Portfolio Manager's Commentary on Investing and Trading in the U.S. Financial Markets

Tuesday, September 05, 2006

Monday, September 04, 2006

Tuesday Watch

Weekend Headlines

Bloomberg:

- Crude oil fell to $68/bbl., a 15-week low, as the US summer travel season drew to a close and traders speculated a dispute with Iran about nuclear research may be resolved without curtailing exports.

- US Treasuries gained this week as the minutes of the Federal Reserve’s August meeting reinforced speculation the central bank is done raising interest rates.

- China Petroleum & Chemical Corp., the nation’s largest refiner, and Japan’s Nippon Oil Corp. are importing more oil from Africa and Russia as Asian nations try to reduce their dependence on Middle East crude.

- UK police officers were given “diversity training” at an Islamic school southeast of London that’s now at the center of a terrorism investigation.

- President Bush said the US must reduce its dependence on oil from overseas and expand technology and job training to keep the American economy the strongest in the world.

- Advancing age increases a man’s risk of having an autistic child as much as 600%, according to a study in the Archives of General Psychiatry.

Wall Street Journal:

- Yahoo!(YHOO) Treasurer Gideon Yu was hired by closely held YouTube Inc. to become the user-uploaded video Web site’s first CFO.

Barron’s:

- The US stock market will make a “key” move in the fourth quarter, although Wall Street strategists can’t agree on the dirction.

NY Times:

- Special Prosecutor Patrick Fitzgerald’s decision to continue investigating the disclosure of a CIA agent’s identity for two years when he already knew who gave out the name has raised questions.

- US automakers expect sales of vehicles that are a cross between a sport utility vehicle and a car to pass 2 million this year and exceed for the first time the number of standard SUVs sold.

- Wiki open-source software, which allows any Web user to write and edit information on a Wiki site, has expanded beyond Wikipedia, the popular online encyclopedia, to several commercial Web sites.

- Vonage Holding(VG) attained 2 million subscribers, an increase from 1.6 million at the end of the first quarter.

- Time magazine, the news magazine owned by Time Warner(TWX), and Newsweek, owned by Washington Post(WPO), are taking on new editors as they seek to retain relevance.

Crain’s NY Business:

- Howard Stern, who broadcast to more than 12 million listeners on commercial radio, has attracted a following of only about 1 million since his move to Sirius Satellite Radio(SIRI).

San Francisco Chronicle:

- Polysilicon, a material used in making semiconductor wafers and solar panels, has more than doubled in price as demand by chipmakers, and subsides that spurred solar panel installation, have diminished supplies.

LA Times:

- Some companies are forcing employees to use their vacation time, even resorting to punitive measures for those who don’t take a break.

Economist.com:

- The new science of synthetic biology is poised between hype and hope. But its time will soon come.

Star-Ledger of Newark:

- Two-thirds of 300 New Jersey employers surveyed by Rutgers University said they have difficulty finding skilled workers, a slight increase from last year.

Detroit News:

- Ford Motor(F) Chairman Bill Ford Jr. plans to fix the company’s North American business, make better use of global assets and boost the leadership team with outsiders when necessary.

Financial Times:

- Barneys New York will open its first store outside the US in a new shopping mall in White City, west London.

- Iran’s former president Mohammad Khatami said a Palestinian state “ready to live alongside Israel” would be acceptable to Iran.

Reuters:

- The number of new oil tankers delivered into service next year will rise 20%.

- Starbucks(SBUX) plans to open its first store in Brazil in November in a city yet to be announced.

Observer:

- Nasdaq Stock Market(NDAQ) is mulling a hostile bid for the London Stock Exchange.

AP:

- Iraq arrested Al-Qaeda’s second-in-command in the country, leaving the terror group’s leadership in “crisis,” citing National Security Advisor Muwafiq al-Rubaie.

Haaretz:

- Deployment of UN troops in southern Lebanon may lead to a complete Israeli withdrawal within 10-to-14 days.

Focus:

- The publication in Germany early this year of cartoons depicting the prophet Muhammad triggered July’s failed terrorist attack on two German trains, the President of the Federal Criminal Office Joerg Ziercke said.

El Universal:

- Most Mexicans oppose protests carried out by Andres Manual Lopez Obrador, the presidential candidate who claims he lost the July 2 elections because of fraud, a poll found.

Weekend Recommendations

Barron's:

- Had positive comments on (BUD) and (SORC).

- Had negative comments on (MED), (IMCL), (DHR) and (IMAX).

Night Trading

Asian indices are -.25% to +.25% on average.

S&P 500 indicated +.17%

NASDAQ 100 indicated +.20%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (FNSR)/.03

- (HAIN)/.23

Upcoming Splits

- (RDY) 2-for-1

Economic Releases

- None of note

Bloomberg:

- Crude oil fell to $68/bbl., a 15-week low, as the US summer travel season drew to a close and traders speculated a dispute with Iran about nuclear research may be resolved without curtailing exports.

- US Treasuries gained this week as the minutes of the Federal Reserve’s August meeting reinforced speculation the central bank is done raising interest rates.

- China Petroleum & Chemical Corp., the nation’s largest refiner, and Japan’s Nippon Oil Corp. are importing more oil from Africa and Russia as Asian nations try to reduce their dependence on Middle East crude.

- UK police officers were given “diversity training” at an Islamic school southeast of London that’s now at the center of a terrorism investigation.

- President Bush said the US must reduce its dependence on oil from overseas and expand technology and job training to keep the American economy the strongest in the world.

- Advancing age increases a man’s risk of having an autistic child as much as 600%, according to a study in the Archives of General Psychiatry.

Wall Street Journal:

- Yahoo!(YHOO) Treasurer Gideon Yu was hired by closely held YouTube Inc. to become the user-uploaded video Web site’s first CFO.

Barron’s:

- The US stock market will make a “key” move in the fourth quarter, although Wall Street strategists can’t agree on the dirction.

NY Times:

- Special Prosecutor Patrick Fitzgerald’s decision to continue investigating the disclosure of a CIA agent’s identity for two years when he already knew who gave out the name has raised questions.

- US automakers expect sales of vehicles that are a cross between a sport utility vehicle and a car to pass 2 million this year and exceed for the first time the number of standard SUVs sold.

- Wiki open-source software, which allows any Web user to write and edit information on a Wiki site, has expanded beyond Wikipedia, the popular online encyclopedia, to several commercial Web sites.

- Vonage Holding(VG) attained 2 million subscribers, an increase from 1.6 million at the end of the first quarter.

- Time magazine, the news magazine owned by Time Warner(TWX), and Newsweek, owned by Washington Post(WPO), are taking on new editors as they seek to retain relevance.

Crain’s NY Business:

- Howard Stern, who broadcast to more than 12 million listeners on commercial radio, has attracted a following of only about 1 million since his move to Sirius Satellite Radio(SIRI).

San Francisco Chronicle:

- Polysilicon, a material used in making semiconductor wafers and solar panels, has more than doubled in price as demand by chipmakers, and subsides that spurred solar panel installation, have diminished supplies.

LA Times:

- Some companies are forcing employees to use their vacation time, even resorting to punitive measures for those who don’t take a break.

Economist.com:

- The new science of synthetic biology is poised between hype and hope. But its time will soon come.

Star-Ledger of Newark:

- Two-thirds of 300 New Jersey employers surveyed by Rutgers University said they have difficulty finding skilled workers, a slight increase from last year.

Detroit News:

- Ford Motor(F) Chairman Bill Ford Jr. plans to fix the company’s North American business, make better use of global assets and boost the leadership team with outsiders when necessary.

Financial Times:

- Barneys New York will open its first store outside the US in a new shopping mall in White City, west London.

- Iran’s former president Mohammad Khatami said a Palestinian state “ready to live alongside Israel” would be acceptable to Iran.

Reuters:

- The number of new oil tankers delivered into service next year will rise 20%.

- Starbucks(SBUX) plans to open its first store in Brazil in November in a city yet to be announced.

Observer:

- Nasdaq Stock Market(NDAQ) is mulling a hostile bid for the London Stock Exchange.

AP:

- Iraq arrested Al-Qaeda’s second-in-command in the country, leaving the terror group’s leadership in “crisis,” citing National Security Advisor Muwafiq al-Rubaie.

Haaretz:

- Deployment of UN troops in southern Lebanon may lead to a complete Israeli withdrawal within 10-to-14 days.

Focus:

- The publication in Germany early this year of cartoons depicting the prophet Muhammad triggered July’s failed terrorist attack on two German trains, the President of the Federal Criminal Office Joerg Ziercke said.

El Universal:

- Most Mexicans oppose protests carried out by Andres Manual Lopez Obrador, the presidential candidate who claims he lost the July 2 elections because of fraud, a poll found.

Weekend Recommendations

Barron's:

- Had positive comments on (BUD) and (SORC).

- Had negative comments on (MED), (IMCL), (DHR) and (IMAX).

Night Trading

Asian indices are -.25% to +.25% on average.

S&P 500 indicated +.17%

NASDAQ 100 indicated +.20%.

Morning Preview

US AM Market Call

NASDAQ 100 Pre-Market Indicator/Heat Map

Pre-market Commentary

Before the Bell CNBC Video(bottom right)

Global Commentary

Asian Indices

European Indices

Top 20 Business Stories

In Play

Bond Ticker

Daily Stock Events

Macro Calls

Rasmussen Consumer/Investor Daily Indices

CNBC Guest Schedule

Earnings of Note

Company/Estimate

- (FNSR)/.03

- (HAIN)/.23

Upcoming Splits

- (RDY) 2-for-1

Economic Releases

- None of note

BOTTOM LINE: Asian Indices are mostly mixed as losses in energy stocks are offsetting gains by mining shares in the region. I expect US stocks to open mixed and to rally into the afternoon, finishing modestly higher. The Portfolio is 100% net long heading into the week.

Weekly Outlook

Click here for The Week Ahead by Reuters

There are a number of economic reports of note and several significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - US Markets Closed

Tues. - None of note

Wed. - Final 2Q Non-farm Productivity, Final 2Q Unit Labor Costs, ISM Non-Manufacturing, Fed’s Beige Book

Thur. - Initial Jobless Claims, Wholesale Inventories

Fri. - Consumer Credit

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - US Markets Closed

Tues. - Hain Celestial(HAIN)

Wed. - Donaldson Co.(DCI), Hovnanian(HOV), Martek Bioscience(MATK)

Thur. - Cooper Cos.(COO), JOS A Bank(JOSB), Korn/Ferry Intl.(KFI), National Semi(NSM), Quiksilver(ZQK), Shuffle Master(SHFL), UTI Worldwide(UTIW)

Fri. - Stage Stores(SSI)

Other events that have market-moving potential this week include:

Mon. - US Markets Closed

Tue. - Citigroup Global Tech Conference, Lehman Brothers Energy Conference

Wed. - Citigroup Global Tech Conference, Lehman Brothers Energy Conference

Thur. - Goldman Sachs Global Retail Conference, Prudential Back-to-School Consumer Conference, Piper Jaffray Software/Services Symposium, Lehman Brothers Energy Conference, CSFB Global Automotive Conference, Citigroup Global Tech Conference

Fri. - Citigroup Global Tech Conference

There are a number of economic reports of note and several significant corporate earnings reports scheduled for release this week.

Economic reports for the week include:

Mon. - US Markets Closed

Tues. - None of note

Wed. - Final 2Q Non-farm Productivity, Final 2Q Unit Labor Costs, ISM Non-Manufacturing, Fed’s Beige Book

Thur. - Initial Jobless Claims, Wholesale Inventories

Fri. - Consumer Credit

Some of the more noteworthy companies that release quarterly earnings this week are:

Mon. - US Markets Closed

Tues. - Hain Celestial(HAIN)

Wed. - Donaldson Co.(DCI), Hovnanian(HOV), Martek Bioscience(MATK)

Thur. - Cooper Cos.(COO), JOS A Bank(JOSB), Korn/Ferry Intl.(KFI), National Semi(NSM), Quiksilver(ZQK), Shuffle Master(SHFL), UTI Worldwide(UTIW)

Fri. - Stage Stores(SSI)

Other events that have market-moving potential this week include:

Mon. - US Markets Closed

Tue. - Citigroup Global Tech Conference, Lehman Brothers Energy Conference

Wed. - Citigroup Global Tech Conference, Lehman Brothers Energy Conference

Thur. - Goldman Sachs Global Retail Conference, Prudential Back-to-School Consumer Conference, Piper Jaffray Software/Services Symposium, Lehman Brothers Energy Conference, CSFB Global Automotive Conference, Citigroup Global Tech Conference

Fri. - Citigroup Global Tech Conference

BOTTOM LINE: I expect US stocks to finish the week modestly higher on short-covering, bargain hunting, lower energy prices, less pessimism and mostly positive economic data. My trading indicators are still giving bullish signals and the Portfolio is 100% net long heading into the week.

Saturday, September 02, 2006

Market Week in Review

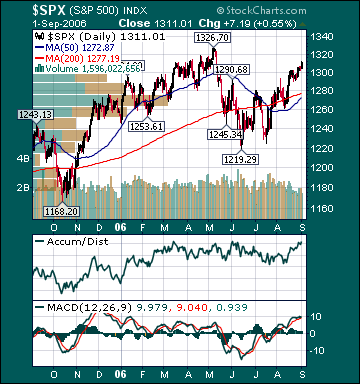

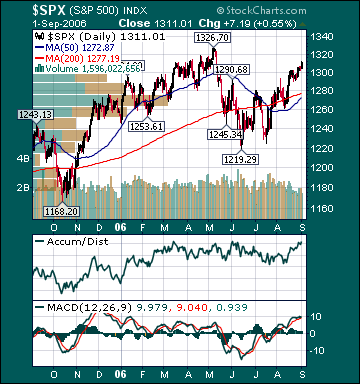

S&P 500 1,311.01 +1.23%*

Click here for the Weekly Wrap by Briefing.com.

*5-day % Change

Click here for the Weekly Wrap by Briefing.com.

BOTTOM LINE: Overall, last week's market performance was bullish. The advance/decline line rose, almost every sector rose and volume was light on the week. Measures of investor anxiety were mixed. The AAII percentage of Bulls rose to 41.57% this week from 39.35% the prior week. This reading is now slightly below-average levels. The AAII percentage of Bears fell to 25.84% this week from 37.42% the prior week. This reading is now slightly below above-average levels. The 10-week moving average of the percent Bears is currently 42.6%. The 10-week moving-average of percent Bears was 43.0% at the major bear market lows during 2002. The only other time it has been higher than these levels, since record keeping began in 1987, was the significant market bottom during the 1990 recession and Gulf War. I continue to believe the “irrational pessimism” aimed towards most US stocks has never been this great in history given the positive macro backdrop.

The average 30-year mortgage rate fell 4 basis points to 6.48%, which is 32 basis points below July highs. I still believe housing is in the process of slowing to more healthy sustainable levels. Mortgage rates have likely begun an intermediate-term move lower, which should help stabilize housing over the next few months. The Case-Shiller housing futures are projecting a 5.0% decline in the average home price over the next 9 months. Considering the average house has appreciated over 50% during the last few years, this would be considered a “soft landing.” The overall negative effects of housing on the US economy are currently being exaggerated, in my opinion.

The benchmark 10-year T-note yield fell another 6 basis points on the week on diminishing inflation worries. I still believe inflation concerns have peaked for the year as economic growth moderates to around average levels, unit labor costs remain subdued and the mania for commodities continues to reverse course.

The EIA reported this week that gasoline supplies rose more than expectations as refinery utilization increased. Unleaded Gasoline futures dropped substantially and are now 40.3% below September 2005 highs even as refinery utilization remains below normal as a result of the hurricanes last year, some Gulf of Mexico oil production remains shut-in and fears over future production disruptions persist. Gasoline demand is estimated to rise .8% this year versus a 20-year average of 1.7% demand growth. According to TradeSports.com, the percent chance of a US and/or Israeli strike on Iran this year has fallen to 12.8% from 36% late last year. The elevated level of gas prices related to crude oil production disruption speculation is further dampening fuel demand, which is beginning to send gas prices back to reasonable levels.

US oil inventories are near 7-year highs. Since December 2003, global oil demand is only up .1%, while global supplies have increased 5.3%, according to the Energy Intelligence Group. Moreover, worldwide inventories are poised to begin increasing at an accelerated rate over the next year. I continue to believe oil is priced at extremely elevated levels on fear and record speculation by investment funds, not fundamentals. Oil will likely test its major uptrend at $66.33 in the near-term, barring the formation of a new hurricane. Escalating tensions with Iran and a Gulf hurricane will likely lead to a major top in oil over the next six weeks as demand destruction further accelerates. As the fear premium in oil dissipates back to more reasonable levels, global growth slows and supplies continue to rise, crude oil should head meaningfully lower over the intermediate-term.

Natural gas inventories rose more than expectations this week, sending prices for the commodity plunging. Supplies are now 12.4% above the 5-year average, a record high level for this time of year, even as some daily Gulf of Mexico production remains shut-in. Natural gas prices have collapsed 62.4% since December 2005 highs. It is very likely US natural gas storage will become full during October, creating the distinct possibility of a “no-bid” situation for the physical commodity. Colorado State recently reduced its forecast from three to two major hurricanes for this season versus seven last year. Natural gas made new cycle lows this week despite the fact that the commodity is in its seasonally strong period.

Gold was about unchanged on the week as US dollar weakness offset diminishing inflation fears. The US dollar fell on declining expectations for further Fed interest rate increases. I continue to believe there is almost zero chance of a Fed rate hike at the September meeting and very little chance of another hike this year.

Technology stocks outperformed for the week on increasing optimism ahead of a seasonally strong period for the sector. Energy stocks underperformed as the mania for these shares continues to subside in the face of falling commodity prices and declining inflation worries. S&P 500 profit growth for the second quarter is coming in a strong 13.2% versus a long-term historical average of 7%, according to Reuters. This would mark the 16th straight quarter of double-digit profit growth, the best streak since recording keeping began in 1936. Moreover, another double-digit gain is likely in the third quarter. Despite a 75.8% total return for the S&P 500 since the October 2002 bottom, its forward p/e has contracted relentlessly and now stands at a very reasonable 15.0. The 20-year average p/e for the S&P 500 is 24.4. The S&P 500 is up 6.4% and the Russell 2000 Index is up 8.0% year-to-date, notwithstanding the recent correction.

The current pullback is still providing longer-term investors very attractive opportunities in many stocks that have been punished indiscriminately. In my entire investment career, I have never seen the best “growth” companies in the world priced as cheaply as they are now relative to the broad market. By contrast, “value” stocks are quite expensive in many cases. A recent CSFB report confirmed this view. The report said that on a price-to-cash flow basis growth stocks are now cheaper than value stocks for the first time since at least 1977. The entire decline in the S&P 500’s p/e, since the bubble burst in 2000, is a function of growth stock multiple contraction. The p/e on value stocks is back near historically high levels. I still expect the most overvalued economically sensitive and emerging market stocks to continue underperforming over the intermediate-term as the manias for those shares subside. I still believe a chain reaction of events has begun that will eventually result in a substantial increase in demand for US stocks.

In my opinion, the market is still factoring in way too much bad news at current levels. One of the characteristics of the current “negativity bubble” is that most potential positives are undermined, downplayed or completely ignored, while almost every potential negative is exaggerated and promptly priced in to stock prices. Problematic inflation, substantially higher long-term rates, a significant US dollar decline, a “hard-landing” in housing, a plunge in consumer spending and ever higher oil prices appear to be mostly factored into stock prices at this point. I view any one of these as unlikely and the occurrence of all as highly unlikely. This “irrational pessimism” by investors is resulting in a dramatic decrease in the supply of stock as companies buy back shares, IPOs are pulled and secondary stock offerings are canceled.

Over the coming months, an end to the Fed rate hikes, lower commodity prices, seasonal strength, the November election, decelerating inflation readings, lower long-term rates, increased consumer/investor confidence, rising demand for US stocks and the realization that economic growth is only slowing to around average levels should provide the catalysts for another substantial push higher in the major averages through year-end as p/e multiples begin to expand. I still believe the S&P 500 will return a total of around 15% for the year. The ECRI Weekly Leading Index was unchanged this week and is forecasting healthy, but decelerating, US economic activity.

*5-day % Change

Friday, September 01, 2006

Weekly Scoreboard*

Indices

S&P 500 1,311.01 +1.23%

DJIA 11,464.15 +1.60%

NASDAQ 2,193.16 +2.47%

Russell 2000 721.56 +3.19%

Wilshire 5000 13,117.19 +1.52%

S&P Barra Growth 608.89 +1.40%

S&P Barra Value 700.03 +1.06%

Morgan Stanley Consumer 646.45 +2.34%

Morgan Stanley Cyclical 810.09 +2.78%

Morgan Stanley Technology 509.52 +2.92%

Transports 4,310.38 +1.67%

Utilities 441.39 +.48%

MSCI Emerging Markets 98.90 +2.98%

S&P 500 Cum A/D Line 7,067 +6.0%

Bloomberg Oil % Bulls 38.0 +7.6%

CFTC Oil Large Speculative Longs 179,681 -2.0%

Put/Call .99 +22.2%

NYSE Arms .75 -33.6%

Volatility(VIX) 11.96 -2.84%

ISE Sentiment 65.0 -56.95%

AAII % Bulls 41.57 +5.6%

AAII % Bears 25.84 -30.9%

US Dollar 84.95 -.49%

CRB 325.42 -3.2%

ECRI Weekly Leading Index 135.10 unch.

Futures Spot Prices

Crude Oil 69.24 -4.48%

Unleaded Gasoline 173.60 -7.2%

Natural Gas 5.94 -19.6%

Heating Oil 196.75 -5.04%

Gold 632.70 +.24%

Base Metals 230.35 -.10%

Copper 346.75 +1.69%

10-year US Treasury Yield 4.72% -1.25%

Average 30-year Mortgage Rate 6.48% -.61%

Leading Sectors

Disk Drives +6.31%

Restaurants +4.80%

Airlines +4.45%

Internet +3.8%

Networking +3.7%

Lagging Sectors

Banks +.24%

Coal -.88%

Oil Service -1.44%

Oil Tankers -2.42%

Energy -2.97%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

S&P 500 1,311.01 +1.23%

DJIA 11,464.15 +1.60%

NASDAQ 2,193.16 +2.47%

Russell 2000 721.56 +3.19%

Wilshire 5000 13,117.19 +1.52%

S&P Barra Growth 608.89 +1.40%

S&P Barra Value 700.03 +1.06%

Morgan Stanley Consumer 646.45 +2.34%

Morgan Stanley Cyclical 810.09 +2.78%

Morgan Stanley Technology 509.52 +2.92%

Transports 4,310.38 +1.67%

Utilities 441.39 +.48%

MSCI Emerging Markets 98.90 +2.98%

S&P 500 Cum A/D Line 7,067 +6.0%

Bloomberg Oil % Bulls 38.0 +7.6%

CFTC Oil Large Speculative Longs 179,681 -2.0%

Put/Call .99 +22.2%

NYSE Arms .75 -33.6%

Volatility(VIX) 11.96 -2.84%

ISE Sentiment 65.0 -56.95%

AAII % Bulls 41.57 +5.6%

AAII % Bears 25.84 -30.9%

US Dollar 84.95 -.49%

CRB 325.42 -3.2%

ECRI Weekly Leading Index 135.10 unch.

Futures Spot Prices

Crude Oil 69.24 -4.48%

Unleaded Gasoline 173.60 -7.2%

Natural Gas 5.94 -19.6%

Heating Oil 196.75 -5.04%

Gold 632.70 +.24%

Base Metals 230.35 -.10%

Copper 346.75 +1.69%

10-year US Treasury Yield 4.72% -1.25%

Average 30-year Mortgage Rate 6.48% -.61%

Leading Sectors

Disk Drives +6.31%

Restaurants +4.80%

Airlines +4.45%

Internet +3.8%

Networking +3.7%

Lagging Sectors

Banks +.24%

Coal -.88%

Oil Service -1.44%

Oil Tankers -2.42%

Energy -2.97%

One-Week High-Volume Gainers

One-Week High-Volume Losers

*5-Day % Change

Subscribe to:

Comments (Atom)