor anxiety were lower. The AAII % Bulls rose to 34.40%, but is still below average levels. The % Bears fell to 41.6% and is still above average levels. Most other measures of investor sentiment are still near levels associated with meaningful market bottoms.

The average 30-year mortgage rate rose to 6.71% which is 150 basis points above all-time lows set in June 2003. I still believe housing is in the process of slowing to more healthy sustainable levels. I still see little evidence of a nationwide “hard landing” for housing at this point.

The benchmark 10-year T-note yield rose 10 basis points on the week as global stock markets further stabilized and US economic data were mostly positive. I still believe inflation concerns have peaked for the year as investors continue to anticipate slower economic growth, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies rose less than expectations even as refinery utilization increased. Unleaded Gasoline futures rose and are now 26.6% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. According to TradeSports.com, the percent chance of a US and/or Israeli strike on Iran this year has fallen to 13.9% from 36% late last year. I continue to believe the elevated level of gas prices related to shortage speculation and crude oil production disruption speculation will further dampen fuel demand over the coming months, sending gas prices back to reasonable levels.

Natural gas inventories rose around expectations this week, however supplies are 35.1% above the 5-year average, an all-time record high for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have plunged 60.6% since December 2005 highs.

US oil inventories are still approaching 9-year highs. Since December 2003, global oil demand is down 1.19%, while global supplies have increased 5.19%. Moreover, worldwide inventories are poised to begin increasing at an accelerated rate over the next year. I continue to believe oil is priced at extremely elevated levels on fear and record speculation by investment funds, not fundamentals. As the fear premium in oil dissipates back to more reasonable levels, global growth slows and supplies continue to rise, crude oil should head meaningfully lower over the intermediate-term. This will likely begin to happen during the next quarter.

Gold rose for the week on worries over North Korea and short-covering. The US dollar surged as the current account deficit shrank, more Fed rate hikes were priced in and shorts covered.

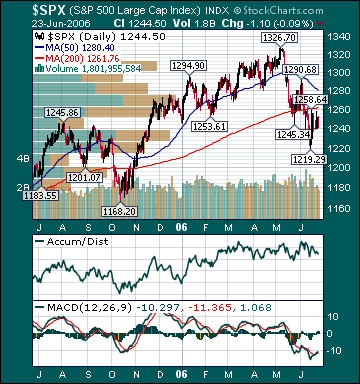

Transportation stocks outperformed for the week on improving fundamentals in the Airline sector and a positive earnings report from FedEx(FDX). The forward p/e on the S&P 500 has contracted relentlessly over the last few years and now stands at a very reasonable 14.5. The average US stock, as measured by the Value Line Geometric Index(VGY), is down .2% this year. The Russell 2000 Index is still up 3.0% year-to-date, notwithstanding the recent correction. In my opinion, the current pullback has provided longer-term investors very attractive opportunities in many stocks that have been punished indiscriminately. However, the most overvalued economically sensitive and emerging market stocks should continue to underperform over the intermediate-term as the manias for those shares subside. I continue to believe a chain reaction of events has begun that will eventually result in a substantial increase in demand for US stocks.

In my opinion, the market is still factoring in way too much bad news at current levels. Problematic inflation, substantially higher long-term rates, a significant US dollar decline, a “hard-landing” in housing, a plunge in consumer spending and ever higher oil prices appear to be mostly factored into stock prices at this point. I view any one of these as unlikely and the occurrence of all as highly unlikely. Upcoming earnings reports will likely provide a positive catalyst for stocks over the near-term.

Over the coming months, a Fed pause, lower commodity prices, decelerating inflation readings, lower long-term rates, increased consumer confidence, increasing demand for US stocks and the realization that economic growth is only slowing should provide the catalysts for another substantial push higher in the major averages through year-end as p/e multiples begin to expand. I still believe the S&P 500 will return a total of around 15% for the year. The ECRI Weekly Leading Index fell this week and is forecasting healthy, but decelerating, US economic activity.

*5-day % Change